Texas corporate law firms spent much of the past decade becoming more profitable and strategic. This meant booting underperforming partners, eliminating less profitable practice groups and taking a stricter look at the rookie lawyers they recruited and hired.

As a result, the number of lawyers practicing at corporate law firms operating in Austin, Dallas and Houston was stagnant for nearly the entire decade. The result was tighter run law firms that produced increased revenues per lawyer and profits per partner.

New Texas Lawbook financial data shows that the years of stingy hiring practices by corporate firms in Texas ended in 2019.

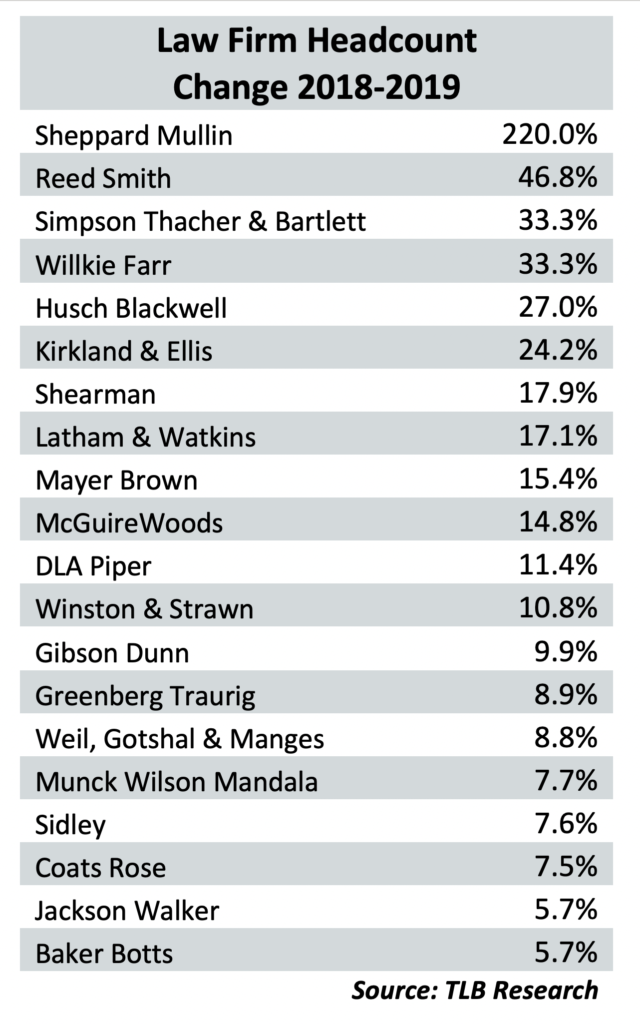

The corporate law firms in The Texas Lawbook 50 went on a relative hiring spree in 2019. Firms that spent the past few years contracting reversed that trend, including Norton Rose Fulbright and Hunton Andrews Kurth. Firms with conservative growth strategies started hiring again, including Baker Botts and Haynes and Boone.

And even firms – Sidley Austin, Greenberg Traurig and Winston & Strawn, for example – that had been aggressively growing their ranks in past years kicked up recruiting efforts to new levels in 2019.

But legal industry analysts say the long-awaited growth may have occurred at exactly the wrong time, citing the one-two punch of COVID-19 and plunging oil and gas prices.

“The economy is contracting. Now is definitely not the time to be hiring new lawyers,” said Jim Cotterman, a law firm consultant at Altman Weil. “The legal profession is 13% to 15% overstaffed. I’ve been trying to tell firms that they have too many people for the legal work that is out there.”

“The smart play right now is to delay commitments to new lawyers,” he said.

The number of lawyers working at The Texas Lawbook 50 – the 50 largest revenue-generating corporate law firms operating in Texas – increased 3.6% in 2019 from the year before and reached an all-time high.

A growth rate of 3.6% seems nominal except for this fact: The Texas Lawbook 50, which includes firms based in Texas and those headquartered outside the state, increased lawyer headcount on average by about one-half of 1% each year from 2014 through 2018.

The combined lawyer count at the top 50 corporate firms in Texas jumped from 6,889 in 2018 to 7,130 last year – an increase of 241 attorneys. By comparison, those same 50 law firms added only 194 lawyers for the four previous years combined.

“For the past several years, the pool of business lawyers practicing in Texas has remained flat, which is not what we would have expected in such a thriving economy,” said Kent Zimmermann, a law firm consultant with Zeughauser Group in Chicago.

“At the same time, dozens of national and regional corporate law firms have opened offices in Texas and are hiring local lawyers from existing firms instead of bringing in new talent from their other offices,” Zimmermann said. “The result has been lawyers jumping from one firm to another in a law firm version of musical chairs.”

The Texas legal market has needed to grow faster for several years, Zimmermann said.

“No one could have predicted a pandemic that would shut down the entire economy nine months or even three months ago,” Zimmermann said. “What seemed like good strategic planning a year ago is now a drain on cash-flow.”

Muy Gordo y Feliz

The story of the Texas corporate legal market is well-known to most.

The large Texas-based corporate law firms grew bigger and bigger throughout the 1980s, 1990s and early 2000s. Clients – especially those in the oil patch – literally walked in the door with no persuasion from sophisticated business development teams. There was minimum discipline when it came to enforcing rate increases. Unproductive lawyers were allowed to stay.

Partners at the big corporate firms with window offices in tall downtown buildings were fat and happy.

Then the Texas legal market took a one-two punch on the chin between 2009 and 2012. The Great Recession killed M&A activity and dried up capital markets, causing law firm revenues to plunge.

During the same period, wealthy national law firms headquartered in New York, Chicago and Los Angeles conducted a full-scale invasion into Houston and Dallas. These large firms had deep pockets and spent tens of millions of dollars luring top rainmakers away from the hometown competition.

“The cycle is simple,” Zimmermann said. “The wealthier, more profitable law firms have the money to hire away the best lawyers. The best lawyers have the best clients. The best clients pay the highest legal fees and generate the most revenues. Those firms can then use those revenues to continue to hire and pay the best lawyers with the best clients. And so it goes.”

To compete for the same talent, the Texas law firms realized they had to significantly improve their revenues per lawyer (RPL) and profits per partner (PPP). The firms hired consultants who pushed them to downsize by unloading less profitable practice groups, forcing less productive lawyers to leave and trimming back on their summer associate and first year hiring efforts.

The Texas firms focused on more profitable practice groups and on business sectors that were not as rate sensitive.

As headcount stalled at some firms and dropped at others, RPL and PPP increased.

The conservative approach is shown in The Texas Lawbook 50 data.

Between 2013 and 2018, the number of lawyers working in Texas for the top 50 law firms never increased by more than 1.5% in a single year. In two years of those years, the headcount actually declined.

The Texas law firms had a co-conspirator contributing to the stagnant lawyer numbers: Texas law schools substantially reduced the number of students they admitted, which meant fewer would graduate three years later.

Then came 2019 and the 3.6% increase. Here are a few key facts from The Texas Lawbook 50 data:

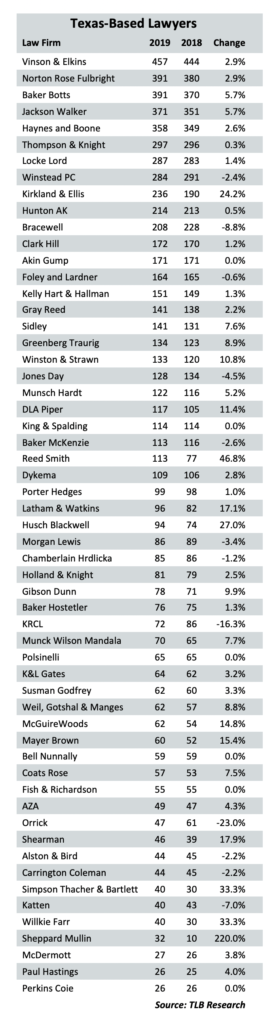

- For the third consecutive year, Houston-based Vinson & Elkins has the most lawyers in Texas (457);

- Baker Botts and Norton Rose Fulbright tied for second with 391 lawyers each;

- Seven of the 10 largest legal operations in the state (V&E, Baker Botts, Jackson Walker, Haynes and Boone, Thompson & Knight, Locke Lord and Winstead) are based in either Houston or Dallas;

- Two of the top 10 (Norton Rose Fulbright and Hunton Andrews Kurth) used to be based in Houston before merging with larger, non-Texas operations;

- Kirkland & Ellis added 46 lawyers in Texas in 2019 – the most of any law firm – and jumped from the 11th largest legal operation in the state to the ninth largest;

- The top 10 law firms employ 3,286 of the 7,130 lawyers;

- Thirty-four of the top 50 firms grew in lawyer count in 2019;

- Twelve of those law firms grew by 10 or more lawyers last year;

- Five law firms (Jackson Walker, Husch Blackwell, Baker Botts, Kirkland and Reed Smith) added a net of 20 lawyers or more;

- Ten firms saw their lawyer ranks decline in 2019;

- The lawyer count at three of the top 50 firms (Bracewell, KRCL and Orrick) dropped by 10 or more; and

- During the past two years, national law firms in The Texas Lawbook 50 relocated only 39 lawyers from other offices to their Texas practices – and 15 of those relocations were by one firm: Jones Day.

To be sure, the raw numbers do not tell the full story.

For example, Foley (previously known as Foley Gardere) saw its lawyer headcount fall by one. But that is still a significant improvement, because the firm had witnessed double-digit declines in 2018 and 2019 headcount.

In fact, legal industry insiders insist that shrinking lawyer count is not always a negative.

“Sometimes firms need to shed specific, less productive lawyers in order to focus strategically on more profitable practice areas,” Zimmermann said. “Once the difficult and hard work has been done, then firms can start to grow again.”

But four law firms – KRCL, Norton Rose Fulbright, HuntonAK and Jones Day – provide unique case studies about how year-to-year lawyer headcount may disguise what is actually happening at specific law firms.

KRCL – Small, Full-Service Boutique

Kane Russell Coleman Logan reported 86 lawyers in 2018 but only 72 last year. KRCL, however, had 20 lawyers from its insurance defense group depart to start their own law firm in what both sides agreed was a “highly amicable and a strategic” departure.

KRCL founding partner Raymond Kane said the firm had seen the insurance defense practice become significantly larger than the other groups and firm leaders wanted to right size.

“We had a great 2019 and an even better first couple months of this year,” Kane said. “The goal is to get rates and revenue per lawyer up. We have kept our overhead low. We are not trying to compete with the big national law firms.”

Texas Lawbook 50 data shows the strategy appears to be working. KRCL increased its RPL by 13% over the past three years. The revenues would have been higher in 2019, but a large fee that was expected to be paid in December did not arrive until January.

Kane and others at KRCL think the firm’s lower rates make their operation more attractive to clients needing “good old fashioned counseling” and to potential lateral hires who have clients that are suddenly rate sensitive because of the COVID-19 and commodity price crises.

“We plan to grow,” Kane said. “We never want to get huge, but we recognize that we may need to take on more office space as we expand over the next year or two.”

Norton Rose Fulbright – Global with Roots in Texas

Norton Rose Fulbright added 11 lawyers to its overall Texas lawyer count in 2019 – a mere 2.9% increase.

For a global, full-service law firm, that seems un-noteworthy, except that Texas Lawbook 50 data shows that Norton Rose Fulbright has been shedding lawyers in its Texas offices during the past five years.

In 2013, Norton Rose Fulbright employed more than 470 attorneys in Austin, Dallas, Houston and San Antonio. By 2018, the number dropped to 380 – a net loss of 90 attorneys.

But as lawyer count declined, the firm’s all-important revenue per lawyer stat increased.

The Texas Lawbook 50 data shows that Norton Rose Fulbright increased its RPL by 45% between 2015 and 2019.

“All the hard work and investment in implementing our strategic plan is paying off,” Norton Rose Fulbright partner Richard Krumholz said in an interview last year. “We are on track to have a great year.”

The Texas Lawbook will publish law firm revenues for Texas later this week.

Hunton AK – A Merger Finds its Footing

Hunton Andrews Kurth added one lawyer in its Texas offices in 2019.

Why is a net gain of a single lawyer newsworthy? Because it follows two consecutive years of massive talent drain at Hunton AK. Indeed, no major corporate law firm in Texas has witnessed as much turmoil during the past five years as Hunton AK.

In 2015 and 2016, Hunton AK – or Andrews Kurth Kenyon as it was known back then – was soaring. The firm had nearly 340 lawyers in Texas and revenues per lawyer close to $1 million. Big national law firms, including Winston & Strawn and Orrick, reportedly contacted Andrews Kurth lawyers about merging.

“We are always open to opportunities, but we are not actively considering any mergers at this time,” then-managing partner Bob Jewell told The Texas Lawbook in 2016.

The firm was celebrating its 115th anniversary in 2017 when national law firms with deep pockets seeking to grow their Texas presence started targeting Andrews Kurth partners, just as they had their sights set on V&E, Baker Botts and Bracewell in the years before.

“Our partners have been getting calls every day from recruiters and firms,” Jewell told The Lawbook in a separate 2017 interview. “I know, because I’ve been getting calls and I’m the managing partner.”

Andrews Kurth lost 48 lawyers in its Texas offices in 2017 and another 83 attorneys in 2018. The firm’s RPL fell to $861,000 a year.

The merger with Virginia-based Hunton & Williams occurred in March 2018. Lawyers at Hunton AK told The Lawbook that it took about a year after the merger for the new firm’s attorneys in Texas to regain their footing.

“We had an excellent 2019, and the first three months of 2020 were strong,” Hunton AK deputy managing partner Robin Russell said in a recent interview. “We are a law firm that made it through two World Wars, the Great Depression, 9/11 and the financial crisis. While there are challenges ahead for all law firms, we have a great advantage of diversity of practices. Given the circumstances, we are pleased.”

“We are monitoring the situation daily or even hourly at times and we are constantly thinking about what our future and the future of our clients are going to look like,” Russell said. “Our two main goals are to take care of our clients and to make sure that our staff and attorneys are safe.”

The numbers show it. Hunton AK’s revenue per lawyer ticked up to $878,079 in 2019.

Russell said the firm’s cybersecurity practice has been huge for their Texas clients.

“We’ve worked with more than 100 clients helping them comply with the California-passed privacy laws and regulations,” she said. “Our labor and employment practice has seen a lot of activity in the past couple months. And our large insurance coverage practice has been very busy, too.”

Hunton AK may only have had a net plus of one Texas lawyer in 2019, but going from losing 83 one year to gaining a lawyer the next year is the largest single year shift in the five year history of The Texas Lawbook 50.

Jones Day’s ‘Different Strategy’

The global law firm Jones Day started this decade with 200 lawyers combined in Dallas and Houston and was the eighth largest corporate law firm operating in the state. For the past six years, the firm has seen its Texas attorney numbers decline almost annually. The firm now ranks 20th with 128 attorneys.

While the headcount chart has arrows pointing down for Jones Day, the graph showing revenues per lawyer has been going in the opposite direction – straight up.

No question, Jones Day has lost some key lawyers to other law firms during the past year or so – some by design and others by circumstance. In February, Shearman & Sterling stole a trio of M&A and private equity partners. Kirkland nabbed Michael Considine, Andrew Van Noord and Alex Rose from Jones Day last year. And Thompson & Knight took project finance partner George Humphrey and tax law partner Louis Jenull in Houston.

At the same time, Jones Day has grabbed some high-profile laterals, too. Former V&E antitrust litigator Jim Reeder, former Reed Smith partner Bryan Brown and former Thompson & Knight partner Alfredo Ramos all joined Jones Day in 2019.

Jones Day’s biggest hire in 2019 was the U.S. Securities and Exchange Commission’s then-Regional Director Shamoil Shipchandler, who joined David Woodcock, his predecessor at the SEC, as part of Jones Day’s highly respected white-collar defense and corporate internal investigations practice.

“We definitely have a different strategy from what other law firms are trying to do,” said Matthew Kairis, partner-in-charge of the Texas offices of Jones Day. “2019 was a great year for Jones Day in Texas. We have seen demand increase and revenue increase, especially in litigation and investigations.”

A Texas Lawbook examination shows that very few national law firms relocated partners and associates from their other offices to their Texas operations.

Jones Day is one of the exceptions.

During the past couple of years, 15 lawyers from Jones Day’s offices in Cleveland, Pittsburgh, New York, Los Angeles and San Francisco have moved to its Dallas and Houston outposts. Their legal specialties range from labor and employment and M&A and private equity to tax law and complex commercial litigation.

Kairis, who has practiced law at Jones Day for nearly three decades, moved from the firm’s Columbus, Ohio, office to Dallas in January 2019.

“Over the past six or seven years, the number of law firms in Texas has increased significantly, but the number of lawyers has not increased that much,” Kairis said. “The result has been to spread out the talent so thin at most law firms in Texas that they have no bench.”

Kairis points out that Jones Day has 2,500 lawyers in 43 offices worldwide.

Jones Day’s financials have been described as “a black box” because firm leaders share very few numbers publicly. The Texas Lawbook 50 data on Jones Day is the result of a combination of sources – former and current Jones Day partners in Texas, legal industry analysts and statistics reported by the American Lawyer.

During the past four years, Jones Day has increased revenue per lawyer by 16%. If the trend continues, the Texas offices will break into the elite status of $1 million RPL in the next two years – COVID-19 permitting.

Editor’s Note: During the next three weeks, The Texas Lawbook plans to publish additional law firm finance articles related to the Texas Lawbook 50. The focus of those articles include: The competition between firms based in Texas and those headquartered elsewhere; An in-depth review of the past five years and what it forecasts for the years ahead; The fight for the middle market in Texas; and a behind-the-scenes peak at hourly rates. Throughout the series, various law firms will be profiled.