“There were two kinds of M&A lawyers in Texas,” Gibson, Dunn & Crutcher partner Jeff Chapman said during the last financial crisis in 2009. “Those who say they are doing no deals and those who are lying.”

New M&A data from The Texas Lawbook’s Corporate Deal Tracker and Mergermarket shows Chapman could say the same about current times.

The number of mergers, acquisitions, divestitures and joint ventures announced by Texas businesses or handled by corporate lawyers in Texas was down significantly in 2019, slowed even more in the first quarter of 2020 and is now in an indefinite holding pattern.

How bad has it been?

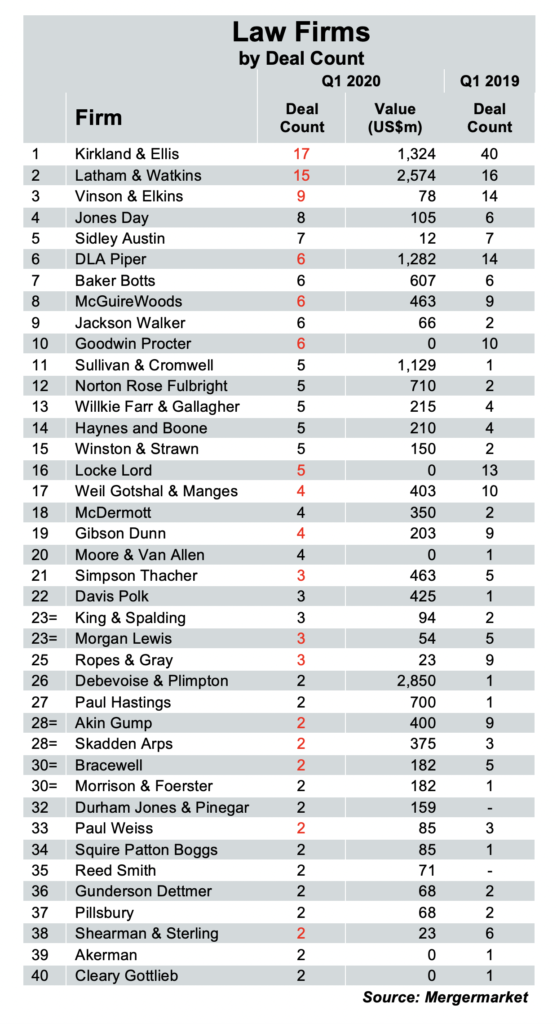

Only two law firms – Kirkland & Ellis and Latham & Watkins – did 10 or more mergers, acquisitions, divestitures or joint ventures involving Texas-based companies during the first three months of 2020, according to new Mergermarket data provided exclusively to The Texas Lawbook. Seven law firms handled 10 or more M&A deals during the first quarter of 2019.

Seventeen of the top 40 firms did fewer Texas transactions during this January, February and March than they did a year ago. A dozen law firms – including two of the top three – saw the value of the deals they handled in 2019 drop 50% or more, according to Mergermarket, which tracks deal activity based on the location of the companies involved.

In fact, M&A dealmaking was so rare during Q1 2020 that 15 law firms worked on only two transactions each involving Texas businesses during the period and those firms still made Mergermarket’s top 40.

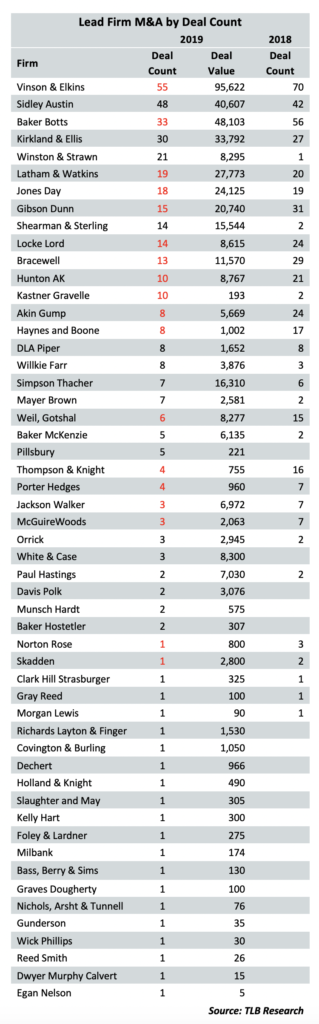

The slowdown in M&A started last year for Texas lawyers, according to the final 2019 report by the Corporate Deal Tracker, which documents every corporate transaction handled by a Texas-based lawyer on all deals, including those outside of Texas and even overseas.

The CDT shows that elite national corporate law firms operating in Texas continue to increase their share of M&A deal work at the expense of firms based in Houston, Dallas and Austin. But even some of those firms headquartered in New York, Chicago and Los Angeles saw the deal work for their Texas attorneys shrink considerably in 2019.

Only eight law firms in Texas were the lead legal advisors for the buyers, sellers or targets on 15 transactions or more in 2019 – down from 14 law firms that led on 15 or more deals in 2018.

Sixteen of the top 25 corporate law firms in Texas saw the number of deals in which they were lead counsel decline in 2019 – 10 of the 15 dropped by 50% or more. Nine of the 16 firms are based in Texas, according to the CDT.

Only two law firms – Vinson & Elkins and Sidley Austin – reported that their Texas lawyers were lead legal advisors on 40 or more transactions.

The Corporate Deal Tracker data favors law firms that have large corporate transactional practices in Texas, especially if those Texas lawyers represent clients beyond the state’s borders. V&E has by far the most corporate transactional lawyers in Texas. Baker Botts is second.

By contrast, Mergermarket data tends to benefit large law firms with partners in New York, Chicago or even London representing buyers, sellers or targets that are headquartered in Texas. This gives the advantage to Kirkland, Latham, Jones Day, Sidley and DLA Piper.

As Texas Lawbook M&A reporter Claire Poole previously reported, overall M&A deal volume handled by Texas lawyers declined by nearly 25% in 2019, according to the CDT. M&A involving Texas businesses continued the nosedive in Q1 2020 by 18%, according to Mergermarket.

At the same time, the lateral market for M&A lawyers with books of business remains steady, meaning that there were more firms vying for slices of a smaller pie.

Below are some highlights from the CDT and Mergermarket.

V&E topped the CDT database for being lead counsel in 55 nonconfidential transactions in 2019 that had a combined value of $95.6 billion. But that is down from 70 deals worth a price tag of $150.3 billion in 2018. Similarly, Mergermarket has V&E third in its Q1 2020 rankings. The firm’s lawyers represented nine Texas businesses – down from 14 a year earlier – with a combined value of only $78 million. That was V&E’s lowest quarterly deal value since Mergermarket began tracking league tables in 2007.

“Traditional oil and gas transactions have been flat or even down, but global energy M&A has been up for us,” V&E chairman Mark Kelly said. “We are having some of our transactional lawyers working with our bankruptcy and restructuring folks.”

Kirkland retained the No. 1 spot on the Mergermarket ranking for deal volume in Q1 2020 and third in deal value. The Chicago-founded firm advised 17 Texas companies or private equity firms in transactions worth $1.3 billion – that’s down from 40 deals valued at $8.7 billion in the first three months of 2019.

The CDT, by contrast, shows that Kirkland’s lawyers in Texas were the lead counsel in 30 transactions with a combined price tag of $33.8 billion in 2019 – an increase of 11% in deal volume and jump of 50% in value from 2018.

Texas lawyers for Sidley Austin were the lead counsel in 48 nonconfidential transactions valued at $40.6 billion in 2019 – up 14% in deal count from 2018, according to CDT. Mergermarket ranked Sidley fifth in Q1 2020 M&A deal volume with seven transactions – the same number as Q1 2019 when Sidley ranked 12th.

“The energy M&A practice simply ground to a halt,” said Cliff Vrielink, a partner at Sidley in Houston. “The M&A deals that have a commodity price attached to it are on pause.”

Mergermarket ranked Latham second with 15 deals valued at $2.57 billion in January, February and March. CDT ranked the Los Angeles-founded firm sixth with 27 transactions with a combined price tag of $27.8 billion in 2019.

A handful of law firms showed increases in the Mergermarket data, including Jackson Walker, Norton Rose Fulbright and McDermott.

The CDT shows that deal count among Texas-based firms as lead counsel in non-confidential M&A activity was down significantly in 2019 from 2018, including Baker Botts (-41%), Bracewell (-55%), Locke Lord (-41%), Akin Gump (-67%), Haynes and Boone (-53%), Thompson Knight (-75%), Porter Hedges (-43%) and Jackson Walker (-57%).

To be fair, the CDT shows that the Texas offices of several top national law firms also experienced major declines in 2019 in the number of matters in which they were lead counsel, including Gibson Dunn (-52%), Hunton Andrews Kurth (-52%), Weil, Gotshal & Manges (-60%) and McGuireWoods (-57%).

The Texas operations of a handful of out-of-state law firms had an exceptional 2019, according to the CDT, including Willkie Farr & Gallagher (+167%), Mayer Brown (+250%), Baker McKenzie (+150%) and Pillsbury, which jumped from zero deals in 2018 to five transactions as lead counsel in 2019.

But the CDT data shows that Shearman & Sterling, Willkie Farr and Mayer Brown were in a superior parallel M&A universe in 2019.

Shearman’s lawyers in Texas were lead counsel in 14 transactions in 2019 worth a combined $15.5 billion – up from two transactions in 2018 valued at $218 million. Texas lawyers for Willkie and Mayer more than doubled the deals they handled last year.

The CDT does have some new names on the list, including Munsch Hardt, White & Case, Paul Hastings, Graves Dougherty, Gray Reed and Wick Phillips.

Editor’s Note: Includes an updated chart.