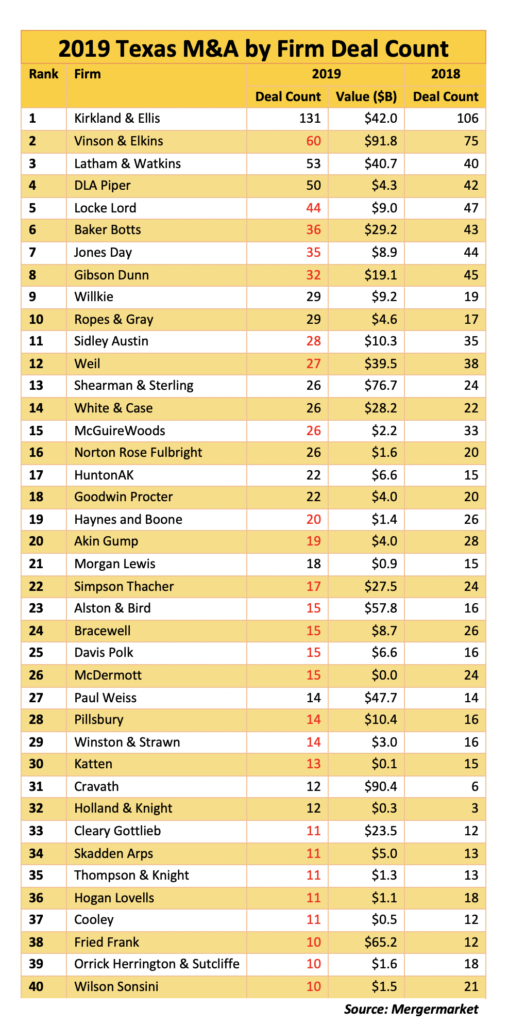

Kirkland & Ellis represented companies or private equity firms involved in 131 mergers, acquisitions, joint ventures or divestitures involving Texas-based businesses in 2019, according to new data provided exclusively to The Texas Lawbook by the independent financial research firm Mergermarket.

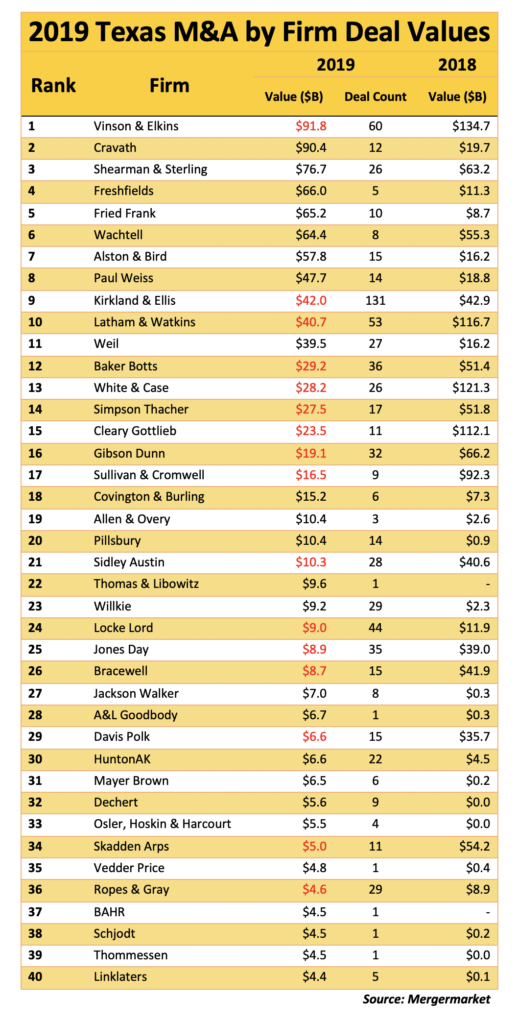

Vinson & Elkins, with 60 transactions, ranked second in deal count involving companies headquartered in Texas. But those 60 deals, according to Mergermarket, had a combined value of $92 billion, which placed V&E as the No. 1 law firm for deal value in 2019.

Latham & Watkins placed a close third in deal count last year with 53 – up from 40 M&A transactions in 2018.

As Texas Lawbook M&A reporter Claire Poole reported earlier this month, deal values involving Texas companies plummeted 38.6% in 2019. Mergermarket reports that last year was the first time in nearly a decade that no law firm had a combined deal value of more than $100 billion.

Mergermarket reports that four law firms increased their Texas M&A deal count by double digits: Kirkland; Latham; Willkie, Farr & Gallagher; and Ropes & Gray. Ropes, which has no offices in Texas, jumped from being ranked 27th in 2018 to 10th last year. DLA Piper also increased its deal count – from 42 in 2018 to 50 last year.

DLA, Willkie and Ropes transactions are almost exclusively in middle market dealmaking in Texas.

Four law firms also witnessed a double-digit decline in deal count last year: V&E; Gibson, Dunn & Crutcher; Weil, Gotshal & Manges; and Bracewell.

Only eight of the top 40 law firms doing the most M&A transactions involving Texas companies are based in Texas – and its eight only if you include Norton Rose Fulbright and Akin Gump as being Texas based.

The biggest leap in the Mergermarket top Texas M&A deal count rankings – from 90th to 32nd – belongs to Holland & Knight, which handled only three deals in 2018 and jumped to working on a dozen transactions last year. It was Holland & Knight’s first-ever appearance in the Mergermarket Texas M&A legal league tables.

An even bigger jump occurred in the deal value category. Jackson Walker did eight deals valued at $7 billion, which is up from less than $1 billion in 2018. As a result, Jackson Walker went from being ranked 128th in 2018 to 27th last year.

The Mergermarket league tables rank law firms based on their representation of deals involving businesses headquartered in Texas, even if the lawyers are based in New York, Chicago or London. Mergermarket, for example, reports that about half of Kirkland’s 131 transactions were led by lawyers who work at the firm’s non-Texas offices. But they still count every bit as much.

Next week, The Texas Lawbook will release exclusive Corporate Deal Tracker year-end data, which tracks transactions of Texas lawyers doing deals no matter the headquarters of their clients.