Texas M&A in the third quarter of 2022 is much like the porridge at the fabled Goldilocks Estate: not too hot, not too cold. But that doesn’t mean that it was just about right. The biggest deal of the quarter wasn’t even an M&A transaction.

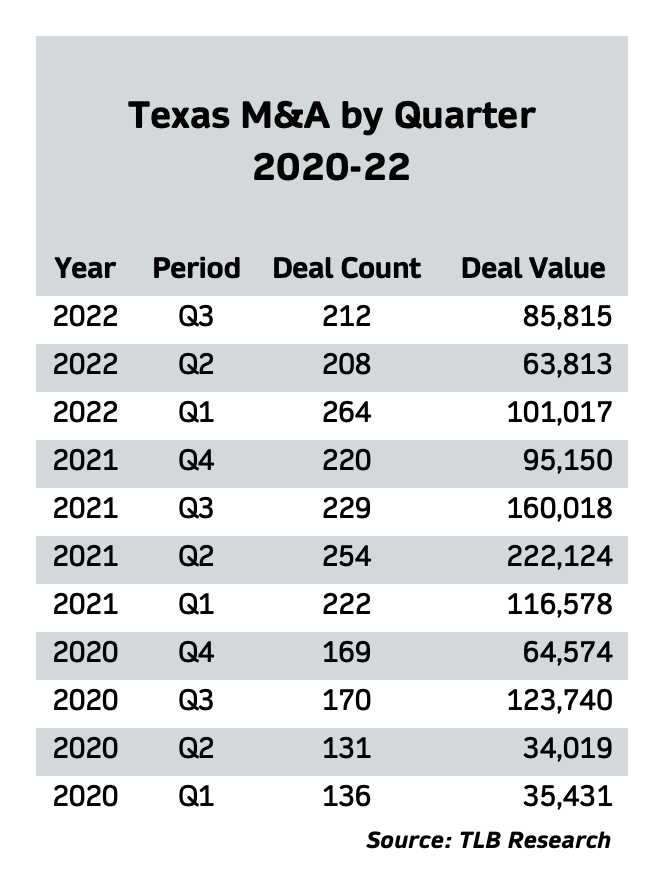

From July through September there were 212 deals reported that involved Texas companies or Texas lawyers. Those deals were worth a reported $85.8 billion. Compared to the last 11 quarters that ranks sixth in deal count and seventh in deal value, no matter how you figure.

For those with a more mathematical bent, the 212-deal count for the quarter was the median for those 11 quarters. That was above the actual average deal count of 201.4 for those 11 quarters. Perhaps more troubling, the $85.8 billion in deal value, though better than Q2 of this year ($63.8 billion), was below the median $95 billion in Q4 2021, and further below the 11-quarter average of $100.2 billion.

As noted, the biggest deal of the quarter wasn’t even an M&A transaction. In August, Intel Corp. announced a co-investment deal, a joint venture of sorts, with Canadian investor Brookfield Infrastructure. The two companies agreed to jointly invest up to $30 billion into semiconductor manufacturing operations in Arizona. Kirkland & Ellis — led from Houston by Andy Calder, Doug Bacon and nearly 20 other Kirkland lawyers — advised Brookfield on its commitment with Skadden Arps on the Intel side.

In September, three firms — Kirkland, Vinson & Elkins and Akin Gump — advised the various parties in a $5.2 billion deal involving Pittsburgh-based EQT Corp. and Quantum Energy Partners. In that transaction EQT acquired major Appalachian upstream and midstream assets from Quantum-backed XcL Midstream and Tug Hill. Kirkland repped EQT, V&A advised both Tug Hill and McL Midstream and Akin Gump counseled Tug Hill.

In a $4.8 billion deal energy infrastructure investor EIG announced a deal in September in which it would acquire a 25 percent stake in Repsol Upstream, a newly formed U.S.-based P&E created by Spanish O&G operator Repsol that is aimed at investments in energy transition. Gibson Dunn partner Hillary Holmes led an international team that counseled EIG financial advisor Goldman Sachs on the deal.

OMERS Infrastructure Management, which is backed by the Canadian Pension Plan, agreed Atlas Ateria to sell their respective indirect stakes in the Skyway Concession Co. for $2 billion. Latham & Watkins advised OMERS on the deal with a team led by Houston partner Justin Stolte.

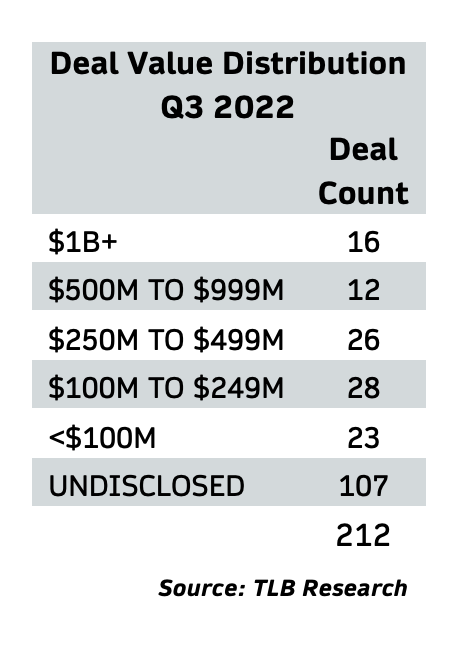

In all, there were 16 deals above the $1 billion mark, more than half of them involving oil & gas. In fact, energy was far and away the most active business sector, representing nearly 40 percent of third-quarter deals.