The first six months of 2023 were not the best of times for Texas-related capital markets. But they could have been far worse.

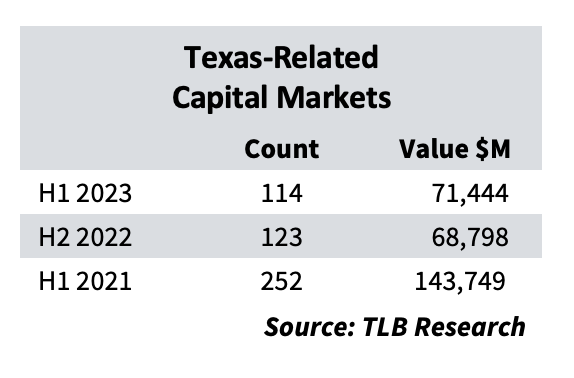

According to the Texas Lawbook’s exclusive Corporate Deal Tracker, there were 114 CapM offerings advised by Texas lawyers during the first six months of 2023, deals valued at a little more than $71.4 billion. That’s not even half of what the market saw two years ago — during the first half of 2021, the high-water mark of recent years — with 252 deals valued at $143 billion.

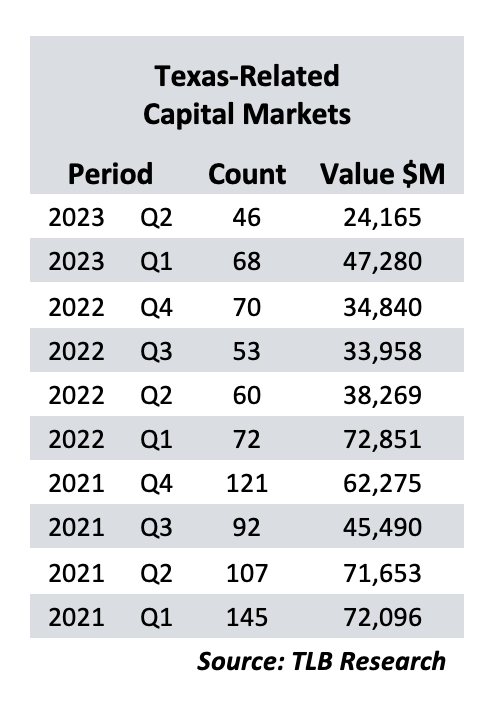

Moreover, capital markets deals dropped in volume and value from quarter to quarter — from 68 issues worth $68.8 billion in the first quarter to 46 valued at $24.2 billion in the second — the lowest numbers for count and value over the last 10 quarters.

But consider the landscape. Concerned with the stubbornness of inflation, the Fed increased interest rates in February, March and May. On March 10, the Fed announced the failure of tech lender Silicon Valley Bank, calling into question the value of technology assets in general. Two days later, followed the failure of Signature Bank. And just seven days after that, a struggling Credit Suisse announced that it had agreed to be absorbed by its Switzerland-based competitor UBS.

Despite the downturn capital markets deal flows, however, have remained stable, and offer some optimism — particularly in the energy sector — notes partner Hillary Holmes at Gibson Dunn & Crutcher.

“[Energy] transactions are driving some creative capital markets and other financing activity in the energy space — while capital markets in the broader US market is sleepy,” Holmes assured The Lawbook recently. “The deals we have been preparing for should only accelerate assuming continued decent and stable news on the inflationary, recession and VIX (volatility index) fronts.”

Just as capital markets help pay for M&A transactions, M&A transactions drive the need for capital markets deals. And during the first half of 2023, energy deals that dominated M&A also drove the largest Texas-led capital markets transactions.

In January, Houston-based Targa Resources issued $1.75 billion in two tranches of senior notes. The company said it planned to use the money, in part, to finance its $1.05 billion purchase of 25 percent of the Grand Prix NGL Pipeline from Blackstone Energy Partners. The issues were led from Texas by Vinson & Elkins and Gibson Dunn & Crutcher.

In June, Denver-based Civitas Resources entered the Permian via the acquisitions of two separate producing entities owned by NGP Capital Management. The transactions were financed, in part, by the year’s largest Texas-led transaction thus far —a $2.7 billion private placement advised by Kirkland & Ellis and V&E.

As The Lawbook recently reported, energy M&A made up more than 3 of every 10 M&A deals in Texas between January and June. Over that same period, there were 73 energy-related offerings, representing a staggering 64 percent of the 114 capital markets transactions.

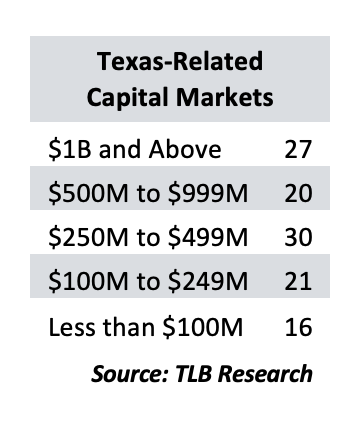

And that energy dominance holds true at both ends of the value spectrum. Of the 27 capital markets offerings valued at $1 billion or more, 16 were in the energy space. Of the 37 valued below $250 million, 20 involved companies in the energy sector.

Initial Public Offerings

Mike Blankenship, managing partner of Winston & Strawn’s Houston office, is predicting a rise in initial public offerings in the second half of the year. At first blush it seems like a bold prediction.

IPOs have been in the tank everywhere since 2021, which saw a record 1,035 in the U.S. and 2,436 across the globe. Like most deal statistics in first post-pandemic year, both were records. But in 2022, the numbers dropped precipitously: down 42 percent globally (to 1,415) and 82 percent (to 186) in the U.S.

Texas-related IPOs fared not much better. In 2021, Texas lawyers worked on 93 IPOs. In 2022 that dropped to 22 (-76 percent). Thus far in 2023, there have been seven Texas-related IPOs, including four that were energy related:

- Austin-based Atlas Energy Solutions entered the public space with a $292 million IPO advised by V&E.

- MorningStar Partners of Fort Worth offered its $100 million advised by Latham & Watkins with Baker Botts representing the underwriters.

- Latham also advised Enlight Renewables, an alternative energy platform based in Israel, in its $289 million IPO.

- Texas-based Kodiak Gas Services, advised by Kirkland & Ellis, launched its IPO, raising $256 million.

The other three IPOs included an insurance platform and two SPACs.

While those seem like depressing numbers, consultants Ernst & Young say global conditions are in place for a rebound:

“Against the backdrop of a divergent global economy and unpredictable geopolitical landscape, some stock markets are reaching a long-time high and enjoying low volatility,” says a recent EY report on IPOs. “Certain theme-centric sectors such as technology and clean energy are signaling an upswing in IPO activity.”

The outlook?

“A resurgence in global IPO activity is anticipated to start late 2023 as economic conditions and market sentiment gradually improve with the tight monetary policy entering its final stage.”

Houston capital markets partner Doug Getten at Baker Botts — and a veteran of the Texas energy space at Paul Hastings and Vinson & Elkins — says he’s not expecting a return to the energy heydays of energy a decade ago, but he says the deals he is seeing in the pipeline suggest a rebound — particularly in the energy capital markets — may well be in the offing.

“We’re seeing a little bit of momentum, the odds of a recession are lower and there’s talk of a ‘soft landing’ [for the economy],” said Getten. That momentum is building, he said, in such key capital markets categories as non-SPAC IPOs, equity offerings and new debt issues like bonds.

But it is the post-pandemic momentum in M&A that he’s been witnessing in a surge of work for his transactional colleagues that forms the foundation of his optimism.

“We [capital markets lawyers] are watching the M&A workflow as they are getting more and more business,” Getten said, stifling a chuckle. “We’re just hoping to have our turn.”

In recent weeks the CDT has witnessed an uptick in the reporting of capital markets issues, many reported as part of acquisitions and joint venture agreements. In early August capital markets deals in a single week outnumbered M&A transactions for only the third time in the past two years — and the most in number since June 2021.

Mike Blankenship may be onto something.

Note: This story was updated to include comments by Doug Getten.