A strong Texas municipal bond market and continued questions around state regulations related to environmental, social and governance policy kept Texas public finance attorneys busy in 2023.

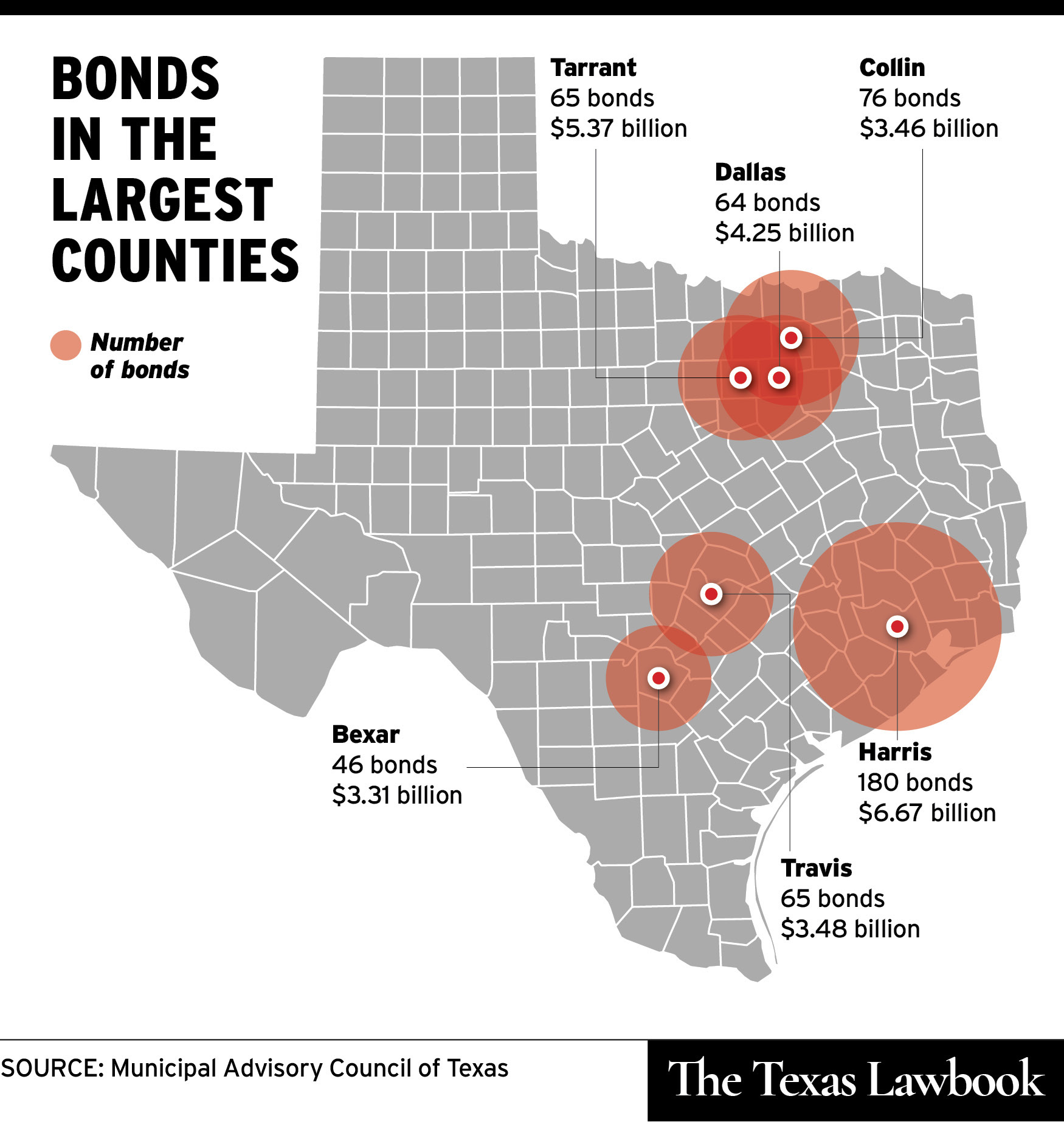

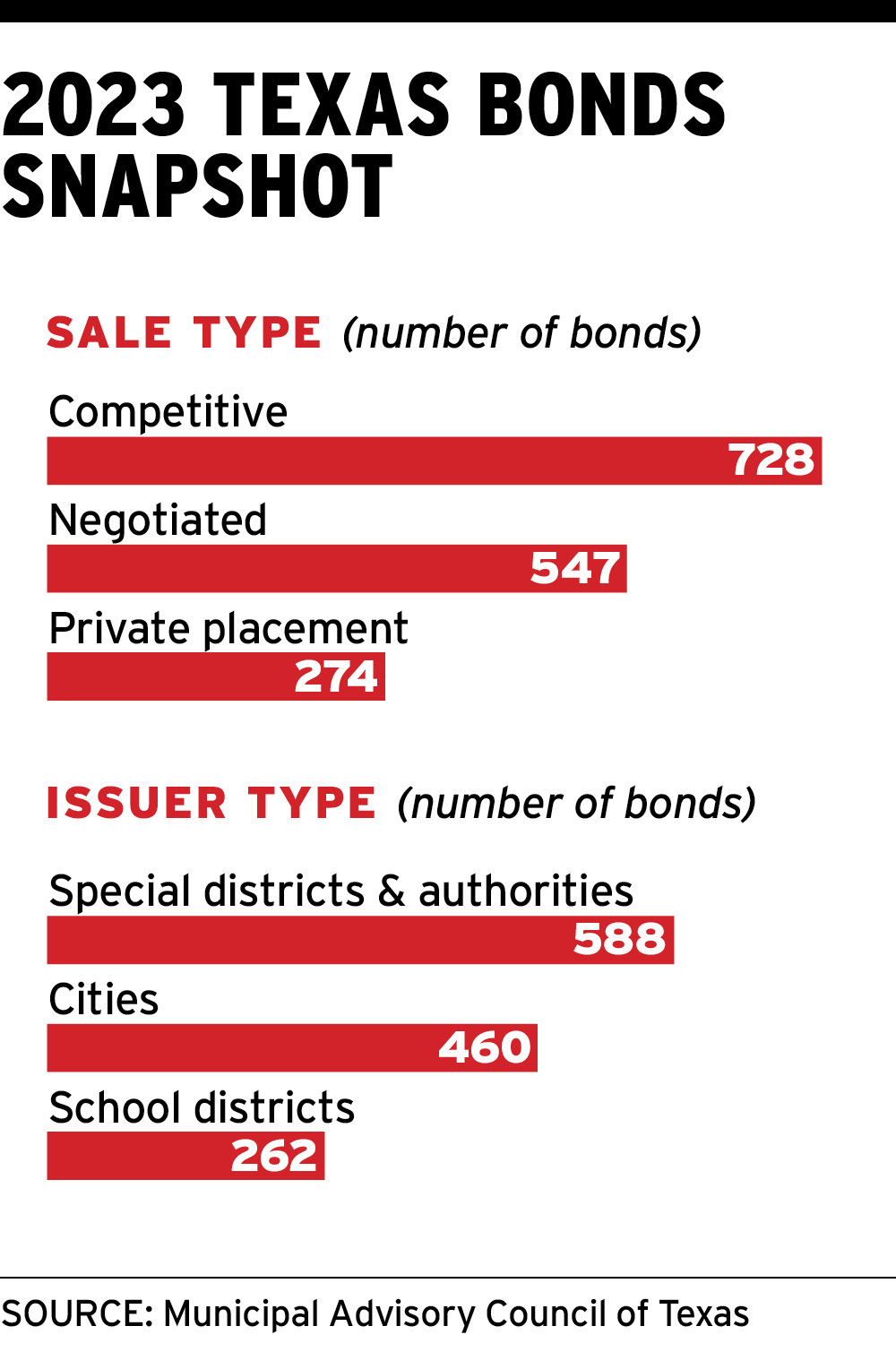

In 2023, there were 1,569 issues totaling $66.41 billion, according to the Municipal Advisory Council of Texas, compared with 1,622 issues totaling $52.44 billion in 2022 — 3.4 percent fewer issues raising more than 26 percent in value over last year.

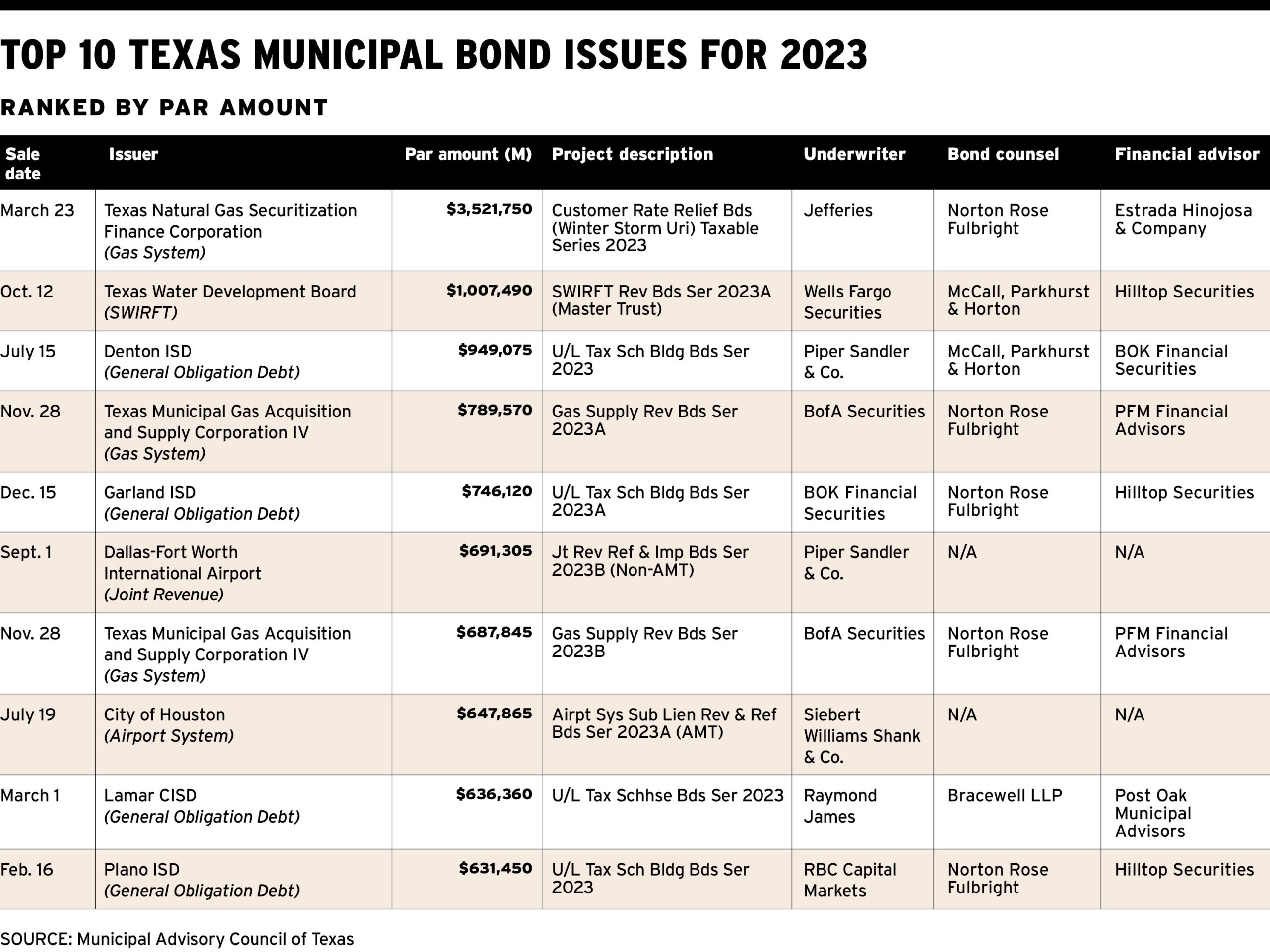

While typical infrastructure deals dominated the list of largest issues, the biggest deal was a gas securitization transaction stemming from the 2021 Winter Storm Uri. The issue was worth a par amount of $3.52 billion.

Other top deals were related to infrastructure, transportation and independent school districts — evidence of the Lone Star State’s continued growth.

“Texas is still very much a growing state, and I would imagine that just general municipal work, like schools particularly, and cities have to accommodate a growing population with infrastructure,” Mark Malveaux, managing partner at Dallas-based McCall, Parkhurst & Horton, said.

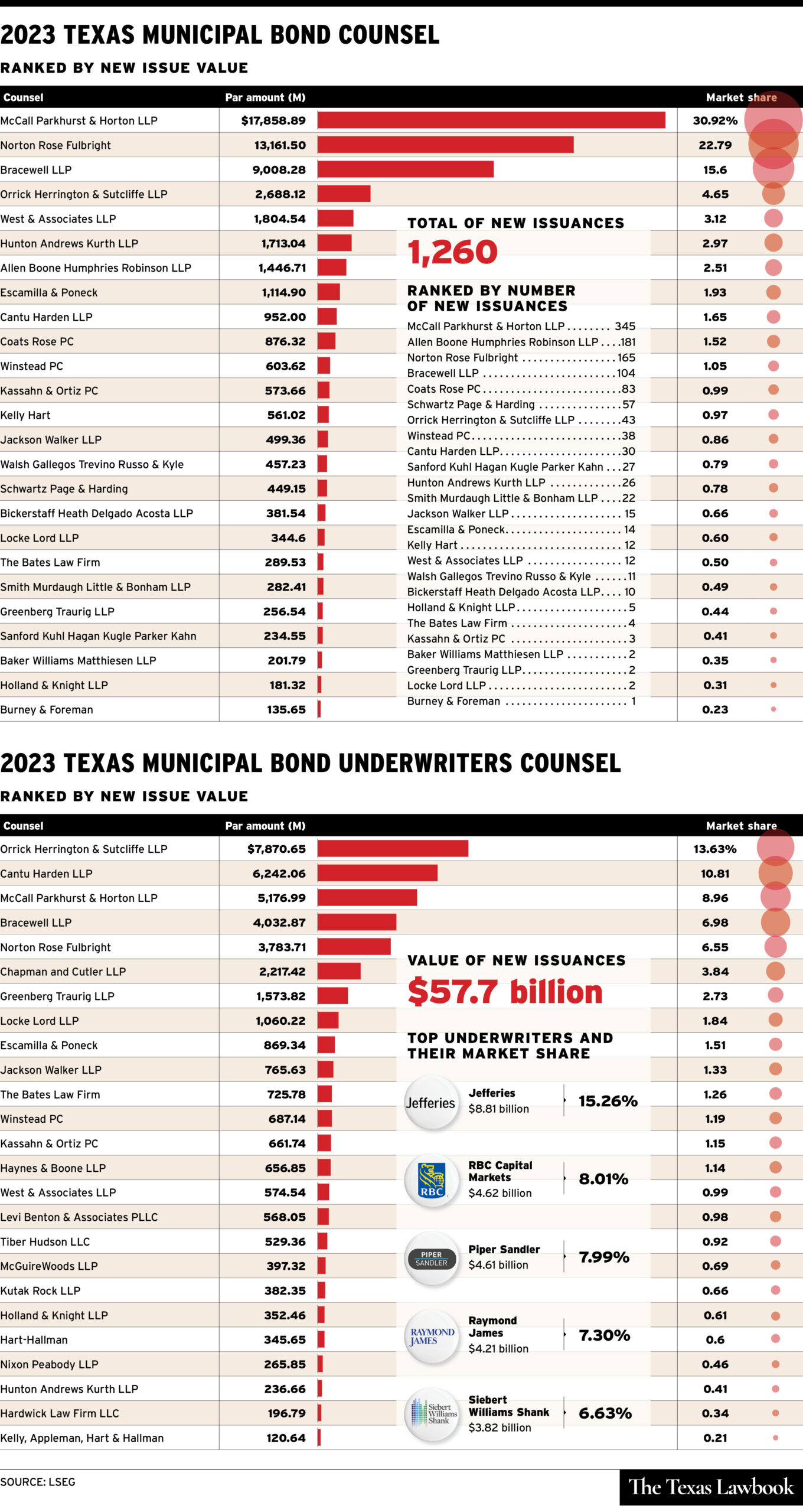

McCall, Parkhurst & Horton topped the 2023 rankings, based on numbers from LSEG. Those numbers represent new bond activity, not all bond deals. School districts are trying to meet the needs of a growing population with new infrastructure, Malveaux said. McCall was bond counsel in the largest school district bond of 2022, an almost $950 million bond issued by Denton ISD.

Four of the 10 largest bond issues in the state were school bonds, according to the 2023 Texas Bond Issuance Report. School districts will continue to issue bonds as voters across the state approved a number of school bonds in May and November of 2023, Malveaux said. External forces like interest rates or inflation, both of which are expected to decline, will not affect the trajectory of the market, Malveaux said.

“I think we probably will still see a significant amount of demand for schools, for roads, for infrastructure,” he said. “Those fundamentals, I don’t believe will change.”

Winter Storm Results in Epic Bond

The largest deal in 2023, and possibly in the state’s history, was the $3.52 billion securitized issuance for natural gas customer rate relief, authorized by the legislature during the 2021 regular session.

The securitization issuance — specifically authorized by the Texas legislature to lessen the impact of costs on natural gas customers because of the effects of Winter Storm Uri — is thought to be the largest single issuance in the state, said Paul Braden, partner at Norton Rose Fulbright and lead partner on the transaction.

“We were tapped early on as bond counsel because of our significant experience in these types of bond deals, especially municipal securitizations, nationwide,” Braden said. “We do a lot of this work.”

The initial expectation was to close the deal by the end of December 2022; the deal closed in March 2023. The bond was unique and complex. The legislature tasked the Texas Public Finance Authority (TPFA) with forming what became known as the “Texas Natural Gas Securitization Finance Corporation” to issue the bond. The unique structure of the credit as a securitization required multiple layers of approval from several state agencies, including the state’s natural gas regulator, the Texas Railroad Commission.

Even agencies that usually take a cursory look at these deals, such as the state’s bond review board, took a more active role. The TPFA was actively involved in the transaction since it formed the special purpose corporation that issued the bonds, and was both a participant and a counterparty to certain contracts.

Like all bonds issued in the state, this bond required approval from the Attorney General, who also took a special interest in the deal because of its first-of-its-kind nature coupled with the fact that it was a securitization bond. On top of all that, attorneys also had to negotiate with nine participating natural gas utilities as well as the underwriters. Jeffries LLC was the lead underwriter in the underwriters syndicate.

“We ended up having over 20 lawyers working on various aspects of this transaction in six of our offices,” Braden said. “The range of expertise ran from securitization law, federal tax law, Texas bond law, municipal bankruptcy and both US and Texas constitutional law. So it really was a significant task and a significant transaction that we were glad to close.”

Orrick, Herrington & Sutcliffe was underwriters counsel for the deal, and with little over 13.5 percent of the market share, was the number one underwriters counsel in Texas last year. The firm also served as underwriters counsel for the second largest issue of 2023, a $1 billion revenue bond issued by the Texas Water Development board for the State Water Implementation Fund. Proceeds from those bonds are used to fund loans to state government entities or nonprofit water corporations for water projects.

“We’ve had the good fortune to serve as underwriting counsel on those actions for many years,” Jerry Kyle, Austin-based partner in Orrick’s public finance practice, said. “Those are really interesting transactions as well.”

Going into 2024, the firm sees good things on the horizon as the market seems to have settled and the state’s population continues to grow, keeping pressure on the demand for new infrastructure.

“There was a lot of economic uncertainty [in 2023], and so that played into the market,” Marcus Deitz, Houston-based Orrick public finance partner, said. “I still think it was a pretty good year last year. The market seems to have settled out a little bit, and so I think that’s giving participants a little bit more confidence going into 2024.”

Both Kyle and Deitz represent a significant number of independent school districts throughout the state.

“We’ve seen recently, particularly in the last election cycle, a focus on new money and growth,” Deitz said. “Coming into 2024, we’re already seeing some of our school district clients continue to try and build infrastructure, for the population gains that continue to come.”

For example, already in the first quarter of 2024, Orrick priced a $550 million Conroe ISD bond package that is expected to close this month. That issue is part of a larger $2 billion bond project that the district has scheduled for the next several years, Deitz said.

“All the indicators that I’m seeing indicate that, despite somewhat concerning economic issues in the past,” Deitz said. “Going forward, growth looks to be a big focus for my clients.”

Increasing interest rates since 2022 has had a big impact on public finance attorneys’ practice, Kyle said. Changes in law from the 2017 federal tax law put restrictions on advanced refundings, but still took place with the use of taxable bonds. Those decreased when interest rates started increasing in 2022.

In July, the City of Houston Airport System closed a $647.87 million bond issue called a tender. One of the largest issues of the year, the deal represents an emerging trend.

A tender is essentially a refunding by having individual holders tender their bonds to the issuer. Bracewell, as well as West and Associates, served as bond counsel for the deal. In terms of market share, Bracewell came in number three as bond counsel in 2023 and number four as underwriters counsel. Bracewell was underwriters counsel for a similar bond issue by City Public Service of San Antonio.

“Issuers were able to produce savings through those transactions,” Barron Wallace, partner at Bracewell, said. “That also drove a little bit more interest in doing refundings.”

When interest rates were low, entities used to issue taxable bonds to advance refund debt. As taxable rates and tax-exempt rates have gone up, those bonds are less valuable.

“So you can go on the secondary market and make an offer to buy it, Wallace said. “So whereas holders might be able to sell it for 85 percent of value, the issuers could offer 88 percent and both the issuers and the holders both benefit.”

A tender is a way to create a refunding but doing it on a current refund basis by purchasing bonds on the open market, Wallace said.

Looking ahead to 2024

Public finance attorneys interviewed all remain optimistic looking at the rest of this year. Public improvement districts remain popular, especially in Central Texas, as the increasing population continues to drive the need to expand infrastructure, such as roads and sewers, so neighborhoods can build up.

Affordable housing and workforce housing will be another area keeping public finance attorneys busy in the future.

“I think there’s going to be increasing focus on the need for affordable housing, but also what’s commonly referred to as workforce housing,” Norton Rose Fulbright’s Braden said. “There might be some type of federal subsidy or federal assistance with that type of bond issues as well. So I think that’s something else keep an eye on.”

Potential challenges ahead

While municipal bond issues continue to be robust in the state, regulatory challenges remain. On Jan. 26, Texas Attorney General Ken Paxton released a statement that the bank, Barclays, would no longer be allowed to underwrite Texas municipal bonds.

In Texas, the attorney general has to approve all bonds before they can be issued.

In 2021, the Texas legislature passed two laws, SB 13 and SB 19, which disallowed the state from doing business with companies that discriminated against energy companies or the firearms industry. Several large banks took themselves out of the market.

Paxton found that Barclays was not in compliance with those laws. In 2023, Barclays was number 10 in terms of market share as an underwriter in the state municipal bond market, according to LSEG data.

The attorney general’s office is still looking at other banks and their ESG policies to see if they comply with state law, including Bank of America, J.P. Morgan, Morgan Stanley and others, asking for more information regarding their net zero commitments.

Last year, Paxton announced that his office had determined that Citigroup discriminated against the firearms industry. The bank ceased their underwriting of Texas municipal bonds, including the deal to finance the massive $3.5 billion securitized gas deal.

The inquiry puts at risk certain investment banking firms that have a long-standing history with the state, NRF’s Braden said.

“They’re going through this process, and hopefully, it can be appropriately resolved in the first quarter of this year,” Braden said.

While the pool of qualified banks has shrunk, from a public finance attorney’s perspective, there hasn’t been a material effect since the banks still doing business in the state are still hiring attorneys to represent them, Braden said.

But as the pool of banks gets smaller, less competition is definitely “not where you want to be if you’re talking about interest rates,” Braden said.

“I think issuers are starting to pay a little closer attention to that,” Braden said.

Other attorneys interviewed are all staying engaged on this issue.

“We’re very engaged on the impact of both, SB 13 and SB 19 on both the underwriting community and the issuing community,” Orrick’s Kyle said. “Because there is an impact on issuers as well.”

The uncertainty over banks’ statuses has introduced a certain level of risk to their clients.

“It’s all about trying to make sure that any risk is mitigated to the greatest extent that is possible,” Kyle said.