Make of it what you will, but Texas law firms made generous use of the Payroll Protection Plan, the pandemic emergency funding distributed by the Small Business Administration.

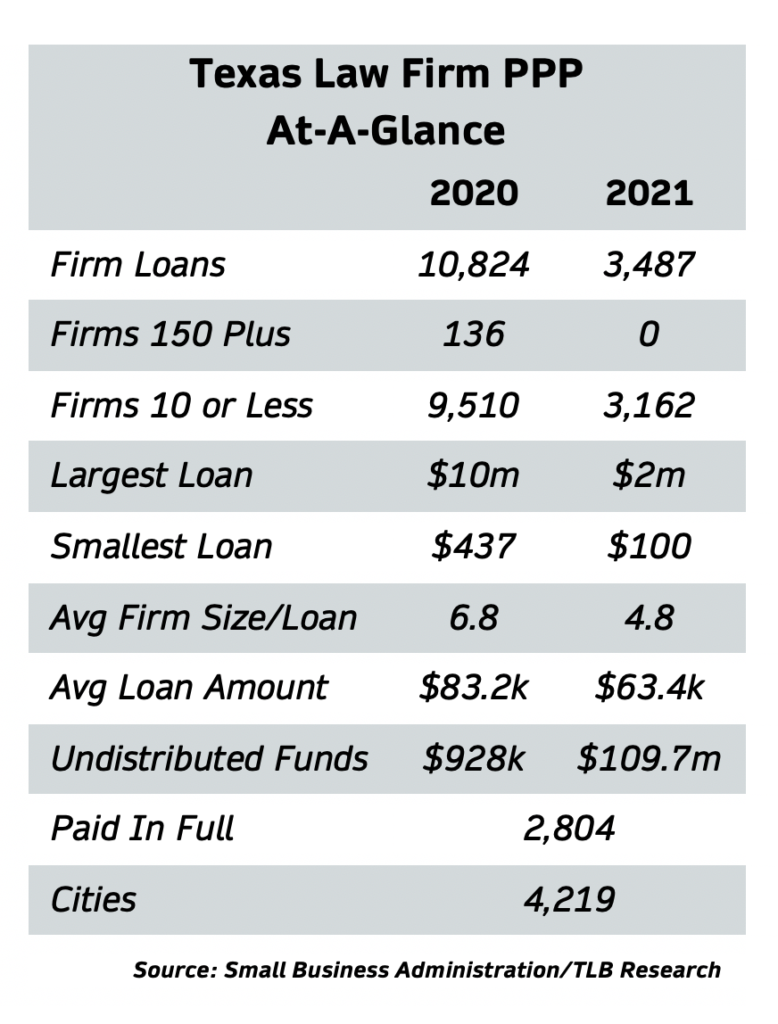

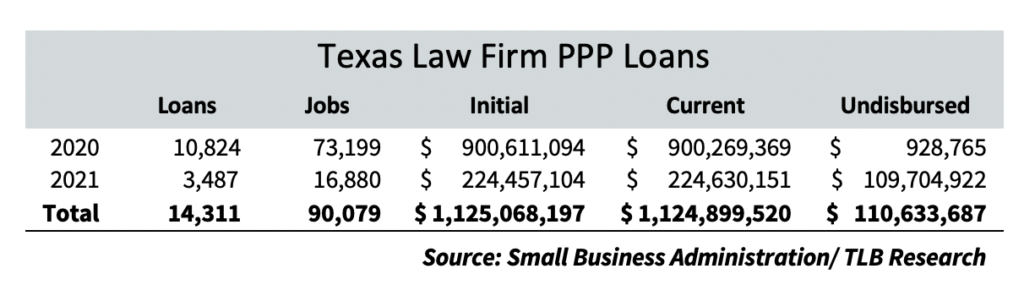

According to SBA data released last month, 3,487 Texas law firms received approval for $224 million in loans in the 2021 round of emergency pandemic funding. But that was far less than 10,824 firms that received more than $900 million during the first round of funding last year. Over both years there were a total of 14,311 loans approved for $1,1125,068,197 which helped buoy more than 90,000 law-related jobs.

The drop in PPP loans, especially among the state’s largest firms, reflects the surprising reality of the pandemic’s effect on the business of law: that many law firms prospered in 2020 despite early fears and restrictions dictated by the public response to Covid-19. As measured by the Texas Lawbook 50, firm revenues — which seemed to have grim prospects in the first half of 2020 — ended the year a full 4% over 2019.

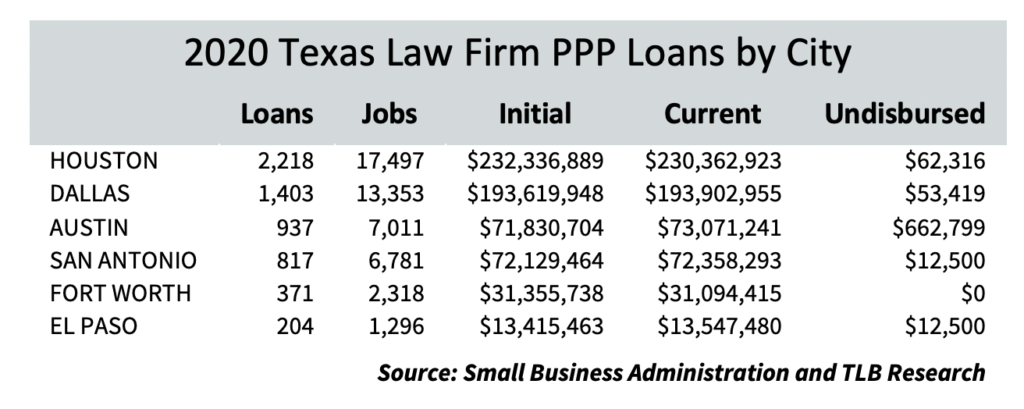

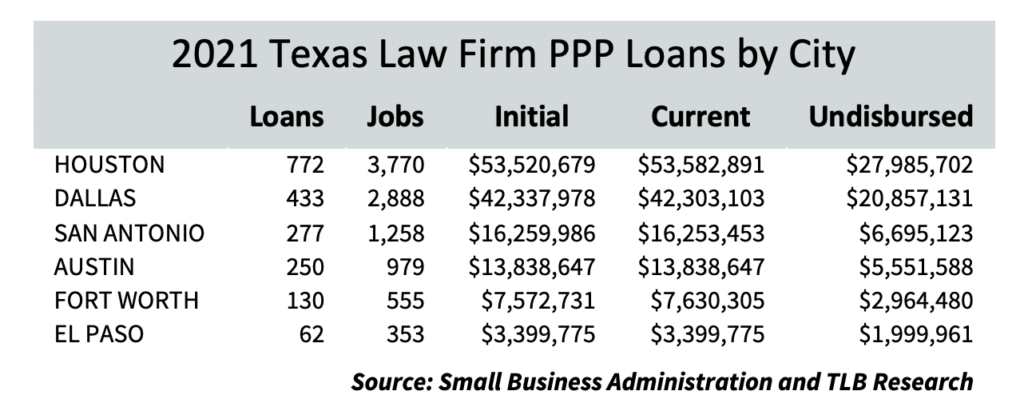

- Jobs = Employment claimed

- Initial = Initial approved amount

- Current = Currently approved amount

- Undisbursed = Funds approved not distributed

The 2020 PPP loans benefited firms of all levels — including 50 non-profits — representing a reported 90,083 jobs. But the average 2020 loan of $83,205 declined to $64,370 in 2021, along with the size of the firms approved: from 6.8 employees per loan in 2020 to 4.8 employees per loan 2021. Of the 50 firms that claimed 150 employees or more in 2020, none received a PPP loan approval this year. Note: The Texas Lawbook also received a fully-disbursed PPP loan of $107,960.

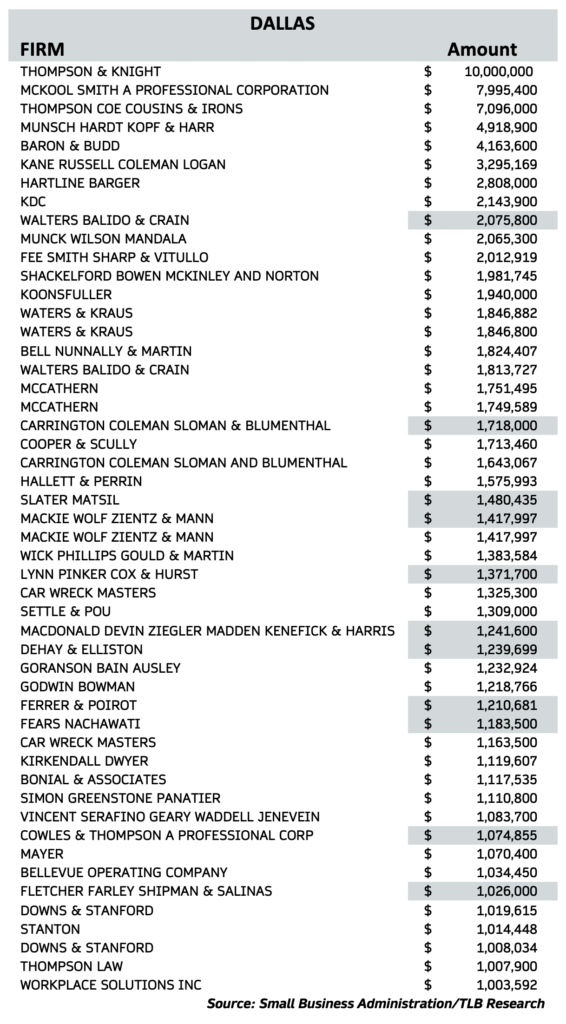

The large firms, however, did benefit. In the past 18 months 136 Texas law firm were approved for PPP loans of $1 million or more. Seven loans were for more than $5 million, with the top three going to Dallas-based firms. In fact, each of the top 50 loans to Dallas firms were for more than $1 million.

Coats Rose, Chamberlain Hrdlicka, Hartline Barger, Thompson Coe, Wick Phillips, along with thousands of other lawyers and their law firms accepted PPP money last year and this. And, in fact, the firm that got the most PPP in Texas, Thompson & Knight, is no longer in business.TK topped the charts at $10 million, and just this week completed its merger with Holland & Knight.

The next two largest loans were to McKool Smith ($7,995,400) and Thompson Coe Cousins & Irons ($7,096,000).

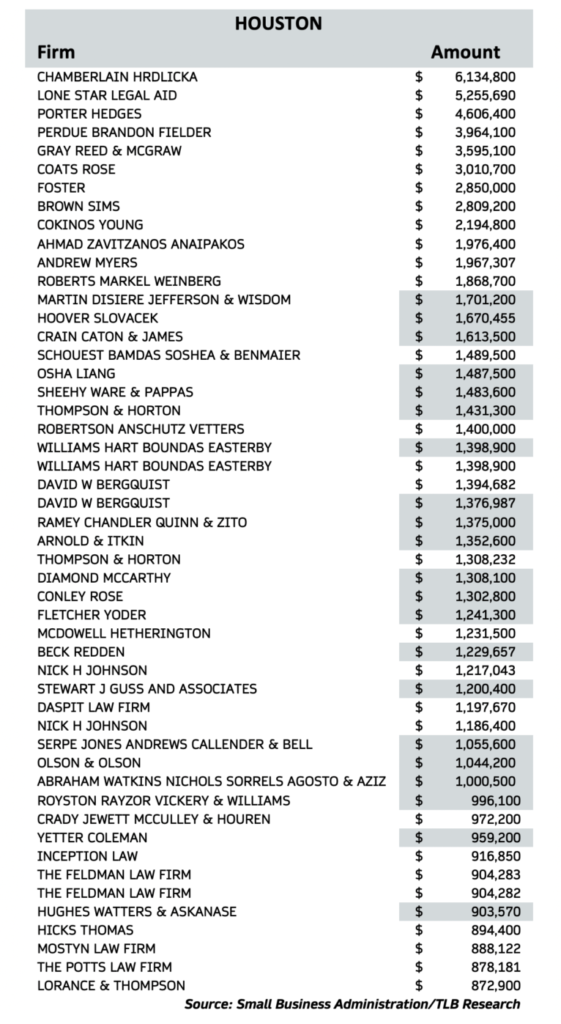

Rounding out the seven over $5 million were Houston-based Chamberlain Hrdlicka, Thomas J. Henry Law of San Antonio, and two non-profits: Texas RioGrande Legal Aid of Mercedes and Lone Star Legal Aid of Houston. The status of the loans was not disclosed, though none were reported as paid and none were undisbursed.

At Lone Star Legal Aid the PPP package was critical. Covid-19 created a surge of legal business, says Lone Star CEO Paul Furrh. As a non-profit providing legal aid to those who can’t afford it, additional work doesn’t show up on the revenue side. But for their $5 million PPP loan, the lawyers and legal staff added to meet the caseload created by Hurricane Harvey might have been lost to Covid-19.

The organization, which serves much of the Gulf Coast region, had reached a staff of about 400 — which includes 200 lawyers — following that surge of Harvey-related cases. Furrh said Lone Star — whose headquarters was destroyed in that storm — would likely have lost as many as 50 from its staff had the PPP funds not been available. Not only that, but the organization wouldn’t have been able to keep up with the 25,000 cases it closes each year.

“We were still dealing with Harvey when Covid-19 hit,” said Furrh. “The money helped us keep on helping people who needed it.”

The Cities

In 2020 and 2021 Houston led all Texas cities in loan count and loan value, with a combined 2,990 loans to law firms worth $285,857,568. Dallas law firms came in second with a total of 1,836 loans worth nearly $236 million. They were followed in order by Austin, San Antonio, Fort Worth and El Paso.

The latest data released by the SBA benefits from changes in the agency’s disclosure policy, which last year held back much of the specific information under exemptions to the Freedom of Information Act. Despite their source as public funds, the amounts last year released were less than specific; even the amounts of loans were reported in ranges, rather than exact amounts.

This year the data is more specific, and includes some demographic data (gender, race and veteran, for instance). But unless the loans are paid in full or undistributed, the current loan status — whether the loan has been paid down or forgiven — remains undisclosed.

There were 30 loans to 27 verifiable non-profit legal organizations totaling $15.1 million. Three of those loans were “Paid in Full” and only three of the organizations sought PPP loans in 2021.

“Paid in Full” doesn’t mean they were paid. It means the loans received forbearance. Many of them are still active. Of the 14,311 loans approved over both years, only 2,804 were marked “Paid in Full” and only 1,672 were “Active Un-disbursed.”

One of the “Paid in Full” loans went to the Dallas litigation firm of Lynn Pinker Hurst & Schwegmann. Mike Lynn minces no words regarding their pursuit of a $1,371,700 loan.

Lynn said that in March and April 2020, when the process was developing, his firm — like many others — was staring into an abyss. Or at least unknown territory. The choice seemed existential.

“Courts were closed. There were no such things as ‘virtual’ trials and hearings. No one knew what Zoom was and all of our employees were gone,” said Lynn. “If you had asked me if our firm would be in business (in 2021) I wouldn’t have been able to answer.”

Most worrisome, Lynn said, was the immediate loss of what he considers the most important characteristic of their working environment: the creativity born of collegial interaction.

“We work on white boards in a room together trying to figure out what we’re going to do next.”

But the firm adapted, he said. Their documents had long been locked into the The Cloud. They had recently changed their email system and working software to be independent of on-location storage. The younger attorneys proved adept at vital technologies. The firm set up its own Virtual Private Network. And by early this year, when additional funds became available, the firm was in a position to refuse further funding.

He is still worried about the emerging threat of variants, but the firm has returned to something familiar.

“Nearly everyone is back. The back office is back. We are, at the moment, more or less normal,” Lynn said.

Dallas vs. Houston

The charts below show the top 50 PPP loans to firms in Dallas and Houston. The list includes loans approved in 2020 and 2021. Amounts highlighted in gray are loans reported as fully paid, which in most cases means the loan has been forgiven. All others are either undisclosed or active and undispersed. Where firm names are repeated means that a new loan was approved in 2021.