© 2014 The Texas Lawbook.

By Natalie Posgate – DALLAS (February 12, 2014) – Energy Transfer Partners’ expert witness told jurors Tuesday that the Seaway Pipeline joint venture between Enterprise Products and Enbridge “would not be the Seaway today” if not for the creation of the Double E project that originally involved ETP.

Expert pipeline economist Jeff Makholm’s viewpoint is that since Seaway is essentially the same pipeline as the would-have-been Double E project, ETP in turn suffered significant damages – at least $594 million – because it was excluded from the Enterprise-Enbridge joint venture.

ETP is asking a state jury to award $1.3 billion in actual and punitive damages because it says Enterprise improperly ended its partnership to build the pipeline so Enterprise could do a better deal with Enbridge, another competitor.

Makholm said the main value of Seaway originated from Double E’s ability to secure Chesapeake Energy as a shipper, which Enterprise in turn brought to the Seaway project after terminating Double E with ETP.

He said the value of Chesapeake’s shipping commitment could be compared to the value a Wal-Mart store’s commitment would be if it became a vendor of a new strip mall.

“Double E and Seaway shipped from the same starting point to the same ending point and contained the same shippers,” said Makholm, the senior vice president at National Economic Research Associates (NERA), the country’s oldest economic consulting firm. “It’s the same project.”

Makholm also issued his opinion that ETP deserves one-fourth of the value of the Seaway project because it was essentially the connection of Enterprise’s separate 50/50 joint ventures with Enbridge and ETP.

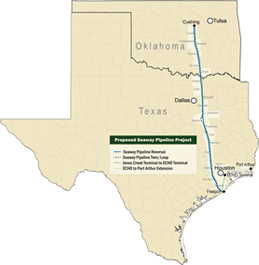

Seaway Crude Pipeline Company LLC is the product of a 50/50 joint venture between Enterprise and Enbridge that includes a 500-mile, 30-inch pipeline between Cushing, Okla. and Houston. Enterprise and Enbridge’s project was originally to be called the Wrangler Pipeline, but that changed in November 2011 when Enbridge purchased ConocoPhillips’ 50 percent ownership interest in the Seaway Pipeline for $1.15 billion.

In May 2012, Enterprise and Enbridge completed a project to reverse the flow direction of the Seaway Pipeline (which originally ran from Houston to Cushing), which Makholm said was the crucial puzzle piece all major oil companies have tried to solve to transport valuable crude oil in Alberta, Canada to refineries in the Gulf Coast.

Before Seaway, Enterprise and ETP explored this puzzle by forming a joint venture in April 2011 to build the Double E Pipeline from Cushing to Houston. Witnesses have testified that Enterprise approached ETP about forming the venture because it thought ETP’s existing Old Ocean Pipeline, which already connected the DFW and Houston areas, would be a valuable component since it would save steps.

Enterprise ended the joint venture with ETP after its open season to seal commitments from shippers expired, claiming “the project wasn’t viable.”

ETP claims by doing so, Enterprise violated their partnership by conspiring with Enbridge to cut ETP out of the new project.

Enterprise and Enbridge are denying the allegations, arguing that Enterprise and ETP had never entered a partnership to begin with and that their relationship was merely non-binding in nature.

During cross-examination Wednesday, Jeff Golub, who represents Enterprise, questioned the validity of Makholm’s opinion that Chesapeake’s commitment to the Double E was the main contributor to the value of the Seaway joint venture.

Golub pointed out that when the Enterprise-Enbridge joint venture was still called the Wrangler Pipeline, Chesapeake was the only committed shipper – which he emphasized was the same case for the Double E project.

But when the Seaway Pipeline came in the picture, it all changed, Golub said, because it was affiliated with Enbridge’s strong foundations in projects that bring oil from the Northern United States and Canada, such as its Flannagan South Pipeline Project.

He pulled up a chart that listed the committed shippers for the Seaway project during its open season, which included a handful of big names such as ExxonMobil, Shell, BP, Devon Energy, Hunt Oil and Cenovus Energy.

“They flocked like geese to that project,” said Golub, a partner at the Houston litigation boutique Beck Redden.

Before Makholm testified, jurors heard from Vern Yu by video deposition, who is Enbridge’s senior vice president of business and market development and attended meetings in 2011 with Enterprise executives to discuss forming a joint venture.

Yu testified that the initial meeting occurred before the open season for Enterprise and ETP’s joint venture was over. During the meeting, Enterprise informed Enbridge that it planned to end the joint venture with ETP once the open season ended, Yu said.

But during cross-examination, Yu told Enterprise’s attorneys that “joint venture” is a loosely used term and doesn’t define a legal partnership.

ETP’s last live witness, the company’s Chairman and Chief Executive Officer Kelcy Warren, took the witness stand at the end of Wednesday afternoon. His testimony will continue on Thursday.

© 2014 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.