For the fifth consecutive year, more companies filed for bankruptcy in Texas last year than any other state in the U.S. But unlike previous years, Delaware made it close in 2024.

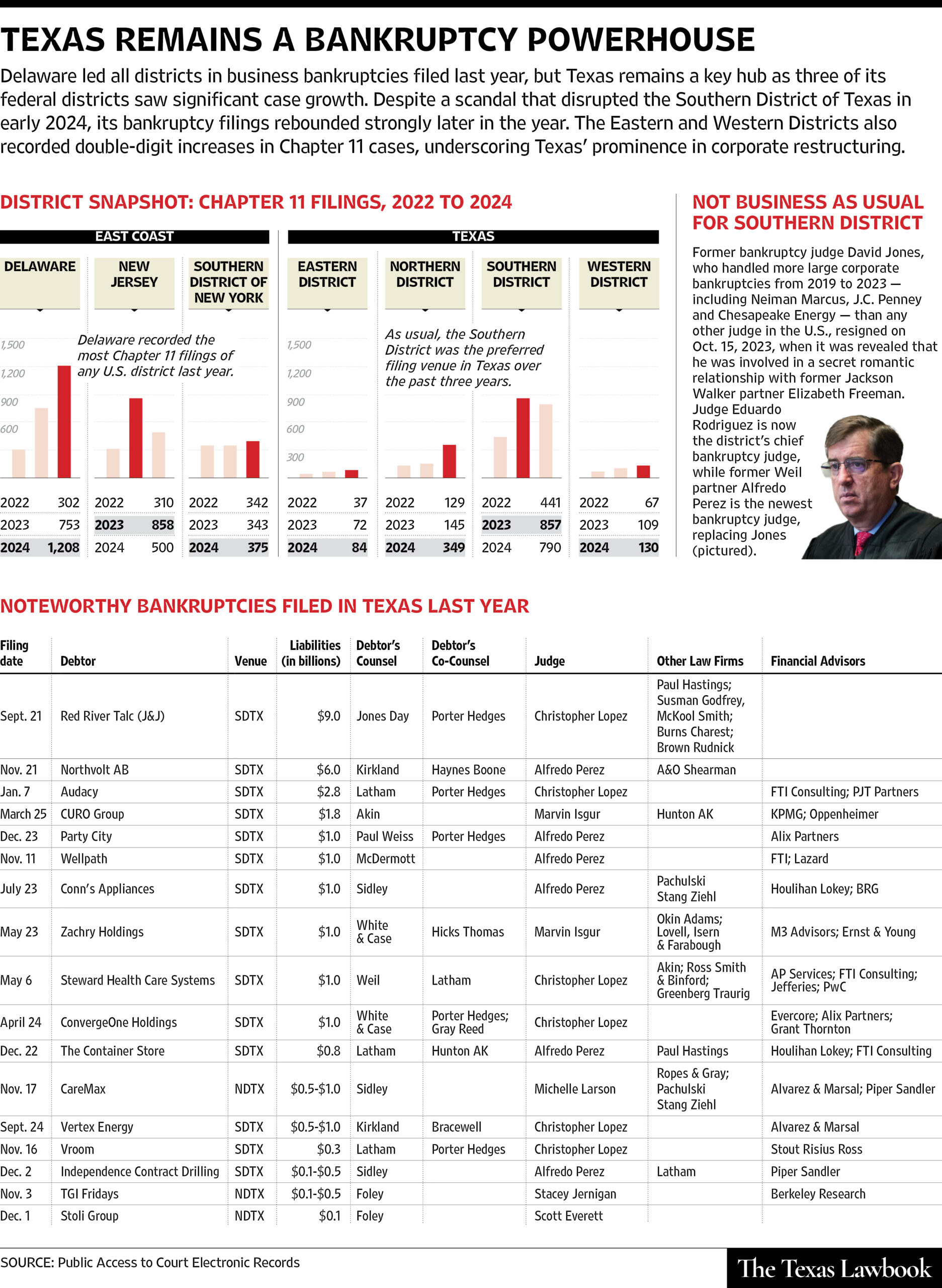

New data shows that the U.S. District of Delaware overtook the Southern District of Texas as the top spot for most business bankruptcies, but three of the four federal court districts in Texas witnessed sizeable increases in their bankruptcy caseloads to keep the state the preeminent destination for companies to go to restructure their financially troubled balance sheets.

The highly acclaimed complex bankruptcy judicial panel in the Southern District of Texas saw its docket plummet during the first half of 2024 due to an unprecedented courthouse scandal that led to the resignation of its top bankruptcy judge, civil litigation against the prominent Texas law firm that employed the lawyer involved in the secret relationship with that judge and a Justice Department investigation seeking to learn who knew what when and if any criminal laws were violated.

But then the Houston-based specialty court experienced a huge rebound in new bankruptcy filings in the second half of last year despite many restructuring experts fearing the Southern District corporate bankruptcy docket itself was on the verge of going belly-up.

At the same time, the number of struggling companies that filed for Chapter 11 bankruptcy protection in the Eastern and Western Districts increased by double digits.

While all the attention was focused on the crisis in the Houston bankruptcy courts, the Northern District of Texas quietly saw its corporate Chapter 11 caseload more than double last year, making Dallas-Fort Worth one of the 10 most popular venues in the nation for business restructurings.

Fueled by financial troubles in industries from healthcare and retail to alternative energy and restaurants, 1,353 companies filed for Chapter 11 bankruptcy protection in Texas courts in 2024 — up 14 percent in 2023, according to federal court data. By comparison, there were 1,208 corporate bankruptcies in Delaware last year.

“Folks are finally figuring out that the Northern District is an excellent court for the bankruptcy practice because of the rule changes to simplify, streamline and provide certainty and five judges who were excellent corporate bankruptcy practitioners,” said Jeff Prostok, a bankruptcy partner with Vartabedian Hester & Haynes. “Between the Northern District and the Southern District, you have two of the most attractive bankruptcy venues in the country right here in Texas.”

The outlook for the business bankruptcy legal practice only 12 months ago was bleak.

Bankruptcy experts in Texas entered 2024 fearing a near-total collapse in the highly profitable legal practice of Chapter 11 corporate restructurings in Houston due to the courthouse romance scandal between then-prominent U.S. Bankruptcy Judge David Jones and former Jackson Walker bankruptcy partner Elizabeth Freeman, which led to Judge Jones’ resignation, civil litigation against Jackson Walker and Kirkland & Ellis, and an investigation by the U.S. Department of Justice.

Federal court data shows that new business bankruptcies filed in the Southern District of Texas plummeted between October 2023, when the secret relationship between Judge David Jones and Freeman was exposed, and July 2024.

Debtwire data compiled exclusively for The Texas Lawbook shows that the number of business bankruptcies filed in Houston with at least $10 million in liabilities dropped more than 70 percent in the 12 months following Judge Jones’ resignation, while Chapter 11s in Delaware and the Northern District of Texas increased.

“The fear was that Houston would turn into a toxic jurisdiction because of the scandal and that law firms like Weil Gotshal and Kirkland, the 800-pound gorillas in the world of corporate bankruptcy, would stop filing cases in Texas,” said Jason Binford, a partner at Ross, Smith & Binford. “There was clearly a significant dip in bankruptcy filings in Houston, but our worst fears were not realized.”

The billion-dollar bankruptcies of Dallas-based Steward Health Care Systems and San Antonio-headquartered Zachry Holdings, both of which were filed in the Southern District of Texas, indicated that the Houston bankruptcy court wasn’t completely dead. In July, Houston-based Conn’s Appliances filed its $1 billion restructuring petition in its hometown. Two months later, Vertex Energy and Johnson & Johnson subsidiary Red River Talc sought Chapter 11 protection in Houston.

November and December saw an avalanche of new business bankruptcies. New Jersey-based Party City, DFW-headquartered The Container Store and European electric vehicle battery maker Northvolt AB filed for bankruptcy in the Southern District, while Dallas-based TGI Fridays, Miami-based CareMax and vodka maker Stoli Group, which is based in New York, filed to restructure in the Northern District of Texas.

“Most of those filings were very situational, but the biggest factor I see is the developed ‘dry-out’ post the trillions of dollars of the prior fed stimulus rounds,” said Duston McFaul, a Houston bankruptcy partner at Sidley Austin. “Our group has been pumping full steam on all cylinders. I expect active filings throughout 2025 as the dry-out continues.”

The Southern District of Texas, which includes Houston, Galveston and Corpus Christi, recorded 790 new corporate bankruptcies in 2024, which is eight percent fewer than the year before.

The Eastern District, which includes Plano and Sherman, had 84 new business bankruptcies last year — a 17 percent increase year over year. And 130 businesses filed for bankruptcy in 2024 in the Western District — a 19 percent bump. The WDTX includes Austin, San Antonio and El Paso.

But the most significant jump was in the Northern District, which includes Dallas and Fort Worth, where 349 businesses sought Chapter 11 protection in 2024 — a 140 percent jump over 2023.

“Dallas has historically underperformed as a bankruptcy venue, but recent changes to the Chapter 11 business bankruptcy rules are bearing fruit and making the Northern District more attractive, and we started seeing that this year,” Binford said.

Many restructuring experts think even better days are ahead in 2025.

“There were more business bankruptcy filings in the second half of 2024 for sure, but they were more middle-market companies and the restructurings are not as complex or massive as we have seen in the past,” said Lou Strubeck, a Dallas bankruptcy partner at O’Melveny & Myers. “The long-awaited surge in corporate bankruptcy filings is not happening yet.”

The one industry that has faced the most distress is commercial real estate, and yet the wave of bankruptcy filings by owners and operators of struggling and depressed commercial real estate properties never developed.

“The problem with commercial real estate is that there is nothing to reorganize or restructure,” Prostok said. “The banks really don’t want those assets back on their books.”

The result, bankruptcy experts say, is a new era of “extend and pretend” — banks extend the terms of the mortgage loans and pretend that the balance sheets are fine just to avoid writing off their capital investments.

SDTX Falls, then Revives

But it was the bankruptcy courts in the Southern District of Texas that faced the greatest tumult in 2024. SDTX became the nation’s venue of choice for large companies seeking to restructure in 2019, replacing Delaware and the Southern District of New York.

Rule changes implemented by Judge Jones and fellow Houston U.S. Bankruptcy Judge Marvin Isgur created a specialty complex business bankruptcy docket that provided a more debtor-friendly environment, which led companies such as J.C. Penney, Neiman Marcus, CEC Entertainment (parent of Chuck E. Cheese), Chesapeake Energy and California Pizza Kitchen to file for Chapter 11 bankruptcy protection in Houston rather than their hometown courts.

The nation’s leading corporate bankruptcy law firms, including Kirkland, Sidley and Weil, Gotshal and Manges, advised business clients that the Houston judges had the most experience to handle their restructurings and thus were more predictable. The ability to predict how judges will rule is all-important in corporate bankruptcies.

According to Debtwire, 54 of the 115 companies with liabilities of $1 billion or more were litigated in the Southern District. By contrast, only 27 such businesses filed their Chapter 11s in Delaware during that period.

Then came Oct. 13, 2023. The U.S. Court of Appeals for the Fifth Circuit announced an investigation into possible ethics violations against Judge Jones for a near-decadelong secret romantic relationship with Freeman, who was involved in dozens of bankruptcy cases in which Jones was the judge or a mediator. Jones resigned two days later.

“Everyone was very uncertain about what was going to happen to the Southern District and whether it was going to remain a viable venue for large complex bankruptcies,” Strubeck said. “The [scandal] was hanging over the court. Judge Jones was gone. Judge Isgur was cutting back. There were real doubts about whether Kirkland or other firms would start turning to New Jersey or back to Delaware as their venue of choice.”

Indeed, the Southern District hit an eight-month drought starting in October 2023 after the Judge Jones scandal broke. Many bankruptcy lawyers stayed busy working on restructurings filed earlier in 2023, including the Diamond Sports Network Chapter 11 and the bankruptcy of former Infowars owner and host Alex Jones.

Debtwire reports that in the year following Judge Jones’ resignation, Delaware outpaced the Southern District in billion-dollar bankruptcies eight to seven. Debtwire’s data also shows that the SDTX’s percentage of all business bankruptcies filed in the U.S. dropped from 26 percent to 19 percent in the year after the Jones scandal was revealed.

There were intermittent signs of life for the Houston bankruptcy court during the first six months of 2024.

In January, Audacy, the second-largest radio company in the U.S., filed for bankruptcy protection in the Southern District. Latham & Watkins and Porter Hedges serve as Audacy’s legal advisors. All three cases were assigned to U.S. Bankruptcy Judge Christopher Lopez, a former Weil Gotshal partner who replaced Judge Isgur on the Houston court’s complex case panel.

In May, Weil Gotshal, the lead legal advisor for Dallas-based Steward Health Care System, and White & Case, which leads the restructuring for Zachry Holdings, filed those cases in Houston.

Sidley Austin filed the Conn’s bankruptcy in July in Houston and then the restructurings of CareMax Health in the Northern District in November and Independence Contract Drilling in the Southern District in December.

But the entire bankruptcy bar in Texas breathed a sigh of relief when Kirkland filed the Vertex Energy bankruptcy in Houston in September and the $6 billion Northvolt AB restructuring in the Southern District in November, providing the signal that the world’s leading corporate bankruptcy firm would still guide its clients to Texas.

Restructuring experts point to the Fifth Circuit’s appointment of retired Weil Gotshal corporate bankruptcy partner Alfredo Perez to replace Judge Jones and join Judge Lopez, also a former Weil partner, as the two judges on the Southern District’s complex case judicial panel.

“The appointment of Alfredo Perez was like manna from heaven,” Strubeck said. “Judge Perez has only been on the bench for a short period, but everyone recognizes his experience and wisdom. With Lopez and Perez, Houston as a top bankruptcy venue appears to be safe once again.”