Lawyers in the world of natural gas know the name Kathryn McCoy. A former lawyer at the Federal Energy Regulatory Commission, McCoy has been an in-house lawyer for some of the biggest companies in the energy industry for nearly three decades, and she’s just about done it all.

During the past few years, McCoy led groundbreaking legal work developing a partnership involving liquified natural gas bunkering for ships in the U.S. She played a leading role in Southern Company’s sale of subsidiary Pivotal LNG to Dominion Energy. She dealt with legislation across the U.S. involving efforts to reduce greenhouse gas emissions.

Photo: Richard Carson

Last year, McCoy handled major force majeure issues related to Winter Storm Uri, and she played a significant role in Southern Co.’s sale of its marketing and trading unit called Sequent Energy Management to Williams Companies.

Lawyers who work with McCoy said her knowledge of the energy industry is unparalleled and her value to her new employer, the Williams Companies, is immeasurable.

“Kathryn has established herself as a visionary in the ranks of corporate counsel, most recently illustrated by her focus on initiatives in other states, such as California, to phase out natural gas use under the mistaken belief that this is necessary to reduce greenhouse gas emissions,” said Thomas Brill, who is of counsel at Greenberg Traurig. “Kathryn immediately recognized the potential threat of these kinds of initiatives on Southern Company Gas, as well as the natural gas industry.

“She therefore initiated a strategy to intervene in proceedings on this subject in California and to monitor the nation for further developments on this subject,” Brill said. “Her proactive strategy in addressing this threat is industry-leading and visionary.”

The Association of Corporate Counsel’s Houston Chapter and The Texas Lawbook recognize McCoy as the winner of the 2021 Houston Corporate Counsel Award for Senior Counsel of the Year for a Small Legal Department.

ACC Houston and The Lawbook honored McCoy and other finalists at a ceremony in Houston last Thursday.

“Kathryn is a phenomenal attorney and outstanding leader whose commitment, ambition and dedication is evident in all that she does,” said Brill, who nominated McCoy for the award. “Through her continued actions, she has made a lasting impact on the legal field. Her achievements are even more significant given that the energy legal practice is a male-dominated industry.”

Photo: Richard Carson

When McCoy was nominated for the Houston Corporate Counsel Award, she was still in the legal department of Atlanta-based Southern Company. Tulsa-headquartered Williams Companies purchased Sequent July 1, and McCoy and three of the four lawyers in her department made the move with the assets – though they still work in Houston.

“Kathy has advised business clients on truly groundbreaking LNG supply arrangements for the first vessels utilizing LNG fuel in North America,” said Archie Fallon, a corporate partner at Willkie Farr in Houston. “She has demonstrated the rare ability to apply experience in adjacent industries like gas storage and transportation to new industries like small-scale LNG.

“As an advisor to developers, she quickly sorts through the risks that are deal breakers and the risks that business clients might agree to take if compensated appropriately,” Fallon said. “This is a rare skill set that will be essential as energy transition clients require counseling on novel technology, development and financing risks.”

McCoy was born in Kingsport, Tennessee, which is about 100 miles east of LaFollette where both of her parents were born. Both of her grandfathers were coal miners. Her maternal grandfather was a Southern Baptist preacher.

McCoy’s father taught high school physics and chemistry, while her mother was a stay-at-home mom who worked for a time at IBM.

“My grandmothers were the matriarchs of our family. They both lived into their late 90s,” she said. “I would spend my summers with my maternal grandmother. We raised a garden. She taught me how to sew on a treadle sewing machine.”

When McCoy was 5, she, her parents and two siblings moved to Louisville, Kentucky, where her father had gotten a job. That is where she went to high school and then earned her bachelor’s degree in political science and her doctor of jurisprudence at the University of Louisville Brandeis School of Law in 1986.

She has no other lawyers in her family.

“As far back as I can remember I wanted to be a lawyer,” she said. “I was influenced by the lawyers on TV who always solved the case just before the show was over.”

Two college professors at the University of Louisville, Phil Laemmle and Paul Weber, had huge impacts on her life and career path. Both taught political science and both encouraged McCoy to higher levels of success.

Liberty National Bank and Trust hired McCoy fresh out of law school to handle tax matters for estates and trusts.

In 1987, a college and law school friend took a job at FERC.

“She knew I was not happy at the bank, so she called and said FERC was hiring,” she said. “I did a phone interview and they hired me. So I packed up and move to D.C. I had no idea about natural gas or interstate pipelines but I went.”

McCoy was hired as a legal advisor in FERC’s Office of General Counsel, where she focused on interstate natural gas pipeline regulations. She handled certificate authorization regarding construction of pipeline facilities and the transportation and sale of natural gas under the Natural Gas Act and Natural Gas Policy Act. She also drafted agency responses to congressional and public inquiries.

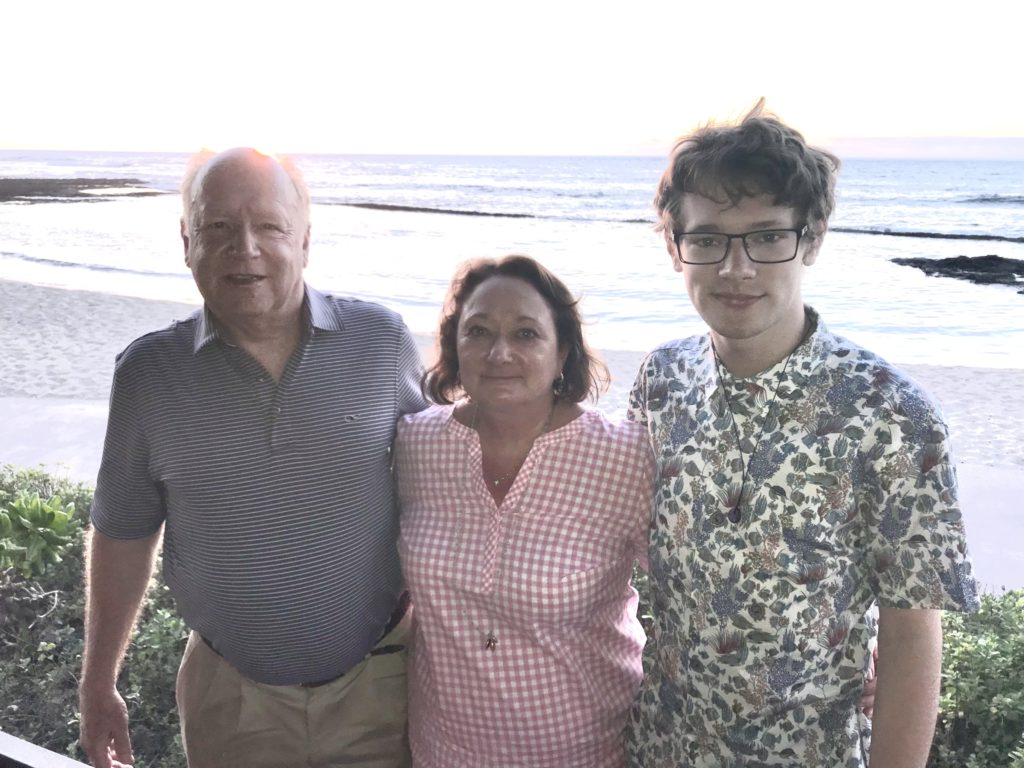

Kathy McCoy with her family

In 1989, McCoy started looking for a new challenge.

“If you stay at FERC for more than three years, you are considered a lifer,” she said.

Colorado-based K N Energy hired McCoy as senior counsel to draft and negotiate broker agreements, swap agreements and derivative agreements. She joined K N Energy as it created a natural gas futures subsidiary at the same time the NYMEX gas contract was developing. K N Energy merged with Kinder Morgan in 1999.

In 1995, K N Energy promoted McCoy to director of the regulated retail group, where she oversaw the company’s gas retail sales and distribution transportation business in 240 cities and three states. She also negotiated franchise agreements with municipalities.

After 13 years in Colorado, McCoy and her husband moved to Houston. She spent two years at Enterprise Products Partners, which had purchased El Paso Energy Partners, handling FERC and state regulatory matters.

In 2007, AGL Resources, a public utility headquartered in Atlanta, hired McCoy to be its chief counsel for its midstream assets. She handled transportation and storage agreements, construction contracts, regulatory matters and mergers and acquisitions.

“We built a salt dome cavern in Texas right after I started,” she said. “I love to learn about the process of removing the salt from the dome and creating a cavern. I went to the facilities often and loved to talk to the guys in the field.”

AGL also grew the LNG business during McCoy’s time at the company, which included building an LNG plant in Jacksonville.

“I would go to the plant and learn all about the liquefaction, the bunkering. … I enjoyed both the legal work, construction and master sale agreements and the geeky engineering/operations side as well,” she said.

Atlanta-based Southern Co. bought AGL Resources in 2015 for $12 billion.

In the five years in the Southern Co. legal department, McCoy has scored some huge successes, including:

- She worked on the development of the LNG business at AGL.

- She led internal counsel in obtaining consent for the first Federal Energy Regulatory Commission and Department of Energy approvals for the bunkering of LNG for ships.

- She successfully negotiated the first LNG bunkering development and sale transaction for any LNG facility. The agreement was one of the first times in the U.S. for an LNG facility to use bunkering, which is the supplying of fuel for ships and includes the shipboard logistics of loading fuel and distributing it among available bunker tanks.

- She successfully negotiated a confidential bunkering transaction for a major cruise line.

- She led the sale of the Southern Company subsidiary Pivotal LNG to Dominion Energy. Pivotal liquifies and delivers LNG for transportation in the southeast U.S. mostly from its LNG production facility on the St. John’s River in Jacksonville, Florida.

- She handled the transaction of the JAX LNG sale, a 50% stake, to Dominion Energy. JAX LNG is the first small-scale LNG facility in the U.S. with both marine- and truck-loading capabilities. The state-of-the-art facility was constructed through a joint venture between Pivotal LNG and NorthStar Midstream.

- And finally, she played a leading role in the sale of Sequent Energy Management, Southern’s marketing and trading company, to Williams in 2021.

“I worked with our in-house M&A lawyer throughout the whole process, developing the data room, presentations, answering questions, working through the purchase and sale agreement transition,” she said. “That was my main job for over a year. That came just after selling the LNG business and a salt dome storage facility in Louisiana, so there was no break.”

McCoy handled many of these transactions while also dealing with the Covid-19 pandemic.

“Covid forced us all to stay at home, of course, and we had to adjust to how we worked from home with new technology, but the biggest challenge was to make sure my group stayed connected and that their stress levels were manageable,” she said. “I believe in over communicating and trust. That is a culture we thrive in.”

Ben Clark, an M&A partner at Eversheds Sutherland in Houston, said McCoy has “a strong understanding of the energy industry in general.”

“Kathy has an expert knowledge of the natural gas transportation and trading business,” Clark said. “I was particularly impressed with how Kathy both anticipated and addressed the myriad legal and commercial issues which arose out of the Texas Winter Storm Uri in early 2021. She recognized the potential areas of risk and dispute at a very early stage and was able to develop a well-organized plan internally and with outside counsel to mitigate those risks.”