The past decade has been a tough one for Texas’ home-grown corporate law firms. Their numbers have dwindled. They’ve lost market share and top talent to firms moving into Texas from out-of-state.

Yet, some characteristics seem to endure – at least among the Texas-based firms still here.

They’re optimistic.

They’re confident.

They’re ready to fight for greater market share – even if the odds are against them.

In the face of the Covid-19 pandemic, recession and increased competition from out-of-state law operations, Texas-based firms more than survived the past 18 months. They thrived – with a few high-profile exceptions.

Ten of the 18 Texas-based law firms in The Texas Lawbook 50, our annual survey of the state’s corporate law finances, reported record Texas revenues in 2020. Even more achieved record profits. In 2021, they’re busier than ever, working for clients on big-dollar matters, including mergers and acquisitions, project financing and high-stakes litigation.

“The first quarter of this year was like last year – very busy – and then in April [this year], all hell broke loose, and it’s just been insane,” said Bracewell partner Alan Rafte, who leads the Houston firm’s business transactional and regulatory practices. “We are struggling to keep up and it looks like it is going to keep going into 2022.”

Over the past three weeks, The Lawbook surveyed the 18 Texas-based firms about revenues and hiring in the first six months of 2021 and their expectations for the rest of the year. Their optimism was palpable: All 15 responding firms told us they were working more hours, hiring more attorneys and raking in more money than were a year ago.

They all expect the trends to continue, projecting further gains in revenues and headcounts in the year’s last six months.

With the revenue outlook favorable and vaccines reducing Covid-19 risks, nearly all of the Texas-based firms have been aggressive in hiring lawyers, adding dozens of lateral hires in the first half of 2021. In September and October, the 15 firms responding to the survey anticipate the arrival of more than 250 first-year associates.

“When the pandemic hit, we were like every other law firm – we worried about how bad it would get,” said Munsch Hardt CEO Phil Appenzeller. “It turned out, 2020 was a very good year for us financially. A record year. And so far this year, we are up 15% in revenues over last year.”

Texas Firms’ Finances in 2020

Phil Appenzeller

The Covid-19 pandemic and recession made 2020 a difficult year for many businesses, but Texas corporate law managed to grow in the inhospitable environment.

The Lawbook 50, published in May, showed corporate firms increased their Texas revenues 4% and added a few dozen jobs for lawyers. They overcame the pandemic’s threat by combining grit and the technology for remote work to meet clients’ increased demand for legal expertise.

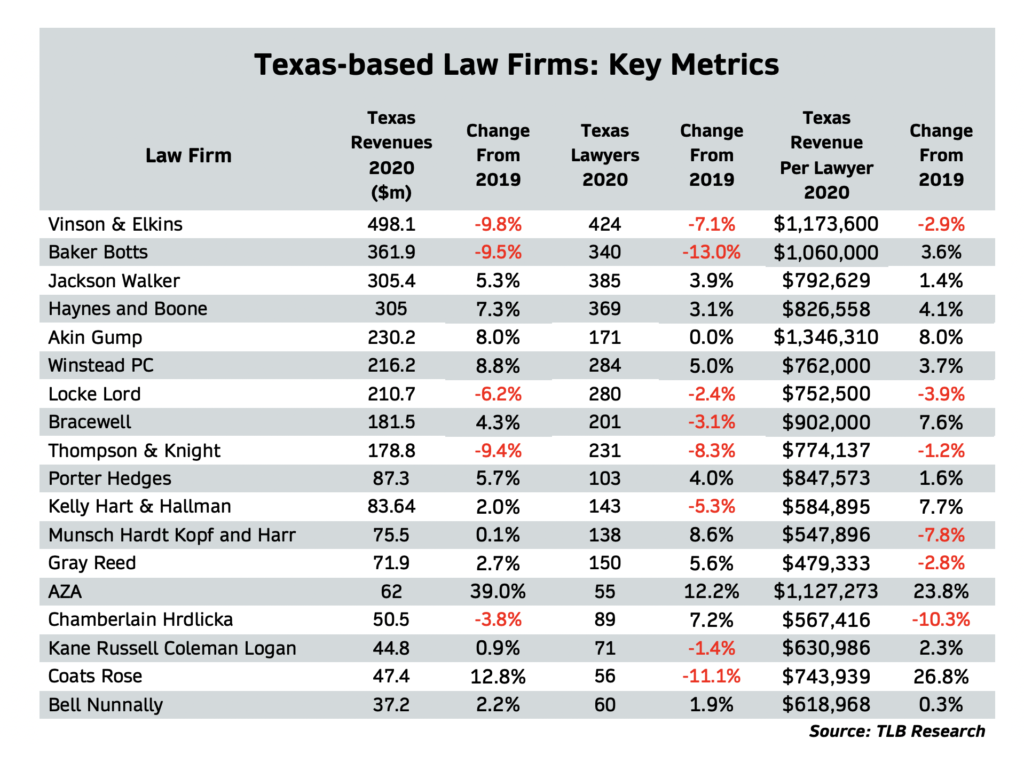

As a group, the 18 Texas-based firms were laggards in 2020. Texas Lawbook data show they generated slightly more than $3 billion in total Texas revenues, down 1.4% from the previous year (see chart 1). These 18 firms employed 3,551 lawyers in Texas, a decline of 1.4%.

Chart 1

Four large corporate law firms with storied names in the state pulled down the overall numbers for the 18. Taken together, Baker Botts, Vinson & Elkins, Thompson & Knight and Locke Lord saw revenues decline by $150 million in 2020. Their lawyer ranks shrank by 111.

The pandemic was partly responsible. Baker Botts and V&E both delayed their first-year associates’ start dates from September and October until January. Bringing them on board in 2020 would have added more than 80 lawyers to the firms’ headcounts, with whatever revenues they produced.

The four firms were noteworthy outliers in a generally upbeat year for corporate law in Texas.

The rest of the Lawbook 50 Texas-based firms increased revenues in the pandemic year — with the lone exception of Chamberlain Hrdlicka. As a group, these 14 firms eclipsed the Lawbook 50 average, posting combined increases of 6% in revenues and 2% in headcount.

Among the big names posting solid revenue gains in 2020 – Winstead at 8.8%, Akin Gump at 8%, Haynes and Boone at 7.3% and Jackson Walker at 5.3%.

Some of the best news came out of the middle market. Two Houston boutiques reported the highest revenue gains among Texas-based firms in 2020 – Ahmad, Zavitsanos, Anaipakos, Alavi & Mensing (AZA) at 39% and Coats Rose at 13%.

Among the 10 firms with record revenues, Haynes and Boone and AZA beat their previous bests by 7%, followed by Porter Hedges at 6% and Jackson Walker at 5%.

Turning to the biggest legacy firms, profits per partner were up by double digits at Akin Gump, Baker Botts and Haynes and Boone.

Those are all positive results – but the uncomfortable fact is that most Texas-based firms lagged the average revenue gains for national firms with offices in the state. According to Lawbook data published earlier this month, the combined Texas revenues for 40 out-of-state firms increased 8.3%, and their lawyer headcount grew by 4%.

Other tidbits culled from the data on the Texas-based law firms include:

- V&E’s 9.8% revenue decline in Texas in 2020 ended its three-year reign atop The Texas Lawbook 50 revenue ranking.

- With V&E sliding to second place, Chicago-based Kirkland & Ellis became the first out-of-state firm to take the top spot on the strength of a 35.5% jump in Texas revenues.

- Another five firms had gains between 5% and 10%.

- Among the seven firms with extensive out-of-state operations, only three posted higher revenues – Akin Gump, Haynes and Boone and Bracewell.

- Eleven Texas-based firms do all or nearly all of their work within the state. All except the now-merged Thompson & Knight increased revenues in 2020.

- The changes in lawyer headcounts were almost evenly split. Nine firms added lawyers, and eight saw net losses. Akin Gump reported 171 Texas lawyers in both years.

- Adding more than 10 lawyers were Jackson Walker (14), Winstead (14), Haynes and Boone (11) and Munsch Hardt (11).

- Three of the 18 firms had Texas revenue per lawyer above $1,000,000 – Akin Gump at $1,346,310, V&E at $1,173,600 and AZA at $1,127,273. Baker Botts missed by a mere $11,000 per lawyer.

- Revenue per lawyer rose at 11 firms, led by gains of 44% at Coats Rose and 24% at AZA.

- RPL fell at five firms with declining revenues, including Baker Botts (-3%), V&E (-3%) and Thompson & Knight (-1%). Munsch Hardt and Gray Reed increased revenues but added lawyers and saw RPIs decline.

- The weighted-average revenue per lawyer for the 18 Texas-based firms was $849,476, up a scant 0.3% from 2019.

Our accounting of corporate law firms with Texas roots isn’t complete. Some were too small to make The Lawbook 50. A handful of corporate law firms, including Carrington Coleman, Susman Godfrey, McKool Smith and Beck Redden, declined to provide their financial data for 2020. All four almost certainly would have ranked in the top 50.

“We are an extremely successful firm financially,” said Susman Godfrey co-managing partner Neal Manne. “Last year, we were spectacularly profitable.”

Neal Manne

The Continuing Challenge

It’s impossible to separate the Texas-based firms’ finances from the national firms’ growing presence of the state’s corporate law market. Arriving almost like an invading force in the past decade, the non-Texas firms had the financial resources to offer high salaries to corral some of the Texas-based firms’ top lawyers and, with them, some of the biggest clients.

The Texas-based firms’ market share has been shrinking for the better part of a decade. In 2010, nearly nine of 10 firms in a hypothetical Lawbook 50 would have been headquartered in Texas. As recently as 2014, they made up three-quarters of the firms in the first The Lawbook 50 revenue rankings. Six year later their share had fallen to a third.

A few years ago, the Texas firms’ share of state revenues slipped below 50%. Their slice of the pie slipped from 43.7% in 2019 to 41.2% in 2020.

The Texas firms took a while to recognize the challenge, devise plans and act on them. “All Texas-based firms tend to wait too long to think about their strategic options,” said Rob Walters, a Dallas-based partner at Gibson Dunn, a Los Angeles firm.

The Texas-based firms are responding to the challenge by finding strategic niches or by focusing on the lucrative practices that produce more competitive financial results. If all else fails, merger may end up the best or only option – just ask Thompson & Knight. On Aug. 1, its 107-year run as a Texas-based firm was ended by a merger with Miami-based Holland & Knight, one of the out-of-state firms seeking to expand in Texas.

Strategic repositioning can be a slow and somewhat painful process, but the Texas-based firms expect to emerge better positioned for the challenge. In interviews, the leaders of Baker Botts and V&E told The Lawbook they considered 2020 a successful year financially, despite the declining revenues and lawyer ranks. Both posted solid gains in profits per partner, a closely watched metric in retaining and recruiting top talent.

At mid-2021, Baker Botts and V&E are already bouncing back. In the recent Lawbook survey, both reported revenues were up in the first half of the year, with expectations upbeat for the second half. Haynes and Boone and Locke Lord also say 2021 revenues are exceeding last year’s numbers.

In 2021, the deep-pocketed out-of-state firms continue to open offices in Texas and snag the state’s legal talent. Los Angeles-based O’Melveny & Meyers set up outposts in Austin and Dallas earlier this year. So, Texas-based firms should expect competition to intensify.

One reason for Texas-based firms’ confidence and optimism may be what attracted the newcomers to Texas over the past decade: Corporate law in Texas remains on a strong growth path.

“Simply because there are new market entrants doesn’t mean the legacy firms are going to be disadvantaged,” said Michael McKenney, managing director of Citi Private Banking’s Law Firm group. “They should be able to capture a share of this growth.”

Winstead Chairman David Dawson said Texas firms must “take advantage of the opportunities that are in the market.”

After Winter Storm Uri hit Texas in February, for example, Winstead quickly assembled a team of lawyers who are now representing ERCOT as a defendant in more than 80 cases.

“2021 is looking fantastic,” Dawson said. “We’ve added 38 attorneys for eight different practice areas, and the demand is absolutely there to keep them all busy.

“Some of these lawyers come from smaller law firms and some come from Am Law 100 firms, and they want to be entrepreneurial and some who want a shorter path to be a shareholder.”

Dave Dawson

United by place of origin, corporate law’s 18 Texas-based firms are a mixed lot. Some are big and diverse enough to warrant a spot in the American Law 100; most others are smaller and more specialized.

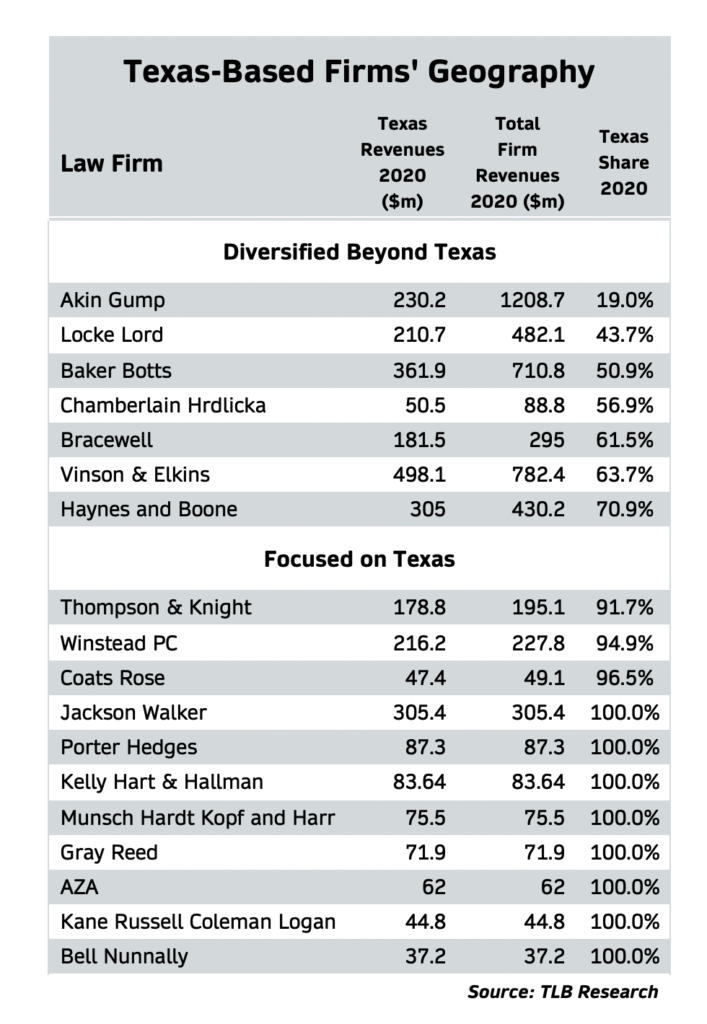

A clear division emerges from viewing the data through a geographic filter. In 2020, seven of the 18 firms generated significant revenues outside the state.

Locke Lord and Baker Botts, for example, did more than half their business someplace else (see chart 2). For Bracewell, V&E and Haynes and Boone, it was roughly a third. Akin Gump, founded in Dallas but with a significant portion of its operational leadership in Washington, D.C., earned 81% of all firm revenues outside Texas in 2020.

Taken together, these six firms have 75 offices in other states and countries.

Chart 2

By contrast, eight of the 18 Texas-based firms generated 100% of their revenues in the state, including Jackson Walker, ranked seventh on the Lawbook 50. Coats Rose approached 97%. Winstead, ranked No. 10 on the Lawbook 50, was at 95%.

In share of out-of-state revenues, Chamberlain Hrdlicka surpasses Bracewell, V&E and Haynes and Boone; however, the firm doesn’t come close to them in size. Setting it aside leaves what we call the Gang of Six, which features the largest Texas legacy firms with the widest geographic footprints.

Thompson & Knight earns 92% of its revenues in Texas. Its recent merger with Florida’s Holland & Knight ended a 107-year run as a Texas-based firm. The remaining firms form a Gang of 10 – those doing nearly all their work in Texas.

On Monday, The Texas Lawbook will take a closer look at the Gang of Six. They’ve had varied success playing in the same league as the national firms that roiled the Texas market.

Next Thursday, we will focus on the Gang of 10. For the most part, they’re not among the financial titans of corporate law but they’ve found a niche in the Texas legal market and managed steady growth.