© 2016 The Texas Lawbook.

By Mark Curriden and Kathryn Butler

(Aug. 4) – Energy Future Holdings has paid its lawyers and financial advisers about $600,000 a day for each and every one of the 827 days – including weekends and holidays – since it filed for bankruptcy in April 2014.

As a result, the Dallas power company’s attempt to shed massive debt through Chapter 11 has become one of the most expensive corporate restructurings in U.S. history.

New data obtained by The Texas Lawbook shows that the legal and financial adviser fees and expenses in the EFH corporate restructuring will reach and pass one-half billion dollars this month. Bankruptcy experts say the price tag will likely reach $700 million – the final cost in the Enron Corp. bankruptcy – before it is over.

Federal court records show that more than 380 business lawyers and more than 240 financial advisers and business consultants have billed EFH thousands upon thousands of hours for work they’ve done on the bankruptcy – some of them charging as much as $1,400 an hour.

Very few of those advisers, however, are from Texas.

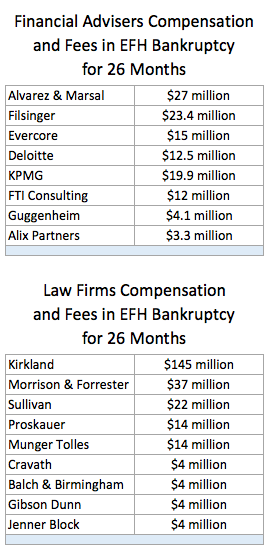

The Texas Lawbook reviewed more than 450 filings in the bankruptcy case and found that EFH has compensated the professional consultants involved in the corporate restructuring more than $420 million in fees and expenses since the company filed for Chapter 11 protection 27 months ago. In addition, the legal and financial advisers are owed another $75 million in deferred payments, which will be paid at the end of the case.

“By any measurement, this is a very expensive bankruptcy – probably one of the five most expensive bankruptcies in U.S. history,” says Lou Strubeck, a bankruptcy partner at Norton Rose Fulbright in Dallas.

“When you actually see the numbers, it’s astonishing,” Doré said in an interview last year.

Bankruptcy judges in Delaware, where the EFH case is being handled, regularly approve lawyer fees exceeding $1,000 an hour and seldom require lawyers or financial advisers to reduce their charges, lawyers say.

In May, the EFH bankruptcy blew past the $400 million expense mark set by American Airlines restructuring, which closed in 2014. Legal experts say the EFH fees will almost certainly reach $700 million in fees and expenses if the bankruptcy continues into next spring, which is likely.

As a comparison, the final fee and expenses in the insolvency of Houston-based Enron Corp. was $700 million and advisers in the Lehman Brothers case, the most expensive bankruptcy ever, reported more than $2 billion in fees and expenses.

EFH, which last week agreed to sell its power transmission subsidiary Oncor to Florida-based NextEra Energy for $18.4 billion, paid more than $380 million in fees and more than $44 million in expenses to lawyers and financial advisers representing the company and creditors through June 30, according to The Texas Lawbook.

The law firms and financial consultants also agreed to defer payment of 20 percent of their fees, which now sit at $75 million and counting, until EFH exits bankruptcy court.

Oncor, which is not part of the bankruptcy, and NextEra are each paying their lawyers millions of dollars as part of EFH’s divestiture, but the amount of those legal fees are not available and are not included in the calculation. Jones Day partner Patricia Villareal in Dallas represents Oncor.

“One reason fees get so high in bankruptcy cases like this is that it requires a lot of specialists in areas such as tax, employment, environmental and regulatory to get involved,” says Daniel Winikka, a partner at Loewinsohn Flegle Deary Simon in Dallas.

Winikka says that EFH or the fee examiners committee could technically challenge either the hourly rates or the time submitted for payment as excessive, but he and other lawyers say such efforts are rarely successful, especially in the Delaware and New York bankruptcy courts.

“Besides, the fee examiners would get to bill EFH for the time they fight to reduce fees and the lawyers and financial advisers get to charge EFH for the time they would spend defending the fee requests,” Winnika says. “All of that results in EFH paying more fees.

“It is very common for general counsel to be frustrated with the fees because they have basically no control,” he says.

Texas Lawbook research shows that 72 of the lawyers working on the bankruptcy are charging EFH $1,000 or more per hour. Another 90 lawyers are charging Texas’ largest power utility $800 to $975 an hour.

Only a tiny fraction of the attorneys and bankruptcy experts – less than 60 of the 600 paid advisers, according to court records – on the EFH payroll are based in Texas.

“It is really unfortunate that EFH filed this bankruptcy in Delaware instead of here in Dallas,” Strubeck says. “EFH is a Texas company regulated by the state of Texas.

“Imagine what a boost it would have been to the Texas legal community and to businesses in Dallas if the bankruptcy had been filed here and all the people involved had to stay in our hotels and eat at our restaurants,” he says.

Strubeck and others say that Texas companies add 15 to 20 percent to their expenses when they file for restructuring in Delaware or New York instead of Texas. They point out that all the parties are required to hire local counsel in Delaware in order to appear before the judges there.

“The billing rates for first- and second-year associates at most of these New York law firms are about the same as highly experienced law partners make at most Texas firms,” says Michael Sutherland, a bankruptcy partner at Carrington Coleman in Dallas.

“New York and Chicago law firms fear that the bankruptcy courts here in Texas will not approve of their large rates as quickly or easily as do bankruptcy judges in the northeast,” Sutherland says.

The biggest financial beneficiary of the EFH bankruptcy is Chicago-based Kirkland & Ellis, which is leading EFH’s restructuring efforts. Kirkland has 32 lawyers billing EFH $1,000 or more per hour and has been paid $130 million in fees, $11 million in expenses and is due another $25 million when the case is over.

California-based Morrison & Foerester, which represents the unsecured creditors in the bankruptcy, has eight lawyers charging EFH $1,000 or more per hour and 22 other attorneys with hourly billing rates from $800 to $950. MoFo, as the firm is called, has been paid $37 million and is due another $6 million at the end of the litigation.

EFH also has paid New York-based Sullivan & Cromwell, which also represents the unsecured creditors, more than $21 million.

The only Texas-based firm on the EFH bankruptcy gravy train is Enoch Kever in Austin, which represents the power company in state regulatory matters. Enoch Kever has been paid $1.7 million so far.

Financial and business advisers are also feasting at the EFH buffet. New York-based Alvarez & Marsal, a business management firm, has been paid $27 million. Filsinger Energy Partners, a Colorado-based energy consulting company, has been paid $24 million. Epiq Bankruptcy Solutions, which is headquartered in Kansas City, has been paid $40 million for its electronic data support services.

The two highest paid lawyers in the case – Todd Maynes of Chicago and Dean Shulman of New York – are partners at Kirkland & Ellis who specialize in tax law. They each charge $1,445 an hour.

When the Texas Public Utility Commission killed the Hunt deal, Calder led EFH’s negotiations with NextEra and other potential buyers.

Doré, in the interview last year, said that Kirkland lawyers had to learn nearly every aspect of EFH’s operation in order to lead it in its restructuring.

“They are expensive, but they are also the best,” she said.

© 2016 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.