For the first time ever, an out-of-state law firm holds the top spot in The Texas Lawbook 50, our annual ranking of corporate law’s Texas revenues. And it is a law firm that didn’t even have an office in Texas just over seven years ago.

Vilified and envied by competitors for their aggressive recruiting tactics, Chicago-founded Kirkland & Ellis leaped over law firms with 100-year-deep Texas roots – such as Baker Botts, Norton Rose Fulbright and Vinson & Elkins – on its way to becoming the state’s largest revenue-generating corporate law firm.

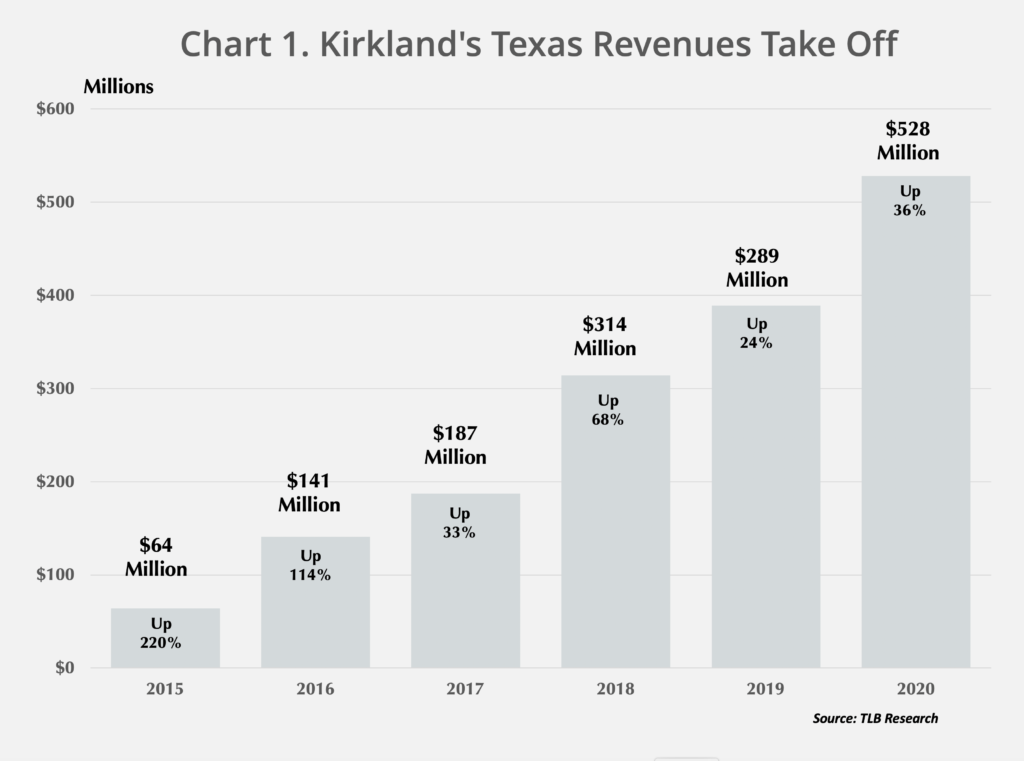

New research by The Texas Lawbook shows that revenues generated by Kirkland’s Texas lawyers jumped from $389 million in 2019 to $528 million in 2020 – a 35.5% increase. Thanks to lucrative practices in corporate restructuring and private equity M&A, Kirkland posted an astonishing one-year gain of $138 million, standing alone in 2020 as the only corporate law firm with revenues exceeding a half billion dollars in Texas.

The entire Texas Lawbook 50 will be released later this week.

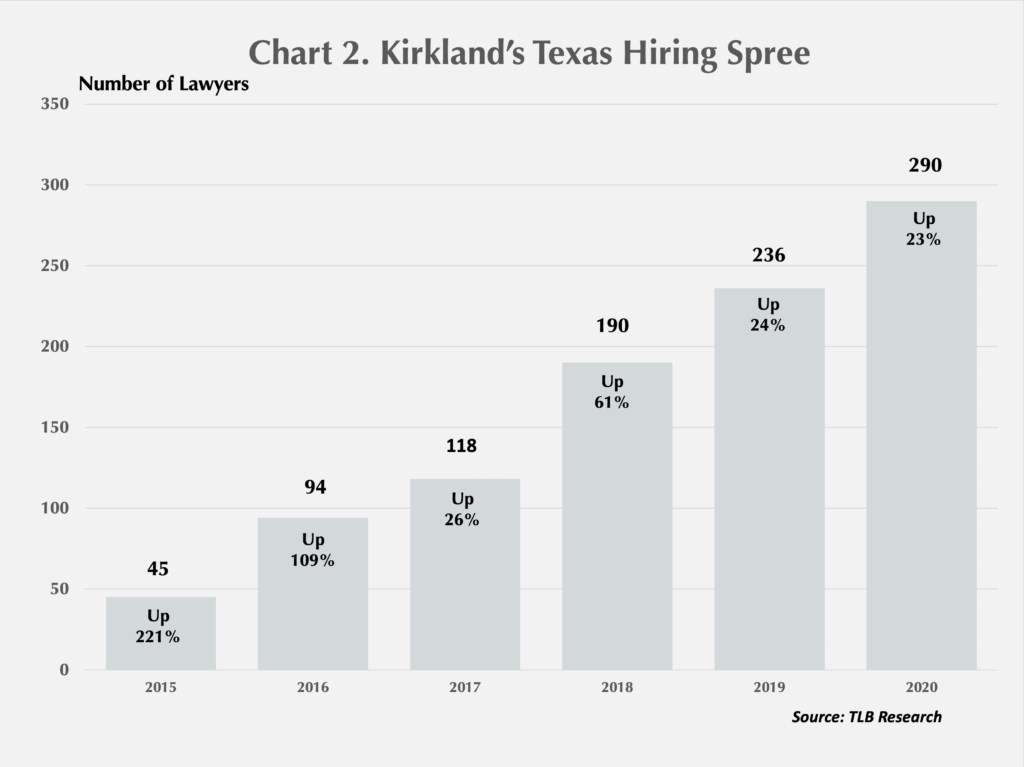

Other measures reinforce the story of Kirkland’s success in Texas. Lawyer headcount increased sharply from 236 in 2019 to 290 in 2020, a gain of 22.9%. Revenues per lawyer for the firm’s Texas attorneys rose 10.3% – from $1,650,000 in 2019 to $1,820,000 last year.

Kirkland partner Andy Calder (pictured above), who opened the firm’s first office in Houston in April 2014, called 2020 an extraordinary year but boldly stated the firm hadn’t reached its peak in Texas. The firm opened a third Texas office last month, adding Austin to their Houston and Dallas offices to complete the Texas Triangle.

In fact, Kirkland now has more offices in Texas than any other state.

“We think there is still a lot more growth ahead for our firm in Texas,” Calder said. “So far this year [2021], we’ve been absolutely slammed with client projects. We may be having the best start to a year that we have had since we opened the office in 2014.”

Kirkland’s Texas operations began modestly enough – 14 lawyers producing revenue of $20 million in 2014. The firm has been on the fast track ever since, posting its sixth consecutive year of double-digit increases in revenues and headcount in 2020.

All told, revenues grew by an annual average of 83% in the seven-year rise to the top of The Lawbook 50 – to $64 million in 2015 and $141 million in 2016 – then $187 million, $314 million, $389 million and now $528 million in 2020 (chart 1). Lawyer headcount march upward along with revenues, rising an average of 77% a year (chart 2).

Even competitors agree Kirkland’s Texas success has been remarkable.

“That is a real watershed event,” said Rob Walters, Gibson Dunn & Crutcher’s Dallas partner-in-charge, referring to Kirkland claiming the No. 1 spot in The Texas Lawbook 50 ranking. “Keep in mind that it was only 10 years ago that national firms found it almost impossible to even survive in Texas.

“Today, the success of Kirkland shows the relentless march of the nationalization of the corporate legal practice in Texas,” Walters said.

Even leaders at the larger Texas legacy law firms tip the hat to Kirkland’s achievement.

“I’m not surprised,” Bracewell managing partner Gregory Bopp said. “They’ve done an excellent job in the Texas market.”

The aggressive move into the Texas market was in character for Kirkland, a firm founded 112 years ago in Chicago. Since 2015, overall revenues have more than doubled, the firm’s 2,725 lawyers producing $4.8 billion in 2020, up 16% from 2019. For three years in a row, Kirkland has held the top spot in the American Lawyer ranking of the nation’s 100 largest law firms.

The Texas operation’s contribution to Kirkland’s overall success has risen steadily from less than 3% in 2015 to nearly 11% in 2020.

A Bankruptcy Bonanza

Like leaders at most other law firms, Calder said he had no idea what to expect last March and April as the Covid-19 pandemic disrupted business and sent the U.S. into recession. He said 2020 was “definitely a strange year that required all law firms to adapt to the new normal.”

In Texas, the new normal included a flood of corporate restructurings. In 2020, the Houston division of the Southern District of Texas became the busiest bankruptcy court in the U.S. for large Chapter 11 bankruptcy cases, especially those involving companies in the oil patch and in the retail industry.

“The restructuring practice was really on fire from March through the end of the summer and early fall,” Calder said. “Then corporate finance and private equity activity took off in the late summer and has kept our lawyers incredibly busy.”

Kirkland represented more than two-dozen large companies that filed for bankruptcy in Texas, including Neiman Marcus, J.C. Penney, Chesapeake Energy, Denbury Resources, Whiting Energy, BJ Services, Arena Energy, Pier 1, Tailored Brands, California Pizza Kitchen, Gulfport Energy and McDermott International.

According to a Texas Lawbook examination of court documents, those companies paid Kirkland a total of more than $400 million in fees and expenses last year. More than 110 different Kirkland lawyers billed time in those two-dozen restructurings, with some partners charging as much as $1,700 an hour. A significant number of those lawyers were based in Kirkland offices outside Texas, so their work wasn’t recorded as Texas revenues.

For example, court records show that Chesapeake Energy paid Kirkland $35 million to represent the Oklahoma oil and gas company in its bankruptcy in Houston.

In an interview last year, Denbury Resources General Counsel Jim Matthews acknowledged that Kirkland’s hourly rates are high, but he said that these restructurings are bet-the-company cases that require the highest levels of expertise.

Matthews said he worked with Kirkland lawyers previously and found them “extremely well prepared and remarkably knowledgeable about Denbury, our business and our assets.”

“Due to the fact this was such a critical path we were considering pursuing, I also completed some pretty significant due diligence on K&E, including contacting several colleagues and nonlegal professionals in the restructuring business to obtain some additional insight,” Matthews said. “The answer always came back the same: Kirkland is the best in the business.”

Fast Start, Big Impact

Kirkland wasn’t the first national firm to open an outpost in Texas. In fact, it was a latecomer.

Jones Day, Weil, Gotshal & Manges and Baker McKenzie arrived in Dallas in the 1980s. A handful of national firms tried to make a go of it in Houston – but most failed in a market dominated by a handful of large legacy operations, including Baker Botts, Bracewell, Andrews Kurth, Fulbright & Jaworski and V&E.

Latham & Watkins burst into the Houston market by hiring away lateral partners from several of the Texas legacy firms. Simpson Thacher, Sidley Austin and other national law firms followed. Latham and the others recognized that the attitudes of Texas corporations’ general counsel had changed and that they were no longer wedded to just one or two law firms.

Kirkland got its first taste of the Texas business community when the oil giant BP hired the firm’s litigation team to defend it in the Deepwater Horizon explosion and oil spill. The Texas-based law firms were conflicted out because they had previously represented Anadarko, Halliburton and Transocean in prior matters.

Legal industry insiders estimate that BP paid Kirkland about $100 million in fees.

In 2013, Dallas-based Energy Future Holdings hired Kirkland to handle its Chapter 11 bankruptcy restructuring.

To open its Houston office, Kirkland recruited Calder, then a young partner at Simpson Thacher in Houston. Exactly one week later, Kirkland filed EFH’s bankruptcy petition – a restructuring that lasted four years, involved four attempts to sell Oncor Electric for $18 billion and resulted in EFH paying Kirkland more than $250 million in fees. Calder was the lead lawyer handing most of those EFH-related transactions.

“The EFH bankruptcy was just a gift for a new Kirkland office in Texas,” said Walters, who was EFH general counsel at the time and part of the decision to hire Kirkland for the restructuring.

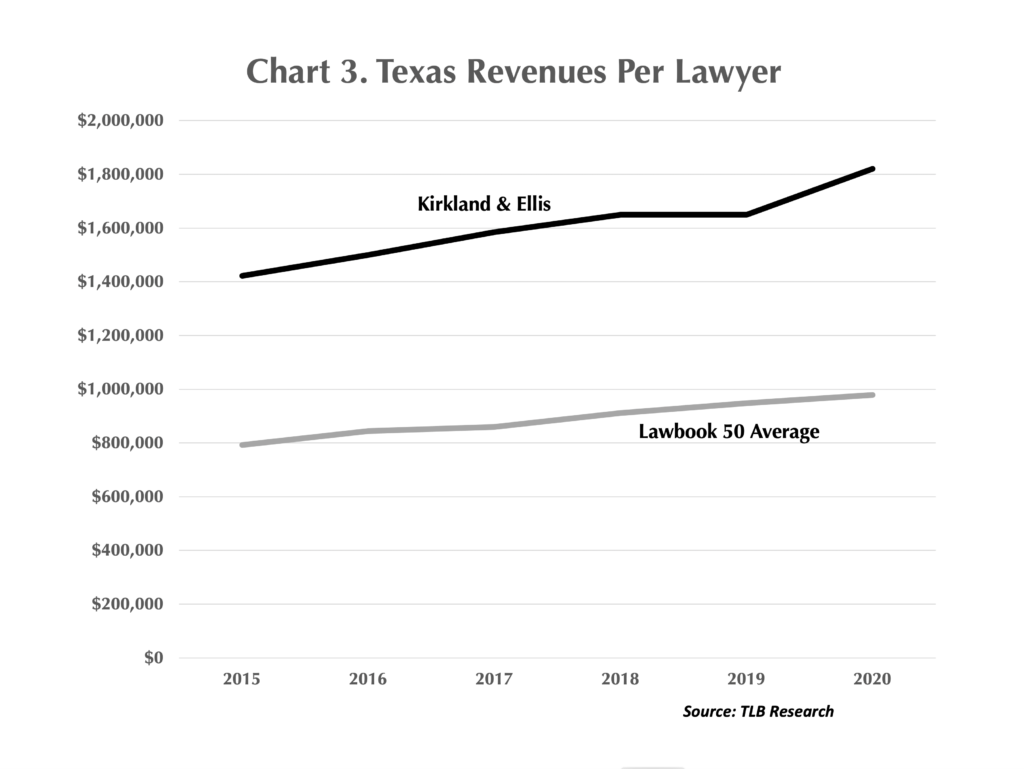

The headline-grabbing cases put Kirkland on a path to superstar status in Texas. The firm’s revenue per lawyer (RPL), a closely watched law firm metric, was already at $1,422,222 in 2015 – nearly twice the Lawbook 50 average (chart 3). Since then, Kirkland’s RPL has been growing a bit faster than the average.

During the same period, Kirkland achieved extraordinary financial successes firm-wide by representing private equity firms. Profits and revenues soared, which gave firm leaders deep pockets to go after top legal talent at competitors.

Kirkland did it aggressively – to the dismay of other Texas firms. Competitors complained that Kirkland was luring talent by offering multiyear, multimillion-dollar guarantees to key partners and signing bonuses in the range of $250,000 to experienced, senior-level associates.

Kirkland declines to discuss signing bonuses, saying employment matters are confidential.

But Kent Zimmermann, a Chicago-based law firm consultant who studies the Texas legal market, said national law firms such as Kirkland, Latham and Sidley, have certainly raised the stakes for talent.

“A couple law firms in the Texas market have the money to get anyone they want if they want them bad enough,” Zimmermann said. “They do it through signing bonuses or raising the floor on base salaries.

“The firms with the most money have the ability to hire the best lawyers, and the best lawyers have the best clients who pay the highest rates,” he said.

This wasn’t the way traditional Texas firms played the game. Since its arrival seven years ago, Kirkland has been a key actor in shaping the new reality in the Texas legal market, where money flows in an intense competition for clients and talent. Now, seven years as a disruptive force has culminated with Kirkland at No. 1 in The Texas Lawbook 50.

Editor’s Note: The Texas Lawbook will publish additional articles on law firm finances over the next month. The Texas Lawbook 50 will be published Monday ranking the law firms that generated the most revenue in the Texas market in 2020. Tip: There’s a huge shake-up at the top and it doesn’t just involve Kirkland.