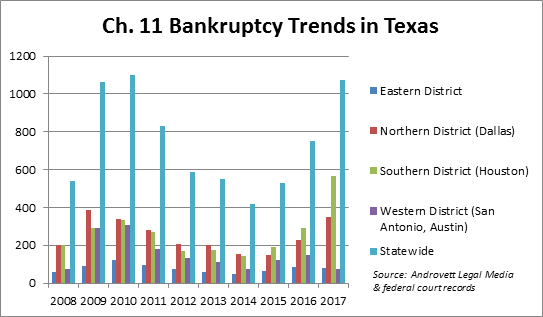

Filings by Texas companies seeking to restructure in federal bankruptcy court jumped more than 42 percent in 2017, nearly reaching the highs of the Great Recession eight years ago, according to new data obtained by The Texas Lawbook.

Some corporate restructuring experts predict there could be another wave of bankruptcies filed by Texas businesses burdened with historic levels of debt.

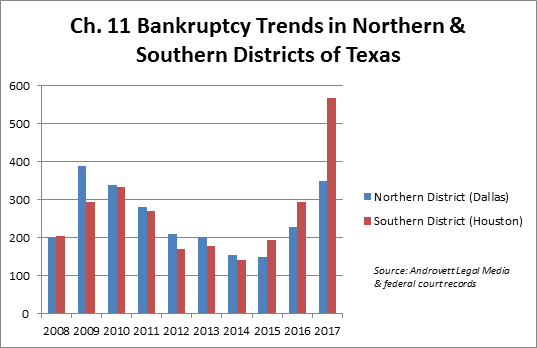

While the economy remained strong and oil and gas prices stabilized last year, the number of businesses – large and small – filing for Chapter 11 bankruptcy protection in 2017 skyrocketed to record levels in the Southern District of Texas, which is overwhelmingly dominated by Houston.

The Northern District, which includes federal courts in Dallas and Fort Worth, also witnessed a dramatic increase with the second most bankruptcy filings in its history.

As a result, the bankruptcy courts in the Southern and Northern Districts in 2017 became the third and fourth busiest in the U.S. for corporate reorganizations, behind only Delaware and the Southern District of New York, according to exclusive federal bankruptcy data compiled by Androvett Legal Media Research.

By contrast, the bankruptcy courts in Austin and San Antonio, which comprise the Western District of Texas, plummeted to near record lows. Bankruptcy filings in the Eastern District were flat.

“It has been a great few years to be a corporate bankruptcy lawyer in Texas, and we have not always been able to say that,” says Ian Peck, a bankruptcy partner at Haynes and Boone in Dallas.

“Business bankruptcies in Texas have been a tale of four industries – energy, retail, healthcare and hospitality or restaurants,” Peck says.

The wave of bankruptcies involving large onshore oil and gas exploration and production companies has slowed significantly, but corporate restructuring experts say the spike in new business bankruptcy filings in Texas is not surprising, and several predict 2018 will witness even more activity in reorganizations.

“Energy bankruptcies – especially offshore and oil and gas service companies – still dominate Houston’s bankruptcy docket, while healthcare restructurings are a significant part of the new cases in DFW,” says Jackson Walker bankruptcy partner Bruce Ruzinsky. “The restaurant industry continues to be a tough business even in cities such as Houston and Dallas where the economies are booming.”

Hunton & Williams bankruptcy partner Greg Hesse agrees.

“There are a lot of restaurants that are struggling, and retail continues to experience a systematic change from brick-and-mortar to online sales – otherwise known as the Amazon effect,” Hesse says.

“We are just starting to see the fallout in healthcare,” he says. “There will be more healthcare-related bankruptcies, especially involving nursing homes and senior care.”

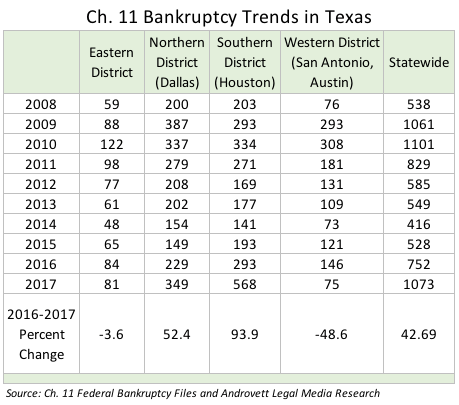

The Raw Data

Legal experts say that the raw numbers are somewhat bloated by a handful of oil drilling corporations and healthcare businesses that filed bankruptcy dozens and dozens of affiliated companies.

The Androvett data shows that:

-

- 1073 Texas businesses filed for bankruptcy restructuring in 2017 – a 42 percent jump from a year earlier and the second most ever recorded, behind only the 1101 such filings in 2010;

-

- A record-breaking 568 companies filed for Chapter 11 in the Southern District in 2017 – a 94 percent spike from 2016 and quadruple the number that filed in 2014;

-

- 349 businesses entered into bankruptcy restructuring in the Northern District in 2017 – up 52 percent from a year earlier and the second most in history to the 387 that filed in 2009;

-

- The Western District saw only 75 companies go into Chapter 11 in 2017 – down from 147 in 2016 and down from 308 in 2010;

- Bankruptcy filings in the Eastern District of Texas fell from XX in 2016 to XX last year.

“Offshore operations are just a disaster and healthcare bankruptcies are about to come on hard and strong,” says William Snyder, a bankruptcy expert at CR3 Partners. “There is total confusion and uncertainty in healthcare about what is going to happen next with the federal government. We are just seeing the fallout from that now.”

Snyder, who served as the chief restructuring officer in the bankruptcies of the Texas Rangers and Pilgrim’s Pride, says CR3 research identified 400 companies that are in the bankruptcy danger zone over the next year.

About one-fourth of the businesses are in the retail industry. Ten percent are in the energy sector. The other major business sectors with major vulnerabilities are healthcare companies, consumer-oriented enterprises and technology-based operations.

Energy Bankruptcy Trends

Snyder says many companies – including a lot of private equity backed oil and gas acquisitions – are facing mounting problems with debt that could likely lead to a wave of new bankruptcy filings.

“The height of the debt craze was 2007, when debt multiples were eight times cash-flow,” Snyder says. “The past two years have exceeded 2007. Last year, it was 9.3 times and it’s more than 10 times now. We are at the height of debt lunacy, and I think there will be fallout.”

Peck, who oversees Haynes and Boone’s Oil Patch Bankruptcy Monitor, says energy E&P filings “have slowed to a crawl, while oil service companies and off-shore have increased.”

“Restructured E&P companies are putting financial pressures on their service companies, and we are only now starting to see the impacts of that,” Peck says.

Several energy industry lawyers say that many oil and gas companies survived the last down turn, but they remain fragile to future pressures.

“Although overall leverage has decreased since 2014 for E&P companies, more than approximately $50 billion in E&P debt is scheduled to mature in 2019,” says Kirkland & Ellis bankruptcy partner Brian Schartz, who is based in Houston.

“Some E&P companies [that] went through chapter 11 during the last few years only restructured a portion of their debt,” Schartz says. “Although commodity prices have increased, commodity price volatility remains and prices are nowhere near the highs of a few years ago. Add to that an increase in interest rates, and it is possible that we could see the need for more companies to file.”

Schartz says liquidity could become tighter for the E&P companies because “stricter lending practices may limit capital-incentive upstream companies from accessing liquidity necessary to continue operations.” In addition, a majority of large oil and gas companies still face large borrowing base reductions because their 2016 redetermination process reduction was not insignificant as it could or should have been.

“The offshore space continues to struggle due to capital intensive production costs, commodity prices and cheaper onshore options,” Schartz says. “Several large offshore oil companies have already gone through or in the midst of going through in-court processes. Offshore spending may continue to drop in 2018 on the heels of 2017 spending declines.”

Affiliated Business Filings

Hesse, the Hunton & Williams lawyer, says the bankruptcy data is not surprising, but he also says the numbers are significantly impacted by a few key cases.

“There are a few healthcare and energy bankruptcies that skew the raw number count of new filings,” he says. “These are businesses that have dozens and dozens of affiliated companies that all filed for bankruptcy at one time.”

Hesse and Ruzinsky point to Rule 1015 of the Federal Rules of Bankruptcy Procedure, which allows bankruptcy judges to consolidate Chapter 11 filings if the companies are interrelated and have the same debtors or business partners.

Examples include:

-

- Lewisville-based Adeptus Health and 139 affiliated companies filed to restructure in April in the Northern District, citing $400 million in debt. Adeptus is represented by prominent bankruptcy lawyer Louis Strubeck, who is a partner in the Dallas office of Norton Rose Fulbright.

-

- Houston-based Montco Offshore and 84 affiliated businesses filed for bankruptcy protection in March 2017, citing $136 million in debt. DLA Piper and Porter Hedges represent the debtor.

-

- Offshore oil driller SeaDrill Ltd and 85 affiliated companies filed for bankruptcy in Houston in September 2017, claiming $12.8 billion in liabilities. Kirkland & Ellis is the law firm representing the debtors, and Jackson Walker is co-counsel.

The trend is continuing into 2018.

-

- In January, Addison-based oil and gas driller firm Exco Resources and 14 of its affiliated companies filed for bankruptcy, citing $1.3 billion in debt. Kirkland is also representing Exco.

-

- On Feb. 15, Houston-based oil producer Fieldwood Energy and a dozen of its affiliates filed for Chapter 11 protection, citing $1.6 billion in debt. Weil, Gotshal & Manges partner Alfredo Perez is the lead lawyer for Fieldwood.

To be sure, groups of affiliated companies filing for bankruptcy is not new. Legal experts say that 2017 and 2018 are simply seeing more than ever before.

Snyder says there is one other explanation for the jump in Texas numbers.

“Businesses have come to view Texas as a good place to file Chapter 11,” he says. “The state has developed a strong bankruptcy bench and bar.”