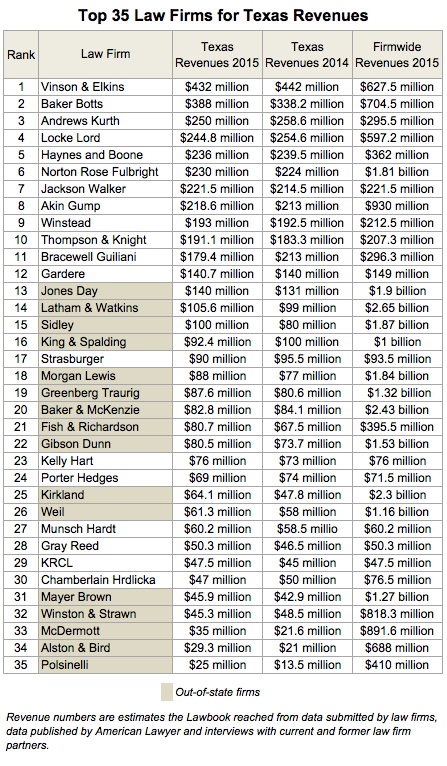

Norton Rose Fulbright has regained the title of largest law firm in Texas. Vinson & Elkins generated the most revenues. Baker Botts generated the most profits.

McDermott, Sidley, Morgan Lewis, Fish & Richardson, Kirkland, Alston & Bird and Polsinelli witnessed the most revenue growth.

Locke Lord and Cox Smith experienced mergers with out-of-state law firms – though the new Dykema Cox Smith declined to turn over revenues.

Burleson went belly up. K&L Gates lost a bunch of lawyers, but then added a few back.

This is the annual report card for law firms, as we analyze 2015 and understand what it means for 2016 and beyond.

There is no argument that two law firms – Baker Botts and Kirkland & Ellis – experienced extraordinary success in 2015.

Baker Botts’s lawyer count in Texas remained even, but its revenues from its Texas offices soared from $338.5 million in 2014 – which, by the way, was a pretty good year for the firm, to $388 million. If you are counting, that’s a 15 percent jump.

Revenues per lawyer at Baker Botts climbed from $935,000 to $1 million. Total revenues for the firm topped $700 million for the first time.

“We are very proud of our 2015 results,” says firm managing partner Andy Baker. “We don’t focus on one-year results. We look to the long-term and we are building for the future. We listen to our clients and aim to have a deep understanding of their business.”

Baker says he has spent a lot of time during the past two years interviewing clients about what the firm can do better.

“We have the deepest and widest full service legal practice that exists in Texas,” he says. “A large part of our growth in the future will be outside of Texas – in California, New York, London and the Asian-Pacific.”

For Kirkland, the Texas lawyers rocked last year like it was 1999. The Chicago-based firm opened its doors in April 2014. The firm now has 65 lawyers in the state and reported $64 million in revenues from its Houston operation.

V&E had its second best year ever, according to firm chairman Mark Kelly, but it could not match the record-breaking year of 2014. V&E’s revenues in Texas dropped from $442 million in 2014 to $432 million last year.

About 60 percent of V&E’s clients are energy-related and the firm is one of the leading capital markets practices in the state. With oil and gas M&A very slow and securities offerings on life support, it should not be surprising that V&E shaved 35 lawyers off its Texas head count – from 462 to 427.

Still, $1 million of revenues per lawyer in a down year is not too bad.

Norton Rose Fulbright – I still want to just call them Fulbright – grew its lawyer ranks by 18 in Texas, from 427 to 445. Firm-wide, lawyer head count is 3,371.

“We have not slowed our recruiting at all,” says Richard Krumholz, a partner in Norton Rose’s Dallas office and head of dispute resolution and litigation for the firm’s U.S. operations. “We have a new cyber law security practice. We have beefed up our corporate compliance practice, including hiring the former head of corporate compliance at Transocean to our team.”

Norton Rose’s revenues per lawyer shrank considerably – to $515,000. Firm leaders say a chunk of the decline is the result of the strong dollar.

“Last year we achieved global growth of 3.5 percent,” says Norton Rose Fulbright’s U.S. Managing Partner Linda Addison. “The U.S. dollar is strong, and our revenue from other regions is converted to U.S. dollars for the Am Law 100. The exchange rate differential of 7.7 percent makes it appear that our global business has shrunk, when in fact it has grown.

“Factors including numbers of lawyers in the US, different compensation structures in certain regions, such as Australia and South Africa, and exchange-rate fluctuations affect us much differently than most firms reporting in these kinds of surveys,” Addison says.

Akin Gump rocks on with solid growth, stable lawyer count and strong revenues, as it marches forward. The firm’s $1.1 million revenues per lawyer is the best of the Texas-based firms. Overall, Akin Gump reported $930 million in revenues. Is $1 billion possible next year?

Andrews Kurth had a remarkably good year despite the horrible capital markets situation. The lawyers at AK, along with V&E and Latham, own the world of securities offerings. Problem is, the capital markets went to crap in the second half of the year and remain in the crapper even now.

In spite of this, Andrews Kurth reported $250 million in revenues from its Texas operations in 2015 – down only slightly from $258.7 million from the year before. More impressively, the firm made strategic moves to significantly improve its revenue per lawyer numbers in Texas – from $934,000 in 2014 to $975,400 in 2015. $1 million next year?

Bracewell has had a rough year or so. The firm lost 31 lawyers in its Texas operations last year and that doesn’t include the departure of named partner Rudy Giuliani in January.

New managing partner Greg Bopp says he is seeing an uptick in the firm’s litigation and bankruptcy practices, but he admits Bracewell and other firms are challenged as long as the price of oil and gas remains in flux.

Fish & Richardson had an excellent year and 2016 should be solid, too. The lead lawyer at Fish in Dallas, Tom Melsheimer, has been hired to defend former Credit Suisse First Boston investment banker Thomas Davis, who is a key defendant in the insider-trading probe into Dean Foods.

Jackson Walker had an excellent year. The firm added 10 lawyers and it now has the second most lawyers practicing in Dallas. Revenues were up 3 percent.

Thompson & Knight saw its lawyer head count in Texas drop 3.5 percent, but its revenues per lawyer jumped 7 percent. That is always music to the ears of equity partners.

Revenues at Gardere were up nearly 3 percent, while Winstead was flat, but but both firms report that revenues so far in 2016 are well ahead of last year.

“We are doubling down on our strengths,” says Gardere managing partner Holly O’Neil. “Litigation and bankruptcy have made up for the decline in oil and gas M&A. Our real estate practice is going gangbusters. Our legal demand month over month is outpacing the AmLaw 200.”

Finally, a law firm that just keeps on rocking is Kelly Hart in Fort Worth. The firm added a dozen lawyers in 2015 and grew its revenues by five percent, to $76 million.

“We continue to thrive in the niche of a regional law firm with more affordable rates and good, solid lawyers,” says firm managing partner Dee Kelly Jr.

In the next three week, The Texas Lawbook will publish articles on the impact of a frenzied lateral market, legal fee discounts to lawyers and the role of non-lawyers in the practice of law.

Stay tuned…