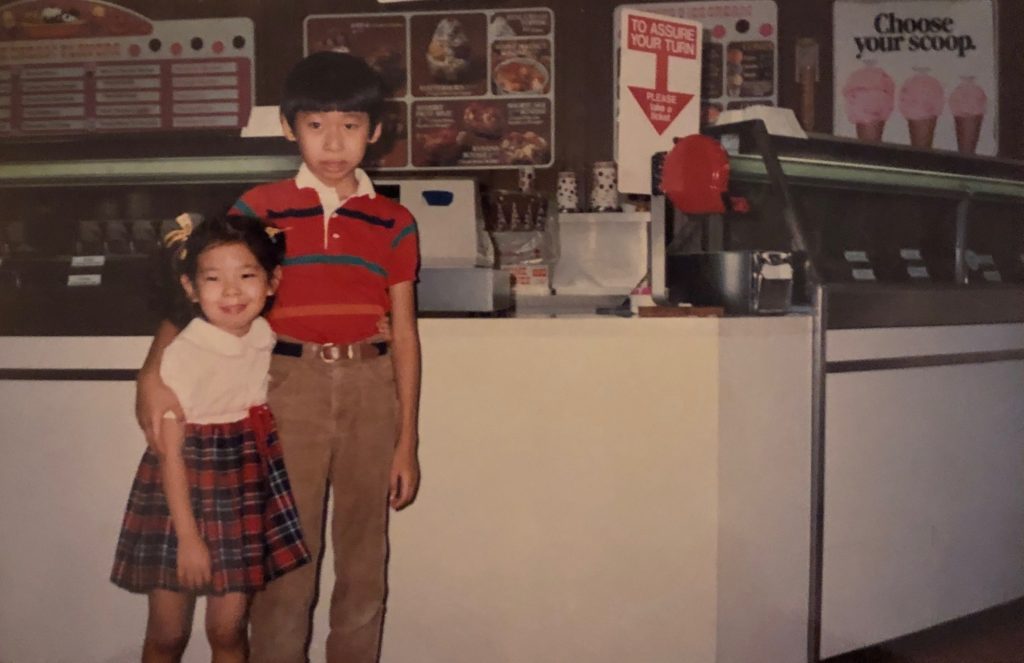

Lisa Wang worked in her parent’s Baskin-Robbins ice cream shops in The Woodlands every day after school when she was a teen.

“I can probably beat anyone in naming ice cream flavors, and I can make great smoothies at home on a whim,” says Wang, who is now director of corporate and securities law at TechnipFMC. “I loved scooping ice cream, writing messages on ice cream cakes, and I was freakin’ fast.”

The hours after school serving ice cream are also a primary reason Wang became a lawyer.

“I cannot tell you how many times customers would come in with empty containers complaining that ‘the ice cream was rotten’ and requesting full refund,” she said. “This is unreasonable to most lay people, but to me, it was worse because it was my parents’ livelihood. I was watching them raise me and my brother one scoop at a time.

“It was preposterous to me that people had the audacity to take advantage of them,” she said.

Wang’s parents told her, however, that “the customer is always right” and to compromise.

“That doesn’t mean I thought it was just and fair,” she said.

Wang, who is now 38 and a mother of three, played a critical role in the incredibly complex $13 billion merger of Houston-based FMC Technologies and Technip of Paris in 2017. She guided the newly formed company through a $460 million debt offering in 2018. And last month, she led an urgent but delicate effort to obtain shareholders approval for a highly sensitive but important matter.

Widely viewed as one of the brightest young stars in the Texas corporate legal world, Wang leads all governance, corporate compliance and regulatory matters for the company, which had $12.5 billion in revenues in 2018 and a market cap of $10 billion.

TechnipFMC, an oil and gas design, engineering and construction company with 37,000 employees in 47 countries, is a United Kingdom-based corporation with co-headquarters in Houston and Paris that is traded on two separate stock exchanges – the New York Stock Exchange and Euronext Paris.

“Lisa manages a complex matrix of corporate governance and regulatory regimes from France, the UK, the [European Union] and the U.S.,” says Latham & Watkins partner Ryan Maierson, who has worked with Wang for more than a dozen years.

“I don’t know how she does it all and does it all so extraordinary well and still takes care of three children,” Maierson said. “Lisa is a prolific texter and responds almost immediately to text messages around the clock. I don’t think she ever sleeps.”

Maierson and TechnipFMC General Counsel Dianne Ralston said that there are very few lawyers in the world who have the experience and knowledge of corporate securities laws and regulatory mandates from multiple jurisdictions as Wang.

“We are one of one in the type of company, and Lisa has navigated us through multiple and sometimes conflicting legal and regulatory requirements,” Ralston said. “Lisa’s work ethic is unparalleled. Her research is impressively thorough.”

Wang has an active to-do list with 141 matters pending, and she has a “ginormous marker board” on her office wall with post-it notes all over.

“I’m known as the person who remembers everything,” she said.

Wang, who speaks fluent Mandarin, was born in Taipei, Taiwan, in 1980 to parents who were professors. When she was one, the family moved to Pasadena, Texas. Her brother was four years old and started kindergarten knowing only two English words: yes and no. She said it was only in recent years that she realized the hardships that her parents faced when they moved to the U.S.

“They had to start over in Houston. There was really no easy way for them to continue their career here, so they opened an ice cream store,” she said. “They went from ‘brain labor,’ as I like to call it, to pure manual labor. Arm soreness, arthritis from going in and out of walk-in freezers, enduring the retail life, etc. They went from a comfortable, salaried life to a life where they counted scoops of ice cream to raise my brother and me.”

The long hours and hard work paid off, as Wang’s parents eventually owned seven Baskin-Robbins shops in the Houston area. As a girl, she would file paperwork for her parents and the business. Later, she served customers in the stores. As a teenager, she ghost-authored legal letters for her parents to the company’s landlord, the corporate franchisor and complaining customers.

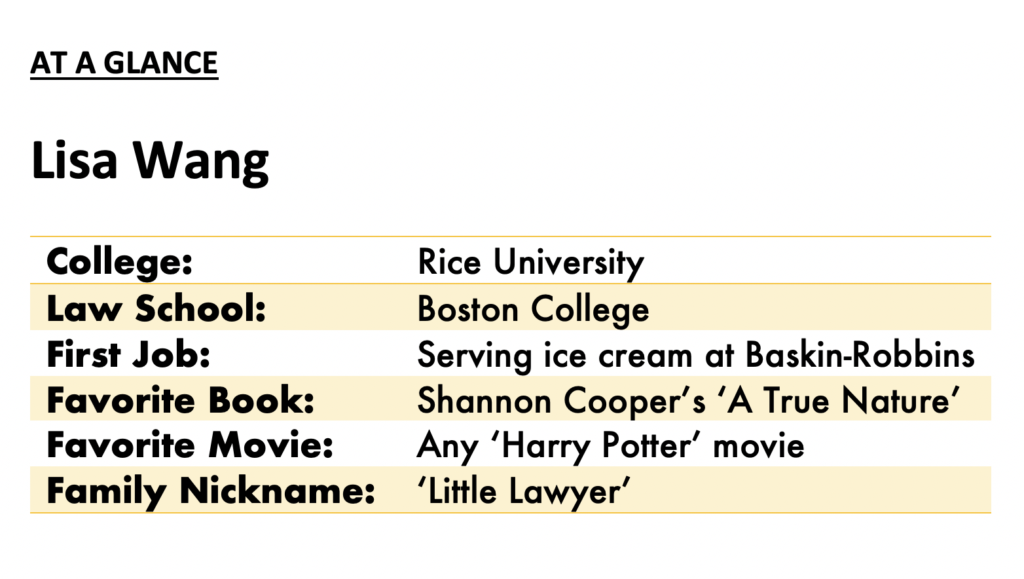

“It was my way of defending my hardworking parents, and it felt good to be able to take a reasoned approach to many matters,” she said. “I went from my parents calling me their ‘little secretary’ to being called their ‘little lawyer.’

“Growing up Asian, I know I was supposed to become a doctor, but my parents thought I should be a lawyer,” she said. “I had a way of convincing people.”

American television also had an influence.

“I grew up watching The People’s Court and people arguing,” she said. “We would watch and I would think, ‘That is the stupidest argument.’ That’s what I thought lawyers did – argue.”

Wang went to Rice University on scholarships and then Boston College Law School. She did summer clerkships at Jones Walker and Andrews Kurth after her first year of law school and then Baker Botts and Bracewell after her second year.

“I ended up starting my career at Baker Botts and L-O-V-E-D every moment of it,” she said, spelling out the word. “I have made some great mentors and friends there. One of the associates I worked for, Ryan Maierson, has now ended up as our lead outside corporate counsel. Small world.”

Maierson, who worked with Wang on dozens of mergers, acquisitions and securities offerings, said she stood out from other young associates from the start.

“The transactional practice doesn’t click for everyone, but it did for Lisa. She got it right away,” he said. “Lisa could see the big picture sooner than many others.”

Wang said transactional work was a better fit for her personality.

“I don’t like a zero-sum game, which is most litigation,” she said. “I’m a people pleaser. In transactional work, we may argue over some terms or key issues, but everyone is working toward one goal and closing the deal.”

Wang was a lawyer at Baker Botts from 2005 to 2010. Nine years ago, she decided to take her legal practice in-house and joined the corporate legal department at TransCanada Corporation, an energy infrastructure company.

What led her to go in-house?

“The untrue belief that I would have better work-life balance and hours,” she said. “In hindsight, I have kept my law firm work ethic, but I think it has actually benefitted me more than I know. You really have to build your ‘brand’ inside a corporation and your work ethic, reliability, good lawyering/professionalism all goes into your brand.

“Ultimately, I think the in-house life and working with the same clients on a daily basis is more fitting for my personality,” she said. “And, frankly, I really disliked keeping track of my day in six minute increments.”

In 2011, she moved to FMC Technologies.

Wang said that the “single most enlightening experience” at the company was the merger of FMC Technologies and Technip, which closed in January 2017.

“Our corporate team at FMC was just three of us, so I managed diligence, benefits, antitrust filings, combination agreements and disclosure documents,” she said. “It probably gave me the broadest overview of both companies – and now, the merged company – better than any annual report or website could do.

“In the process, I learned the EU disclosure regime, which is similar to the U.S. SEC disclosure regime,” she said.

As a result, lawyers say that Wang became one of a handful of corporate attorneys in the world who can speak intelligently about European and U.S. disclosure obligations and rules.

FMC executives brought Wang and Ralston into the negotiations early.

“We were told if we spoke a word about it, we would be fired,” she said. “There were a lot of negotiations held outside of Houston because we were afraid the news media would find out. The extensive due diligence in such a short period was intense.

“We would start at 6 or 7 a.m. and go until 2 or 3 a.m., and then start over again,” she said. “This went on for months, but it also was an extraordinary experience.”

Wang said that TechnipFMC being a dual-listed company carries with it “a lot of ancillary considerations.”

“The two regimes don’t necessarily match, so it’s finding ways to understand the regulations and take a parallel approach to disclosure for our global shareholder base,” she said. “It’s challenging and a LOT of learning has taken place,” she adds, emphasizing lot. “There are new issues almost every day.”

Wang has a creative side. On the night before the FMC and Technip merger closed in January 2017, she took a few minutes to pen a poem.

Twas the night before the closing,

The EU prospectus was filed.

RSUs were all vested,

And no number unreconciled.

The lawyers and accountants were all snug in their beds,

As visions of shares outstanding danced in their heads.

With everything done, we say ‘That’s a wrap.’

And the team settles in for a long, overdue nap.

But let us step back,

And recall the beginning,

That it’s about innovation,

And not just about winning.

A year of collaboration and back-to-back calls,

And numerous flights to Charles de Gaulle.

We endured sleepless nights and hot offices in DC.

But as of tomorrow we’ll be TechnipFMC.”

Editor’s Note: This is the first in a series of a dozen articles profiling young corporate in-house counsel in Texas. The series is made possible thanks to the sponsorship of Latham & Watkins. However, Latham played no role and had no influence in the reporting, writing or publishing of the article. The Texas Lawbook retains absolute editorial control of the articles in the series. The Lawbook thanks Latham for its sponsorship of this important series.