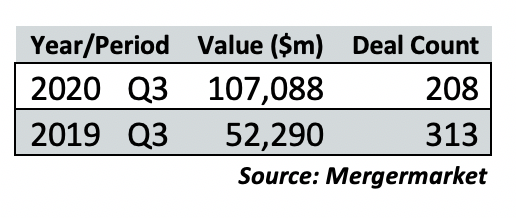

Third quarter M&A deal value in 2020 was up dramatically compared to last year, but deal count was down dramatically, according to Mergermarket data provided exclusively to The Texas Lawbook.

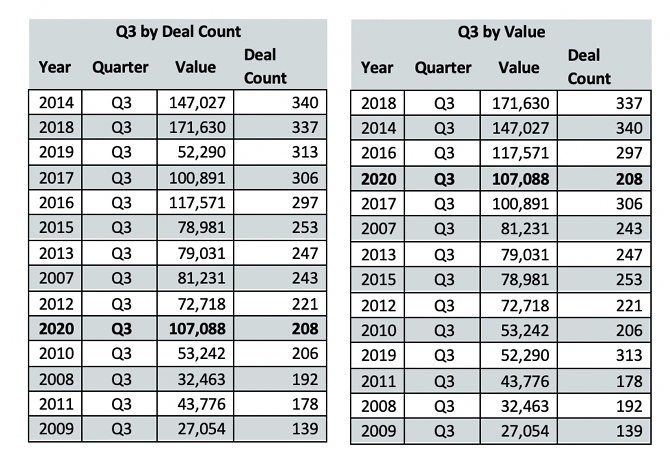

The Q3 values for 2020 ($107 billion) were more than double those for the same period last year ($52.3 billion), the fourth best Q3 since 2007 and well above the 14-year quarterly average of $83.2 billion since then.

But this year’s Q3 deal count of 208 is a third less than the 313 deals reported for Q3 last year — well below the average of 249 for the quarter, and the lowest Q3 deal count since 2010.

Still, the Q3 deal count of 208 was 60 transactions above a coronavirus–plagued Q2. The Q2 deal count of 148 this year broke a string of 32 quarters — dating back to Q1 in 2012 and the Great Recession —in which Texas businesses recorded 200 M&A deals or more.

Average Deal Count: 249 — Average Deal Value: 83,214

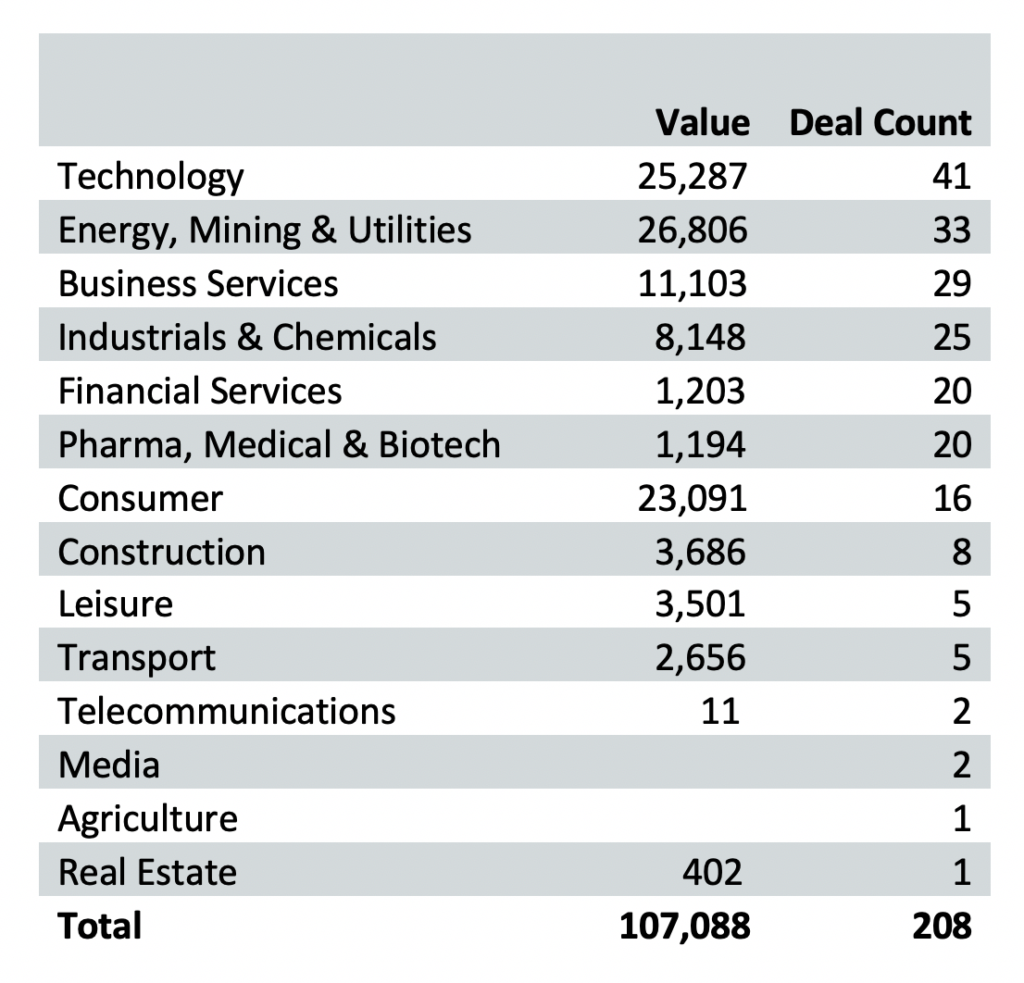

In total value, the energy and mining sector led at $26 billion — as usual, but only barely. Close behind were technology, at $25 billion and consumer-oriented businesses at $23 billion.

Deal count, however, was another story. Energy and mining accounted for only 33, second behind technology (41 transactions) and only about 15% of the 208 transaction total.

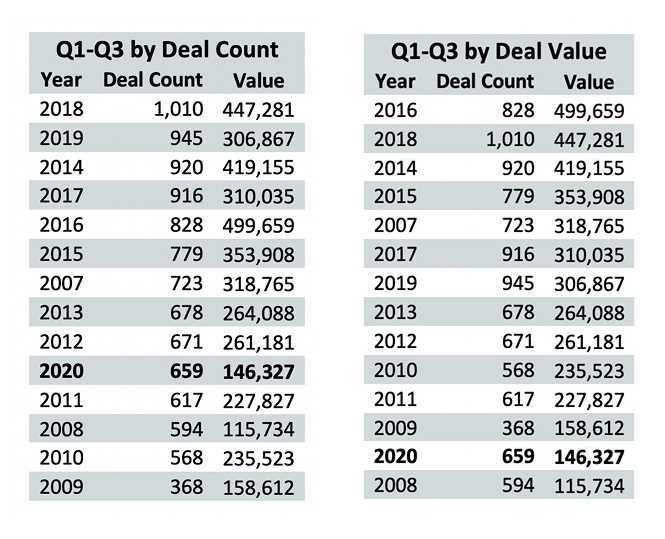

Year-to-date totals are equally dismal. Totals for the first three quarters of 2020 are way down: from 945 deals worth $306.8 billion in 2019 to 659 deals worth $146.3 billion year-over-year. The 2020 year-to-date numbers are the fifth worst for deal count and the second worst for deal value in the last 14 years.

Average Deal Count: 734 — Average Deal Value: 290,345

The biggest deals in the quarter include the dramatic $21 billion acquisition of Speedway stores by 7-Eleven, the $12.5 billion acquisition of Noble Energy by Oxy, an $11 billion purchase of the business services company MultiPlan Inc. by Churchill Capital and a $7 billion purchase of CPA Global Ltd. by Clarivate Analytics, along with the $7 billion acquisition of Cheniere assets by Brookfield Infrastructure and Blackstone Infrastructure Partners.

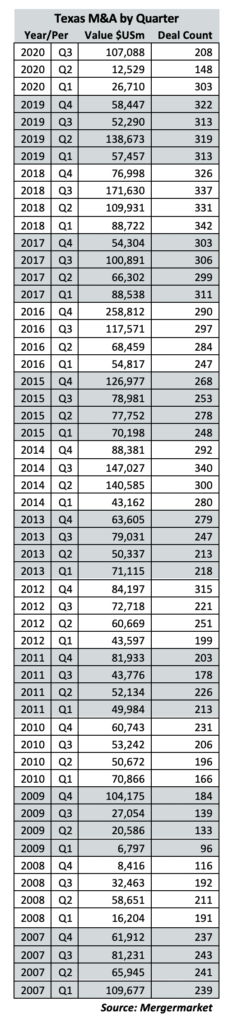

Here’s a quarter by quarter history of the last 14 years.