© 2015 The Texas Lawbook.

By Natalie Posgate and Mark Curriden

(May 6) – Merger and acquisition activity for Texas-based companies was bad in 2015, but it has been even worse so far in 2016.

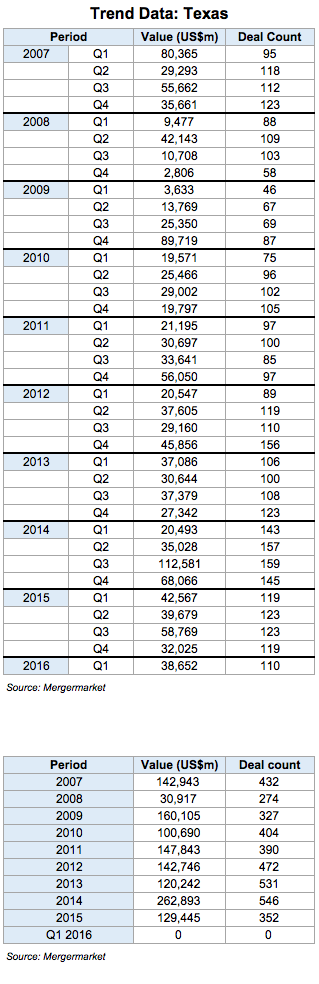

Corporate deal-making in Texas plunged eight percent during the first quarter of 2016 compared to one year earlier and it was down about 40 percent from the peak of M&A in 2014, according to data provided exclusively to The Texas Lawbook by independent M&A research firm Mergermarket.

At the same time, the capital markets closed for most Texas business, especially those in the energy sector. The number of initial public offerings this year plummeted to the lowest levels since the depths of the Great Recession in 2009, while the number of equity and debt offerings for Texas businesses is down 56 percent from one year ago, according to data from The Texas Lawbook’s Corporate Deal Tracker.

“It’s such a bad quarter that deals struck last year are falling apart,” said Chad Watt, an analyst with Mergermarket in Dallas.

Three of the largest corporate transactions of 2014 and 2015 – Dallas-based Energy Transfer Equity’s $38 billion proposed acquisition of Tulsa-based Williams Companies, Energy Future Holdings’ attempted sale of its Oncor utility business to Hunt for $18 billion and Houston-based Halliburton’s $28 billion effort to merge with Baker Hughes – have either fallen apart or have only a thread of a chance of moving forward.

‘Pretty Dead’

“Pretty dead – that’s how I would describe the oil and gas M&A market for the past year and a half,” said Robin Fredrickson, an oil and gas partner at Latham & Watkins in Houston. “Strict M&A involving the sale of assets and equity of companies not in bankruptcy has been pretty dead for more than a year now.

“I’ve never experienced a downturn in the energy M&A market that has gone on this long,” said Fredrickson, who has represented Dallas-based companies Energy Transfer Partners and EXCO Resources in multibillion dollar transactions. “But I think it is starting to change. In just the past four to six weeks, I have seen an uptick in phone calls from companies who think the conditions are better for a deal.”

Mergermarket reports that, during the first three months of 2016, Texas businesses were involved in 110 mergers, acquisitions, joint ventures or divestitures with a combined value of $38.6 billion. By comparison, there were 159 such deals valued at $112.6 billion in the third quarter of 2014, which was the peak of M&A in Texas after the end of the recession.

“There has been a huge attitude disconnect or divide between sellers and potential buyers on valuations of assets,” said Rodney Moore, a corporate partner at Weil, Gotshal & Manges in Dallas. “The deals we have gotten done are mostly complex joint ventures and M&A for midstream oil and gas clients.”

Lawyers and financial advisers who specialize in the capital markets practice have been even slower than those doing M&A work. The first half of 2015 saw a record amount of securities offerings, as oil and gas companies hired armies of lawyers and bankers to raise cash for them while the capital markets were still available. But in mid-July, the flow of cash stopped as markets became weary of loaning over-leveraged energy companies more money in a down market.

Securities Offerings Down 55 Percent

Data from the Corporate Deal Tracker shows Texas lawyers advised clients on 37 securities offerings totaling $18 billion in the first quarter of 2016, compared to 85 offerings valued at $51 billion during the same time period a year earlier.

To emphasize the point, Latham & Watkins and Andrews Kurth, which are two of the top dogs handling securities offerings in Texas, worked on 40 percent and 67 percent fewer securities offerings, respectively, than they did in the first quarter of 2015.

IPO investment firm Renaissance Capital reports that there were only eight initial public offerings priced in the U.S. during the first quarter of 2016 – down from 34 IPOs in Q1 of 2015 and 64 IPOs that priced in the first quarter of 2014, according to a recent Texas Lawbook article by Sidley Austin corporate law partner William Howell in Dallas.

The eight 2016 IPOs raised $700 million, which was 93 percent less than the $10.6 billion generated in 2014, Howell said.

Howell said that Silver Run Acquisition Corp., a Special Purpose Acquisition Company that priced its IPO in January, was the only Texas-based business to price during the first quarter. By contrast, three Texas companies priced their IPOs in Q1 2014 and two during the same period a year ago.

The IPO pipeline doesn’t look promising either.

Only 24 companies filed to go public during the first three months of this year. By contrast, there were 48 new filings during Q1 2015 and 98 in 2014, according to Renaissance.

Howell said that Silver Run Acquisition Corp., a Special Purpose Acquisition Company that priced its IPO in January, was the only Texas-based business to price during the first quarter. By contrast, three Texas companies priced their IPOs in Q1 2014 and two during the same period a year ago.

Two Texas-based companies made their initial filings in the first quarter of 2016, which is slightly fewer than the three and four initial filings made by Texas-based companies in the first quarters of 2015 and 2014, respectively, Howell wrote.

Fredrickson, Moore and other lawyers who specialize in deal-making in the oil patch think the M&A dam will break soon.

“Many upstream companies now realize that they need to shed non-core and even some core assets just to fix their balance sheets,” said Moore, who has represented Dallas-based HM Capital Partners, Pioneer Natural Resources and Approach Resources in several large-dollar deals.

“The private equity firms still have the cash and we will start seeing some big checks being written soon,” he said.

Jim Rice, a Houston corporate finance lawyer, said that he has a “growing sense of optimism” that sub-$40 oil prices are history and that the M&A market involving exploration and production companies has hit the bottom.

“Many companies have balance sheets that have been grievously wounded and will require repair beyond what improvement in commodity prices alone can do,” said Rice, who is a partner in the Houston office of Sidley Austin. “Even the financially healthier companies are capital-constrained in the current environment, and many have initiated asset sale programs as their best options for bolstering capital resources and liquidity.”

M&A Drought Hitting Law Firms

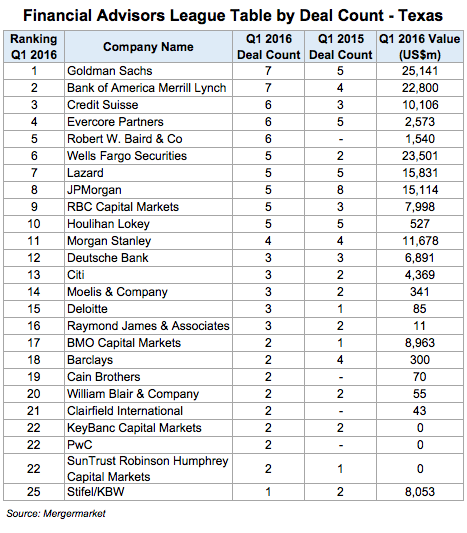

The prolonged drought in M&A and securities offerings in Texas has meant significantly less work for the thousands of lawyers and investment bankers who now specialize in corporate transactions in Texas.

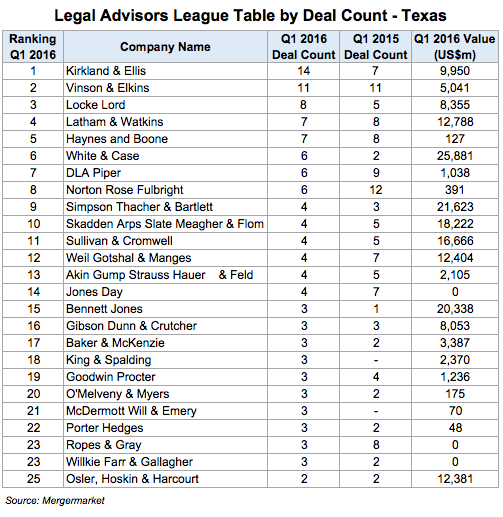

Mergermarket reports that 11 of the top 25 legal advisers for M&A in Texas worked on fewer deals during the first quarter of 2016 than the same period a year earlier. Nine law firms had their M&A work increase this year.

Seven of the 11 law firms that saw a decline in deal count have offices in Texas.

Lawyers at Kirkland & Ellis doubled their M&A activity during Q1 2016 by representing 14 Texas businesses – up from seven such deals a year earlier, according to Mergermarket. As a result, the Chicago-based law firm jumped from being ranked 12th in the league tables last year to No. 1 so far in 2016.

Watt said one factor for the slowdown is out-of-state investors’ somewhat “unfair” perception of the state of the Texas economy.

“When you leave Texas, the impression is that the oil bust is killing everything,” Watt said. “There’s this vibe that it’s going to be the 80’s oil bust all over again. If you’re in Texas and had exposure to the oil bust, you know that’s not going to happen, but the perception is out there, so M&A or capital investment companies’ stock valuations to Texas-based companies are down.”

Inside the Law Firm Numbers

Texas-based M&A lawyers are following the same trend. According to new data from The Texas Lawbook’s Corporate Deal Tracker, Texas lawyers handled nearly 12 percent fewer deals in the first quarter of 2016 than they did in 2015.

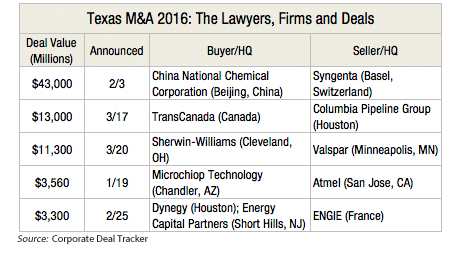

On the upside, the value of deals that Texas lawyers handled in Q1 2016 is nearly double the amount they handled in the same time period last year. The attorneys handled $96.7 billion worth of deals this quarter, compared to $51.75 billion in Q1 2015 – or an 87 percent increase.

The sharp value spike is attributed to one megadeal announced Feb. 3: ChemChina’s $43 billion purchase of Syngenta. Chris May of Simpson Thacher’s Houston office led the deal for ChemChina. If that deal is taken out of the equation, the deal value for Q1 2016 handled by Texas-based lawyers is $53.74 billion, which is still a 4 percent increase from the same time period last year.

To the contrary, the biggest deal that Texas lawyers handled in 2015 did not come until the fourth quarter: Dell’s $67 billion purchase of EMC (which May was also involved in).

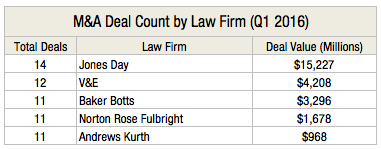

As the deal count decreases, it appears competition among Texas law firms gets tighter. Jones Day handled the most M&A deals in the first quarter (14), outpacing Vinson & Elkins for the first time. Three law firms – Baker Botts, Norton Rose Fulbright and Andrews Kurth – ranked third in deal count, each handling 11 M&A deals in Q1.

Andrews Kurth’s Mike O’Leary is the most prolific lawyer so far for M&A. The Houston partner led four deals valued at $798 million. Michael Considine of Jones Day’s Dallas office came in second, leading three deals in the first quarter.

The firm that leads securities offering count for this quarter, Vinson & Elkins, slightly increased the amount it handled compared to Q1 2015. V&E worked on 14 securities offerings valued at $11.4 billion in the first three months of 2016, compared to 13 during the same time period last year.

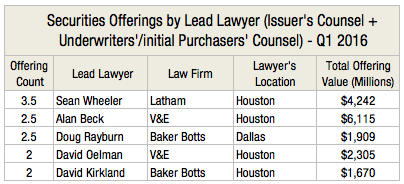

Two Houston partners from Latham and V&E took the prize for the top two lead lawyers handling securities offerings so far this year. Latham’s Sean Wheeler led or co-led four securities offerings, including the biggest of this quarter: Anadarko’s $3 billion debt offering of three sets of senior notes. V&E’s Alan Beck, who also worked on the Anadarko offering, co-led five securities offerings.

(Editor’s Note: Mergermarket calculates deal count based on where the companies are headquartered. The Corporate Deal Tracker reports deals handled by Texas lawyers regardless of where the companies they represent are headquartered. Lawyers receive higher credit if they are the solo lead on a deal. Lawyers that co-lead a deal with another attorney at their firm receive a half credit each. Full Q1 results for the Corporate Deal Tracker can be found at the bottom of the home page.)

© 2014 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.