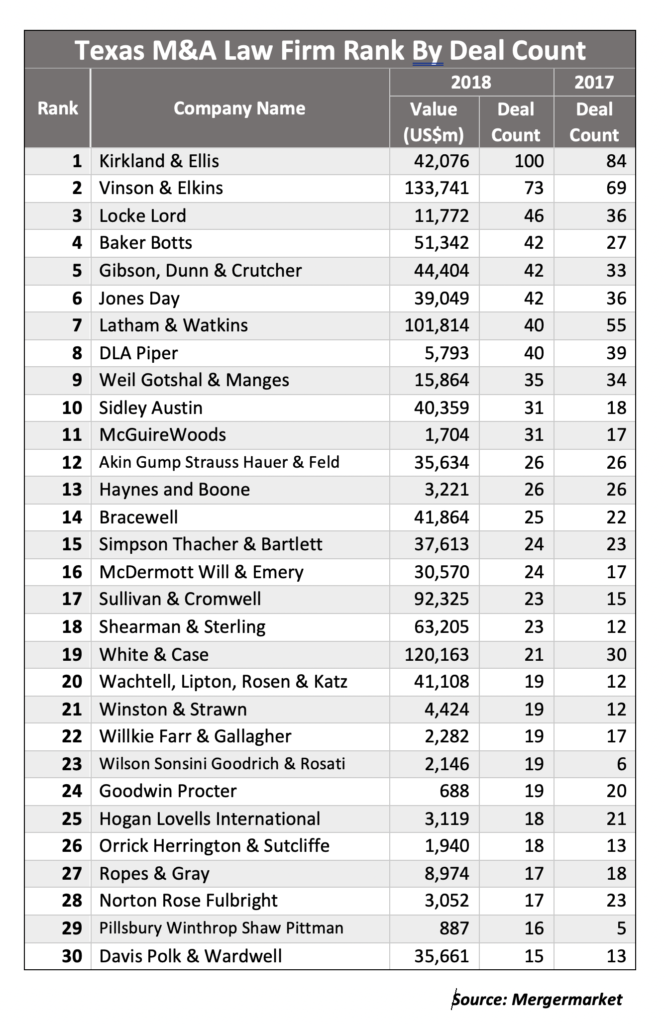

Kirkland & Ellis represented more Texas companies in a single year doing mergers, acquisitions and divestitures in 2018 than any law firm in Texas history.

New Mergermarket data provided exclusively to The Texas Lawbook shows that the Chicago-based firm was the legal advisor on 100 deals in Texas in 2018 – the first time any firm has ever reached triple digits. The previous high was in 2014 when Vinson & Elkins represented 86 Texas businesses in M&A transactions.

For the third consecutive year, Kirkland ranked No. 1 in M&A dealmaking in Texas – not bad for a law firm that’s only had an office in the state since 2014.

V&E ranked second for the third consecutive year. The Houston-based firm and Kirkland have been locked in a heated battle for the top spot in the Texas M&A rankings for the past five years.

The new 2018 Mergermarket rankings, however, show that there is a growing separation between Kirkland and V&E and even more separation between V&E and the rest of the pack.

In 2015, V&E, Kirkland and Latham were nearly tied in the Mergermarket rankings. Five deals separated the top three firms.

The Mergermarket data shows that a dozen law firms were separated by 27 transactions from the No. 1 spot.

By contrast, Kirkland’s 100 deals in Texas are 27 more than V&E, which is in second place.

Similarly, V&E’s 73 transactions are also 27 more than the third place law firm, Locke Lord. Twenty-two law firms were the legal advisors in 19 to 46 deals, which is the third set of 27 transactions.

That’s not to say that the third segment of law firms did poorly in 2018.

Mergermarket data shows that 22 of the top 30 corporate law firms increased the number of Texas deals they handled during 2018. Eight law firms – Kirkland, Locke Lord, Baker Botts, Sidley, McGuireWoods, Shearman & Sterling, Wilson Sonsini and Pillsbury – increased their deal count by double-digits last year.

By contrast, only one law firm – Latham & Watkins – saw its M&A deal count decline by double-digits. Even then, the sizes of the deals that Latham handled in 2018 increased by 62 percent over the previous year.

Twenty-three of the top 30 law firms in the Texas M&A rankings are headquartered outside the state – 18 of the 23 non-Texas based firms now have offices in Dallas, Houston or Austin.

The law firms in Texas are benefiting from a strong M&A market, which meant more work for more legal advisors.

The Texas Lawbook reported Wednesday that M&A activity set new records in 2018 with 1,072 transactions involving Texas-based companies. The Mergermarket data shows that Kirkland represented businesses in one in every 10 of those deals, while V&E was involved in another one of 12.

There are other factors also at work in the state that impact law firm rankings, including law firm consolidation and aggressive hiring practices of firms such as Kirkland to hire away experienced M&A lawyers from competitors.

The strong M&A data is an early indication that law firms operating in Texas will likely report record revenues when they release their annual financials in March.

By any measurement, the Mergermarket M&A data shows Kirkland had a blockbuster 2018.

The firm’s lawyers were legal advisors in exactly 100 Texas transactions in 2018 – a 19 percent increase from 2017 and more than double the number of deals it handled in 2015. V&E excluded, Kirkland did more than twice the number of M&A transactions as any other law firm.

In 2015, 35 deals separated the No. 1 ranked M&A firm on deal count from the 30th spot. In 2018, the separation between No. 1 Kirkland and No. 30 Davis Polk is 85 transactions, according to Mergermarket.

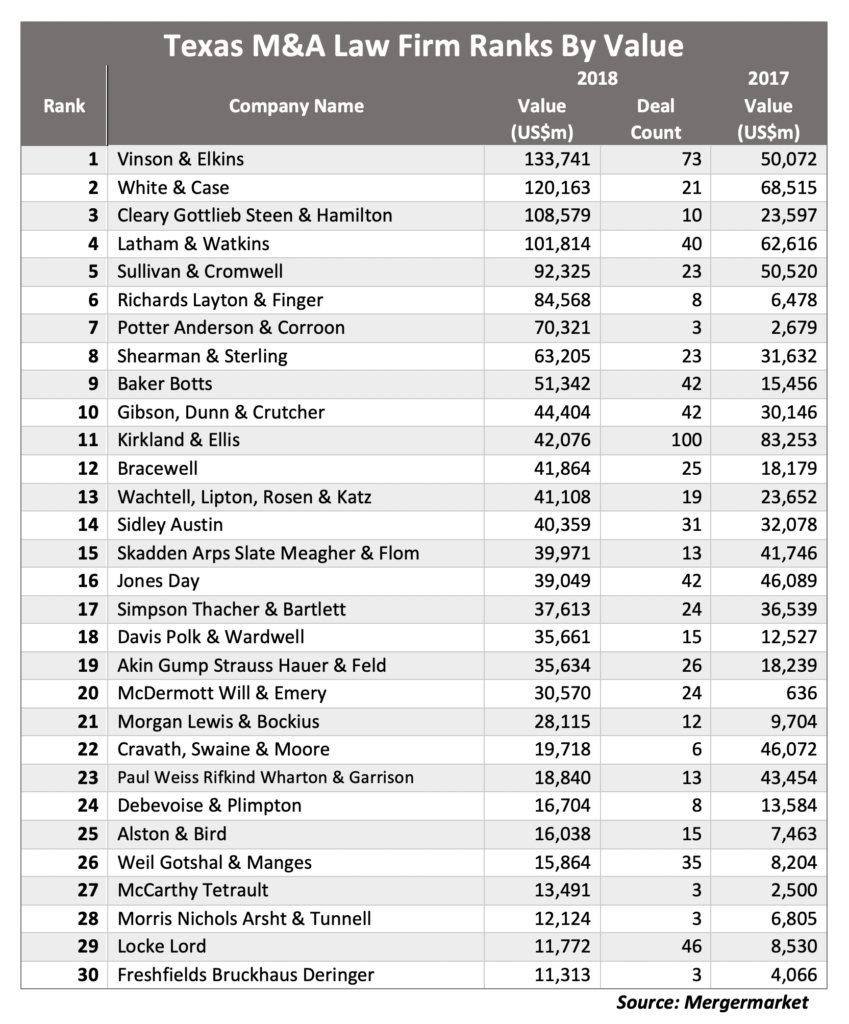

The one slippage for Kirkland came in the deal value category, where it dropped from first in 2017 to 11th last year.

Houston-based V&E used its insider edge in the oil patch and strength in private equity to work on 73 deals in 2018 – four more than 2017 and 55 percent more transactions than 2015, according to Mergermarket. V&E’s 73 transactions in 2018 are the second highest in the firm’s history. In 2014, Mergermarket reported that the Houston firm advised in 86 M&A transactions.

V&E took top honors for deal value in 2018, as the firm represented Energy Transfer Partners in its $60 billion simplification restructuring and RSP Permian in its $9 billion sale to Concho. In all, the firm worked on deals with a combined value of $133.7 billion.

The Mergermarket data shows that the M&A practices at several law firms had strong years. Several law firms saw significant jumps in the number of deals they handled in 2018, including:

- • Locke Lord’s M&A deal count jumped 28 percent;

• Baker Botts’ increased 56 percent;

• Weil Gotshal shot up 72 percent;

• McGuireWoods jumped 82 percent;

• Shearman & Sterling nearly doubled its Texas deal count;

Wilson Sonsini and Pillsbury witnessed the biggest percentage increases in 2018, as both firms more than tripled the number of Texas transactions the firm’s lawyers handled last year compared to 2017.