In 2008, only nine of the top 30 law firms advising Texas-based businesses in the most mergers and acquisitions were headquartered outside of the state.

A decade later, only nine of the top 30 M&A law firms are based in Texas.

New data provided exclusively to The Texas Lawbook by the independent research firm Mergermarket shows that a dramatic shift has taken place in the corporate legal marketplace in Texas when it comes to representing Texas–based companies in M&A activity.

The trend clearly shows that national law firms have systematically stolen top legal talent – and some of the best corporate clients – from law firms headquartered in Austin, Dallas and Houston since 2010.

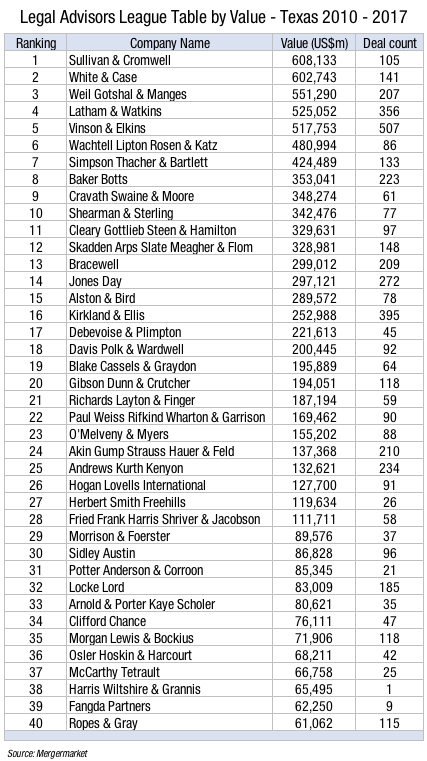

Mergermarket data shows that 28 of the 40 law firms advising Texas businesses in the most M&A deals from 2010 to 2017 are based outside Texas.

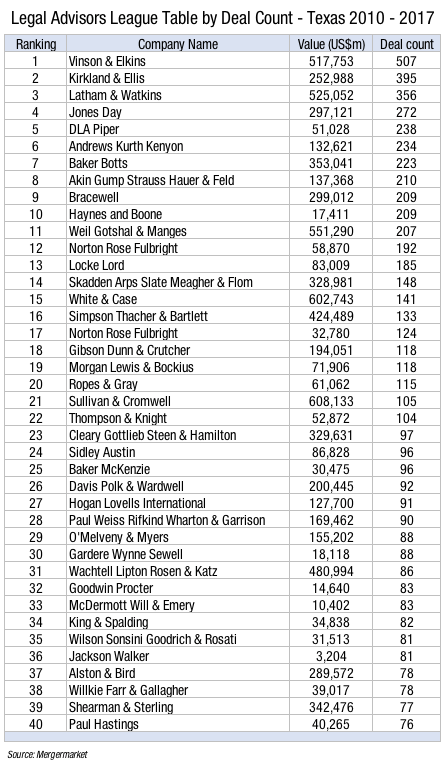

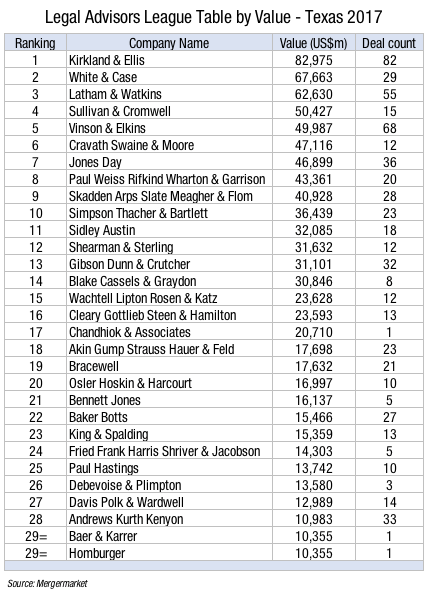

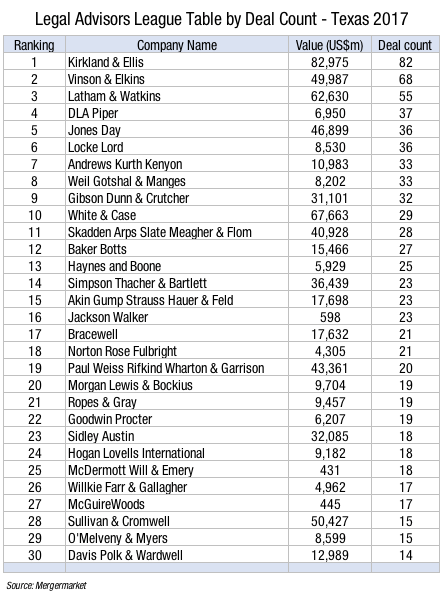

Houston-based Vinson & Elkins is in a heated battle with Kirkland & Ellis and Latham & Watkins for the title of M&A lord in Texas. Jones Day has solidified its spot in the top five.

DLA Piper, Andrews Kurth Kenyon, Baker Botts, Akin Gump, Bracewell, Haynes and Boone and Weil, Gotshal & Manges occupy the rest of the top 10 during the eight-year period.

The Mergermarket data shows that national law firms – many of which have opened offices in Dallas and Houston since 2010 – are also getting hired by Texas companies in most of the largest corporate transactions.

“These numbers are further evidence that the competitive landscape was turned on its head when Latham moved into the Texas market,” says Kent Zimmerman, a law firm consultant with Zeughauser Group.

“The law firms with the most money and resources can hire the best legal talent,” Zimmerman says. “The best talent gets the best clients. The best clients pay the highest rates and generate the most revenues. And the cycle continues.”

The Mergermarket data examining M&A dealmaking involving Texas companies from 2010 through 2017 show the following:

-

- V&E advised in 507 transactions – 25 percent more than the nearest competition;

-

- Kirkland came in second with 395 deals during the past eight years, but the Chicago headquartered firm has actually claimed the top spot for most M&A deals involving Texas businesses in 2017 and 2016;

-

- Latham ranks third during the past eight years with 356 deals;

-

- AKK, which is expected to officially announce it is merging with Hunton & Williams in the next couple weeks, ranks sixth in M&A activity from 2010 to 2017 and ranked seventh in 2017;

- The three law firms in the top 40 – Sullivan & Cromwell, Watchell Lipton and Cravath – that recorded the highest dollar value per deal ($5 billion or more) do not even have outposts in Texas.