During a down year for the capital markets practice in Texas, a handful of law firms stayed busy.

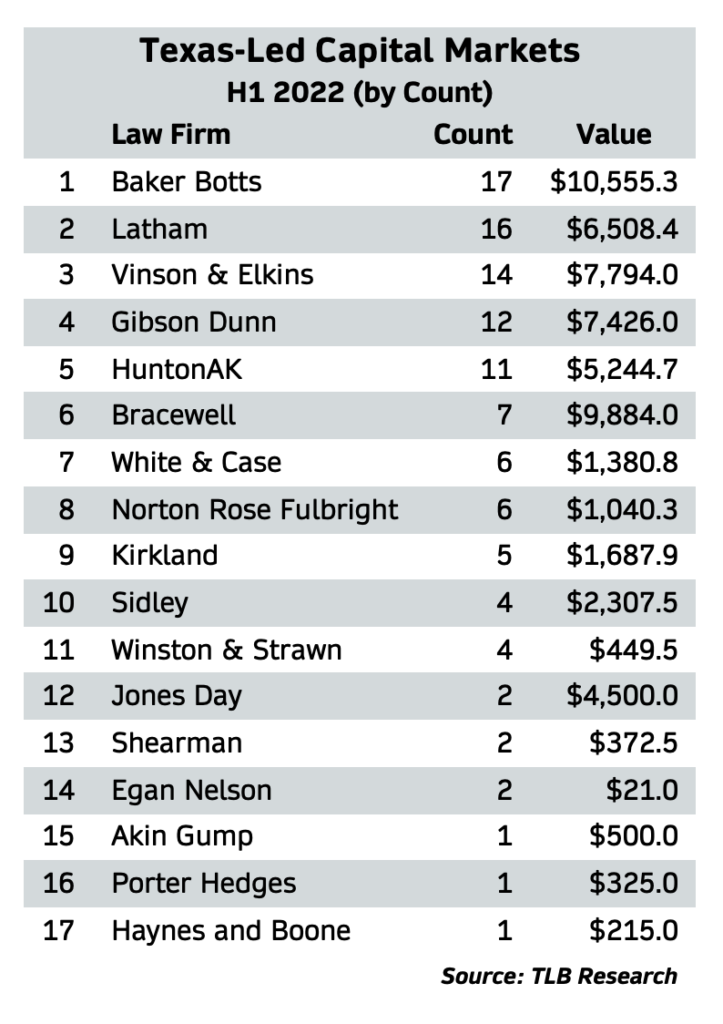

Data from The Texas Lawbook’s exclusive Corporate Deal Tracker shows that six corporate law firms with CapM practices in Texas topped the securities offerings rankings for deal count and deal value for the first six months of 2022.

But after an adjustment for a previously reported deal, it is Baker Botts currently atop CDT charts for deal count and deal value in H1 2022 securities offerings.

The CDT data, which tracks all CapM handled by lawyers who office in Texas, shows that Baker Botts led all law firms with 17 securities offerings worth $10.5 billion reported between Jan. 1 and June 30.

Latham was number two in deal count with 16 H1 capital markets deals worth $6.5 billion and Bracewell number two in the value of securities offerings at $9.884 billion.

(Editor’s note: The Lawbook previously reported that Baker Botts led 16 CapM deals when it was actually 17. This article has been updated to reflect the clarification.)

The CDT securities offerings rankings includes only CapM transactions announced during the first six months of 2022 and led by lawyers in Texas. Lead lawyers include only those whose firms represented principals in qualified transactions: representing the issuers, lead underwriters or bookrunners and disclosed initial purchasers.

H1 2022 CapM Deal Count Rankings

Baker Botts Dallas partners Shad Sumrow and Josh Espinosa (who has since left to become assistant general counsel at JPMorgan) represented Halliburton in a $3.5 billion credit facility. Halliburton General Counsel Van Beckwith is a former Baker Botts partner in Dallas. Houston partner Carina Antweil and special counsel Lakshmi Ramanathan advised Fort Worth-based Burlington Northern Santa Fe in a $1 billion public offering.

It’s worth noting that Baker Botts has continued its surge in capital markets deals in the third quarter, reporting at least nine additional securities transactions in the most recent updates of the Corporate Deal Tracker portal.

Latham partners Ryan Maierson and Nick Dhesi advised EQM Midstream Partners on its $1 billion private equity offering announced May 31. Partners Michael Chambers and David Miller teamed up on multiple securities offerings, including Diamondback Energy’s $750 million public equity offering and Earthstone Energy’s $500 million private offering.

Vinson & Elkins ranked third in securities offerings deal count with 14. V&E Houston partners Thomas Zentner and David Stone advised Targa Resources in its $1.5 billion public offering in March. In fact, H1 2022 was the David Stone show for V&E. He was involved in eight of the firm’s 14 Texas-led CapM transactions.

CDT data shows that Gibson, Dunn & Crutcher ranked fourth in the securities offerings by transaction count with 12. Houston partner Doug Rayburn advised Bank of America Securities in three offerings by Targa Resources that had a combined value of $4.25 billion. No CapM lawyer was busier in H1 2022 than Gibson Dunn’s Hillary Holmes, who worked on eight securities offerings for corporations such as Waste Management, Hess Midstream and Excelerate Energy.

Rounding out the CDT securities offering rankings by deal count is Hunton Andrews Kurth, whose Texas lawyers handled 11 transactions announced during the first six months of this year. Hunton AK partner James Davidson in Houston advised Nashville-based Healthcare Realty Trust in a $1.15 billion exchange.

H1 2022 CapM Deal Value Rankings

The competition for No. 1 in CapM value during the first six months of 2022 was fierce. Bracewell edged out Baker Botts ever so slightly.

The CDT shows that Bracewell lawyers in Texas worked on seven CapM transactions during H1 2022, but the firm ranks No. 1 in value at $9.884 billion.

Heather Brown, a partner in Bracewell’s Houston office, led a $5 billion credit facility for Phillips 66 in June (Hunton Andrews Kurth’s Jeff Butler, Tom Perich, Rachel Morico and Emma Ivory-Ganja counseled administrative agent Mizuho). Another Bracewell partner, Will Anderson, advised Phillips 66 on a $3.5 billion offering exchange in May.

With Bracewell at second, $V&E ranked third at $7.8 billion and Gibson Dunn ranked fourth with $7.4 billion. Latham rounded out the top five at $6.5 billion.