The money continued to roll into private equity firms last year while Austin companies raised the most venture capital since 2000. Claire Poole delves into the data and discusses dealmaking last week among Texas attorneys.

CDT Roundup: 21 Deals, 18 Firms, 199 Lawyers, $14.2B

The average value of M&A deals globally last year reached $389 million, the highest since 2015, and take-privates amounted to $158.3 billion, the highest value since 2007. Claire Poole discusses those and other Mergermarket statistics plus the dealmaking week that was among Texas lawyers.

2019 In Review: The Top 10 Most Important Deals in Texas

The year was dominated by creatively crafted oil and gas deals, given the negative climate around the industry, but also populated with bank combinations and sell-offs of much-loved state brands.

CDT Roundup: 22 Deals, 11 Firms, 119 Lawyers, $6.4B

Globally, 2019 came in as the fourth highest dealmaking year ever, thanks to U.S. buyers, but a slight slowdown in deal value and count over 2018 could portend a different-looking 2020.

‘A Herculean Effort’

Despite the malaise in the oilfield services sector, which has put the kibosh on M&A, boutique investment bank PPHB is still managing to eke out deals. Co-founder Joe Hoepfl talked with The Texas Lawbook about the state of the market and his outlook for next year.

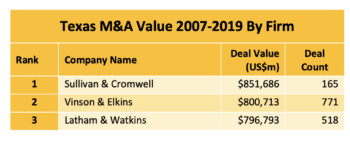

Elite National Corporate Firms Dominate Big Dollar M&A in Texas

There have been 11,013 M&A transactions in Texas during the past 13 years with a combined value of $3.4 trillion. Mergermarket and The Texas Lawbook examined which law firms did most of the biggest deals. Only five of the top 30 firms are based in Texas. Four of the top 10 firms do not have an office in the state.

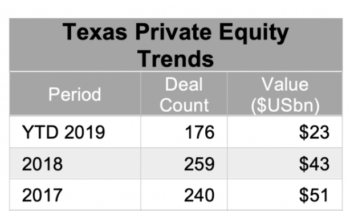

Texas PE Deals are Down and O&G is the Culprit

Private equity investment is down this year in Texas, and oil and gas have been particularly affected, according to exclusive data provided to The Texas Lawbook by Mergermarket. How low? Claire Poole has an analysis.

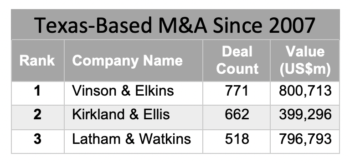

Thirteen Years of Texas M&A: Three Law Firms, 2,000 Deals, $2 Trillion

Lawyers at Kirkland, Latham and V&E say they see each other across the table in the biggest M&A deals in the Lone Star State. New Mergermarket data shows the dominance of the trio of law firms in Texas dealmaking is far from a new trend. The numbers are staggering. To be sure, other corporate law firms operating in Texas have done their fair share of dealmaking. The Texas Lawbook looks back at more than a dozen years of M&A and the law firms doing the work.

Mergermarket: Kirkland Sets Texas M&A Record for Second Straight Year

Kirkland & Ellis is having back-to-back record years for representing businesses and private equity firms doing deals in Texas. Three law firms – Kirkland, V&E and Latham & Watkins – hold the top 18 spots for having advised the most buyers, sellers and investment banks in M&A transactions in a single year. The Texas Lawbook has the details.

Q&A in the PE Space: Mike McGill of MHT Partners

Mike McGill co-founded MHT Partners in Dallas in the first half of 2001. The timing wasn’t great. But McGill and MHT have endured, and Claire Poole talked to him about the growing influence of PE, what it takes to survive and what to expect after 2019.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 34

- Go to page 35

- Go to page 36

- Go to page 37

- Go to page 38

- Interim pages omitted …

- Go to page 47

- Go to Next Page »