For the ninth consecutive quarter, Texas businesses turned more to national law firms instead of locally based legal operations to lead their major mergers, acquisitions and divestitures.

New data by Mergermarket provided exclusively to The Texas Lawbook shows that 24 of the 30 law firms representing Texas companies in the most corporate transactions during the first quarter of 2018 are headquartered outside of the state.

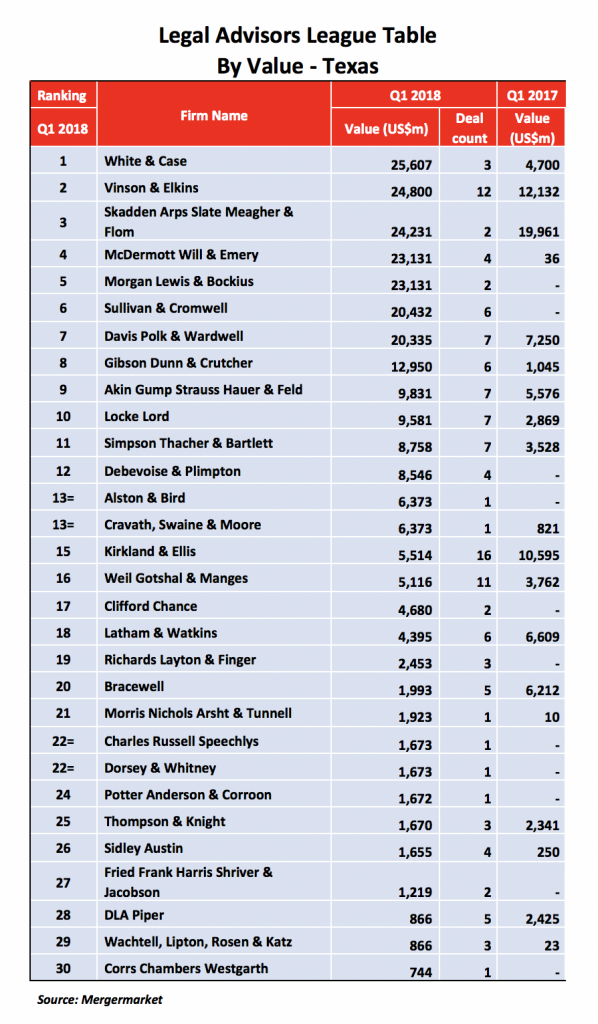

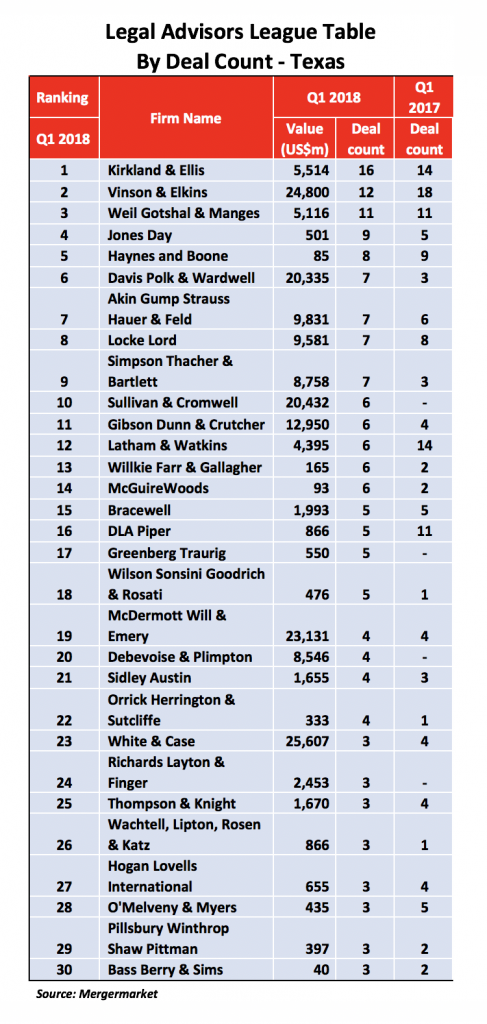

Kirkland & Ellis, according to Mergermarket, ranks No. 1 with 16 deals valued at $5.5 billion during the first three months of 2018.

Kirkland dethroned long-time Texas corporate legal powerhouse Vinson & Elkins in 2016 in representing the most Texas companies involved in M&A, according to Mergermarket. V&E ranks second with 12 transactions with a combined price tag of $24.8 billion.

Kirkland dethroned long-time Texas corporate legal powerhouse Vinson & Elkins in 2016 in representing the most Texas companies involved in M&A, according to Mergermarket. V&E ranks second with 12 transactions with a combined price tag of $24.8 billion.

Weil, Gotshal & Manges ranks third by acting as legal advisor in 11 deals valued at $5.1 billion, while Jones Day is fourth with nine transactions.

Mergermarket tracks M&A activity based on the location of the companies involved in transactions. For The Texas Lawbook, Mergermarket provides M&A data about Texas companies and the law firms that represent those businesses.

Only six Texas-based law firms made the Mergermarket top 30 for Q1 2018: V&E, Haynes and Boone, Akin Gump, Locke Lord, Bracewell and Thompson & Knight. Those six law firms led a total of 42 deals.

By contrast, the 24 national law firms acted as lead counsel for companies involved in 132 deals, according to Mergermarket.

Seven of the top 30 law firms do not even have an office in Texas.

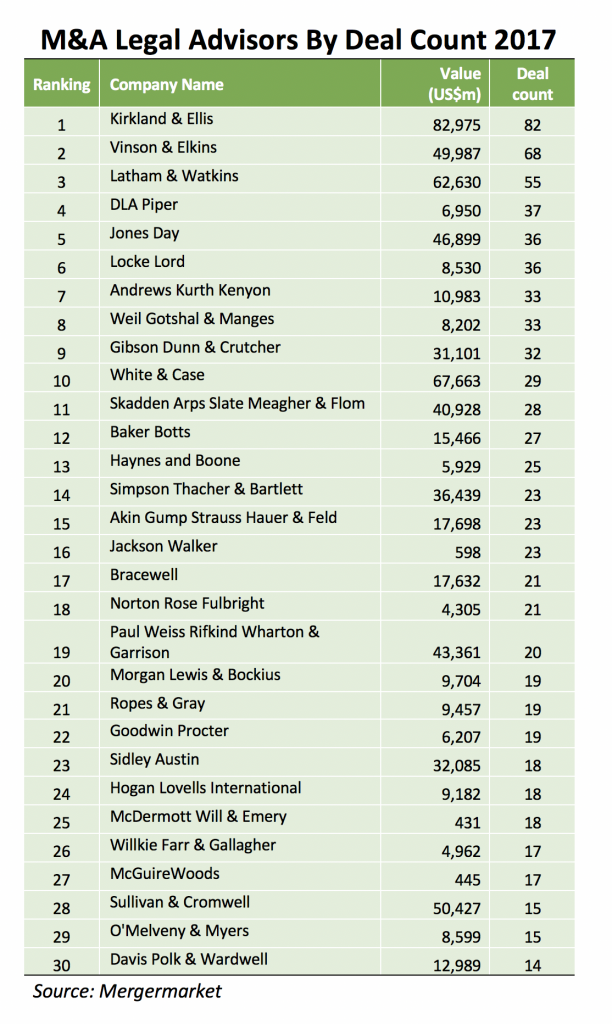

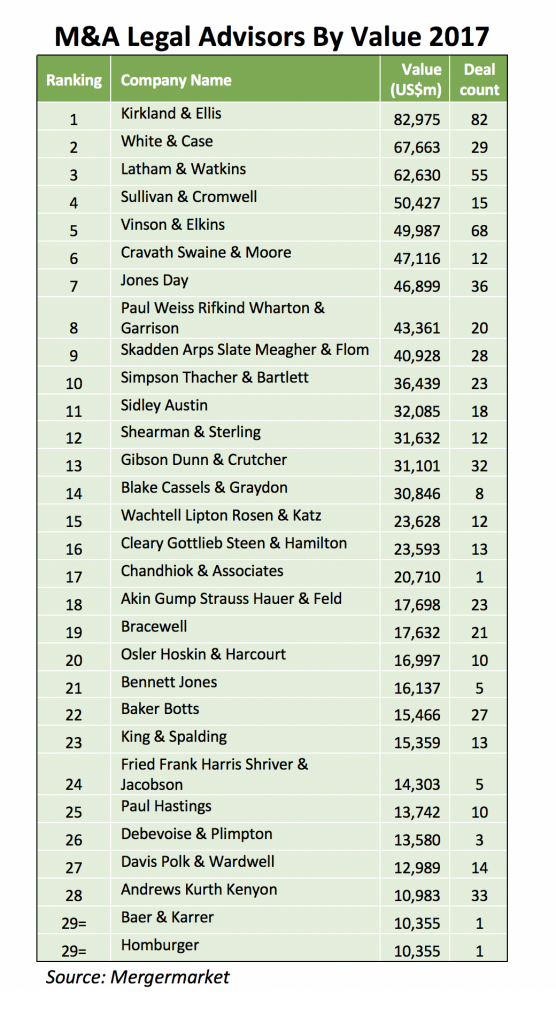

Kirkland, a Chicago-based law firm that opened its Houston office in 2014, actually became the reigning M&A champ for representing Texas companies last year. Mergermarket shows that Kirkland was the lead legal advisor in 82 transactions valued at $83 billion. The data shows that V&E was second and Latham & Watkins was third.

Separately, The Texas Lawbook’s Corporate Deal Tracker also reported Monday that lawyers working for national law firms in Texas are stealing away more and more M&A activity from lawyers at Texas-based firms.

The Corporate Deal Tracker and Mergermarket measure two different elements of Texas M&A. Mergermarket tracks corporate transactions of businesses headquartered in Texas without regards to the geographic location of the law firms advising them. By contrast, the Corporate Deal Tracker measures the M&A work being handled by lawyers based in Texas, and that includes transactions in which the companies are based outside of the state.