© 2012 The Texas Lawbook.

By Doug Rayburn and Krysta Edwards

Baker Botts

Since the stock market crash of 2008, the U.S. capital markets, consistent with markets worldwide, have been struggling to regain investor confidence. In the months immediately following the crash, Wall Street appeared to be holding its breath, waiting to see what the aftermath would bring, and management teams that once might have been priming the pumps to take their companies public decided to sit on the sidelines a little longer. But as the capital markets in general have steadily regained their strength, the IPO market has followed suit.

The IPO market started making its comeback in 2010, with a total of 154 IPOs pricing that year according to Renaissance Capital (renaissancecapital.com). And although that number dropped slightly in 2011 and 2012, with 125 and 128 IPOs, respectively, pricing each year, the number of IPO deals going to market, though not yet on par with the more robust IPO market leading up to the 2008 crash, reflects a cautious but steady return of companies’, bankers’ and investors’ confidence in the system.

Interestingly, one might be inclined to draw a different conclusion about the health of the IPO market when considering the number of companies filing for, as opposed to pricing, an initial public offering in a given year. In 2010, the number of companies filing for an IPO jumped sharply, more than doubling the number than had filed in 2009. According to Renaissance Capital, a total of 253 and 257 companies filed to go public in 2010 and 2011, respectively, but in 2012 those numbers appear to have again fallen severely, with only 136 companies filing for to go public. Reconciling the apparent incongruity, then, between the IPO filing data and pricing data ultimately drives the conclusion of whether 2012 was a year of disappointment or moderate success.

It seems likely that a portion of this decline is due to the passage and enactment of the Jumpstart Our Business Startups Act (JOBS Act) in April of 2012. The JOBS Act allows “Emerging Growth Companies” (companies with less than $1 billion in annual revenue) to confidentially submit their initial registration statement filings with the SEC, so the market can no longer maintain an accurate tally of the number of backlogged IPO filings for deals that have not yet gone to market. Though not every company that could take advantage of this provision does, its impact has been significant enough to make pricing data the more reliable measure of the IPO market’s well-being. And as those numbers show, 2012 was a year of welcome stability and conservative optimism. Some of this conservatism was reflected in the average deal size of the 2012 IPOs, which according to PricewaterhouseCoopers, when excluding the Facebook IPO that was completed this year, decreased by 32% as compared to the 2011 average value raised.

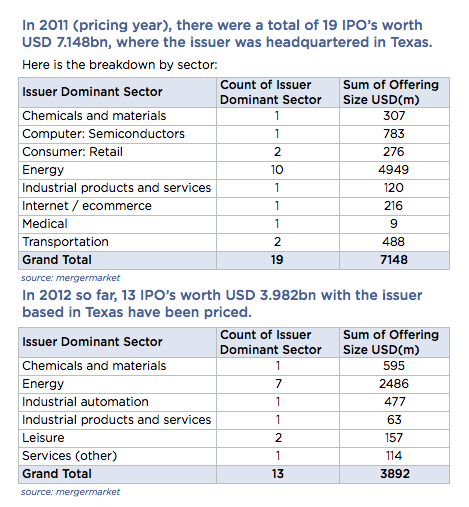

The Texas IPO market in 2012, though it performed respectably, also saw average proceeds decline and, when looking at the number of completed IPOs, was not quite as robust as the U.S. market as a whole. According to mergermarket, in 2011, 19 companies headquartered in Texas priced initial public offerings, but in 2012, only 13 Texas companies completed their IPOs. The average offering size for Texas IPOs also decreased from $376 million in 2011 ($7.158 billion aggregate) to $306 million in 2012 ($3.982 billion aggregate). But as the Dallas Morning News noted at the end of 2011, Texas had outperformed the broader U.S. IPO market in 2011, and the 2012 results may simply reflect a return to equilibrium with the market generally.

Not surprisingly, the energy sector continued as the leading industry for Texas IPOs, accounting for 10 of the 19 (53%) IPOs in 2011 and 7 of the 13 (54%) IPOs in 2012 according to mergermarket. And IPOs for energy businesses, particularly Master Limited Partnerships, or MLPs, have also been very well received, generating average proceeds of $495 million in 2011 and $355 million in 2012, well above the Texas average. In fact, energy IPOs have been prominent throughout the U.S., representing the second largest number (29) of U.S. IPOs in 2012. (According to Renaissance Capital, with 39 IPOs, the technology sector was most prominent in the 2012 IPO market; the financial sector was third with 20.)

So what does this mean as we ring out 2012 and look toward 2013? Although the JOBS Act makes it easier for Emerging Growth Companies to go public because of reduced regulatory requirements, that incentive, in and of itself, is unlikely to spark a flurry of market activity. Instead, it will be the broader economy and its reaction to the federal government’s action (or inaction) on a variety of economic matters that will be a driving force behind a newly energized market or another potential decline. As has become the theme in recent years, the outlook is cautiously optimistic, but we may not be done holding our breath just yet.

Doug Rayburn is a partner in Baker Botts’ Capital Markets Practice in Dallas. He can be reached at doug.rayburn@bakerbotts.com. Krysta Edwards is an associate in Baker Botts’ Dallas office and also specializes in Capital Markets Krysta can be contacted at krysta.edwards@bakerbotts.com.

© 2012 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.