Law firms in Texas are engaged in a fierce battle to represent businesses, private equity funds and banks involved in mergers, acquisitions, divestitures and joint ventures – and an estimated $3 billion in legal fees are at stake.

A small cadre of Texas-based law firms – Vinson & Elkins, Baker Botts, Akin Gump, Bracewell, Locke Lord and Thompson & Knight – are desperately competing against a group of deep-pocketed national legal practices – Kirkland & Ellis, Latham & Watkins, Sidley Austin, Gibson Dunn and Jones Day, just to name a few – to represent buyers and sellers in M&A deals large and small.

The Texas Lawbook’s Corporate Deal Tracker, which documents every corporate transaction reported by lawyers based in Texas, shows that law firms operating in the state handled a record 869 deals in 2018 valued at $493.7 billion.

Clients paid those law firms more than $3 billion in fees for the legal work on those transactions, according to new research conducted exclusively by The Texas Lawbook.

Later this week, The Texas Lawbook will publish full 2018 financial data for the 40 largest corporate law firms practicing in Texas.

But an early analysis reveals that there is a direct correlation between the firms that handled the most M&A activity in Texas and those practices that generated the highest revenues last year.

Two separate M&A databases – Mergermarket and the Corporate Deal Tracker – appear to show the same conclusion: Traditional Texas-headquartered law firms are struggling to retain large corporate clients and that elite national law firms are doing more and more of the top transactional legal work.

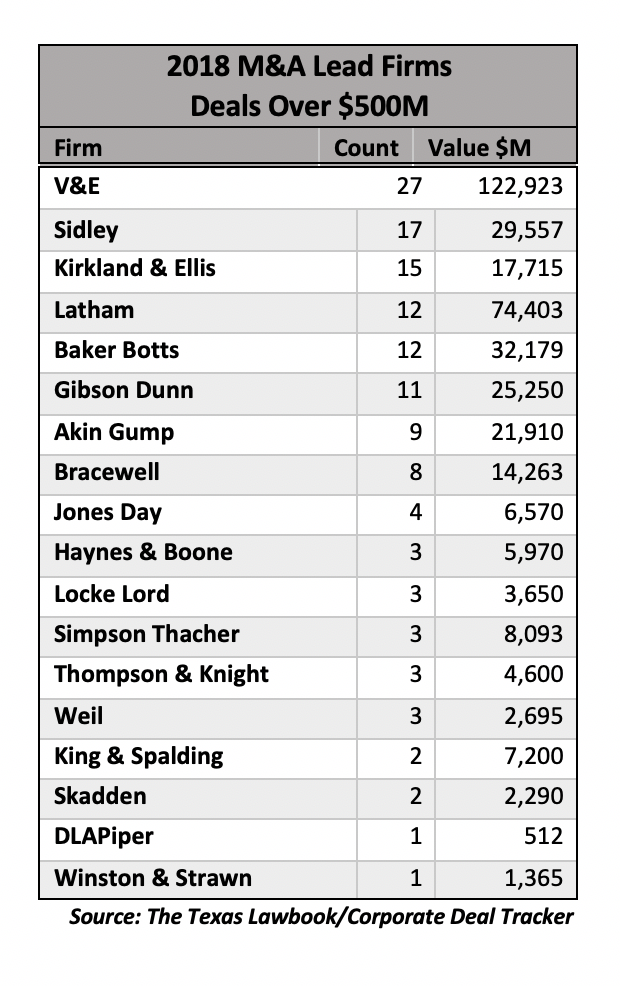

The Corporate Deal Tracker shows that Texas attorneys for 18 law firms operating in Houston, Dallas or Austin led M&A deals with values of $500 million or more in 2018. Eleven of those law firms are headquartered outside of Texas. Four of the top six law firms were lead counsel in the most mega-transactions – though they have offices in Dallas and Houston.

Of the 150 transactions valued at $500 million or more in 2018, Houston-based V&E acted as the lead legal advisor in 27 of them, according to the Corporate Deal Tracker.

Lawyers in the Houston and Dallas offices of Sidley Austin and Kirkland – two Chicago-headquartered firms – ranked second and third, respectively, in leading the biggest of the big M&A transactions. Latham, Baker Botts, Gibson Dunn and Akin Gump round out the top seven.

The Texas offices of those seven law firms worked on a combined 328 M&A deals – sometimes representing the buyers or sellers and other times advising financial institutions or conflicts committees – valued at nearly $400 billion in 2018, according to the Corporate Deal Tracker.

One-third of those 328 transactions – although handled by Texas lawyers – involved businesses based outside of the state.

Mergermarket, which provides its Texas research data exclusively to The Texas Lawbook, ranks Kirkland No. 1 in representing businesses headquartered in the state. Kirkland led exactly 100 transactions in 2018, while V&E came in second with 73 deals. Locke Lord, Baker Botts, Gibson Dunn and Latham rounded up the top six firms.

While the Corporate Deal Tracker records all M&A activity handled by lawyers who office in Texas, even if the deals involve companies outside of the state, Mergermarket chronicles every transaction involving a Texas-based business, even if the lawyers and law firms doing the legal work are not in Texas.

“The bottom line is that two law firms – V&E and Kirkland – continue to fight for the top of the M&A leaderboard in representing Texas companies,” says Chad Watt, an M&A analyst and senior writer for Mergermarket in Texas. “Kirkland has been ranked No. 1 for three years in a row for deal count and V&E has been a solid second.”

With 430 business lawyers in Houston, Dallas and Austin, V&E is the largest corporate law firm in Texas and has long been viewed as having one of the leading energy M&A practices in the U.S., according to Watt.

Legal industry analysts say that V&E, which is 102 years old, has a historical advantage in Texas because the firm has placed scores of its former partners as general counsel at dozens of energy companies. Those V&E alumni tend to hire their old law firm for some of their legal work.

For example, V&E represented Energy Transfer Equity in its $60 billion restructuring and simplification and RSP Permian in its $9.5 billion sale to Concho Resources in 2018. The general counsel at ETE and RSP Permian are former lawyers at V&E.

Kirkland’s surge in the Texas legal market has been nothing short of extraordinary. The firm opened its first Texas office in Houston in April 2014. It now has more than 200 lawyers in the state – most of them stolen from V&E and other Texas competitors.

Watt and others point out that Kirkland, which counts a handful of aggressive private equity funds as clients, has its own strategic advantage: The firm has more than 2,300 lawyers worldwide and revenues topping $3.7 billion. More than half of 100 Texas M&A transactions handled by Kirkland in 2018 were led by lawyers for the firm based outside of Texas, according to Mergermarket.

CDT Numbers In-Depth

The Corporate Deal Tracker shows that Kirkland lawyers in Texas were the lead advisors for buyer or seller 29 times in 2018, including in 15 of the mega-deals of $500 million or more.

The lead legal advisors for the buyers and sellers in a transaction do most of the legal work and are paid the most money because they do the most work, including negotiating deal terms and conducting due diligence, according to more than a dozen law firm leaders interviewed by The Texas Lawbook.

Law firms also represent other players in M&A dealmaking, including conflicts committees, minority investors and financial institutions, but those clients pay a fraction of the legal fees that the buyers and sellers pay their primary outside M&Acounsel.

In addition, these numbers do not include more than 400 reported transactions in which the dollar value of the deal or the parties involved were listed as confidential.

To be sure, the other corporate law firms operating in Texas are not suffering.

Sidley, for example, has seen its lawyer head count in Texas more than double during the past five years. To build its corporate M&A practice, the firm has stolen away senior attorneys from several legacy Texas legal practices. The investment is paying off.

In 2018, Sidley lawyers in Dallas and Houston were involved in 73 M&A deals in 2018 valued at $55.5 billion – up from 40 transactions worth $30.2 billion last year. The firm was lead counsel in 41 of the 73 deals, according to the Corporate Deal Tracker.

Baker Botts, which boasts 370 lawyers in Texas, represented clients in 56 matters with a total value of $89.4 billion, which is up from 38 deals with a combined price tag of $62.2 billion. Baker Botts lawyers acted as lead counsel for the buyer or seller in 29 of the 56 transactions.

The Texas lawyers at Los Angeles-based Gibson Dunn, which only opened its Houston office in 2017, worked on 33 deals – 20 of them as lead counsel – in 2018 for a combined value of $50.1 billion.

Akin Gump, which was founded in Dallas, reports that its Texas attorneys handled 34 deals – 20 of them working as the lead legal advisor for the buyer or seller – valued at $32.3 billion.

Editor’s Note: During the next two weeks, The Texas Lawbook will publish new Corporate Deal Tracker charts and rankings that examine various aspects of the Texas M&A market and the lawyers and firms that worked on the deals in 2018.