© 2015 The Texas Lawbook.

By Natalie Posgate

(March 14) – While billion-dollar megadeals steal headlines, middle-market transactions are the deals that keep Texas M&A lawyers the most busy.

The Texas Lawbook’s Corporate Deal Tracker data shows that 46 percent of all mergers, acquisitions, divestitures and joint ventures in 2015 were valued between $50 million and $500 million.

Deals valued at $500 million or above made up for 25 percent, while 29 percent were transactions worth below $50 million. Texas lawyers reported that the dollar values in 211 of the 566 deals they submitted to the Corporate Deal Tracker were confidential.

Nearly 70 percent of the middle-market deals involved businesses in the energy sector.

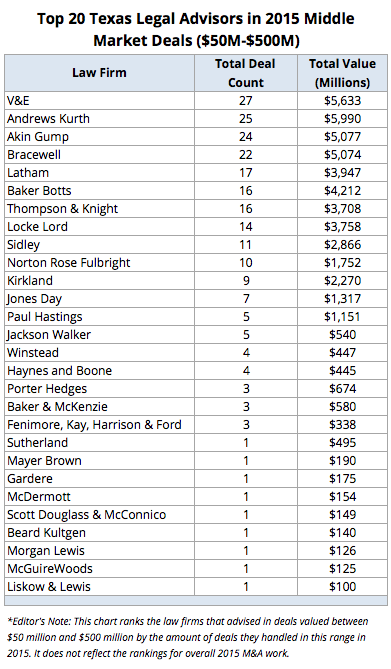

The five law firms that advised in the most middle-market M&A last year were Vinson & Elkins, Andrews Kurth, Akin Gump, Bracewell and Latham & Watkins, according to the Corporate Deal Tracker.

Though M&A lawyers concur that the large amount of midsized transactions they witnessed last year was not necessarily a new trend, deal flow in the $50 to $500 million range could have been active as a result of the low oil and gas prices the energy market has continued to undergo.

“Assets that may be selling for $750 million a year or two ago may now be $500 million or less, falling into the middle-market range,” said Holt Foster, a corporate partner in Thompson & Knight’s Dallas office. “Sellers are starting to get used to the new norm with respect to prices.”

At the same time, some executives at large private equity firms that traditionally could only focus their investments on larger deals are breaking off and joining a new niche that includes sophisticated family offices and institutional investors that are focusing on mid-sized oil and gas investments, Foster added.

“Smaller middle-market deals wouldn’t move the needle for a larger private equity fund,” Foster said. “People are trying to split off non-core assets and keep core assets [which created] a confluence of events that resulted in a pretty hot [middle] market. A lot of smart people realized that.”

Foster said he has noticed increased competition among law firms for upper middle market-deals, because the current drop in value of the deals that were worth more a couple years ago is bringing some firms that normally focus on larger deals down to the next threshold of deal size.

Benton Cantey, a Fort Worth-based partner at Kelly Hart & Hallman and chair of the firm’s corporate & securities section, said the higher competition could also be attributed to the current downturn in deal work in Texas.

“I think competition [in the middle market] will get even more robust as deal flow slows,” Cantey said. “I think it’s just a matter of big law firms trying to create more market share by trying to now do deals they’ve previously ignored. They were initially too small, so to speak.”

Others contend the overall competition for midsized deals has been the same.

“You always have a lot of great attorneys with a lot of great firms and greater talent,” said Sargon Daniel, a partner at Winstead who predominately represents upstream oil and gas companies and renewable energy clients.

“We’re competing on a national level whether we think we are or not,” he added. “I see it as an opportunity for us to demonstrate our negotiation [skills] and be fine counterparties to some national and international firms that we see across the table.”

The larger firms that are crossing the threshold to middle market deals are likely not handling work that was once 10 digits, legal experts say.

John McGowan of Haynes and Boone said it is “difficult for a law firm that only does billion-dollar deals to drop” to lower value deals.

“You have to be more deliberate about due diligence, and be more mindful about where you’re spending the client’s money,” said McGowan, a Dallas-based partner in Haynes and Boone’s business transaction section. “In some ways, it’s easier to do bigger deals.”

Joe Perillo, an M&A lawyer in Locke Lord’s Houston office, said last year was “a very robust year for mid-market deals” for he and his firm colleagues, but not necessarily any different from previous years, since those kinds of transactions are Locke Lord’s “bread and butter.”

“Private equity right now is looking for a lot more money out there in Houston to be deployed. The middle market is perfect for that,” he said.

Some firms said they started noticing a pickup in middle-market deals toward the second half of 2015.

“We noticed at the end of the year it got really busy, and that rolled into 2016,” said Jim Ryan of Jackson Walker in Dallas.

Foster said big “homerun” deals, however, are still not ruled out in 2016.

“We have a couple billion-dollar deals being shopped right now,” Foster said. “Bankruptcy assets can be sizable [too], but without a doubt, you’re seeing private equity funds back management teams that are focused on middle-market transactions.”

© 2014 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.