A North Texas judge has been appointed to handle allegations of criminal misconduct made by the children of deceased Dallas banker Arthur Ruff against lawyers and bankers involved in their family’s multimillion-dollar trust.

Three adult children of Ruff confidentially filed an application in July asking a Texas judge to open a criminal investigation into alleged exploitation of their 74-year-old mother, Suzann Ruff, and misapplication of hundreds of thousands – or even millions – of dollars from the family trust by Frost Bank and their mother’s own lawyer, Randal Mathis.

These allegations come less than two years after an arbitration panel found that one of the Ruff children actually defrauded his mother and awarded her $49 million in damages – a verdict that is currently on appeal.

The three Ruff children – a corporate lawyer, a medical doctor and a military and commercial airline pilot – claim that another sibling, who is a convicted child pornographer, bank officials and Mathis are illegally “controlling and isolating” their mother and stealing money from the trust, according to court records obtained by The Texas Lawbook.

“We are gravely concerned that both Frost Bank, its officers and Randal Mathis are engaged in the systematic and ongoing financial exploitation of our elderly and psychiatrically ill mother and misapplication of fiduciary property,” the Ruff children stated in a confidential document presented to court officials.

“Millions of dollars have been stolen from the trust over the last several years,” the Ruff children stated in the record submitted to the judge. “That money was meant to remain in the trust for our mother’s benefit. It was not meant to be stolen from her or for her to be exploited by her own trustee and her own attorney.”

Lawyers for Mark Ruff, Kelly Frazier, Tracy Bakshi and Mike Ruff filed the allegations under a little-used provision in Chapter 52 of the Texas Code of Criminal Procedure that allows individuals to seek an independent criminal investigation called a “court of inquiry” led by a state district judge. Mike Ruff, a businessman, however, is not a party to this court of inquiry application.

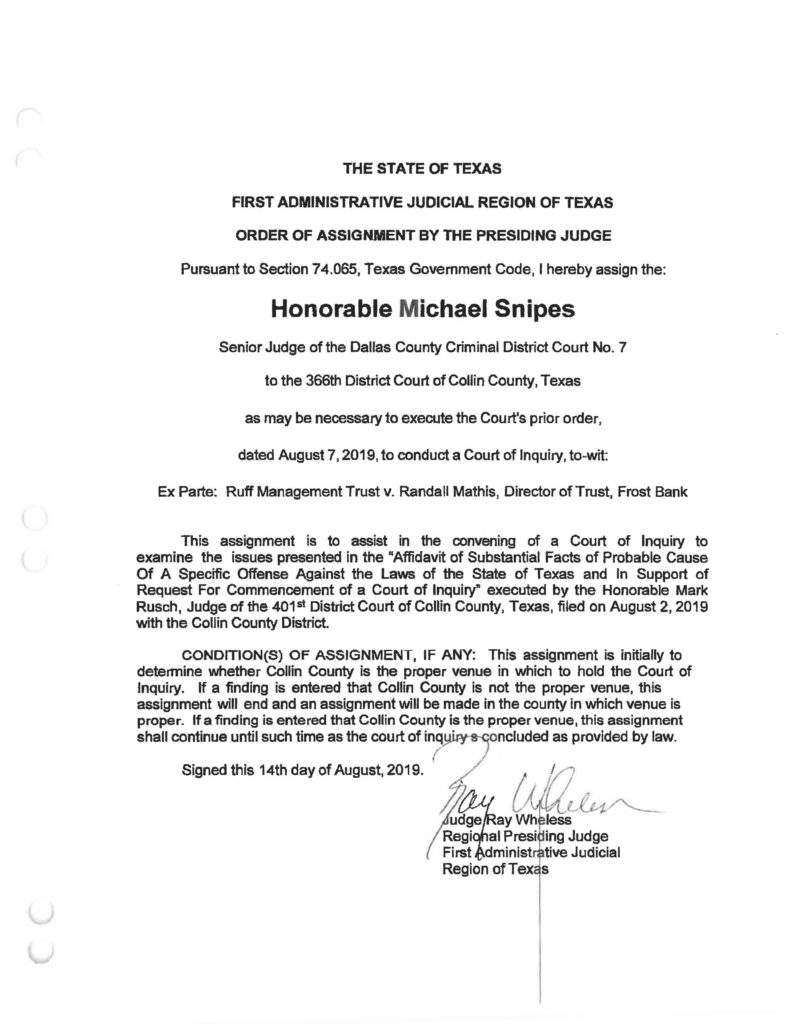

On Aug. 2, a Collin County district judge granted the request and forwarded it to Presiding Judge Ray Wheless of the First Administrative Judicial Regional of Texas, who signed a one-page order on Aug. 14 appointing Dallas County Senior District Judge Michael Snipes to handle the initial stages of the “court of inquiry,” according to documents provided to The Texas Lawbook.

Judge Wheless asked Judge Snipes to determine the appropriate venue for the court of inquiry – Dallas County or Collin County. Depending on the jurisdiction decision, the case will either stay with Judge Snipes or be assigned to another judge in Collin County.

“Frost has not been provided a copy of the ‘court of inquiry,’ so Frost cannot comment on that proceeding,” Frost Bank said in a statement to The Texas Lawbook. “However, Frost at all times has acted appropriately, fairly, and consistent with applicable law, both in the Ruff family litigation and in its administration of the trust, including its decisions to make and not make distributions of trust assets to Mrs. Ruff.”

Mathis did not provide a statement regarding the court of inquiry, but he did forward copies of legal documents from the probate court validating his representation of Suzann Ruff, the $49 million judgment he won for her and millions of dollars in legal fees he is reportedly due to be paid under his contingency fee contract with Suzann Ruff.

The Ruff children are represented by former Dallas prosecutor and judge Dan Wyde and by Robert Gilbreath, a partner at Hawkins Parnell & Young. Hunton Andrews Kurth partner James Bowen, Greenberg Traurig partner Karl Dial and Bill Ucherek of Juneau, Boll, Stacy & Ucherek are representing Frost Bank.

Web of Intrafamily Litigation

The application for a court of inquiry is the latest legal maneuver in a nasty decade-long litigation battle involving the Ruff family, the trust and the lawyers and bankers working for the trust.

Court records show that there was $7 million in assets in the Ruff Management Trust in 2010. Since then, more than $4 million has been paid to the lawyers and bankers. There is now slightly more than $2.2 million remaining in the trust. Each side is blaming the other for the dwindling value.

The Fifth Court of Appeals in Dallas is currently handling an appeal of a probate court matter in which Suzann Ruff accused her oldest son, Michael Ruff, of fraudulently misappropriating his mother’s assets. An arbitration panel found in favor of Ms. Ruff and awarded $66 million – a decision that is now the subject of appeal.

Nearly a dozen other legal actions have been filed by members of the Ruff family against each other during the past decade, including restraining orders and bankruptcy filings.

In an exclusive interview, Mark Ruff, a 38-year-old Air Force major and pilot for American Airlines, said his father would have been horrified by what has happened during the past decade.

“This has been a terrible experience and has torn our family apart,” he said. “Everyone – the bank, the lawyers, our brother – they are all fleecing our mother and using her for their own financial benefit. I hope the court of inquiry stops that.”

Arthur Ruff & the Trust

Arthur Ruff earned two Purple Hearts and a Bronze Star while serving with the 25th Infantry in Vietnam in 1965 and 1966. He founded Lennox Properties, a large Dallas-based property development company, and Texas Central Bank. He was a driving force behind the Texas Vietnam Veterans Memorial in Dallas. He died in 1998 and left behind assets and a trust valued between $20 million and $45 million.

Family members were united for the first decade following Ruff’s death. The oldest son, Michael Ruff, a graduate of Rice University with a business degree, took over the management of the family’s company. Suzann Ruff and the children created the Ruff Management Trust in 2007, and Michael Ruff was named the trustee.

But the family’s life took a dark turn in 2009 when Dallas police arrested Matt Ruff, the second youngest son, for possession of child pornography. He was found guilty and sentenced to seven years in prison. Suzann Ruff became upset with her other children when they refused to openly support their brother in court and help him seek a lighter sentence.

“My father would have recognized right and wrong, and he would have wanted us to help our mother and our brother, Matt,” Mark Ruff told The Texas Lawbook. “But our father also understood that actions have consequences.”

Suzann Ruff, who the court filings allege has been diagnosed with borderline personality disorder, bipolar disorder and atypical depression, requested in 2009 that Michael resign as trustee as part of a “Family Settlement Agreement” in which Suzann agreed to release all claims she would have against her son. Suzann Ruff claimed that Michael surprised his mother at family events to force her to sign various business and legal documents that increased his control of the Ruff finances and business operations.

The other Ruff children served as joint trustees for one year and then were replaced by Frost Bank in 2010. That same year, Suzann Ruff and Frost Bank, according to court records, signed a “Release and Indemnity Agreement” – a document that did not include Michael Ruff.

Ruff v. Ruff

The family’s litigation battle technically started in 2011 when Suzann Ruff filed a petition in Dallas Probate Court seeking to modify the terms of the trust by increasing the monthly compensation she received.

In 2012, Suzann Ruff sued Michael for “defrauding Suzann out of millions of dollars while acting as her fiduciary.” She accused her son of hiding assets so that she and her lawyers could not trace the money.

Suzann Ruff also sued her other children, Kelly, Tracy and Mark, accusing them of helping Michael.

While Michael Ruff was not a signatory to the agreement between his mother and Frost Bank, he filed a motion with the probate court to have the challenges to the Family Settlement Agreement be decided by an arbitration panel.

Lawyers for Michael Ruff said he did not agree to have the arbitration panel also consider his mother’s tort claims against him. As a result, Michael Ruff and his attorneys refused to participate in proceedings involving Suzann Ruff’s claims of fraud.

In 2017, the dispute was sent to a three-person arbitration panel, which awarded Suzann Ruff $49 million.

Dallas Probate Judge Brenda Thompson confirmed the judgment against Michael Ruff and added $17 million in prejudgment interest and legal fees.

In briefs filed with the Fifth Court of Appeals in Dallas, lawyers for Michael Ruff say that the judgment should be reversed because “Michael never agreed to arbitrate Suzann’s tort claims” and because one of the three members of the arbitration panel had a conflict of interest because he represented Frost Bank in another matter.

“A party cannot be forced to arbitrate absent a binding agreement,” Robert Gilbreath, a partner at Hawkins Parnell & Young, wrote in his appellate brief on behalf of Michael Ruff.

In response, Suzann Ruff’s lawyer, Randal Mathis, states that Michael Ruff is the person who initiated the arbitration request and that he is now making the exact opposite arguments that he made prior to $49 million award.

“He repeatedly argued in the trial court that the arbitrators should decide if Suzy’s tort claims would be arbitrated,” Mathis states. “He cannot, for the first time on appeal, change his position.”

“Suzy believes that this is a frivolous appeal,” Mathis argues. “But she is not asking this court to impose sanctions, at least not against Mike, for a simple and obvious reason. Although Mike is incredibly wealthy … all of his wealth consists of Suzy’s money or assets. Therefore, if Mike individually was ordered to pay, he would be paying with Suzy’s money, if he ever paid at all.”

For its part, Frost Bank has asked the Fifth Court of Appeals to impose sanctions against Michael Ruff and two of his lawyers – Scott Weber and Jeffrey Hellberg – claiming that they made “arguments and factual statements that beyond question were objectively false and frivolous” and “failed to disclose critical facts” that “they had a duty to disclose.”

Lawyers for the Ruff children reject Frost Bank’s request for sanctions as grandstanding.

Court of Inquiry

Lawyers involved in the litigation say that both sides have tried to convince law enforcement authorities to open criminal investigations into the actions by other family members.

Until last month, there was no evidence that any of those attempts had been successful.

In documents seeking the court of inquiry, the Ruff children raised the ante by seeking criminal charges against their brother Matt, Frost Bank and Mathis.

Financial records provided to The Texas Lawbook show that the law firm Hunton Andrews Kurth, which represents Frost Bank, has been paid $1.6 million from the trust. Luhn Vu, a paralegal at the law firm Brown Fox and a friend of Suzann Ruff also was paid $1.38 million. The trust paid an estimated $500,000 to Matt Ruff at the request of his mother.

“Over the years, Matt has forged and kited checks from our mother,” the four Ruff children stated in court documents. “He has stolen cash and jewelry from her. He has provided her with prescription drugs and kept her in a medicated state to take advantage of her.

“And he perpetrated a scam from his prison cell against her that stole more than $300,000 from the trust,” the Ruff children stated.

The Ruff children also point a finger at Mathis, who led Suzann Ruff’s successful $49 million claim against Michael Ruff.

In court documents, the children claim that Mathis has illegally received about $800,000 from the trust.

“On Aug. 17, 2018, Frost Bank distributed $250,000 from the trust to Suzann Ruff,” court documents state. “However, Frost Bank and its officers knew that this money was not going to our mother but that Randal Mathis would immediately receive it and our mother was simply a pawn in Frost Bank and Randal Mathis exploitation scheme.”

Frost Bank distributed another $550,000 from the trust to Suzann Ruff in September 2018, according to the Ruff children.

“Frost Bank and its officers knew that this additional money was also not going to our mother but that Randal Mathis would immediately receive it and use it to pay his IRS tax levy and his other past due bank debt,” the children claim.

The Ruff children, in court documents they filed, also accuse Frost Bank of violating its fiduciary duties to the trust.

“Frost Bank and the officers who are supposed to oversee the trust as well as to protect our mother, has been made aware of our mother’s psychiatric illnesses and vulnerabilities,” they state. “Instead, Frost Bank and its officers have actively participated in the elder exploitation and criminal enterprise that has been formed to steal money from our mother and the Ruff Management Trust.”

Lawyers for Frost Bank, however, say that it is the constant and ongoing legal disputes pursued by the Ruff children that is hurting the financial value of the trust.

“Because Frost was a party to the Ruff family litigation in its capacity as trustee, Frost was entitled to pay its attorneys’ fees and expenses from the assets of the trust,” Frost Bank said in its statement to The Lawbook. “In order to minimize those fees and expenses, Frost repeatedly made efforts to be excused from the litigation, but Michael Ruff and his attorneys repeatedly objected.”

Mark Ruff, the Air Force and airline pilot, said that the loss of money is only a small part of the harm being caused by the family battle.

“We’ve reached out to our mother many, many times and she’s been completely isolated,” he said. “Her lawyer sends our lawyer a threatening letter telling us to stop trying to contact our mother. There are many things we disagree about and don’t understand, but she is still our mother and we still love her very much.”