The top 50 corporate law firms operating in Texas added an average of one lawyer per firm in 2020, which would make for lonely orientations. Even one new face is more than most industry insiders anticipated a year ago as the Covid-19 pandemic and sinking oil prices plunged the economy into recession.

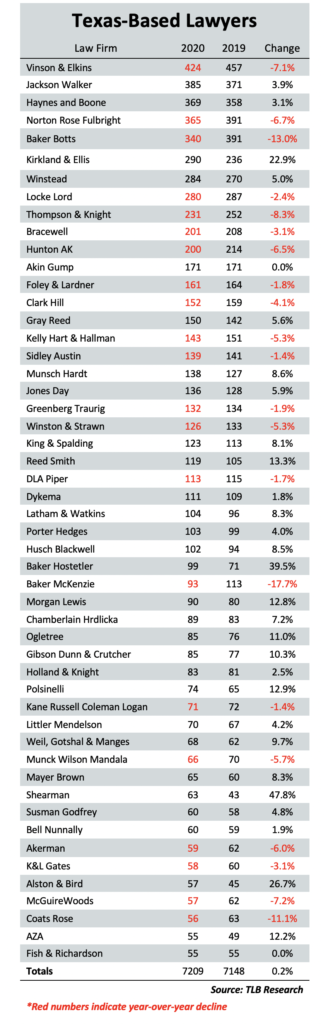

Taken together, the 50 largest firms in the Lone Star State employed 7,209 lawyers in 2020, according to new research by The Texas Lawbook. The overall increase from 2019 was 61 attorneys, just less than 1%.

By contrast, The Texas Lawbook 50 law firms went on a hiring spree in 2019, adding 250 lawyers, or 3.5%, from the 2018 headcount. The gain was five lawyers per firm.

The headcount gain in 2020 might well have been larger if not for the pandemic, which closed firms’ offices, disrupted the normal process of recruiting and forced firms to hold summer associate programs remotely.

Many law firms delayed the starting dates for newly minted attorneys from the fall until after the start of 2021. As the Lawbook reported last week, the pandemic year’s economic uncertainty also was a big reason lateral hiring failed to match the previous year’s pace. Covid-19 risks led some lawyers nearing retirement age to leave early.

Going into 2019, growth in the number of lawyers practicing corporate law at firms in Dallas, Houston and Austin had been anemic, with the Texas Lawbook 50’s annual headcount growth averaging 0.5% over the previous five years.

The so-so 2020 results might auger a return to the days of small increases in lawyer headcounts, but Texas Lawbook interviews in March and April found firms flush with business, worried about overworking their lawyers and keen to hire new lawyers in 2021.

“We’re actively looking for associates at all levels and a few senior people in the right areas,” said Robert Rabalais, partner in charge Simpson Thatcher’s Houston office.

Vinson & Elkins chairman Mark Kelly sounded equally bold and confident: “I’m very bullish on 2021. We’re hiring.”

Yvette Ostolaza, chair-elect of Sidley Austin and head of the firm’s Dallas office, said that she and her team “have never been busier” and that Sidley is in “serious growth mode” in Texas.

“We are definitely in hiring mode,” said John Zavitsanos, founding partner of the Houston litigation boutique Ahmad, Zavitsanos, Anaipakos, Alavi & Mensing. “We had six trials last year. Hopefully we will have more this year. So if you are a trial lawyer and you love being a trial lawyer, call us.”

The optimism on hiring contains echoes of early 2020. Then as now, many firms saw a surge of business in the first two or three months of the year and looked forward to doing even better than the banner year of 2019. They go into the rest of this year optimistic but chastened – a lesson from the trials and tribulations of a pandemic that seems to be abating but as yet unconquered.

The Texas Lawbook used responses to a survey sent out to about 75 firms in March to compile headcount and percentage change rankings of the Top 50 – actually, 51 firms this year due to a tie between AZA and Fish & Richardson for No. 50 at 55 lawyers.

Among the number-crunching’s notable findings:

- On lawyer headcounts, more than half of the 10 largest firms contracted in 2020 – the notable exceptions being Kirkland & Ellis and Jackson Walker.

- The headcounts also show 28 firms added attorneys, 21 lost lawyers and two – Akin Gump and Fish & Richardson – had exactly the same headcount in 2019 and 2020.

- On firm rankings, Jackson Walker moved up to second and Haynes and Boone third, displacing the shrinking Norton Rose Fulbright and Baker Botts.

- On headcounts and percentage changes, law firms with Texas roots didn’t do as well as the out-of-state firms that have set up shop in the state.

Headcounts: The Ups and Downs

The Texas Lawbook 50’s headcount for 2020 shines a spotlight on Kirkland & Ellis, the Chicago firm that entered the Texas market seven years ago and has done nothing but grow and grow.

In the face of the pandemic – or possibly because of its economic disruption – Kirkland added 52 lawyers, more than any other corporate firm operating in Texas. The firm’s Dallas and Houston lawyers had a busy year supporting Kirkland’s corporate restructuring practice, which represented more debtors filing for bankruptcy in Houston than any other law firm.

At Kirkland, aggressiveness has become a trademark. It had just 45 Texas lawyers in 2015 but grew in spurts – to 94 lawyers in 2016, then 118, 190, 236 and now 290 in 2020.

Kirkland partner Andy Calder said the firm intends to stay on the fast track in hiring lawyers, opening its third Texas office in Austin this year.

“We are certainly not done growing,” Calder said. “We think the Austin market is going to be critically important moving forward, and I think you will see us grow that office steadily.”

In terms of adding to their ranks in 2020, , the next four firms after Kirkland – three of them recent arrivals from out-of-state –were Cleveland-based Baker Hostetler with 29, New York-headquartered Shearman with 20, Texas-only Jackson Walker with 21 and Pittsburgh-based Reed Smith with 14.

Baker Botts went from 391 to 340 lawyers in Texas, a decline of 51 lawyers. The next four firms reporting large headcount declines were Vinson & Elkins with 33, Norton Rose Fulbright with 26, Thompson & Knight, which a month ago announced a proposed merger with Florida-based Holland & Knight, with 21 and Baker McKenzie with 20.

Even in a year scarred by a pandemic, large headcount declines at firms with big Texas footprints caught the eye of Kent Zimmermann, a law firm consultant at Zeughauser Group in Chicago.

“Some firms shrunk by design to get more profitable,” he said.

Strategic moves to fatten the bottom lines generally involve shrinking underperforming practices and expanding those with higher upsides. Firms encourage less productive partners and lawyers billing at low hourly rates to leave the firm. Achieving higher profits plays a key role in the intense battle for legal talent – they’re what gives the top firms an edge in attracting elite lawyers.

“You have to decide what your power practices are – that’s where you focus,” said Michael McKenney, managing director of Citi Private Banking’s Law Firm group.

Baker Botts managing partner John Martin said the firm had rolled out a new strategic vision right before the pandemic hit. “We plan to continue to sharpen our focus on energy and technology,” he said.

At V&E, a longtime leader in oil and gas law, Kelly said recent personnel moves would assist clients in the transition to alternative energy sources. “We wanted to move our energy expertise in that direction,” he said.

Rankings: Shuffling at the Top

The gains and losses led to some shuffling in the Texas Lawbook 50 rankings. Among the Top 10, Vinson & Elkins held on to the top spot – even though its headcount fell from 457 in 2019 to 424 in 2020.

Fourth last year, Jackson Walker increased to 385 lawyers in 2020, leaping over the shrinking Norton Rose Fulbright and Baker Botts to capture the second place behind V&E. Haynes and Boone added 11 lawyers in 2020 and rose from fifth to third. Kirkland jumped from ninth to sixth. Only one newcomer entered the Top 10 – Bracewell moved up one spot No. 10, pushing Hunton AK down one spot to No. 11.

Six firms in the Top 10 employed fewer lawyers in 2020 – a noteworthy turnabout from 2019, when nine of 10 largest employers added Texas lawyers and only Winstead reported a decline, shedding just 7 lawyers.

Overall, 2020’s Top 10 had a combined headcount decline of 51 lawyers. Baker Botts, V&E and Norton Rose Fulbright– the top three in the 2019 rankings – shed a combined 110 lawyers. Three other Texas firms – Jackson Walker, Haynes and Boone and Winstead – added a combined 39 attorneys.

Expanding to the Top 20, only Munsch Hardt managed to elbow its way in, rising from No. 21 in 2019 to No. 18 in 2020, displacing Winston & Strawn, now No. 21.

Kelly, Hart & Hallman dropped one spot to No. 16 as its lawyer headcount fell 5.3% – from 151 in 2019 to 143 in 2020. Marianne Auld, the firm’s managing partner, said the smaller headcount wasn’t by design; it resulted from of lawyers leaving for personal reasons. Hiring replacements took until early 2021, when the firm added nine attorneys.

The Texas Lawbook 50 had only two roster changes – both involving firms with smaller Texas operations that did a lot of hiring. Shearman added 20 lawyers to jump up to No. 42; Alston & Bird grew by 12 lawyers, good for No. 48. Cantey Hanger and Fee Smith dropped out.

Percentages: A Different View

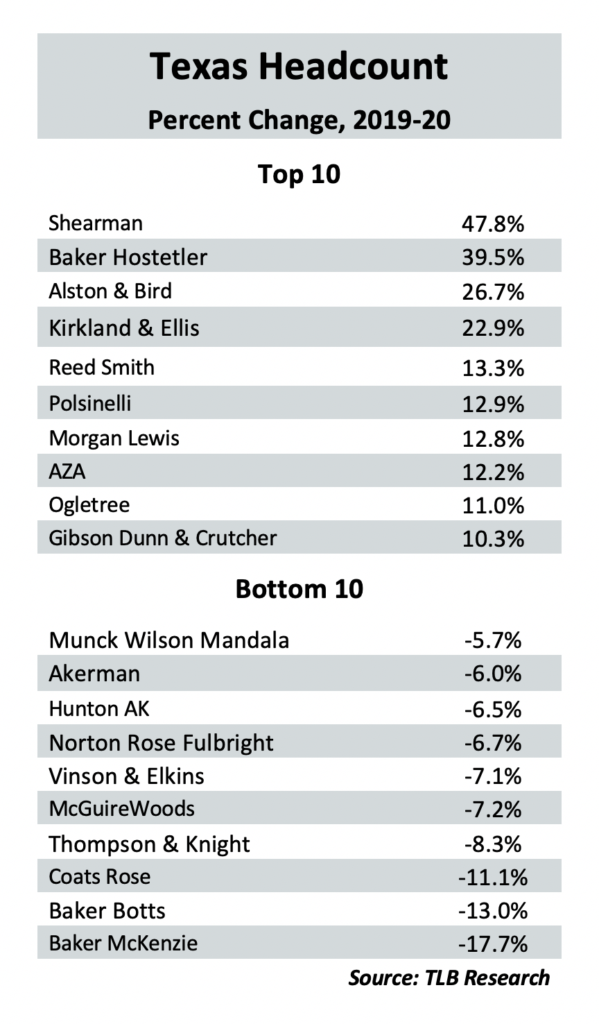

Headcounts give an edge to bigger firms, so it’s worth looking at the year-to-year changes in percentages. Shearman, for example, ranked in the bottom 10 in headcount at 63 in 2020 – but it rose to the top with an increase of almost 48%. The only big employer among the 10 firms with the largest percentage gains was Kirkland at 23%.

Other top gainers were Baker Hostetler at 40%, Alston & Bird at 27% and Reed Smith at 13%. Overall, 10 firms increased Texas lawyer headcounts by 10% or more, and another 10 expanded employment by at least 5%.

Turning to the 10 firms with largest losses, only three posted exceeded 10 percent of their lawyers – Baker McKenzie was down almost 18%, followed by Baker Botts at 13% and Coats Rose, a 56-lawyer firm, at 12%. Another 10 firms had declines of at least 5%. Big-name firms made up half of the 10 with the largest percentage declines. In addition to Baker Botts, the list includes Thompson & Knight, V&E, Norton Rose Fulbright and Hunton AK.

“Some firms are losing headcount because richer law firms are stealing away their partners and more experienced associates, and there is nothing the less profitable law firms can do about it,” Zimmerman said.

The lawyer counts and percentage changes for 2020 reinforce a theme often found in Texas Lawbook reporting – firms with in-state roots aren’t faring as well as their competitors that entered the Texas market in recent years.

Home-grown Texas firms stood out as the state’s big employers, making up nine of the 10 largest firms by headcount. However, the 22 Texas firms saw a decline of 64 lawyers in 2020, while the 29 out-of-staters added 151 positions.

Only one Texas firm broke into the Top 10 in percentage growth in lawyer headcounts – the Houston litigation boutique AZA, which ranked eighth with a 12% gain. By contrast, five of the 10 firms that saw the largest percentage declines in lawyers have Texas roots – from bottom to top, it was Baker Botts, Coats Rose, Thompson & Knight, V&E and Munck Wilson Mandala.

Strategic repositioning aside, and compared to many other professions, lawyer jobs held up well in a year of uncertainty and turmoil in the overall labor market. Few corporate firms, either in Texas or nationwide, resorted to firings or furloughs. Any compensation cuts were quickly restored, and firms were increasing their bonuses as the pandemic year closed.

A year ago, firms feared potentially catastrophic losses as the pandemic shut down the economy. However, they avoided the wholesale staff-cutting that took place in the Great Recession of 2008-09, and the associated interruption of recruiting efforts that left holes in the staffing structure. This time, it proved wiser to hang on to talent for when the economy returns to normal and keep the normal personnel patterns in place.

“The firms did learn from the experience of 2008,” Zimmermann said. “They didn’t want to repeat their mistakes.”