The battle is fierce among law firms and investment banks to represent Texas-based companies and foreign-owned corporations involved in cross-border mergers, acquisitions and joint ventures.

The independent M&A research firm Mergermarket, which supplied data exclusively to The Texas Lawbook, shows that the competition to advise the corporate buyers and sellers involved in multinational dealmaking in Texas during the past four years is dominated by non-Texas-based law firms with five exceptions – Vinson & Elkins, Norton Rose Fulbright, Baker Botts, Andrews Kurth Kenyon and Bracewell.

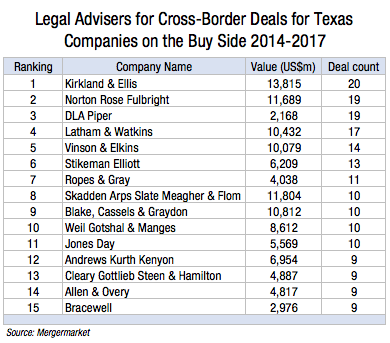

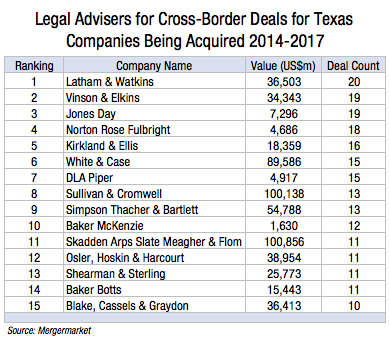

Topping the Mergermarket charts are two large national corporate law firms – Kirkland & Ellis led the most transactions in which Texas businesses bought foreign assets, while Latham & Watkins is number one in deals in which Texas companies were the target.

Four global mega-firms – DLA Piper, Jones Day, Baker McKenzie and Norton Rose Fulbright – also jumped into the leading legal advisers by deal count.

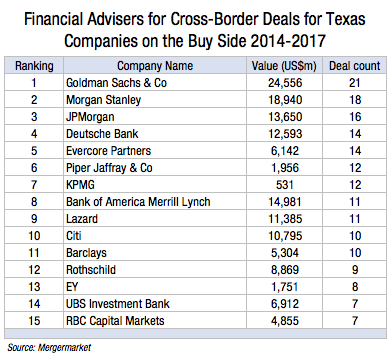

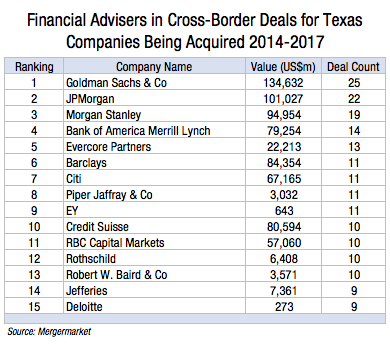

In the world of financial advisers, three investment banks – Goldman Sachs, JPMorgan and Morgan Stanley – dominate.

Since 2014, there have been 579 cross-border deals involving Texas corporations as the buyer or the seller with a combined deal value of $224 billion, according to Mergermarket.

In ranking the legal and financial advisers, Mergermarket breaks down its cross-border M&A data into two categories: (1) transactions in which foreign companies buy Texas-based businesses or assets and (2) international M&A in which Texas corporations are the buyer.

Foreign Buyers, Texas Sellers

Fifteen law firms have been involved in 10 or more multinational deals during the past four years in which Texas businesses were acquired by a non-U.S. company.

Latham, which has a large office in Houston, narrowly edged out V&E and Jones Day for the top spot by advising in 20 transactions valued at a combined $36.5 billion. Houston-based V&E used its deep connections in the oil patch to be the lead lawyers in 19 deals valued at $34.3 billion. Jones Day also advised in 19 transactions with a $7.3 billion value.

Norton Rose Fulbright handled the fourth most international deals in which Texas companies were the target. Kirkland came in fifth.

Houston-based Norton Rose Fulbright and DLA Piper jumped into the top five.

Baker Botts advised clients in 11 cross-border deals in which foreign companies bought Texas assets valued at $15.4 billion.

Skadden Arps and Sullivan & Cromwell were involved in fewer transactions – 11 and 13 respectively – but the dollar value of their deals topped $100 billion, which dwarfed the other firms.

Texas Buyers, Foreign Sellers

Kirkland, which opened its Houston outpost in 2014, advised in the most cross-border M&A activity with Texas corporations acquiring foreign assets. The firm led 20 such deals with a value of $13.8 billion.

Mergermarket reports that Norton Rose and DLA Piper tied for second in deal count with 19 each. Latham did 17 such transactions, while V&E advised clients in 14 multinational deals in which Texas businesses were buyers.

Houston-based Andrews Kurth Kenyon was involved in nine deals valued at nearly $7 billion in which Texas companies acquired foreign assets. Bracewell also advised in nine such transactions with a combined $3 billion value.

Financial Advisers

The clear-cut leader among the investment banks is Goldman Sachs, which ranks number one in handling M&A in which Texas companies are the buyer and seller in cross-border activity. The New York financial giant advised clients in 46 deals valued at a combined $159.2 billion.

JP Morgan and Morgan Stanley basically tied for second. JPMorgan was the financial adviser in 38 multinational transactions with a value of $113.7 billion involving businesses headquartered in Texas. Morgan Stanley did 37 such deals with a combined price tag of $114 billion, according to Mergermarket.