© 2014 The Texas Lawbook.

By Mark Curriden – HOUSTON (Jan. 2) – Corporate lawyers in Texas have never been busier than they were in 2014, but new data shows that many businesses based in the state are getting non-Texas lawyers to represent them in the larger and more complex M&A transactions.

New data by Mergermarket shows that Texas-based companies did more mergers, acquisitions, divestitures and joint ventures last year than any year in history. Not only were there more deals, the transactions were larger in value and much more complex. (See full report called “2014 was the Year of the Deal.”)

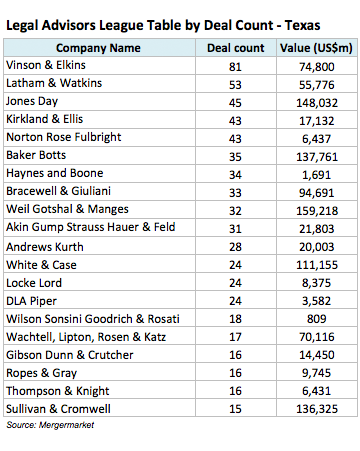

The Mergermarket leader board also shows that, for the fourth consecutive year, Vinson & Elkins acted as legal advisers in the most deals during the past year. Latham & Watkins, also for the fourth straight year, was second. Jones Day and Kirkland & Ellis were not far behind.

“V&E’s remarkable strength in the energy sector keeps them head and shoulders above the other law firms doing M&A,” says Mergermarket’s Chad Watt.

“Nearly all the large Texas law firms did well in 2014 – Baker Botts, Bracewell & Giuliani, Akin Gump, Andrews Kurth,” Watt says. “But the non-Texas law firms, such as Latham and Gibson and Weil, also had very good years.

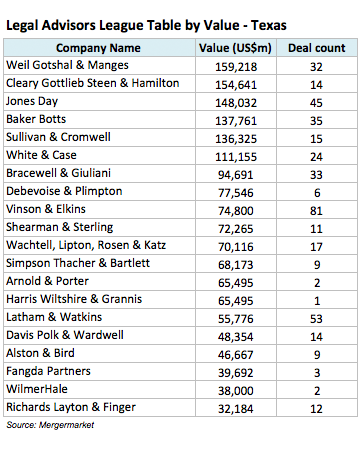

Mergermarket, which provides the Texas data exclusively to The Texas Lawbook, ranks law firms two ways: deal count and deal value.

The Texas-based firms fared much better in the deal count category, where nine of them ranked in the top 20.

By contrast, only three law firms headquartered in Texas – Baker Botts, Bracewell and V&E – made the top 20 by deal value.

In fact, 11 of the top 20 law firms ranked by deal value don’t have offices in Texas. Six other law firms are based elsewhere but have an office in Austin, Dallas or Houston.

For example, AT&T tapped Gibson Dunn to lead its $48.5 billion acquisition efforts of DirecTV. Most of the Gibson Dunn lawyers working on the deal office outside of Texas, except Dallas litigation partner Sean Royall, who is advising AT&T on antitrust matters related to the transaction. It should be noted that Gibson Dunn broke into the top 20 Texas deal count list for the first time ever.

In doing so, it knocked Simpson Thacher out of the top 20 on deal count, though the New York firm ranks 12th on the deal value chart. Cravath, a New York corporate powerhouse, also dropped out of the top 20 deal value chart for the first time in four years.

Baker Botts ranked sixth on the deal count chart and fourth on the deal value chart. Corporate lawyers at Baker Botts were involved in five of the six largest transactions in 2014.

V&E did more than double the number of deals than Baker Botts (81 to 35), but the total value of the Baker Botts transactions was nearly twice as high as the deals worked on by V&E.

Lawyers at firms such as Haynes and Boone, Kelly Hart, Locke Lord, Porter Hedges and Thompson & Knight are quick to point out that many their clients tend to be privately held companies and that many of their deals are never made public.

© 2014 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.