Since 2007, mergers with out-of-state firms have swallowed up one-time stalwarts of Texas corporate law – Fulbright & Jaworski, Hughes & Luce, Andrews Kurth, Gardere Wynne Sewell, Strasburger & Price. Thompson & Knight was the most recent to go, merging with Florida-based Holland & Knight.

With the Aug. 1 merger, the number of big Texas legacy firms with 200 or more attorneys dwindled to just eight. Two of those full-service Texas firms, Jackson Walker and Winstead, operate almost entirely within the state lines.

That leaves Vinson & Elkins, Baker Botts, Haynes and Boone, Akin Gump, Locke Lord and Bracewell. The Texas Lawbook dubbed these firms the “Gang of Six,” and they play in U.S. corporate law’s big leagues. All but Bracewell made American Lawyer’s most recent Top 100 list of the nation’s largest law firms.

Size isn’t the Gang of Six’s only calling card. They also stand apart on geographical reach, with a combined 75 offices in other states and countries. Akin Gump, which opened in Dallas 75 years ago and created a co-headquarters in Washington, D.C. in 1971, earned 81% of all firm revenues outside Texas in 2020.

Locke Lord and Baker Botts did more than half their business someplace else. For Bracewell, V&E and Haynes and Boone, it was roughly a third.

(From Left) Mark Kelly and Keith Fullenweider of Vinson & Elkins

Among the other Texas-based firms in the Lawbook 50, eight generated all their revenues in Texas, with three others above 92%.

For the Gang of Six, the big leagues have never been tougher, even at home. Over the past decade, the arrival of dozens of big, wealthy out-of-state firms meant greater competition in Texas corporate law. The newcomers have used their considerable financial clout to snag some of the state’s best lawyers and top clients – both once the domain of the big Texas firms.

As out-of-state firms expanded, Texas-based firms lost market share. The home-grown firms’ slice of state’s corporate law pie slipped below 50% a few years ago. And their market share has continued to fall, going from 43.7% in 2019 to 41.2% in 2020. The widening gap’s dollar value – $175 million.

Non-Texas firms now dominate The Texas Lawbook 50, our annual review of corporate law finances in the state. They claimed two-thirds of the spots in 2020, up from a quarter in 2014, and Chicago-founded Kirkland & Ellis this year became the first out-of-state firm to rank No. 1 in Texas corporate law revenues.

Non-Texas firms may have gobbled up market share, but the state’s remaining legacy firms still carry considerable weight in Texas corporate law.

The Gang of Six firms all ranked among the top 11 in both revenues and head counts on the latest Lawbook 50. In 2020, the Gang combined to employ 1,786 Texas lawyers and generated Texas revenue of almost $1.8 billion – just six firms, accounting for a quarter of the Lawbook 50 totals.

2020: Some Ups, Some Downs

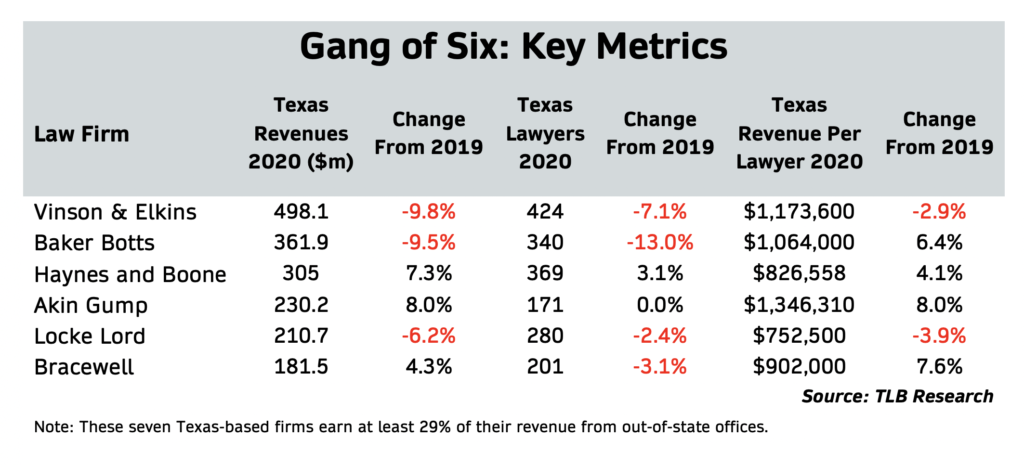

Chart 1

The Gang of Six split on key Lawbook 50 metrics in 2020 (see chart 1). Revenues declined more than 9% at both V&E and Baker Botts and more than 6% at Locke Lord. The three others grew revenues – Akin Gump by 8%, Haynes and Boone by over 7% and Bracewell by more than 4%. Taken together, the six firms saw revenues fall more than $60 million, or just over 3%.

To put the year in perspective, overall Lawbook 50 revenues increased 4%. The 18 Texas-based firms saw a 1.4% decline – only because of the Gang of Six’s weaker results. Set them aside, and the remaining Texas-headquartered firms posted a modest 2% revenue gain.

Turning to Texas lawyer staffing, the Gang of Six tilted toward retrenchment in 2020. Baker Botts employed 51 fewer lawyers (-13%) in 2020 than in 2019. V&E was down 33 (-7%). The pandemic forced both firms to push the arrival of first-year associates into this year, so the declining headcounts in 2020 didn’t necessarily reflect firm performance.

Headcounts fell by seven lawyers at both Locke Lord and Bracewell, and Akin Gump reported no change. That leaves Haynes and Boone – the only Gang of Six firm to add lawyers in 2020, with a gain of just 11 (3%).

The mixed results on revenues and headcounts impact what many analysts consider law firm finance’s best indicator – revenue per lawyer. Akin Gump had an 8% gain. Baker Botts’ RPL increased more than 6% in the face of falling revenues.

V&E and Locke Lord finished the year with a trifecta – declines in revenues, headcounts and revenue per lawyer. Despite a 3% decline, V&E’s RPL remained the Gang of Six’s second highest at nearly $1.2 million, trailing Akin Gump’s $1.3 million. Baker Botts also topped $1 million.

The three other Gang of Six firms had RPLs below $1 million. The lowest were $826,558 at Haynes and Boone (up 4%) and $752,500 at Locke Lord (down 4%).

The Gang of Six had a weighted-average Texas RPL of $1 million – nearly $300,000 above the rest of the Texas-based firms.

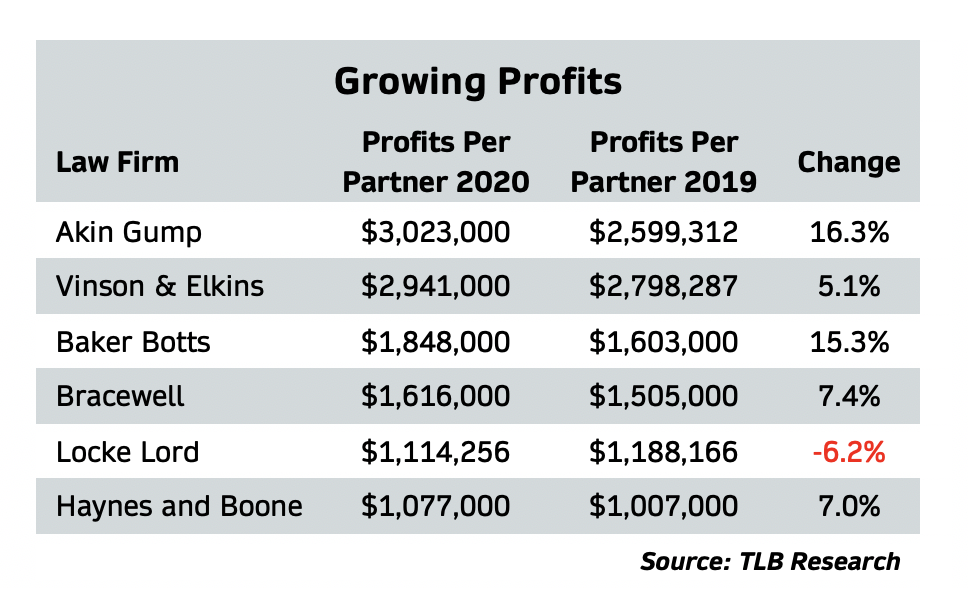

For the Gang of Six, the most encouraging metric for 2020 was profits per equity partner, with all topping $1 million (see chart 2). Two firms posted double-digit increases across the firms’ operations – Akin Gump at 16% and Baker Botts 15%. Bracewell and Haynes and Boone were up 7% and V&E 5%. Only Locke Lord saw profits per partner fall.

Chart 2

Better Days in 2021

The books are closed on 2020, and firms are focused on 2021 and beyond. As the business world edges it way back toward normalcy, law firms operating in the state – the big ones as well as the smaller ones – are telling The Lawbook that 2021 shaping up as a banner year.

Gang of Six firms appear on course to prove that any negative numbers from 2020 were an aberration. In a recent Lawbook survey, all six were among the 15 Texas-based firms saying first-half revenues were higher this year than last; all of them projected higher revenues in the second half of the year. They are all hiring lawyers, including laterals in the year’s first six months. About 200 first-year associates coming on board in the next few months.

V&E doesn’t appear in danger or repeating last year’s declines in headcount and revenue. Firm chair Mark Kelly said 2021 revenues and productivity were more than 15% higher than last year – and the firm just finished its “best July ever.”

“I remain very optimistic that the growth will continue through the end of this year and into next year,” Kelly said. “We’ve really tried to grow our practices outside of Texas with good success.”

According to Kelly, productivity increased because “existing clients are more active” and the firm’s “new lateral hires have been successful in bringing in new clients.” Twenty of V&E’s 73 firmwide first-year hires are outside Texas.

Scott Barnard, managing partner of Akin Gump’s Dallas office, said the firm has increased its Texas headcount 9% in 2021, and it’s adding another 13 first-year associates in September and October.

“Work has been incredibly strong,” Barnard said. “There’s not enough lawyers to meet the legal demand of our clients. Keeping up with the demand and hiring enough lawyers has been extremely challenging.”

Bracewell partner Alan Rafte said the Houston-based firm’s corporate transactional and litigation practices have been busier this year than they were during the second half of last year, which set records in demand, productivity and revenues.

“The second half of this year is shaping up to be even busier,” Rafte said. “Upstream and midstream are busy. On carbon capture, we have 10 live projects underway right now. Public finance has been really strong – we did an offshore deep water crude oil financing just last month. In the power world, we’ve seen a lot of activity in solar and wind, too.”

“Our difficulty is our people are too stretched out,” Rafte said. “We have 25 new hires coming in October, but we need more. If you know any experienced lawyers wanting a job, have them call me.”

Home-Turf Troubles

The Gang of Six firms earn considerable revenues outside Texas – more than $2.1 billion in 2020, up more than 6% from the previous year. That’s close to the national revenue gain calculated by Michael McKenney, managing director of Citi Private Bank Law Group.

This suggests the big Texas-based company held their own against competition in markets across the country and around the world. For the Gang of Six as a whole, the troubles were on their home turf, where they’re battling Kirkland, Gibson Dunn, Sidley Austin, Latham & Watkins and other out-of-state firms for Texas market share.

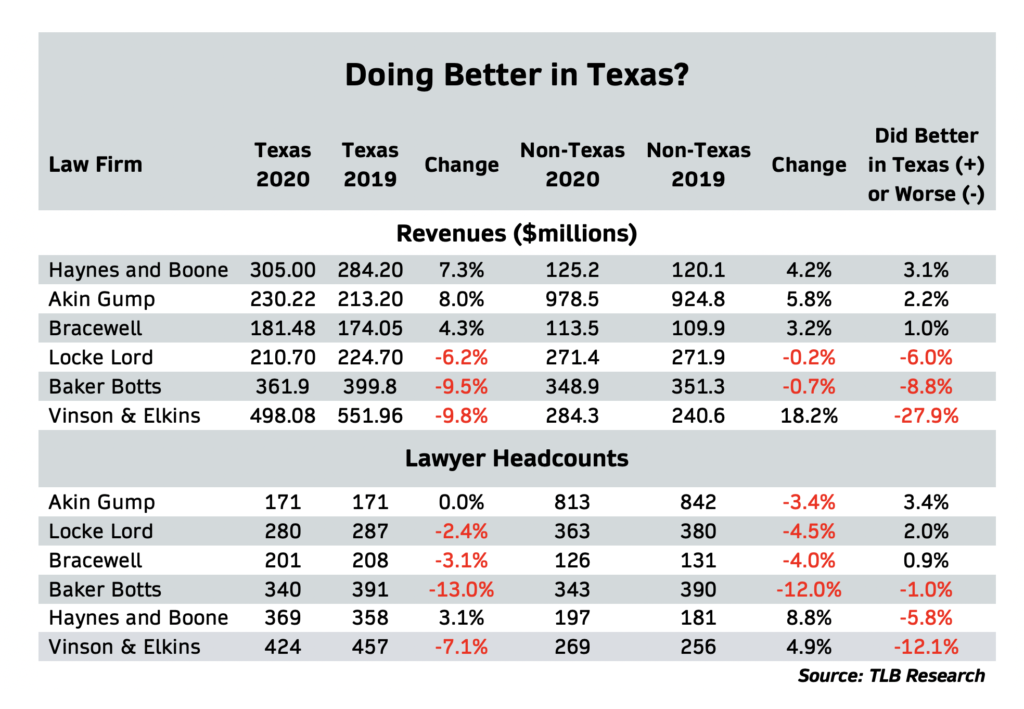

Chart 3

How did the Gang of Six’s Texas operations compare to the firms’ overall performance? Three firms did better in Texas; for the other three, it was the opposite.

At V&E, Texas was solely responsible for declining revenues in 2020. Its out-of-state billings increased $45 million (18%), but its Texas billings fell by $54 million (9.8%) (see chart 3, top). Baker Botts and Locke Lord saw revenues fall both inside and outside the state – but the declines for both were larger in Texas.

Akin Gump, Haynes and Boone and Bracewell looked quite different. They increased revenue more in their Texas offices than from their out-of-state outposts

Turning to headcounts, the Gang of Six taken together had a 4% decline in Texas lawyer jobs, a little larger than the 3% for their out-of-state offices. V&E added lawyers outside Texas (4.9%) while losing lawyers in its state offices (-7.1%) (see chart 3, bottom).

V&E’s 2020 class of 57 new lawyers didn’t arrive until January 2021, significantly impacting the firm’s Lawbook 50 headcount numbers. Bracewell also delayed the start date for more than 20 of its first-year associates until January 2021.

At Locke Lord, lawyer losses titled toward out-of-state offices. At Baker Botts and Bracewell, they were fairly close in Texas and elsewhere. All of Akin Gump’s 29 job losses were out-of-state. Haynes and Boone added more lawyers out-of-state than in Texas.

“This is part of our long-term strategic plan,” said Haynes and Boone managing partner Taylor Wilson. “We added 46 attorneys during the pandemic last year, including 11 lawyers in our San Francisco office. We are not taking our foot off the gas because of the pandemic.”

Looking Back in Time

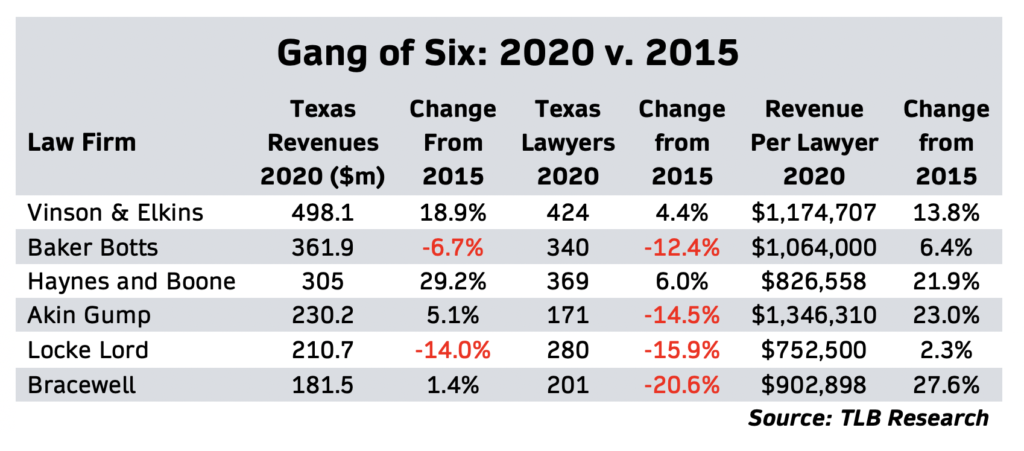

Chart 4

Changes from one year to another don’t provide a full picture of how the Gang of Six has fared in the era of increasing competition from aggressive, deep-pocketed out-of-state firms. Looking back to 2015, four firms increased revenues, led by Haynes and Boone at 29% – a sign the firm maintains its competitive spark (see chart 4).

V&E was up a solid 19%, with last year being the firm’s only down year for revenues. Akin Gump and Bracewell settled for single-digit growth.

The Lawbook data reveal that revenues fell 14% over those six years at Locke Lord and nearly 7% at Baker Botts.

Only two firms employed more lawyers in 2020 than in 2013 – Haynes and Boone, up 21, and V&E, up 18. The four other firms shed a total of 182 lawyers, with net losses of more than 50 each at Bracewell and Locke Lord.

On revenue per lawyer, the entire Gang of Six improved since 2015%. Their collective RPL was up a weighted average of almost 15%, with Bracewell (28%), Akin Gump (23%) and Haynes and Boone (22%) taking high honors.

A War for Talent

For firms in the big leagues of U.S. corporate law, financial success starts rest largely on hiring top-flight talent. Clients want the best lawyers to handle their most important legal matters, and they’re willing to pay the highest hourly rates to get it.

And what’s key to getting the best lawyers? Money.

Higher pay attracts the lawyers needed to drive up revenues and profits; higher revenues and profits provide the financial wherewithal to attract the top lawyers. At the top of Texas corporate law, Texas-based and out-of-state firms have launched a bidding war for talent that creates an upward spiral of increasing revenues, fatter firm profits and higher lawyer salaries.

“It is a full-time job just to do two things – attract talent and retain talent,” said Tom Melsheimer, managing partner at Winston & Strawn, a Chicago firm that opened offices in Houston in 2011 and Dallas in 2017.

The Gang of Six firms stand well above other Texas firms in the key financial metrics. On revenue per lawyer, for example, the six legacy firms have a weighted average of just above $1 million, almost 40% higher than the rest of the Texas-based firms.

Lawbook data indicate 40 non-Texas firms had a weighted-average Texas RPL of $1,036,016 in 2020, only $50,000 above the Gang of Six. However, the national firms’ heavy hitters are what’s vexing the remaining Texas legacy firms. Seven of them did better than Akin Gump, with Simpson Thacher and Kirkland above $1.8 million and Gibson Dunn at $1.6 million.

Akin Gump, the Gang of Six leader in profit per partner at more than $3 million, ranked 27th on the American Lawyer 100 for 2020, well behind a half-dozen national firms prospering in Texas. Profits per partner were nearly $6.2 million at Kirkland & Ellis, and Simpson Thacher, Latham & Watkins, Weil Gotshal and Gibson Dunn all topped Akin Gump’s profits by at least $1 million.

In today’s more competitive Texas corporate law market, the full-service model doesn’t generate top-tier revenue per lawyer and profits per partner – the metrics that matter most for firms striving to attract talent and compete in the big leagues of corporate law.

“The global firms are going to continue to win the war for talent,” said Tracie Renfroe, managing partner of Atlanta-based King & Spalding’s Houston office. “It’s going to be more difficult for the local firms to compete.”

Being big, with attendant swagger, was an advantage back in the Texas legacy firms’ heyday. At the start of this century, Baker Botts, V&E and Fulbright & Jaworski comprised the state’s Big Three, offering clients a full range of practices, the dynamic and the mundane.

By contrast, the most disruptive out-of-state firms’ formula for success in Texas involves concentrating on the most profitable practices, such as bankruptcy and restructuring and private equity M&A, then recruiting the best Texas lawyers and charging high hourly rates for their services.

“Most of the firms that came to Texas didn’t come in and set up diversified shops,” said Robert Rabalais, partner in charge of Simpson Thacher’s Houston office. “All those legacy practices dragged those (Texas) firms down.”

Series at a glance…

Last week, Part 1 of the series looked at how 18 Texas-based firms fared on key financial metrics in 2020, plus a mid-year survey on expectations on headcounts and revenues in 2021.

This installment, Part 2 focused on the Gang of Six big Texas-based firms trying to compete against the nation’s top firms in Texas and elsewhere.

Coming Next, Part 3 of the series will survey the Gang of 10 Texas-based firms that aren’t among the financial titans of corporate law. They’ve found a niche in the Texas legal market and have managed steady growth.

Still to come, Part 4 will reveal an ironic twist the Lawbook uncovered when trying to determine whether Dallas or Houston can claim supremacy as the capital of Texas corporate law.