In the world of mergers and acquisitions, 2014 and 2015 couldn’t have been more different in Texas.

What’s more, legal and financial experts have no idea what is in store for 2016.

After a record-shattering year for Texas M&A in 2014, the deal environment in 2015 took a stark contrast.

M&A deals involving Texas-based companies declined 23 percent last year, according to Mergermarket, an independent global research firm. The downturn was significantly more pronounced in the energy sector, which saw a near 40 percent decline in deal-making in 2015 from the year before.

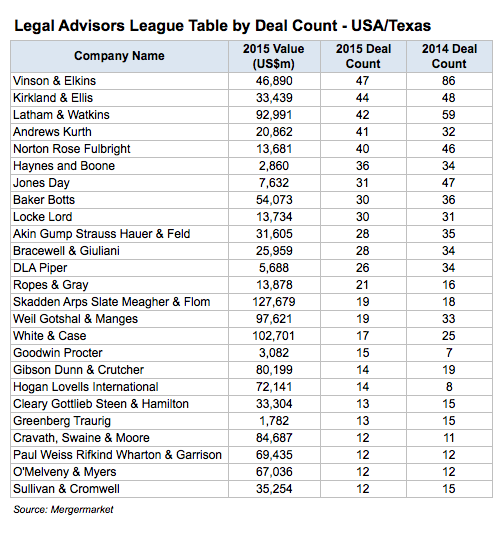

Mergermarket reports that 16 of the top 25 corporate law firms representing companies saw a decline in their Texas-based M&A work – some by as much as 45 percent. In addition, 16 of the top 25 investment banks witnessed a drop in transactions in Texas. One financial adviser saw its saw deal activity plunge 56 percent.

“Any industry that has significant exposure to oil and gas – manufacturing and industrial sectors, for example – are being hit,” says Rick Lacher, managing director at Houlihan Lokey in Dallas.

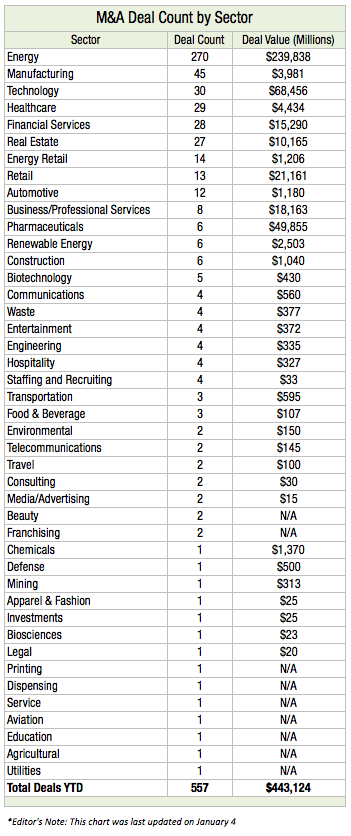

Mergermarket reports that 37 percent of the 460 Texas transactions announced in 2015 involved companies in the energy sector – down from about 50 percent in 2014. Twenty-five percent of the deals were in the combined technology and Internet services sectors.

Some law firms certainly took a bigger hit than others. Vinson & Elkins’ deal count among Texas businesses declined 45 percent and Weil, Gotshal & Manges dropped 42 percent. . Jones Day was down 34 percent and Latham & Watkins dipped 28 percent.

Only Andrews Kurth witnessed a significant M&A deal count increase – from 32 deals in 2014 to 41 in 2015, or a 28 percent jump. David Buck, who co-chairs Andrews Kurth’s corporate and securities practice, attributed the jump to a few factors, such as the firm’s continuing active role in representing private equity firms in Texas investments, particularly in technology and real estate in addition to energy. He also said there was an increase in “M&A activity for other firm clients in the same industries.”

There is good news, however, from The Texas Lawbook’s Corporate Deal Tracker, which shows many of the law firms that lost deal work from Texas oil and gas companies generated a sizeable amount of work – as much as 53 percent – from clients outside of Texas.

In addition, Texas M&A lawyers say they stayed busy working on potential deals for energy clients, even if those deals never occurred.

“2015 was a profoundly cyclical year,” said Adam Larson, a corporate partner in Vinson & Elkins’ Houston office. “The first half of deal flow had a very different variety, as commodity prices continued to decline” throughout the year.

“In the second half and the transition into 2016, there were much more distressed assets and [focus on] fixing balance sheet problems,” Larson said. “You’re going to see a very different looking deal flow.”

Deals in the energy sector accounted for nearly half of all 2015 transactions submitted to the Corporate Deal Tracker, which reports every M&A deal or securities offering led or worked on by a Texas lawyer, even if those transactions involve non-Texas-based companies.

The drop of commodity prices Larson refers to began in the fall of 2014, when crude oil and natural gas prices dropped from $100 a barrel to below $80 a barrel. Many oil and gas companies thought that would be the steepest decline they’d see, as many use $80 a barrel as the bottom of their accounting models.

Then 2015 happened. Oil prices declined well below $80 a barrel throughout the year into the $30s – a price range the industry had not seen since the 2008-2009 period of the Great Recession.

If oil prices continue to remain low in 2016 – which has already seen oil sell for as low as $28 a barrel – Texas lawyers representing those affected companies say they will certainly maintain a different busy.

“This quarter, we’re starting to see the ripple effect of the energy downturn as layoffs continued,” said Buck, a partner in Andrews Kurth’s Houston office. “We saw a lot of fat get trimmed in 2015. This year, we’ll see a lot of muscle and bone.”

Among that muscle and bone, experts say, could be components of companies’ less profitable businesses, and, for companies in more distressed financial positions, even the “crown jewel” assets critical to the core of their businesses.

Experts say these assets are likely to get picked up by buyers in healthy financial conditions – especially private equity firms swimming in cash.

That’s not to say this phenomenon didn’t occur last year, lawyers working on these kinds of deals pointed out. They said many deals did not get done last year because buyers and sellers walked away after failing to agree on a price.

“Distressed companies and management teams resisted being seen selling at the bottom last year,” said Latham & Watkins partner Ryan Maierson.

Maierson said some sellers had the mindset that oil prices would bounce back, making their assets more valuable, while potential buyers were seeking sweetheart deals.

“Last year, there were more false starts than normal,” said Efren Acosta, who heads Norton Rose Fulbright’s corporate, M&A and securities practice in Houston. “People were talking about doing deals, they’d go underway, but because of a gap in valuation… deals were more fragile.”

Buck said that buyer-seller disconnect still exists, but sellers are being forced to be more realistic about their price.

“Given the greater uncertainty we have entering 2016, the lower commodity prices will be an incentive for a lot of sellers to accept the reality that we’re living in today,” he said.

Other sectors

According to the Corporate Deal Tracker, Texas lawyers handled 557 deals that totaled $443 billion. Of those, the most (270) were in the energy sector, followed by manufacturing (45), technology (30), healthcare (29), financial services (28) and real estate (27).

Attorneys that specialize in some of these sectors said M&A activity in their practice areas remained healthy in 2015 in comparison to previous years.

Dallas real estate partner Winston Walp II of Norton Rose Fulbright, for example, ranked third in leading the most deals last year. Out of the 11 deals he handled, 10 were for Dallas-based Capital Senior Living Corporation, the nation’s largest operator of senior housing facilities.

Walp said real estate activity last year was comparable to the pre-recession levels in 2006, which he described as extremely active.

“I think [real estate for] all asset types has been very busy, partly because financing is now available,” Walp said.

Norton Rose Fulbright colleague Debbi Johnstone, who represents healthcare clients in M&A and regulatory matters, said her 2015 was “pretty consistent” to her 2014, which she described as very active.

“The last three years have been the busiest in my practice,” said Johnstone, a partner in Norton Rose Fulbright’s Houston office. “I’ve increased my practice on the transactional side.”

Senior Texas Lawbook writer Mark Curriden contributed to this article.

*Editor’s Note: The Mergermarket data and the Corporate Deal Tracker data are calculated separately. Mergermarket tracks data involving Texas-based companies, regardless of where lawyers working on those deals are based. The Corporate Deal Tracker tracks only deals handled by Texas-based lawyers, even if the companies involved are based outside of Texas.