© 2017 The Texas Lawbook.

By Natalie Posgate and Mark Curriden

Texas businesses smashed all records when it came to mega-mergers, acquisitions and divestitures during the fourth quarter of 2016.

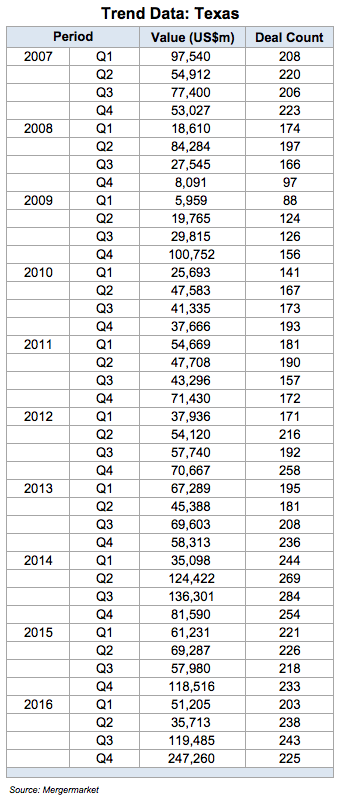

For the first time ever, the average value of M&A deals in Texas topped $1 billion during the final three months of last year, which is nearly triple the average price tag of corporate transactions during the past three years.

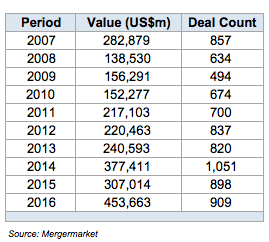

There were 909 total deals in 2016 in Texas, which is a meager one percent increase over a year earlier, but still the second most ever recorded by Mergermarket, an independent data research firm.

However, the size of the corporate transactions exploded, especially during the fourth quarter.

Mergermarket, which provides exclusive Texas M&A data to The Texas Lawbook, reports that the 909 deals in 2016 had a combined value of $453.7 billion, which is 50 percent higher than 2015 and 20 percent higher than 2014, which was the previous record.

“It was the year of the big deal and the year of the big finish,” says Chad Watt, an analyst at Mergermarket who specializes in M&A in Texas. “We blew the doors off in the second half.

“The fourth quarter had the highest deal values in history,” Watt says.

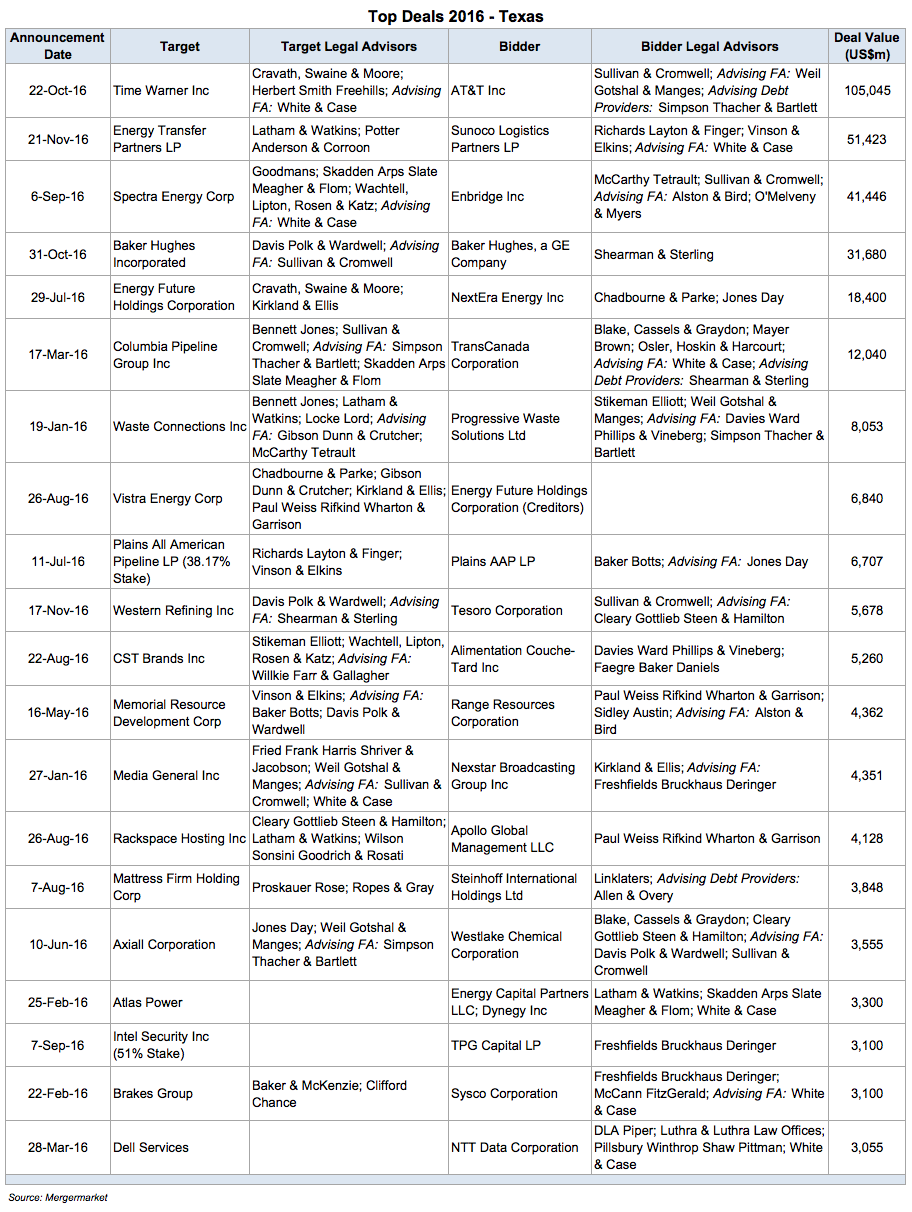

Driven by 11 and 12 digit transactions by AT&T, Energy Transfer Partners, Spectra Energy and Energy Future Holdings, Texas-based businesses were involved in 468 M&A transactions valued at $366.7 billion during the second half of 2016, which is also the record for back-to-back months combined.

Corporate law firms representing those companies stayed busy.

“The end of the year was a crazy flurry of activity,” said Andrew Calder, a partner in the Houston office of Kirkland & Ellis and the lead lawyer in EFH’s $18.4 billion sale of Oncor to NextEra Energy in July. “As a firm, we signed 10 deals in the week leading up to Christmas.”

But it was the size of the deals announced in October, November and December that were astonishing.

The total value of the M&A activity in Q4 was $247.3 billion, which was double the amount of deal value during the third quarter and seven times more than the value of all the deals combined during the second quarter of 2016.

The average value of corporate transactions announced in October, November and December was $1.1 billion, which is more than twice as much as the average $493 million price tag of deals in the third quarter of 2016 and five times more than the $197 million average during the first half of 2016.

The parade of mega-deals started in September, when Enbridge announced it was buying Spectra Energy for $41.4 billion. On Oct. 22, AT&T agreed to buy Time Warner for $105 billion. Nine days later, Baker Hughes and GE Oil and Gas announced a $31 billion merger. In November, ETP and Sunoco Logistics reached a $51.4 billion merger agreement.

Of the 20 largest Texas deals announced in 2016, half were in the energy, mining & utilities sector; three were in business services; three were in media; two were in industrials & chemicals; and the rest were in consumer products and technology.

“Buyers confidence drives the M&A market, and when there’s confidence in the future, coupled with the need to show the public markets growth in the business, M&A is a natural go-to to buy that growth,” says Jim Griffin, a partner in the Dallas office of Weil, Gotshal & Manges.

“I believe 2017 will be a great year for M&A, particularly in the technology space,” Griffin says. “Technology is constantly changing, change requires companies to adapt and grow, and M&A is a logical path to facilitate that adaptation and growth.

“The Texas M&A market is clearly more than just energy, but energy does make up a significant portion of the Texas M&A market, much like the technology space drives the Silicon Valley market,” he says.

The 2017 energy market is already presenting a completely different picture from a year ago.

“Coming out of 2016, if you look at E&P companies’ aggregated balance sheets, they’ve been repaired,” Jim Rice, a co-managing partner of Sidley Austin’s Houston office said at a media round-table discussion this week. “The industry is positioned to pivot from being in asset sale mode to asset acquire mode. The industry is much more capitalized.”

In particular, Rice said, there is explosive potential for shale plays in the Permian Basin, that vast region of West Texas that encompasses 48 million acres stretched over 75,000 square miles.

“There’s no question that the focus will be a strong following of the activity in the Permian. The economics continue to be superior [there].

© 2017 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.