© 2017 The Texas Lawbook.

By Mark Curriden

(Feb. 16) – The U.S. Securities and Exchange Commission has charged Dallas venture capitalist Patrick O. Howard and his two investment firms with operating a $13 million Ponzi scheme and providing false or misleading information to investors.

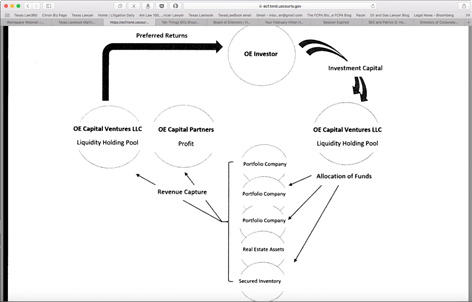

Enforcement lawyers in the SEC’s Fort Worth Regional Office say that Howard and agents of Howard Capital and Optimal Economics raised $13.1 million from investors with the promise that the funds would be reinvested in various portfolio companies and would reap a minimum 12 percent annual return.

“In reality, the defendants perpetrated an egregious fraud on the fund’s investors,” the SEC states in a 19-page complaint filed Thursday in the U.S. District Court in Dallas. “They have misappropriated and misapplied offering funds. They have issued investors phony account statements showing returns, which in fact did not exist.

“And they have disseminated offering materials containing numerous untrue and misleading statements as to material facts,” according to the SEC.

Howard did not respond to requests for an interview. The federal court has appointed Craig Stokley of Palter Stokley Sims to be the receiver while the assets are frozen.

Howard and his team targeted young and middle-aged investors who earned between $100,000 and $150,000 a year, according to an article last August in the Dallas Business Journal.

“We allege that Patrick Howard enticed investors with promises of guaranteed double-digit returns generated from stable revenue streams from established portfolio companies,” SEC Regional Director Shamoil T. Shipchandler told The Texas Lawbook. “Investors instead received only Ponzi payments or illusory paper profits, while their money was being dissipated in large part to keep defendants in business.”

The SEC claims that Howard falsely told investors that he was a registered investment adviser and that his fund paid no sales commissions, when $175,000 in commissions were provided. The lawsuit also states that Howard used money he raised from investors to “fund a radio advertising campaign” to attract additional investors.

Howard told investors that his funds “achieved average annual growth of 20 percent.

“In reality, the funds have earned just $33,334 since inception, a growth rate of 0.25 percent,” the SEC states.

For example, Howard Capital and Optimal Economics invested only $50,000 of the $833,993 it raised for a fund called CFG I, according to the SEC. The rest went to pay himself and expenses unrelated to the fund.

On Tuesday, the SEC filed under seal a petition seeking a temporary restraining order freezing the defendants’ assets and prohibiting Howard and his employees from continuing to market its securities offerings to investors – an order that Judge Lindsay granted later that same day.

Judge Lindsay also prohibited the defendants from destroying any financial documents or potential evidence.

The SEC enforcement lawyers leading the case are Timothy McCole, B. David Fraser and Scott Mascianica.

© 2017 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.