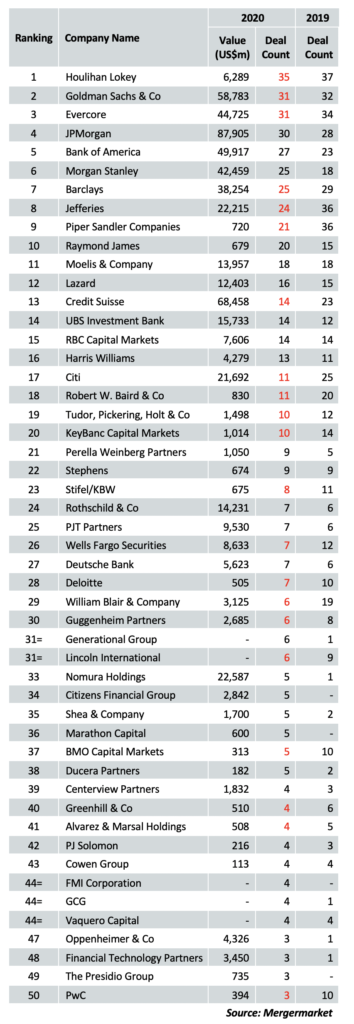

Los Angeles-based financial advisor Houlihan Lokey held the top spot for number of deals in Texas in 2020 though its transaction count fell by two amid the Covid-19 pandemic, according to data provided exclusively to The Texas Lawbook by Mergermarket.

However, the firm made about a 33.6% gain in terms of deal value, the data show. According to Mergermarket, Houlihan Lokey advised on 35 Texas deals amounting to $6.3 billion last year, compared to 37 transactions adding up to just $4.7 billion in 2019.

Houlihan Lokey managing director Rick Lacher, who is based in Dallas, told roughly the same story about the 2020 deal market that corporate lawyers have also recounted to The Texas Lawbook: It started out strong in the first quarter, ground to a halt in the second as lockdowns and travel restrictions were implemented, found its footing in the third and finished out the year strong in the fourth.

“It has turned out to be a very, very active year,” Lacher, told The Texas Lawbook. “And that momentum has continued into 2021.”

Goldman Sachs and Evercore ranked second- and third-highest in terms of deal count on Mergermarket’s list, with 31 deals each. Last year, Evercore placed fourth with 34 and Goldman placed fifth with 32.

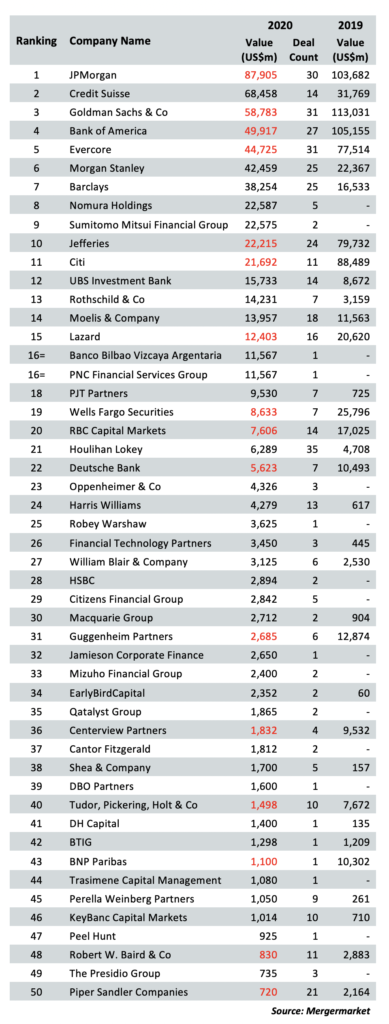

In terms of deal value, JP Morgan was in the top spot with $87.9 billion, a 15.2% decline over last year, according to Mergermarket. The firm overtook Goldman Sachs, which held first place in 2019 with transactions amounting to $113 billion but fell to third place last year with just $58.8 billion in deals, a 48% decline.

Credit Suisse was in second place in terms of deal value with $68.5 billion in transactions, a 115% increase from 2019. The firm previously ranked 14th with $31.8 billion in 2019.

Lacher himself worked on a number of notable deals last year, including advising Houston-based Bristow Group on its merger with Era Helicopters and Danimer Scientific on its go-public merger with blank check firm Live Oak Acquisition.

The Danimer deal closed at the end of December, and its stock price has ballooned since Live Oak’s IPO at $10 per share to over $60 currently. Lacher said it is an example of how active the market for special purpose acquisition companies like Live Oak is.

“It’s a very active SPAC market, and that market is putting premium values on premium assets,” he said. “SPAC sponsors are willing to underwrite rich valuations. It’s interesting how some of these companies that are at an earlier stage in their development from a revenue or profitability standpoint, are being well-accepted in the public markets.”

He expects that trend to continue in 2021 following a raft of new SPAC formations, and says that more SPAC money has been raised in January alone than in any year prior.

Lacher alo expects to see a healthy showing from private equity firms in the deal market, as well as a general desire to wrap up acquisitions ahead of any potential changes in tax structure with the new Biden administration.

“I think you’ll see a rush to try to get out the door prior to any potential tax increases,” he said.