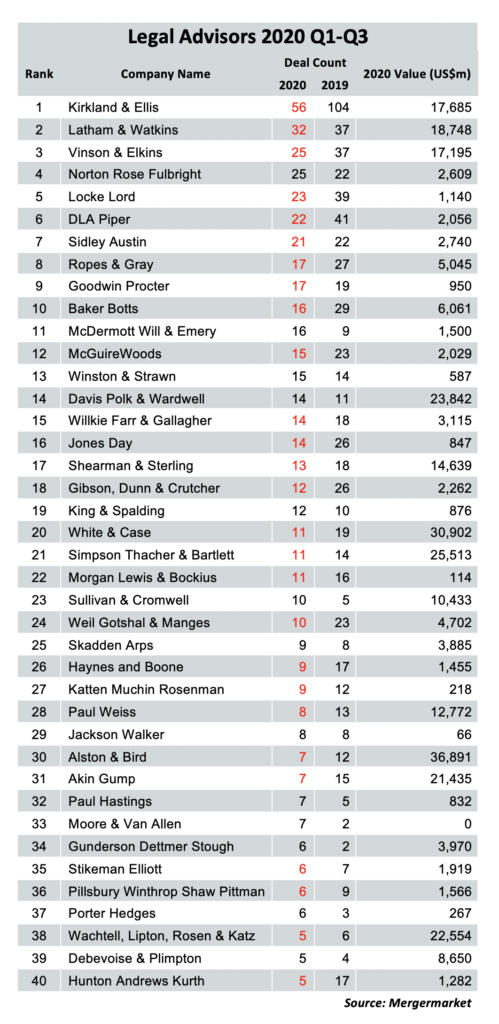

Nine of the top 10 corporate law firms experienced a year over year decline in the number of mergers, acquisitions and joint ventures they did for Texas businesses during the first nine months of 2020, according to new data provided exclusively to The Texas Lawbook.

The research firm Mergermarket reports that 27 of the top 40 law firms handled fewer M&A transactions involving Texas companies as the buyer or seller from Jan. 1 to Sept. 30 than they did in 2019.

The three large corporate law firms that traditionally dominate the Texas M&A deal market – Kirkland & Ellis, Latham & Watkins and Vinson & Elkins – are still the top three, but they have worked on significantly fewer transactions this year than they did a year ago.

Norton Rose Fulbright is the only large corporate law firm in the top 10 to increase its deal activity during the past nine months, according to Mergermarket. The firm’s attorneys worked on 25 transactions involving Texas companies – up from 22 in 2019. In doing so, Norton Rose Fulbright jumped from 13th in the rankings last year to a tie for third this year with V&E.

Only seven Texas-based law firms rank in the top 40, and five of those firms witnessed a declined in M&A activity. Thirty-three of the top 40 firms are based outside of Texas.

Combined, the seven Texas-headquartered firms – Akin Gump, Baker Botts, Haynes and Boone, Jackson Walker, Locke Lord, Porter Hedges and V&E – worked on 94 corporate transactions during the first three quarters of 2020 – down from 149 during the first nine months of 2019.

Porter Hedges is the only Texas firm that increased the numbers of deals its lawyers handled for Texas companies, and it doubled from three to six, according to Mergermarket data.

The two perennial powerhouse corporate law firms in Houston, Baker Botts and V&E, have worked on significantly fewer M&A deals so far this year.

Lawyers at V&E, which ranks third overall in the Mergermarket rankings by deal count, were hired 25 times during the first nine months of 2020 to execute corporate transactions involving Texas – down from 37 such deals in 2019.

Baker Botts lawyers worked 16 such matters so far in 2020, compared to 29 of them last year.

Editor’s Note: Next week, The Texas Lawbook will publish exclusive Corporate Deal Tracker data from the first three quarters of 2020. The CDT documents all deals – in Texas and beyond – being handled by lawyers in Texas.

Only five law firms in the top 20 – Norton Rose Fulbright, McDermott Will & Emery, Winston & Strawn, Davis Polk and King & Spalding – have handled more M&A deals involving Texas companies so far this year than they did one year ago. McDermott’s deal count jumped from nine in 2019 to 16 this year – a 78% increase.

The law firms that witnesses the biggest declines in M&A activity during the first nine months of 2020, according to Mergermarket, are Kirkland, V&E, Locke Lord, DLA Piper, Ropes & Gray, McGuireWoods, Jones Day, Gibson Dunn, White & Case, Weil Gotshal and Haynes and Boone.

Kirkland still dominates the Texas M&A world. The Chicago-founded law firm worked on 56 deals involving Texas companies in the first three quarters of 2020, which is down from 104 from the same period last year – a drop of 46%. Even so, Kirkland’s 56 transactions this year are nearly many as Latham and V&E combined, which rank second and third, respectively.

Hunton Andrews Kurth experienced the most significant fall in the rankings. Last year, Mergermarket ranked Hunton AK ranked 17th with 17 M&A deals. This year, the research company places the firm 40th in the rankings with only five transactions during the first nine months of 2020.

Reporter’s note: Some law firms submit their M&A deals later in the year because they are awaiting client approval for the submission or due to a lack of workers during COVID-19.