Dallas-based Jackson Walker added three dozen attorneys in 2023 to become the largest corporate law firm operating in Texas by lawyer headcount, according to the new Texas Lawbook 50, our annual review of the top corporate law firms Texas’ business.

Former No. 1 Vinson & Elkins dropped into a second-place tie in the Lawbook 50 headcount with Kirkland & Ellis and Haynes Boone. Each gained seven lawyers and had a full-time equivalent (FTE) of 414 Texas attorneys, well behind Jackson Walker’s 460.

Norton Rose Fulbright saw a three percent decline in Texas lawyer headcount and dropped to fifth with 375.

In addition to the new hirings, the shakeup at the top of the Lawbook 50 is the result of shifting the way the Lawbook 50 calculates headcounts to a method used by other legal publications. Under the revised formula, Jackson Walker would have taken the top spot in 2022, rather than waiting until 2023.

More on that later in this article.

Digging into the Data

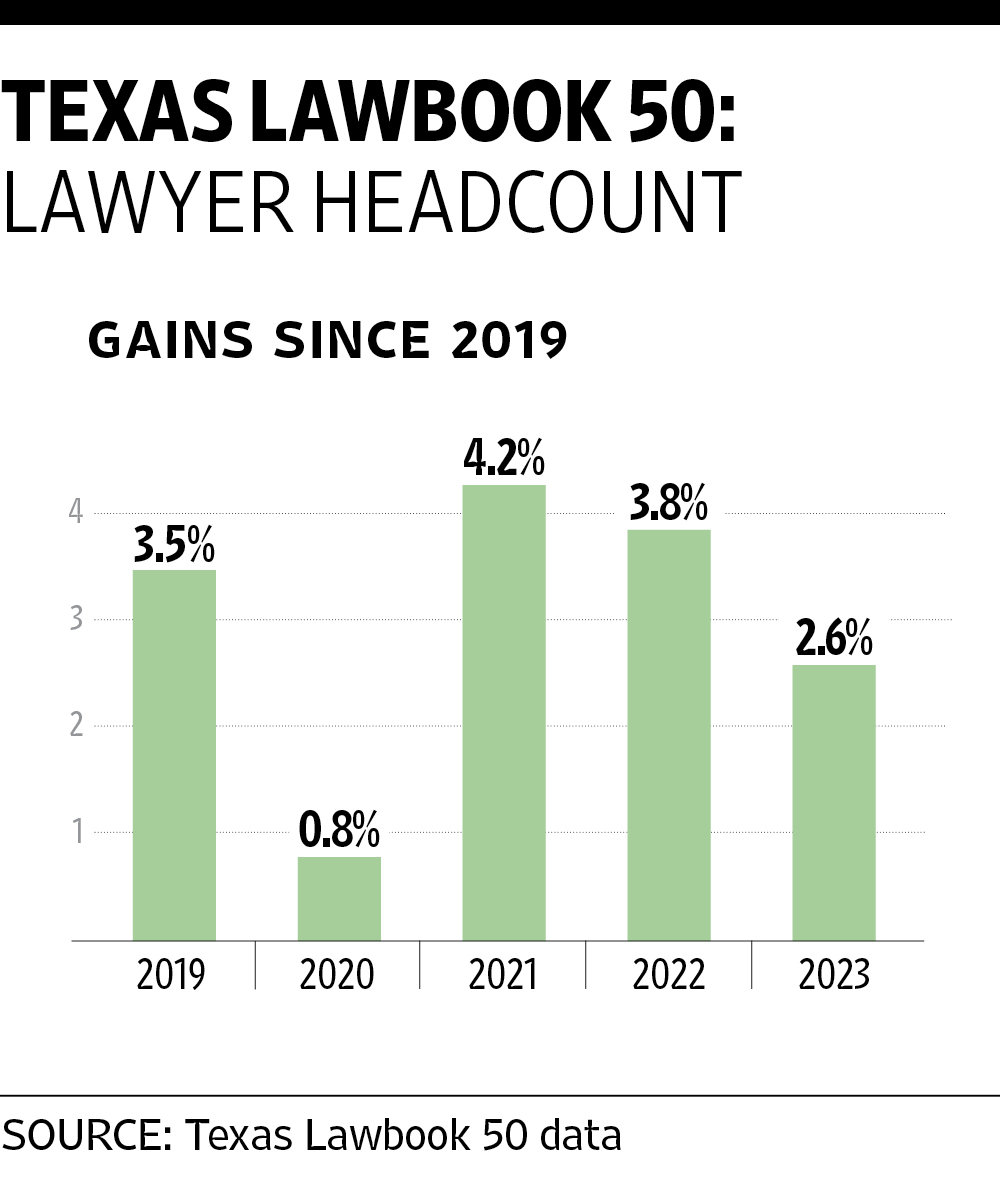

On an FTE basis, Lawbook 50 firms increased lawyer employment to 8,074 in 2023 from 7,867 the previous year — a healthy gain of 2.6 percent.

The new Lawbook 50 extends a winning streak that began with a net-hiring rush in 2019, took a year off for the pandemic in 2020, then roared back even stronger in the past two years. From 2010 to 2018, the annual headcount was essentially flat, with five up years offset by four down ones.

However, the new data may point to a downshifting in the law firm labor market after record gains of 301 lawyers in 2021 and 287 in 2022.

In 2023, 29 firms increased headcounts, Mayer Brown reported no change and 20 firms employed fewer lawyers. The decline count crept up a bit from 13 in 2022 and 17 in 2021, a sign of less market activity.

Jackson Walker and Kirkland topped the list of a dozen firms with double-digit gains in lawyer headcounts. McDermott, a Chicago-founded firm with a much smaller Texas footprint, nearly matched them with a gain or 32 lawyers.

In its second year after merging with Dallas-based Thompson & Knight, Tampa, Florida-based Holland & Knight grew by 28 lawyers.

Only five firms had double-digit headcount declines in 2023, led by Bracewell at 18.

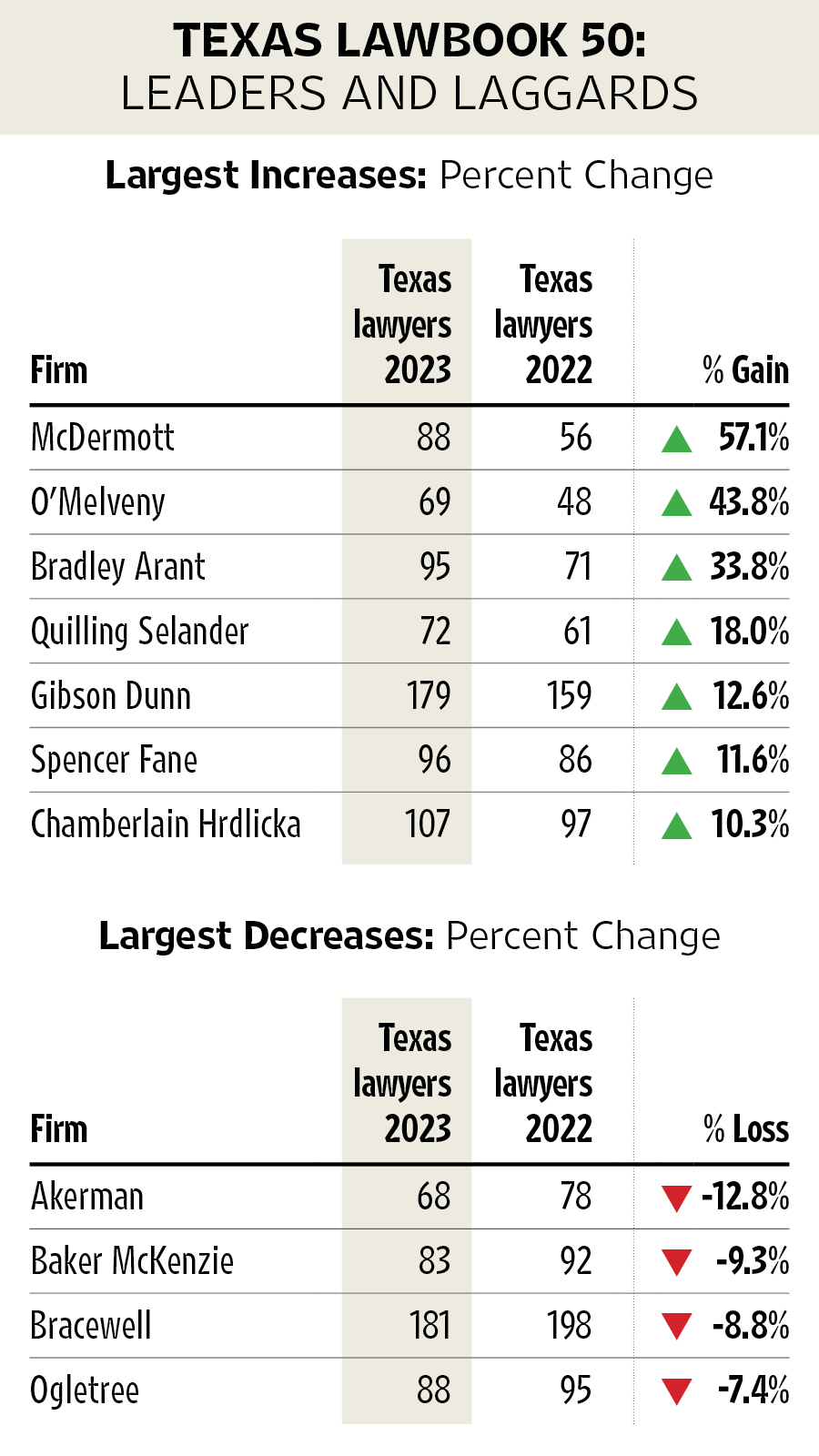

In percentage terms, McDermott led the Lawbook 50 with a gain of 57 percent, followed by Los Angeles-founded O’Melveny at 44 percent. Alabama-based Bradley Arant was next at 34 percent. Only Florida-based Ackerman had a double-digit decline at 13 percent.

Only one law firm in the top 25 — Gibson, Dunn & Crutcher — had a double-digit jump in lawyer headcount in Texas (12.6 percent).

Among the biggest firms, Jackson Walker and Kirkland each grew by more than 8 percent, while gains for V&E and Haynes Boone were below two percent.

Holland & Knight, Thompson Coe and Greenberg Traurig were Lawbook 50 top 25 firms that also saw headcount increases of 8 percent or more.

Some other nuggets sifted from the Lawbook 50:

- Seven of the 10 largest employers in Texas corporate law were firms founded or headquartered in the state. However, just 12 other Texas-based firms made the Lawbook 50 headcount rankings.

- Texas-headquartered firms increased lawyer employment by 57, or 1.5 percent. Headcounts grew by 150, or 3.5 percent, in the Lawbook 50’s 31 out-of-state firms.

- Continuing a trend that began several years ago, the non-Texan firms’ share of this key segment of the corporate law labor market rose from 52.4 percent in 2022 to 52.9 percent.

- O’Melveny added 58 lawyers in the past two years, and McDermott grew by 50. The aggressive hiring helped the two firms make their debuts in our headcount rankings — the former at No. 48 and the latter at No. 36.

- But two bigger firms had even larger headcount increases in those two years — Jackson Walker at 73 and Gibson Dunn at 62.

- Other newcomers to the rankings were Ogletree, Quilling Selander and Mayer Brown. None of them submitted data in 2022.

- The five newcomers replace Shearman & Sterling, Katten, K&L Gates, Carrington Coleman and Simpson Thacher. None of them reached this year’s cutoff of No. 50 Akerman’s 68 lawyers.

- The 10 firms with the largest headcounts added 101 lawyers, about a third of the net hiring. Four firms contributed nearly all of it: Jackson Walker, Kirkland, Holland & Knight and Thompson Coe.

- The second 10 posted a meager net gain of five lawyers. Only Gibson Dunn (20) and Greenberg Traurig (11) had significant gains.

- The middle group grew by 23 lawyers, although no firm had double-digit headcount growth. The next 10 had four double-digit gainers, who contributed a net addition of 60 lawyers, or 6.8 percent.

- The bottom 10 increased headcounts by 16, or 2.6 percent. Without O’Melveny, the group would have been in negative territory.

- All told, the Lawbook 50 project collected 2023 and 2022 headcount numbers for 73 firms. The entire sample shows growth of 190 lawyer jobs, or 2.1 percent.

Lawbook 50 FTE Formula Revised

When The Texas Lawbook launched its annual project on the business side of Texas corporate law, we surveyed firms on key metrics on their Texas operations, including how many lawyers they had on payroll.

Until this year, The Lawbook asked firms to report lawyer headcounts as full-time equivalents (FTEs) at the end of December. This yielded meaningful results, and an annual Lawbook 50 ranking, but it rewarded firms that added lawyers late in the year and penalized firms that lost lawyers right up into December.

For the survey for 2023, sent out in February, The Lawbook switched to the more widely accepted industry standard of annual average FTEs and asked firms to use it for both 2023 and 2022. We expect the change to produce a more accurate reading on Texas corporate law’s labor market — but it created some immediate issues for the comparisons with prior years.

The best example is who reigns at the top of the Lawbook 50 headcount ranking. Using Dec. 31 FTEs for 2022, it was Vinson & Elkins, with 441 lawyers. Then came Jackson Walker at 424.

The 2023 survey puts Jackson Walker as No. 1. However, we didn’t hail Jackson Walker’s toppling of V&E in a banner headline — for the simple reason it happened a year ago.

Using annual average FTEs, Jackson Walker was already top dog in 2022 at 424 lawyers and V&E, now at 414 lawyers, was tied for second with Haynes Boone at 407 last year. Norton Rose Fulbright ranked fourth with 387 lawyers.

Jackson Walker, Kirkland and Norton Rose Fulbright were already using average FTEs in 2022, and their headcounts stayed the same. The other two firms reported Dec. 31 FTEs, with V&E dropping by 34 lawyers and Haynes Boone increasing by 22 lawyers. Both V&E and Haynes Boone confirmed the numbers they reported for 2022 changed because of the switch to the average FTE methodology.

While some firms had large headcount gains or losses, past rankings don’t need a wholesale revision. The top four firms remained the same, only their order changed. No firms soar or plunge in the rankings, and the potential size of revisions dwindle as firms become smaller.

For the Lawbook 50 as a whole, the change produced a disparity of just 28 jobs among the more than 7,800 lawyers reported in 2022. The growth in lawyer employment was 2.6 percent using either way of measuring FTEs.

The Texas Lawbook 50 is a series of articles published annually that looks at the business side of corporate law in Texas. The Lawbook published the articles below during the past month: