Everything is bigger in Texas, as the popular saying goes, but not in terms of dealmaking in the third quarter.

Two new data reports show a significant decline in mergers, acquisitions and joint ventures involving Texas companies and Texas lawyers during July, August and September of this year. Observers blame trade wars and economic concerns as the culprits.

M&A activity in the third quarter fell 31% in terms of deal count over the same three months in 2018, according to new Mergermarket data provided exclusively to The Texas Lawbook.

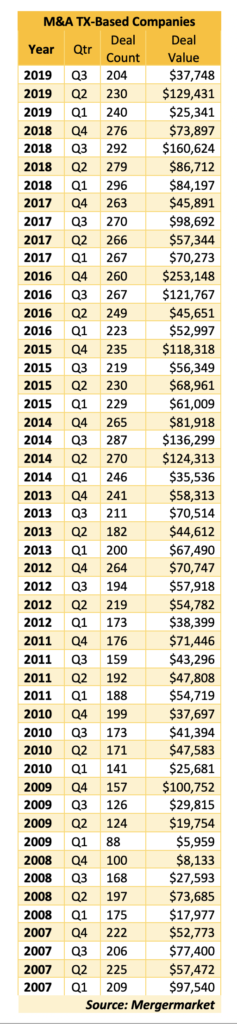

Total deal count with Texas-based companies as buyers or sellers during the third quarter fell to 204 transactions worth $37.7 billion – down from 255 deals valued at $130 billion in the second quarter and 295 worth $160.7 billion in the third quarter of last year.

Mergermarket reports that it was the 25th consecutive quarter with a deal count above 200, but it was the lowest volume of M&A in Texas since the second quarter of 2013.

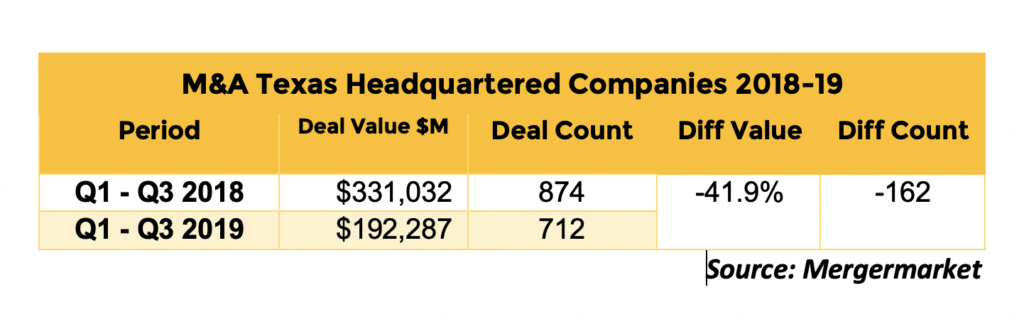

For the first nine months of this year, the number of deals declined to 712, versus 874 for the same period last year. Total value slid 41.9% to $192.3 billion, compared with $331 billion at the same time last year, according to Mergermarket.

Separately, dealmaking involving Texas lawyers – no matter the location of the

clients’ headquarters – also was down in the third quarter, according to The

Texas Lawbook’s Corporate Deal Tracker.

There were 124 deals valued at $71 billion in the third quarter compared with 138 transactions worth $158.3 billion at the same time last year, according to the CDT.

Conditions in the first nine months improved on a deal count basis, however, with the number of transactions reaching 416 valued at more than $235.4 billion compared with 347 transactions worth $296.5 billion in the same period last year.

Weil, Gotshal & Manges partner Jim Griffin, who spoke at an M&A CLE event in Dallas on Wednesday hosted by The Lawbook, blamed the government shutdown for dampening enthusiasm for deals earlier in the year but said conditions appear to be picking up this quarter.

“There are a lot of industries that are active right now,” he said. “It wasn’t that way during the first several months of the year – partially because of the government shutdown.”

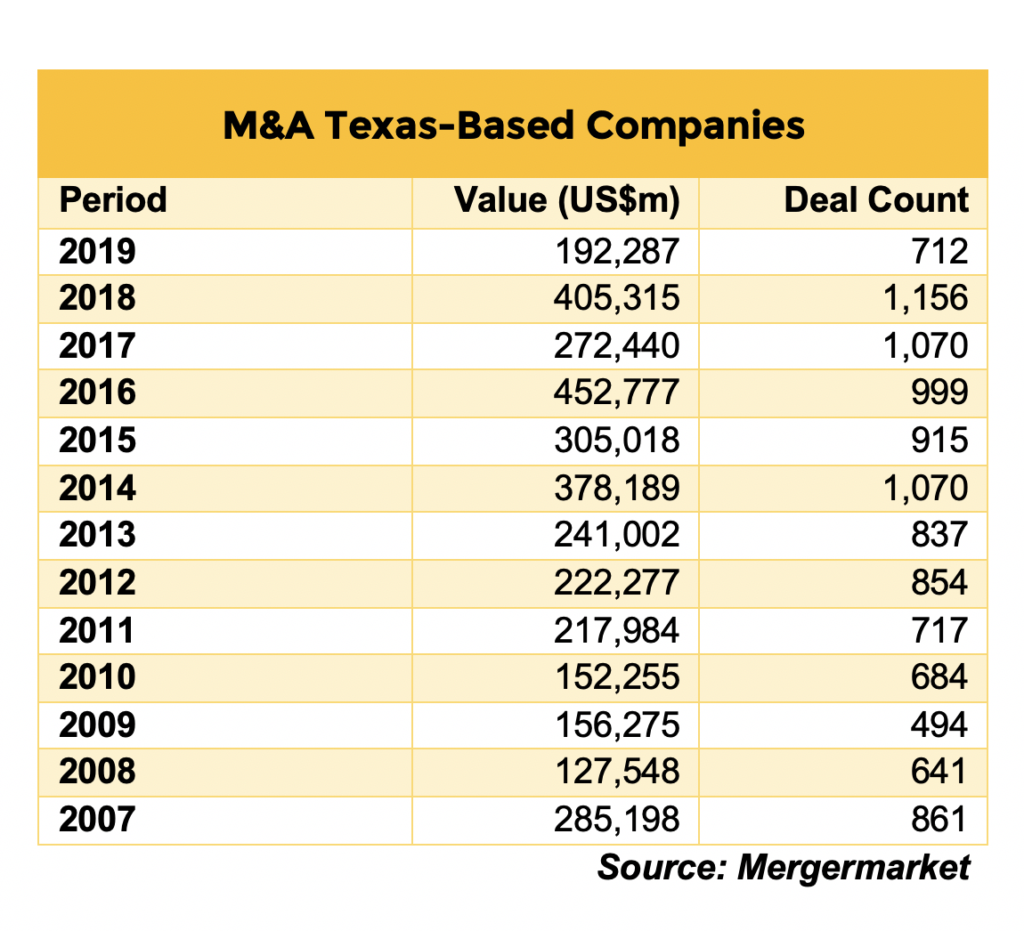

While 2019 has been weak so far, there’s still been more deal activity over the last six or seven years than ever before, according to Katten Muchin Rosenman partner Mark Solomon, who also spoke at the event.

“The thriving economy, low interest rates and strong capital markets have encouraged dealmaking,” he said.

Solomon said public exits aren’t being discussed very often right now but he’s seeing a lot of private equity trades.

“There is still a ton of dry powder out there,” he said. “We are still seeing a seller’s market. It’s very frothy – not unusual right now to see two or three bidders per deal.”

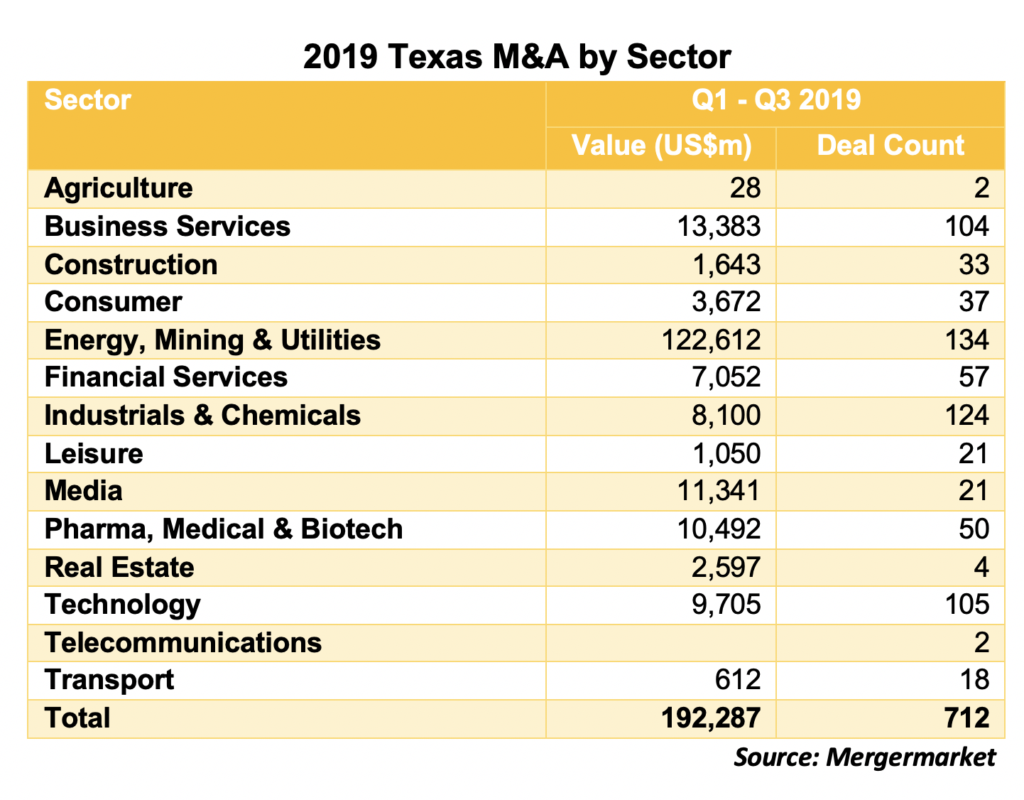

Not surprisingly, the energy, mining and utilities sector made up the biggest chunk of deal activity involving Texas companies so far this year, according to Mergermarket, with 134 transactions worth $122.6 billion, or 63.8% of the year’s total deal value.

Anadarko Petroleum’s $54 billion purchase of Occidental Petroleum – and its $8.8 billion sale of its African assets to Total – certainly helped boost the energy industry’s numbers, along with Buckeye’s $10.2 billion purchase by IFM Investors, both of which were announced in May.

The energy industry was followed in the ranking by business services with 104 deals worth $13.3 billion, or 7% of the market (highlighted by Waste Management’s $4.8 billion purchase of Advanced Disposal Services); media with 21 transactions valued at $11.3 billion, or 5.9% of the market (helped by Sinclair Broadcast Group’s $9.6 billion purchase of Fox Sports Net); and pharma, medical and biotech with 50 deals worth $10.5 billion, or 5.5% of the market (aided by 3M’s $6.7 billion acquisition of Acelity).

The next biggest sectors were technology, which racked up 105 deals valued at $9.7 billion, or 5% of the market; industrials and chemicals, which hit 124 deals worth $8.1 billion, or 4.2% of the market; and financial services, which generated 57 transactions valued at $7 billion, or 3.7% of the market.

“Because of the challenge in the Sabre deal [for Farelogix], tech companies are a little hesitant [to do deals] right now,” Weil’s Griffin said.

Top Texas M&A Deals 2019 Q3

Source: Mergermarket (Scroll Right for More Columns)| Date Announced | Value (US$M) | Target | Target Sector | Target Legal Advisors | Buyer | Bidder Legal Advisors | Seller | Seller Legal Advisors | |

|---|---|---|---|---|---|---|---|---|---|

| 1 | May 9, 2019 | $54,388 | Anadarko Petroleum Corporation | Energy, Mining & Utilities | Wachtell, Lipton, Rosen & Katz Advising FA : Fried Frank Harris Shriver & Jacobson | Occidental Petroleum Corporation | Cravath, Swaine & Moore; Freshfields Bruckhaus Deringer Advising FA : Weil Gotshal & Manges | ||

| 2 | May 10, 2019 | $10,188 | Buckeye Partners LP | Energy, Mining & Utilities | Cravath, Swaine & Moore; Vinson & Elkins Advising FA : Cleary Gottlieb Steen & Hamilton | IFM Investors | Allen & Overy; Baker Botts; White & Case Advising FA : Shearman & Sterling | ||

| 3 | May 3, 2019 | $9,600 | Fox Sports Net LLC | Media | Sinclair Broadcast Group Inc | Fried Frank Harris Shriver & Jacobson; Latham & Watkins; Pillsbury Winthrop Shaw Pittman; Thomas & Libowitz Advising FA : Simpson Thacher & Bartlett; Weil Gotshal & Manges | The Walt Disney Company | Covington & Burling; Cravath, Swaine & Moore | |

| 4 | May 5, 2019 | $8,800 | Anadarko Petroleum Corporation (Algerian assets in the Berkine basin) (24.5% stake); Anadarko Petroleum Corporation (Assets in Ghana in Jubilee field) (27% stake); Anadarko Petroleum Corporation (Assets in Ghana in TEN fields) (19% stake); and Anadarko Petroleum Corporation (Assets in Mozambique in Area 1) (26.5% stake) | Energy, Mining & Utilities | Total SA | Weil Gotshal & Manges | Anadarko Petroleum Corporation | Cravath, Swaine & Moore | |

| 5 | May 2, 2019 | $6,725 | Acelity | Pharma, Medical & Biotech | 3M Company | Cleary Gottlieb Steen & Hamilton Advising FA : Alston & Bird | Apax Partners LLP; Canada Pension Plan Investment Board; and Public Sector Pension Investment Board | Jackson Walker; Simpson Thacher & Bartlett | |

| 6 | April 15, 2019 | $4,840 | Advanced Disposal Services Inc | Business Services | Mayer Brown; Shearman & Sterling Advising FA : Sullivan & Cromwell | Waste Management Inc | Simpson Thacher & Bartlett; Vedder Price | Canada Pension Plan Investment Board | Debevoise & Plimpton |

| 7 | September 26, 2019 | $4,500 | Exxon Mobil Corporation (Norwegian oil and gas assets) | Energy, Mining & Utilities | Var Energi AS | Thommessen | Exxon Mobil Corporation | ||

| 8 | April 14, 2019 | $4,400 | Epsilon Data Management LLC | Business Services | Publicis Groupe SA | Wachtell, Lipton, Rosen & Katz | Alliance Data Systems Corporation | Latham & Watkins Advising FA : Sullivan & Cromwell |

|

| 9 | August 27, 2019 | $4,000 | BP plc (Alaska business) | Energy, Mining & Utilities | Hilcorp Energy Company | Kirkland & Ellis | BP plc | Baker Botts | |

| 10 | September 16, 2019 | $3,613 | SemGroup Corporation | Energy, Mining & Utilities | Kirkland & Ellis; Osler, Hoskin & Harcourt | Energy Transfer LP | Latham & Watkins | Warburg Pincus LLC | Davis Polk & Wardwell |

| 11 | April 2, 2019 | $3,600 | Oryx Midstream Services LLC | Energy, Mining & Utilities | Shearman & Sterling; Vinson & Elkins Advising FA: White & Case | Stonepeak Infrastructure Partners | Hunton Andrews Kurth; Latham & Watkins; Sidley Austin | Concho Resources Inc; Quantum Energy Partners; Post Oak Energy Capital LP; and WPX Energy Inc | |

| 12 | April 1, 2019 | $2,959 | OOO Lenta (92.57% stake) | Consumer | Ogier | Severgroup OOO | Freshfields Bruckhaus Deringer | TPG Capital LP; and VTB Capital Private Equity | Cleary Gottlieb Steen & Hamilton |

| 13 | July 15, 2019 | $2,930 | Carrizo Oil & Gas Inc | Energy, Mining & Utilities | Baker Botts; O'Melveny & Myers Advising FA: Gibson, Dunn & Crutcher | Callon Petroleum Company | Kirkland & Ellis Advising FA: Davis Polk & Wardwell | ||

| 14 | April 18, 2019 | $2,675 | ConocoPhillips Company (UK oil and gas business) | Energy, Mining & Utilities | Chrysaor Holdings Limited | Clifford Chance | ConocoPhillips Company | CMS | |

| 15 | August 12, 2019 | $2,413 | Advanced Computer Software Group Ltd (50% stake) | Technology | BC Partners Limited | Kirkland & Ellis | Vista Equity Partners Management LLC | Kirkland & Ellis | |

| 16 | March 25, 2019 | $2,319 | TIER REIT Inc | Real Estate | Goodwin Procter Advising FA : Cravath, Swaine & Moore | Cousins Properties Inc | Wachtell, Lipton, Rosen & Katz | ||

| 17 | March 18, 2019 | $2,243 | Third Coast Midstream (71.53% stake) | Energy, Mining & Utilities | Gibson, Dunn & Crutcher; Thompson & Knight Advising FA : Bracewell | ArcLight Capital Partners LLC | Kirkland & Ellis | ||

| 18 | June 10, 2019 | $2,098 | Covey Park Energy LLC | Energy, Mining & Utilities | Vinson & Elkins | Comstock Resources Inc | Gibson, Dunn & Crutcher; Locke Lord; McGuireWoods Advising FA: Cravath, Swaine & Moore | Denham Capital Management LP | |

| 19 | August 7, 2019 | $2,076 | Huntsman Corporation (Chemical Intermediates and Surfactants Business) | Industrials & Chemicals | Indorama Ventures Public Company Limited | Herbert Smith Freehills; Lowenstein Sandler | Huntsman Corporation | Kirkland & Ellis Advising FA : Weil Gotshal & Manges |

|

| 20 | June 17, 2019 | $2,040 | LegacyTexas Financial Group Inc | Financial Services | Shapiro Bieging Barber Otteson Advising FA: Simpson Thacher & Bartlett | Prosperity Bancshares Inc | Bracewell | ||

| 21 | March 19, 2019 | $1,976 | HFF Inc | Financial Services | Dechert Advising FA: Proskauer | Jones Lang LaSalle Incorporated | Sidley Austin Advising FA : Cravath, Swaine & Moore | ||

| 22 | July 25, 2019 | $1,800 | USAA Investment Management Company | Financial Services | The Charles Schwab Corporation | Davis Polk & Wardwell Advising FA: Alston & Bird | USAA | Simpson Thacher & Bartlett | |

| 23 | August 21, 2019 | $1,713 | Kinder Morgan Canada Limited | Energy, Mining & Utilities | Blake, Cassels & Graydon; Goodmans Advising FA: Osler, Hoskin & Harcourt | Pembina Pipeline Corporation | Latham & Watkins; Stikeman Elliott | Kinder Morgan Inc | Bracewell |

| 24 | February 19, 2019 | $1,600 | Targa Badlands LLC (45% stake) | Energy, Mining & Utilities | Blackstone Group LP | Akin Gump Strauss Hauer & Feld | Targa Resources Corp | Vinson & Elkins | |

| 25 | August 21, 2019 | $1,546 | Kinder Morgan Inc (US portion of the Cochin Pipeline) | Energy, Mining & Utilities | Pembina Pipeline Corporation | Latham & Watkins; Stikeman Elliott | Kinder Morgan Inc | Bracewell Advising FA: White & Case |

|

| 26 | February 11, 2019 | $1,450 | Precision Flow Systems | Industrials & Chemicals | Latham & Watkins | Ingersoll-Rand Plc | Khaitan & Co; Kirkland & Ellis | Accudyne Industries LLC | |

| 27 | April 15, 2019 | $1,430 | Hulu LLC (9.5% stake) | Technology | Hulu LLC | AT&T Inc | Sullivan & Cromwell | ||

| 28 | July 30, 2019 | $1,321 | United Family Healthcare | Pharma, Medical & Biotech | Hughes Hubbard & Reed | New Frontier Corporation | Global Law Office; Kirkland & Ellis; Simpson Thacher & Bartlett; The International Law Firm of Winston & Strawn | TPG Capital LP; Canada Pension Plan Investment Board; and Shanghai Fosun Pharmaceutical (Group) Co Ltd | Cleary Gottlieb Steen & Hamilton; Fangda Partners; Paul Hastings |

| 29 | September 30, 2019 | $1,280 | Central Penn Line in Pennsylvania’s Susquehanna and Lancaster counties (39.2% stake) | Energy, Mining & Utilities | NextEra Energy Partners LP | Locke Lord | Cabot Oil & Gas Corporation; WGL Midstream Inc; Vega Energy Partners Ltd; and River Road Interests LLC | ||

| 30 | July 2, 2019 | $1,275 | Columbia Midstream Group LLC | Energy, Mining & Utilities | UGI Energy Services LLC | Latham & Watkins Advising FA: Alston & Bird | TransCanada Corporation | Bracewell | |

| 31 | March 22, 2019 | $1,209 | IPSCO Tubulars Inc | Industrials & Chemicals | Latham & Watkins | Tenaris SA | Mitrani, Caballero & Ruiz Moreno Abogados; Sullivan & Cromwell | TMK OAO | Advising FA : DLA Piper |

| 32 | May 21, 2019 | $1,050 | Peloton Therapeutics Inc | Pharma, Medical & Biotech | Wilson Sonsini Goodrich & Rosati | Merck & Co Inc | Covington & Burling | Topspin Partners LP; OrbiMed Advisors LLC; The Column Group LLC; Nextech Invest Ltd; Remeditex Ventures LLC; Foresite Capital Management LLC; EcoR1 Capital LLC; Curative Ventures Management LLC; and Vida Ventures LLC | |

| 33 | March 14, 2019 | $1,030 | Eureka Midstream Holdings LLC (60% stake); and Hornet Midstream Holdings LLC | Energy, Mining & Utilities | EQM Midstream Partners LP | Latham & Watkins | Morgan Stanley Infrastructure Inc | Vinson & Elkins | |

| 34 | June 11, 2019 | $1,000 | Shell Oil Products (Martinez Refinery) | Energy, Mining & Utilities | PBF Energy Inc | Cleary Gottlieb Steen & Hamilton | Equilon Enterprises LLC | ||

| 35 | March 22, 2019 | $1,000 | Silver Eagle Distributors LP (Beer distribution business in Houston) | Business Services | Redwood Capital Investments LLC | Kirkland & Ellis | Silver Eagle Distributors LP | Locke Lord | |

| 36 | January 7, 2019 | $1.000 | Discovery Midstream Partners II LLC (Undisclosed stake) | Energy, Mining & Utilities | Kirkland & Ellis | Stonepeak Infrastructure Partners | Hunton Andrews Kurth | ||

| 37 | September 3, 2019 | 925 | Concho Resources Inc (New Mexico Shelf assets) | Energy, Mining & Utilities | Spur Energy Partners LLC | DLA Piper; Kirkland & Ellis | Concho Resources Inc | Gibson, Dunn & Crutcher | |

| 38 | April 22, 2019 | 835 | KEYW Holding Corp | Technology | Weil Gotshal & Manges Advising FA : Sidley Austin | Jacobs Engineering Group Inc | Fried Frank Harris Shriver & Jacobson | ||

| 39 | June 24, 2019 | 804 | NRC Group Holdings Corp | Industrials & Chemicals | US Ecology Inc | Dechert Advising FA : White & Case | JF Lehman & Company | Jones Day | |

| 40 | May 13, 2019 | 800 | Colonial Pipeline Company (10.13% stake); and Explorer Pipeline Inc (25.97% stake) | Energy, Mining & Utilities | Shell Midstream Partners LP | Hunton Andrews Kurth Advising FA : Bracewell | Royal Dutch Shell Plc | ||

| 41 | March 20, 2019 | 740 | KFSM TV; WQAD TV; WNEP TV; WOI-DT Local 5; KCWI 23-HD; WZDX; WATN-TV Local 24; WLMT; WPMT FOX43; FOX 61 - WTIC; and WCCT-TV | Media | TEGNA Inc | Hughes Hubbard & Reed; Jenner & Block; Nixon Peabody | Nexstar Media Group Inc | Kirkland & Ellis; Wiley Rein | |

| 42 | July 30, 2019 | 700 | Diamondback Energy Inc (Net royalty acres in the Midland and Delaware Basins) | Energy, Mining & Utilities | Viper Energy Partners LP | Hunton Andrews Kurth | Diamondback Energy Inc | Akin Gump Strauss Hauer & Feld | |

| 43 | June 17, 2019 | 657 | C&J Energy Services Inc | Energy, Mining & Utilities | Kirkland & Ellis Advising FA : Vinson & Elkins | Keane Group Inc | Schulte Roth & Zabel; Simpson Thacher & Bartlett Advising FA: Baker Botts; Shearman & Sterling | ||

| 44 | February 8, 2019 | 640 | Nexeo Solutions Plastics LLC | Business Services | One Rock Capital Partners LLC | Hogan Lovells International; Latham & Watkins | Nexeo Solutions Inc | Wachtell, Lipton, Rosen & Katz; Weil Gotshal & Manges Advising FA: Latham & Watkins |

|

| 45 | August 13, 2019 | 617 | Atlas Technical Consultants LLC | Construction | Kirkland & Ellis | Boxwood Merger Corp | Atrium; The International Law Firm of Winston & Strawn | Bernhard Capital Partners Management LP | |

| 46 | March 20, 2019 | 580 | WPIX-TV; WTKR TV; WTVR-Richmond Va; KASW-TV Inc ; WXMI-TV; KSTU-FOX 13; and WSFL-TV | Media | The EW Scripps Company | BakerHostetler | Tribune Media Company; and Nexstar Media Group Inc | Kirkland & Ellis; Wiley Rein | |

| 47 | May 6, 2019 | 509 | Amplify Energy Corp | Energy, Mining & Utilities | Kirkland & Ellis | Midstates Petroleum Company Inc | Latham & Watkins | ||

| 48 | May 22, 2019 | 505 | Global Restoration Holdings (95% stake) | Business Services | Goodwin Procter | FirstService Corporation | Ferrante & Associates; Fogler, Rubinoff | Delos Capital LLC | |

| 49 | August 6, 2019 | 500 | Vertice Technologies LLC | Technology | K&L Gates | Vista Equity Partners Management LLC | Kirkland & Ellis | ||

| 50 | May 3, 2019 | 500 | Kaseya Limited (Undisclosed stake) | Technology | TPG Capital LP; and Insight Venture Partners LLC | Ropes & Gray |