Texas municipal bond attorneys were very busy in 2020, serving as bond counsel for a record number of issues.

Over $66 billion worth of bonds were issued in Texas last year, a record, according to the Municipal Advisory Council of Texas. The second highest amount was in 2016, when a par amount of over $54 billion of bonds were issued. Low interest rates were one of the main driving forces, according to public finance attorneys.

The low rates provided savings opportunities through refinancing, not only for tax exempt but taxable bonds as well, said Mark Malvuex, partner at McCall Parkhurst & Horton.

The firm served as bond counsel for eight of the ten largest issues of the year, including $2.3 billion Grand Parkway Transport Corp. transaction in February, the largest issue of 2020, according to Refinitiv.

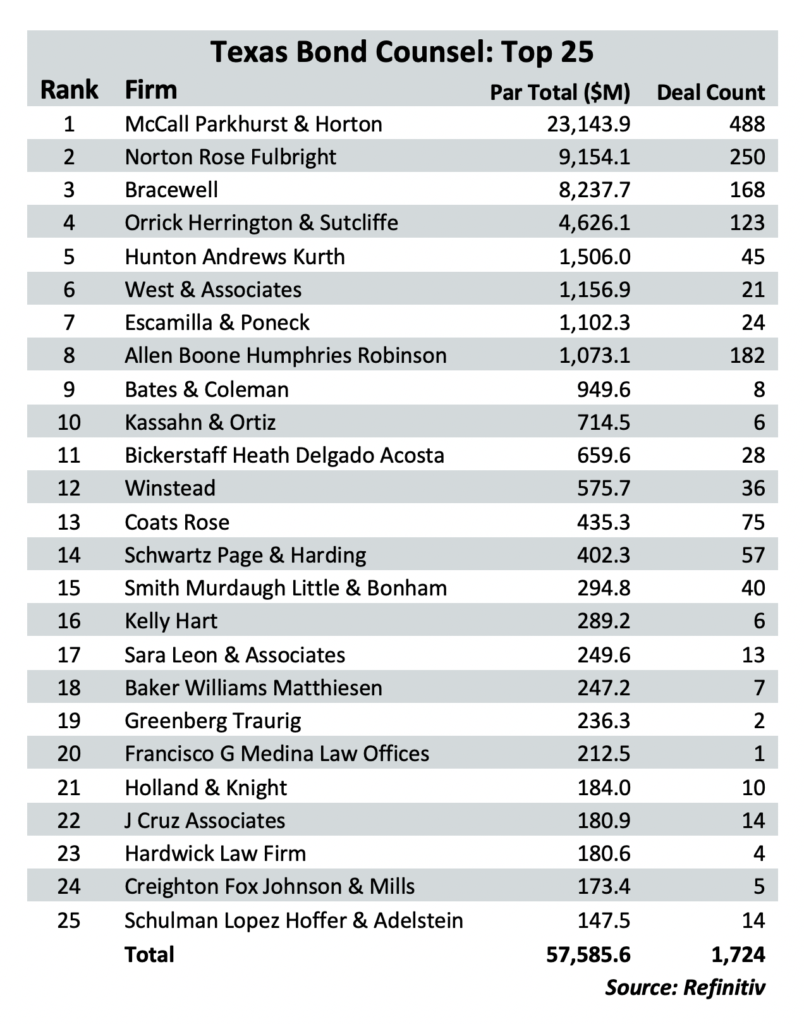

The top five firms that did the most municipal bond work in Texas were the boutique firm McCall Parkhust & Horton, as well as Big Law firms Norton Rose Fulbright, Bracewell, Orrick and Hunton Andrew’s Kurth. The rankings are based on numbers provided by Refinitiv and reflect issues in which the firm represented issuers as lead bond counsel for municipal bonds in Texas. Numbers quoted in the article were provided by the firms and represented issues in which firm attorneys worked as bond, disclosure and underwriters counsel.

McCall Parkhurst & Horton

McCall Parkhurst & Horton served as either bond, disclosure or underwriters counsel for 1,136 deals totaling over $26 billion. The boutique firm of 34 attorneys, focuses solely on public finance. Its clients include the cities of Dallas, Fort Worth, Austin, Houston, and San Antonio. Other large clients include the Texas Department of Transportation, Texas Water Development Board, DFW Airport, and University of Texas.

Norton Rose Fulbright

Norton Rose Fulbright represented clients in 499 issues in municipal finance, totaling a par amount of over $18 billion, according to the firm. The firm has 22 public finance lawyers, all of whom work both as bond counsel and underwriters’ counsel. Some of its clients include the cities of Austin, Dallas and Houston, as well as Baylor College of Medicine and the Memorial Hermann Hospital System.

Paul Braden, the firm’s US Head of Public Finance, attributed the record-breaking year to “favorable interest rates and low taxable rates- coupled with the stability provided by high quality munis.”

Bracewell

The federal 2017 tax act prohibited advance refunding with tax exempt bonds, but the low interest rates, and smaller differential between taxable and non-taxable rates allowed issuers to advance refund debt, said Barron Wallace, partner at Bracewell.

“In some cases, advance refundings may be used to refinance and restructure debt, thereby allowing the issuer to manage through the current economic recession,” Wallace said.

Bracewell served as counsel to 312 issues for a par amount of over $28 billion, the firm said. Its 35 public finance attorneys, of which 32 also serve as underwriter’s counsel represent clients such as the Texas Department of Housing and Community Affairs, the city of Houston, Central Texas Regional Mobility Authority, Texas Medical Center Foundation, and Bexar County.

Orrick

An incredible increase in taxable bonds accounted for over third of total issuance in July, said Adrian Patterson, a partner at Orrick. Not only have the low interest rates for taxable bonds become an effective replacement for advance refunding of tax-exempt bonds, they also have fewer restrictions on what the proceeds from those bonds can be used for compared to tax-exempt bonds.

Additionally, between March and May — as the reality of the coronavirus pandemic — a huge backlog of deals accumulated as issuers waited for some calm in the market — a calm finally provided by the fed’s assurance of continued liquidity and commitment to low interest rates, Patterson said.

Orrick, which has about 20 public finance attorneys in Texas, served as a counsel to 445 deals for a par amount of $24.8 billion in 2020. Among its clients are State of Texas, Harris County, City of Houston, Katy Independent School District, Tomball Independent School District, Montgomery County, Hays County, City of Conroe, Austin Independent School District, and City of Tomball.

Hunton Andrews Kurth

Rounding out the top five firms is Hunton Andrews Kurth, whose Texas public finance practice has 10 attorneys, all of whom work as both bond counsel and underwriters’ counsel. The practice worked on 90 issues worth $2.7 billion, according to the firm. Its largest clients are Houston Community College, Spring Branch ISD, Fort Bend County, IDEA Public Schools, and Goose Creek ISD.