Sometimes it’s hard to admit what is most obvious, even in dealmaking.

But according to first half deal stats from The Texas Lawbook’s exclusive Corporate Deal Tracker, the truth is pretty simple: Energy still rules in Texas.

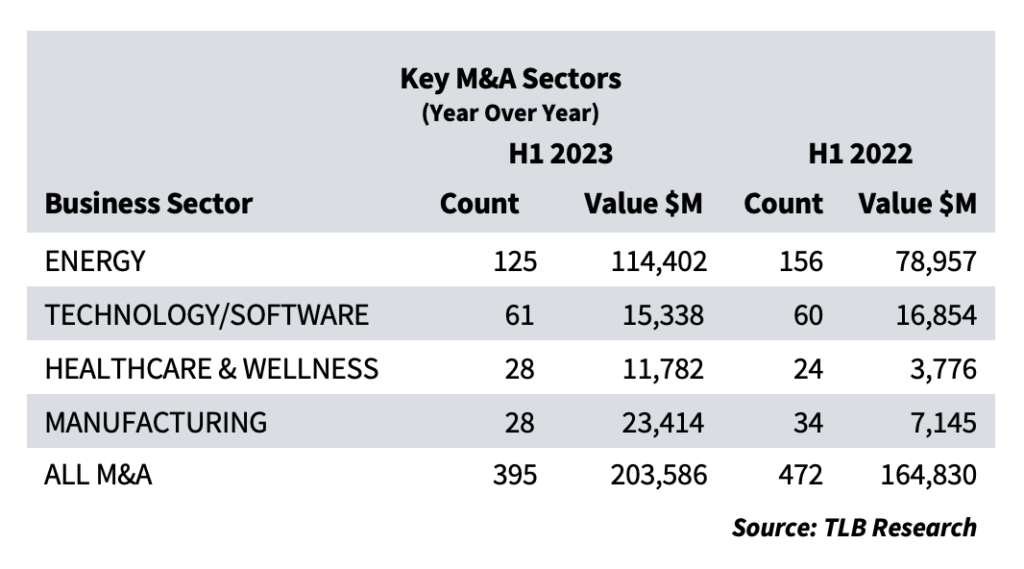

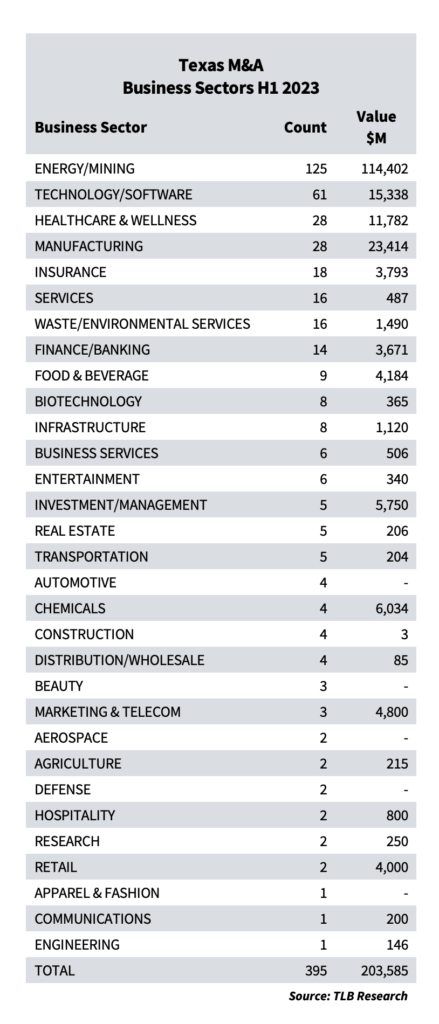

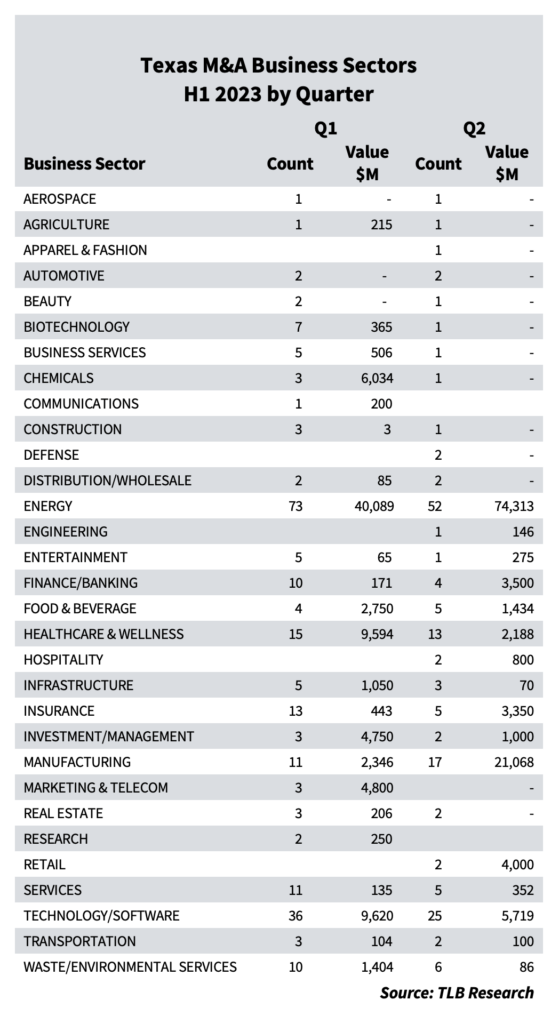

Of the 395 M&A transactions in the first half of 2023, 125 were energy-specific, whether upstream, midstream or energy services. Although that’s down from 156 energy deals during the same period last year, it represents a higher deal count than the next three most productive sectors combined: technology (61), manufacturing (28) and healthcare (28).

Perhaps more significant in a stingy M&A credit market, energy deals represented well more than half of the deal value (56 percent) for the first six months this year — $114 billion of a total $203.6 billion.

Ask Gibson Dunn partner Hillary Holmes where the action is and the answer is energy, energy, energy: “It’s extremely busy right now — in all energy sectors.”

That said, there are a variety of dramatic changes taking place in the energy sector. The rise of energy transition projects, the consolidation of productive fields, the dramatic entry of LNG production to the traditional mix, to name but a few. But at this particular moment, it is the traditional energy deal that is proving most durable, while energy transition projects still carry a few warning labels.

“Conventional energy has returned excess cash flow to investors and restored a confidence factor that should enable growth,” says Archie Fallon, a partner at Willkie Farr & Gallagher in Houston. “Renewables and energy transition projects have captured a mix of governmental economic support and private capital dry powder — and public imagination — but the abundant risks — technology, power transmission queue, permitting wait times — could still temper the enthusiasm for those projects.”

One of the more notable reasons is the vigorous consolidation that is taking place in both upstream and midstream. Productive oil fields are dependable sources of cash and as LNG production ramps up along the Gulf Coast, investors are buying up natural gas production and the pipelines that feed them.

“Consolidation in basins is a major driver in many of the recent, large M&A deals, particularly in upstream,” notes Rahul Vashi, Holmes’ colleague at Gibson. “Public E&Ps have adjusted to the new normal of drilling within cash flows and returning capital to shareholders, their balance sheets are strong, and many are looking to acquire assets they can easily scale up and increase their undrilled inventory in core basins,” says Vashi.

For instance, in April Denver-based Ovintiv consolidated its presence in the Permian Basin with the $4.275 billion acquisition of Permian assets from three entities owned by EnCap Investments. In a separate transaction, Ontiviv sold its position in the Bakken region of North Dakota to an EnCap portfolio company for $825 million. Vinson & Elkins, Kirkland & Ellis and Gibson Dunn advised parties in the deals.

In similar pairing of acquisitions announced in June, another Denver company, Civitas Resources announced $4.7 billion in acquisitions from Hibernia II and Tap Rock Resources. Those, too, were advised by Kirkland and V&E.

In February came a different kind of consolidation as Miami-headquartered I-Squared Capital acquired the Whistler Pipeline from three different equity holders. Terms weren’t disclosed but the 450-mile natural gas conduit connects NG gatherers in the Permian with LNG production and terminals along the Texas Gulf Coast. Lawyers from Kirkland, Simpson Thacher & Bartlett and Sidley Austin advised on that deal.

And in the largest Texas-led deal so far in 2023, natural gas transmission giant ONEOK agreed to in May to acquire its crosstown energy infrastructure rival Magellan Midstream for $18.8 billion. Magellan owns ammonia and crude oil pipelines across the Mid-Continent oil producing area, which includes the Permian Basin. Texas lawyers from Kirkland, Latham & Watkins and Haynes Boone advised on the deal.

Notes Vashi: “The Permian Basin still stands above all other basins, but with the core of the Midland Basin getting heavily consolidated over the last two years, much of the M&A activity has shifted to the Delaware Basin. The Eagle Ford and Haynesville are also drawing heavy interest, particularly among gas players looking for assets with easy access to LNG export terminals on the gulf coast.”

“The story is similar in the oilfield services space,” add Holmes. “Public companies are consolidating or acquiring segments in order to offer a broader suite of services. Private companies are taking advantage of the favorable multiples to dual track a sale and an IPO.”

That is likely to continue in the coming months, says Willkie’s Fallon.

“We see public midstream companies gaining equity holder support for acquiring strategic assets that they have chosen not to build themselves over past 3-4 years,” said Fallon. “We see new energy divisions of integrated energy companies acquiring private equity funded energy transition businesses in CCS, green hydrogen and energy storage. We see sub-$200 million [exploration and production] asset packages attracting private equity buyers.”

Technology, on the other hand, is down. The emerging darling of dealmakers as recently as a year ago, overpricing in the tech sector was exposed by the spring 2023 failures of several tech-centric banking institutions, beginning with the March failure of Silicon Valley Bank. Those failures dampened the credit markets for nearly every sector and, in the short term, soured the seemingly limitless rise of technology M&A per se.

The largest Texas-led tech-related deal during the first six months of 2023 was the $7.7 billion sale by SAP to Silver Lake Investors of all its shares in Utah software provider Qualtrix — part of a larger, $12.5 billion take-private deal. Shearman & Sterling advised SAP with Dallas partner Robert Cardone as co-lead. Next came a $4.8 billion merger in March between California-based Concentrix Corp. and the French web-based business service WebHelp. Latham & Watkins Houston counsel Thomas Verity advised on that transaction.

But that was it. Those were the only pure technology Texas-led deals with a values reported above $1 billion. In the second half of 2022, there were six such billion-dollar technology deals.

Despite that, Ryan Maierson, the veteran corporate partner at Latham & Watkins, said he feels the year will finish strong — with a tail into 2024.

“We expect to see largely more of the same for the rest of this year and into 2024, as inflation worries are cooling but recession fears persist. As financing becomes more readily available, public-to-public M&A, particularly in the energy and tech industries, is likely to continue episodically.”