© 2012 The Texas Lawbook.

By Mark Curriden

Senior Writer for The Texas Lawbook

Energy M&A shows no sign of slowing down, and that is good news for many Texas law firms.

Houston-based Targa Resources announced last week that it is purchasing crude oil pipeline, terminal system and processing operations from Saddle Butte Pipeline for $950 million. Vinson & Elkins is representing Targa, while Thompson & Knight is advising Saddle Butte.

A few days earlier, New York-based private equity giant Blackstone and a Louisiana energy company announced the pair were entering into a $1.2 billion joint venture. The two companies turned to Houston lawyers with Haynes and Boone and Simpson, Thacher & Bartlett to handle the transaction.

Just a week earlier, Oklahoma-based Williams Partners acquired chemical and pipeline assets from a subsidiary for $2.4 billion. Baker Botts is leading the deal.

And on Oct. 31, Houston-based Halcón Resources hired Thompson & Knight to handle its $1.45 billion acquisition of North Dakota oil and gas assets from Dallas-based Petro-Hunt, which was represented by Fulbright & Jaworski.

For months, energy lawyers and industry analysts quietly have thought there would be a pause in the number of significant mergers, acquisitions, joint ventures and asset divestitures in the oil and gas sector.

So far, that hasn’t happened. It appears as if the deal-making may never slowdown.

“It is a very good time to be an experienced oil and gas lawyer in Texas,” says Mark Berg, general counsel and senior vice president of Pioneer Natural Resources. “There are a lot of energy companies still looking for solid strategic deals.”

During the first three quarters of 2012, energy M&A comprised more than one-third of all deals announced in Texas and more than 23 percent of all transactions in the U.S. – nearly double the amount of M&A in technology, retail or pharmaceuticals, according to mergermarket, an independent global M&A research firm affiliated with the Financial Times.

Four of the 10 largest U.S. deals announced during the first nine months of 2012 involved oil and gas companies – all of them based in Texas and involving dozens of highly compensated energy lawyers based in Texas.

Quarterly M&A reports are fun to read, but seldom give an accurate view of the marketplace. While annual league table reports are certainly more reliable, they still do not always give the full picture. To that extent, The Texas Lawbook and mergermarket are periodically evaluating legal trends in the energy M&A sector over a more extended time period.

Between January 1, 2010 and September 30, 2012, Texas-based energy companies announced 292 deals valued at $237 billion, according to mergermarket. During that same 32-month time period, all U.S.-based energy companies did 740 transactions that carried a combined price tag of $463.6 billion.

Globally, there were 2,454 energy deals valued at more than $1 trillion.

“There’s a lot of money flowing into energy and Texas right now,” says Stephen Coats, a managing partner and general counsel at New York-based Riverstone Holdings, a private equity firm with more than $22 billion in investments in the energy sector, including several billion in Texas.

The result, according to legal industry analysts, is that energy transactional law has been on fire. The traditional energy powerhouses, including Baker Botts and Vinson & Elkins, are experiencing record profits. National firms, such as Latham & Watkins, Simpson, Thacher & Bartlett, Jones Day and Weil Gotshal & Manges, have successfully swept into the energy sector through strategic lateral hires and are grabbing a significant slice of the pie.

“Law firms with strong energy practices, especially Vinson & Elkins and Baker Botts, are doing very well,” says Ward Bower, a principal at Altman Weil Inc., a national consulting firm. “If you have energy transactional experience, you are in demand. I don’t think a sector can get any hotter and there’s no end in sight.”

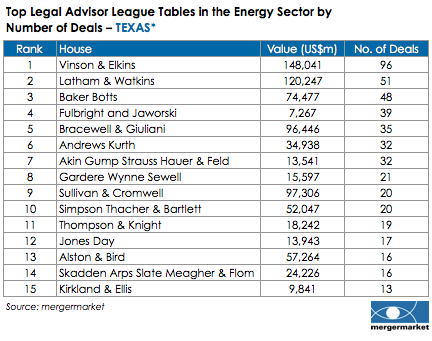

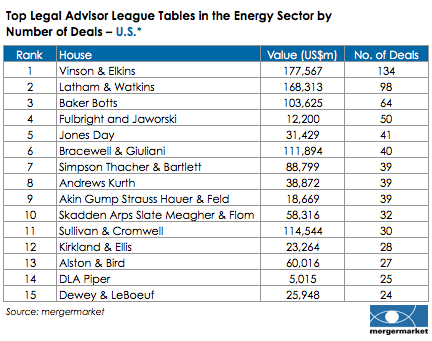

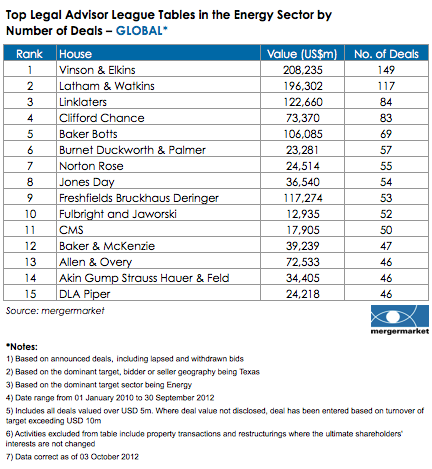

According to mergermarket, V&E has represented Texas-based energy companies and private equity firms in 96 separate deals since January 2010, which is nearly double the number of any other law firm. Globally, V&E handled 149 energy transactions valued at $208.2 billion.

Latham consistently ranks second in the league tables examining the past 32 months of energy deals. Latham represented 117 energy companies with a combined price tag of $196.3 billion.

“The presence of V&E and Latham atop the league tables for Texas, the US and the world highlights the importance of Texas businesses and the law firms that advise them,” says Chad Watt, an analyst for mergermarket in Texas. “V&E and Latham advised on a wide spectrum of deals within the energy universe – it wasn’t just acquisitions, asset divestitures or IPOs, and it wasn’t just upstream producers doing deals.

“These two firms continued domination of the leader board shows the value of having a diversified transactional practice group,” he says.

Keith Fullenweider, who heads the M&A practice at V&E, says the firm has been able to successfully challenge the out-of-state law firms seeking to steal away energy clients.

“We continue to see a steady flow of interest from traditional energy companies, private equity firms and foreign government-owned energy companies seeking to invest,” says Fullenweider. “We are having a record year.”

None of this, of course, means that the other Texas firms with energy practices are exactly suffering. Baker Botts advised 64 energy companies in deals valued at $103.6 billion, according to the mergermarket survey. Bracewell, Fulbright & Jaworski, Andrews Kurth and Akin Gump were not far behind.

“M&A activity in Texas and throughout the energy industry should remain strong through 2013,” said David Kirkland, chair of Baker Botts’ Corporate Practice. “A number of companies continue to look for businesses that will add value as they seek to position themselves for changes that may affect the sector over the next few years.”

Not all energy transactional work for lawyers involves M&A activity. For example, Dallas-based Thompson & Knight handled more than $68 billion in energy loan transactions for clients – a statistic that doesn’t even show up in the mergermarket data.

“In the third quarter, oil and gas M&A closings were down, perhaps at least partially as a result of this year’s generally lower gas prices and some decline in oil prices,” says T&K partner Joe Dannenmaier. “The fourth quarter is seeing significantly more activity.”

“We continued to participate in transactions involving overseas investors with long-term interest in US oil and gas,” says Dannenmaier. “These investors have large US dollar holdings and make wise decisions investing in the US oil and gas industry.”

© 2012 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.