The roster of M&A deals in 2024 suggests that we should be thankful for small things. Or, at least, small deals.

There were 1,310 mergers and acquisitions reported to the Corporate Deal Tracker in 2024.

Of those, 635 reported values — including those reported confidentially — and for 675 the terms were undisclosed.

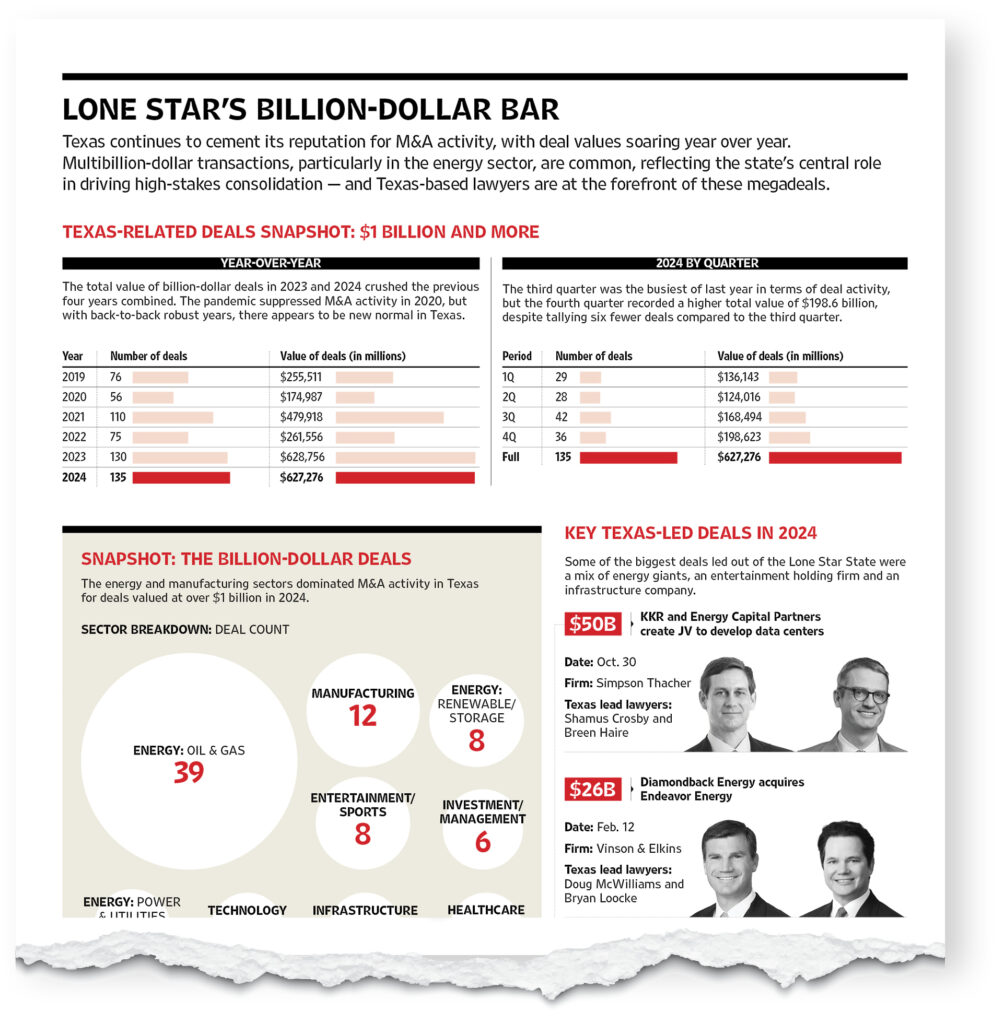

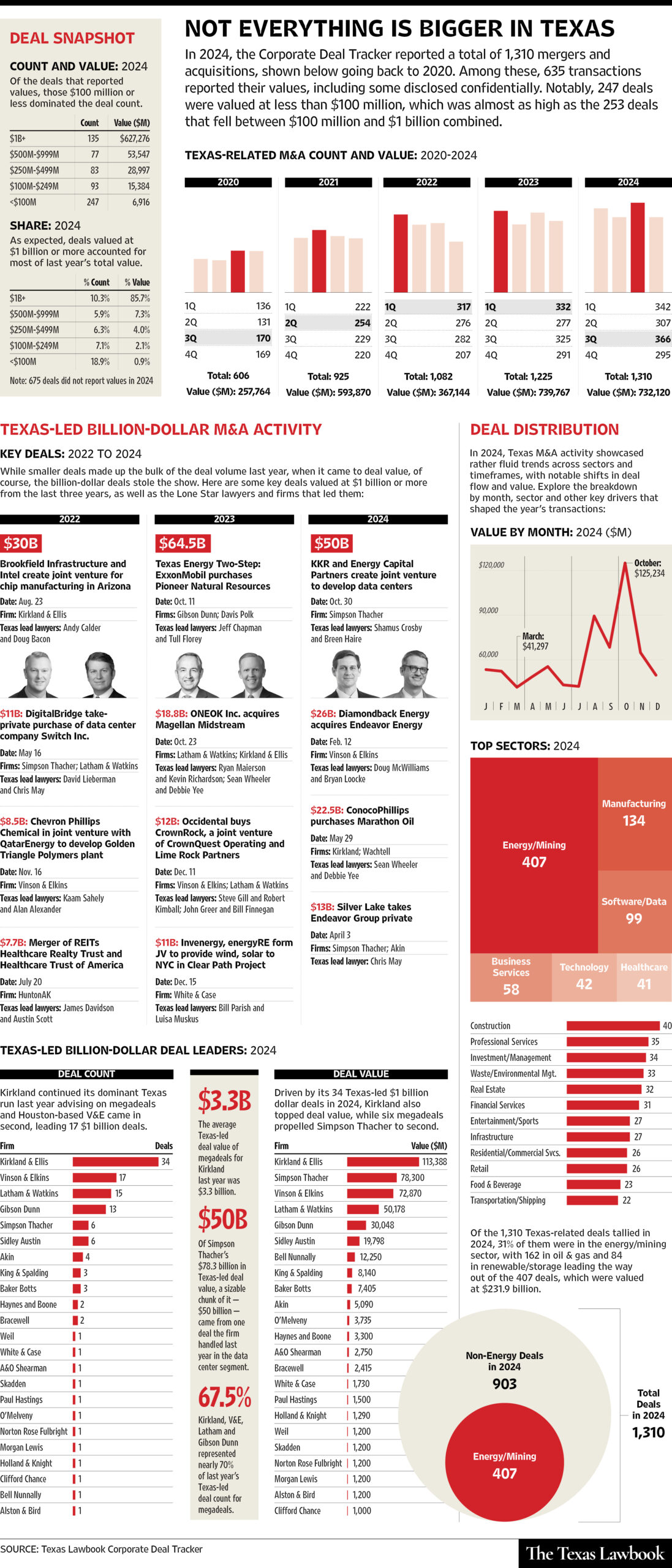

But 247 of those 635 transactions were valued at less than $100 million. That was far more, by count, than the 135 $1 billion-dollar-plus transactions. And nearly as many as the 253 deals between them valued between $100 million and $1 billion combined.

Jennie Simmons, an energy M&A partner at Troutman Pepper Locke in Houston, says small deals are a growing, generational thing. The deals, she said, often involve independent sponsors who, rather than raising a general fund are financing by what she describes as a “pass-the-hat-around-on-a-deal-by-deal-basis” business model.

“We are seeing this approach from frankly, my generation (35- to 45-year-olds), most of whom were former private equity and who are still deal junkies but now want to do it on a more individualized basis,” Simmons said.

Whatever the source, that boost in small deals helped to vault 2024 M&A to a higher volume (+6.9%) than the 1,225 deals reported during 2023. The smaller deals also helped make 2024 a record year by volume, higher than any in Texas-related transactions reported to the Corporate Deal Tracker over the last six years.

But that volume came, quite literally, at a cost. The 1,310 M&A transactions — actually, the 635 with values reported — totaled $732 billion, representing a slight drop in value from the 2023 record total of $739.8 billion.

MORE: Premium Lawbook subscribers can access the 2024 M&A Master List.

In sum, small deals were significant at both ends of the spectrum. The 247 deals account for 19 percent of the year’s 1,310 deal count; but their total of $6.2 billion is less than 1 percent of the year’s total value. By contrast, the 135 deals valued at $1 billion or more represented 10.3 percent of the year’s deal count, but 85.7 percent of the year’s total value.

Those seemingly bifurcated results make perfect sense to deal lawyers who say the two ends of the spectrum can be explained — though maybe not easily — by the race to create organizations of sufficient scale to provide the infrastructure and power requirements necessary to support the development of artificial intelligence. In Texas, that obviously means real estate and energy.

The resurgence of Texas energy deals since 2022 has been obvious and urgent. Driven by a variety of factors, energy dominated again in 2024, with energy related deals accounting for more than 30 percent of both deal count (407) and deal value ($232 billion).

RELATED: Last year, there were 135 Texas-related deals (one that involves a party headquartered in Texas or advised by Texas-based lawyers) submitted to the Corporate Deal Tracker that reached or broke the $1 billion barrier — some of them by a lot. Read more about the evolving landscape of these billion-dollar deals and the Texas lawyers who lead them.

Simmons says that exuberance is part of a consolidation that has taking place in Texas energy and infrastructure markets over the past several years: particularly in midstream and the energy services industries, including traditional oilfield services, which had been dormant the last few years. The surge in interest has even included “old yet newly invigorated and energized” subsectors like nuclear energy.

Some backburner deals, especially those created on the strategic and private equity side, have simply found their moment as interest rate and regulatory obstacles have subsided.

“Timing is, of course, always a key component and crucial driver to M&A activity. Though the Texas M&A market has, without doubt, been strong the past few years, I think that a lot of sellers were waiting for the right opportunity to bring certain assets to market,” says Simmons.

Kirkland & Ellis partner John Kaercher says the effects of the data center M&A surge are likely to be felt across the board in Texas.

“Beyond the obvious areas directly tied to data centers like real estate, power supply, hardware manufacturing and technology broadly, the sheer volume of activity in the data center space is almost certainly going to have substantial knock-on effects on Texas M&A in data center-adjacent spaces,” says Kaercher.

Kaercher said more small deals are likely to derive from data center development, as well as some deals that have already been taking place.

“Many sponsors were already in the process of rolling up traditional ‘main street’ HVAC, pre-fab construction, electrician and plumbing businesses and you can be sure that some may accelerate those plans so with an eye toward serving data center developers and operators,” Kaercher said. “Water and refrigerant supply or conservation businesses are an obvious candidate for growth and consolidation as necessary components of cooling data centers.”

RELATED: How Private Equity Will Shape Texas M&A in 2025

“For similar reasons you could see substantial growth in businesses focused on things like energy efficiency, staffing solutions, healthcare and insurance, all of which are critical to ensuring low costs and minimal downtime,” Kaercher says. “Sometimes when you are in the midst of a gold rush it’s better to be the person selling the pickaxes or lodging.”

Don’t overlook businesses that use AI, says A&O Shearman’s Alain Dermarkar.

“While AI is clearly a driver of a lot of activity, particularly with respect to assets related to providing the infrastructure necessary for AI, we are also now seeing more activity around M&A related to AI-based products and services.”

“Outside of AI, general consensus is that 2025 will see increased M&A activity, as traditional PE exits are anticipated to increase and revert to normal levels. In addition, I think that we may see a lot of activity with respect to crypto related transactions, and also increased activity in traditional energy.”

Still, the resurgence of energy in all its forms has, in some ways, renewed Texas’ sense of self.

Says Kaercher: “One of the most interesting developments to me, in particular in Texas, is the rapid pivot following Uri and compounded by the explosive growth in AI and data centers — to an understanding that we need all the power we can get our hands on, even among renewable or hydrocarbon evangelists.”

RELATED: The Top Deals of 2024: When AI Met M&A

Becky Diffen, a partner at Norton Rose Fulbright in Austin might agree. Diffen, a renewables evangelist, has seen her end of the energy M&A spectrum explode, especially in recent months. She describes December as the highest month for billing that her projects group at NRF has ever seen. The deals have been big and small, international and domestic. And she attributes the surge in business both to data center demand and the kind of emerging detente between legacy O&G and renewables that Kaercher describes.

Although she describes a large amount of her recent work as “safe-harboring” of renewables projects that might become targets for changes in Biden administration tax incentives and finacing, she doesn’t see existential changes from the in-coming administration.

“About 75 percent of the projects created under the IRA (Biden’s Inflation Reduction Act) are in Republican areas and I think enough of them (Republicans lawmakers) realize that. The wind PTC (wind production tax credit) was (Sen. Chuck) Grassley (R-Iowa).”

“One of the things that helped the IRA that there was so much in there. That’s why it passed. It centered on projects that benefitted American manufacturing. It was focused on job-creation,” Diffen says.

But like Kaercher she, too, has noted a new acceptance of renewables, however reluctant, even among hydrocarbon investors. She first noticed it, she said, when she started hearing them use the term “energy transition,” which she took as an acceptance of change.

“They had never used the term before,” said Diffen. “And I took that to mean: ‘Instead of fighting it, I’m going to be a part of it; to influence how the change occurs.”