U.S. capital markets were mostly shut to the oil and gas industry last year given the sector’s out-of-favor status among investors. The result was fewer securities offerings transactions handled by Texas lawyers overall, according to exclusive data compiled by The Texas Lawbook’s Corporate Deal Tracker.

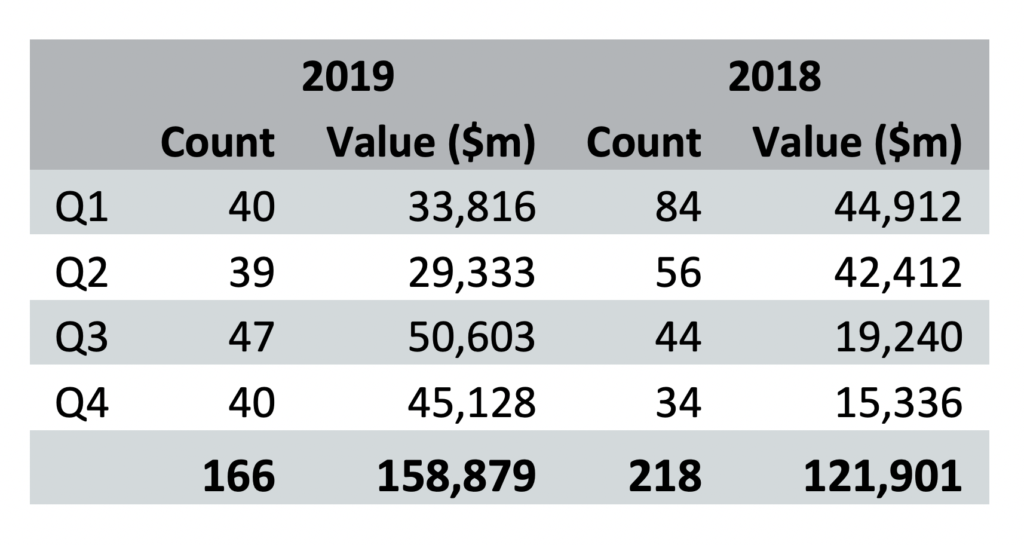

The number of securities deals slid by almost quarter last year to 166, versus 218 the year before.

Those transactions’ dollar value jumped by a third to $158.8 billion for the year. But nearly one-fourth of that sum involved two transactions: Saudi Aramco’s $25.6 billion initial public offering and Occidental Petroleum’s $13 billion loan to pay for its Anadarko Petroleum purchase.

Without those deals, the yearly total would have reached just $120.2 billion in capital markets transactions, below the $121.9 billion logged in 2018.

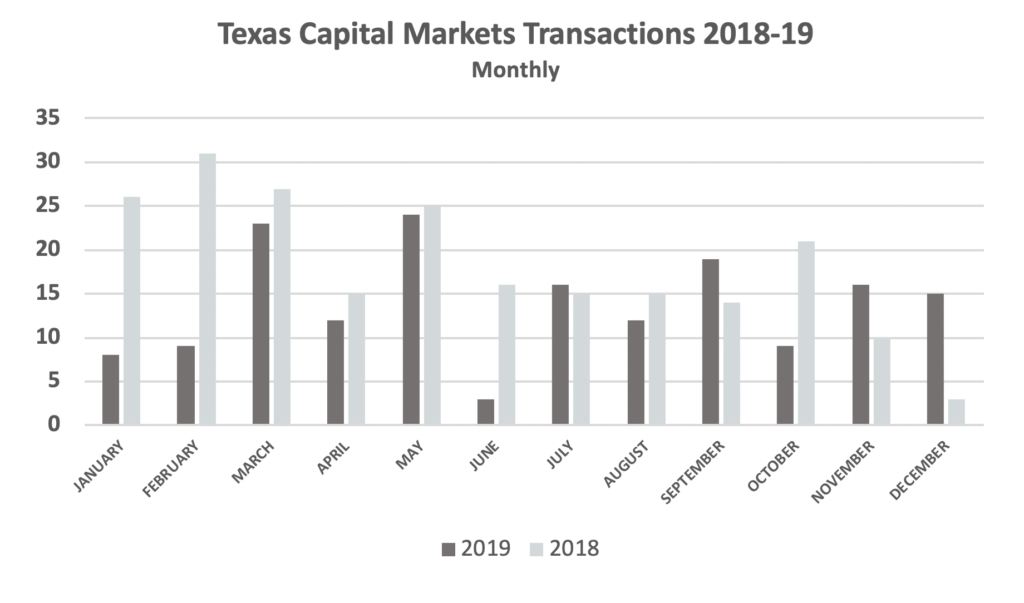

Capital markets activity started the year slowly, with 40 and 39 deals in first two quarters compared with 84 and 56 in the same periods in 2018. Activity rose to 47 deals in the third quarter (versus 44 in the same quarter in 2018) only to fall back to 40 transactions in the fourth (versus 34 in the same quarter in 2018).

In terms of value, capital markets deals in the first half of the year were worth 28% less than in same period in 2018. But in the second half of 2019, values increased more than 50% over the first half of the year, and more than 175% over the second half of 2018.

“We started to see a lot more activity in mid- to late 2019, as everyone had expected a recession earlier in the year and it never came,” said Ryan Cox, the former co-head of Haynes and Boone’s capital markets and securities practice who recently moved to Akin Gump. “One company was even kicking around the idea of an initial public offering.”

Doug McWilliams, a capital markets partner at Vinson & Elkins in Houston, said energy companies faced challenging market conditions in 2019, which continued into 2020 even before the oil price crash and the impacts of the coronavirus.

“Funds continued to flow out of the energy sector during 2019, partially due to industry fundamentals as well as ESG [environmental, social and governance] concerns, resulting in energy being the weakest performing sector in the S&P 500 again in 2019 as it was in 2018,” he said.

IPO volumes in the U.S. were substantially down from previous years, McWilliams added, with most of the activity involving minerals companies – due to their ability to generate free cash flows without substantial capital requirements – along with renewables and infrastructure.

Secondary stock offerings by energy companies, meanwhile, were rather limited given that many energy companies saw their equity prices fall in 2019, McWilliams said. High-yield issuances experienced a similar – although not as dramatic – reduction in activity levels with the second half being slower than the first, he added. “This was, in part, due to the same factors weighing on equities,” he said.

Will Anderson, co-chair of the corporate and securities practice at Bracewell, said the debt capital markets were fairly receptive to energy companies last year and the first two months of this year, at least to the extent that proceeds were being used to pay down maturing debt. “The message from investors continues to be that energy companies, particularly upstream and midstream, need to reduce leverage,” he said.

Anderson said a number of the firm’s bank clients also accessed the debt capital markets in 2019 by issuing subordinated notes.

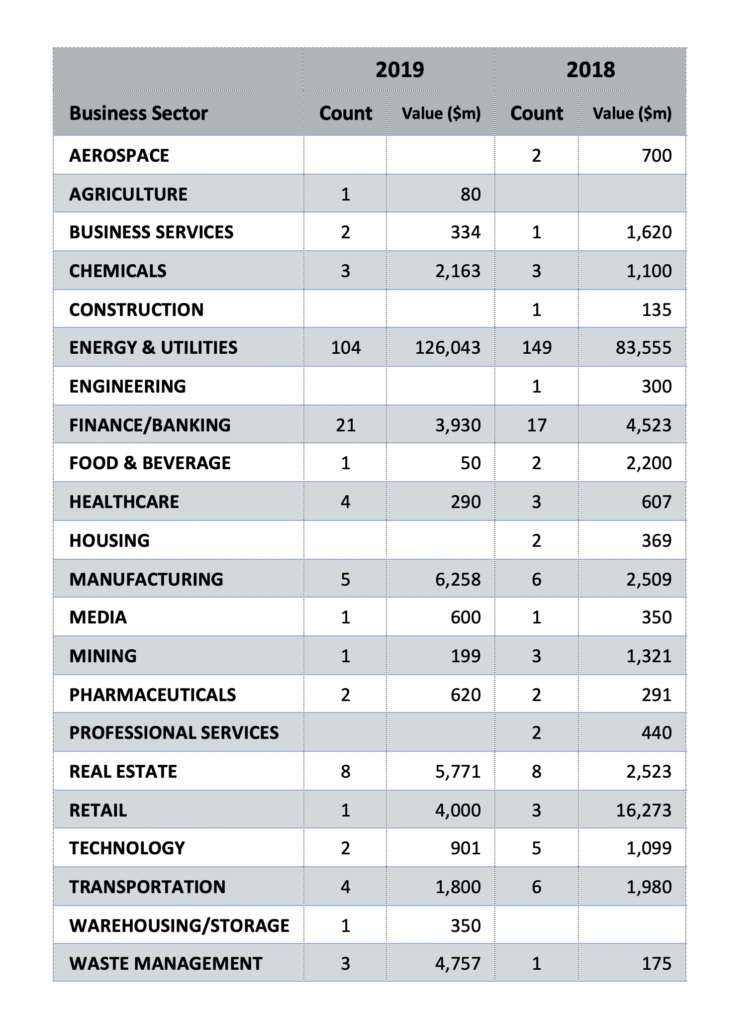

Indeed, finance/banking (including some special purpose entities) was the second most active sector for capital markets deals after energy in 2019, generating 21 transactions valued at $3.9 billion versus 17 worth $4.52 billion in 2018. Moneygram International’s $925 million loan refinancing was the largest strictly finance/banking transaction of the year (V&E advised Moneygram).

Real estate ranked third, with eight deals valued at $5.7 billion (versus eight transactions worth $2.5 billion the previous year). Manufacturing saw five capital markets deals while healthcare and transportation each notched four and chemicals and waste management generated three each.

Texas attorneys led or co-led 121 capital markets transactions in Houston last year compared with 13 in Dallas.

Latham & Watkins partner John Greer agrees that last year was challenging for energy capital markets due to continued supply and demand imbalances and a decline in new capital allocations in the energy sector.

“Equity markets were limited throughout the year and there were only three energy-related IPOs,” he noted. “The offering sizes for the deals that were successful were consistent with what we saw in previous years, but the volume of deals was lower.”

Baker Botts partner A.J. Ericksen said 2019 saw fairly healthy debt capital markets activity across various sectors of the energy space but limited equity issuances.

“In recent years, energy has represented an ever-shrinking share of the S&P 500 because it hasn’t generated equity returns that kept up with tech and other sectors,” he said. “However, energy grew to represent an outsized share of the high-yield debt market.”

Sidley Austin capital markets and M&A partner Bill Howell in Dallas said the start of 2020 appeared to be strong, with many issuers successfully tapping into robust debt capital markets for low interest rates or planning to raise money in the first half of the year. But, he noted, “There was less certainty about the second half of 2020 heading into election season.”

The year began on the right foot for energy companies, with the high-yield markets open in January through early February, leading to substantial activity. But then the window quickly shut after the poor performance of some of those bonds in the aftermarket combined with coronavirus concerns, V&E’s McWilliams said.

However, he noted that many energy companies had few near-term maturities, “resulting in a lack of a need to pull the trigger on an offering at a suboptimal time,” he said.

Latham’s Greer said there were quite a few offerings completed during the early 2020 window and a pipeline of additional issuances was starting to develop.

“However, the window was hit with both barrels when geopolitical shifts exacerbated the global oversupply and the pandemic impaired global demand,” he said. “The result is that Q1 deal flow started with a bang and ended with a whimper.”

Equity markets continued to face challenges at the outset of 2020 “and we didn’t see a window open up like we did for debt,” Greer said.

Baker Botts’ Ericksen said the firm had capital markets deals ready to launch after fourth quarter earnings releases, but then conditions started sputtering in late February and early March when the Saudis started a price war and crude plummeted.

“That price decline has been exacerbated by the sudden drop off in demand since nobody is flying and much of the country and the world is staying home,” he said. “It’s hard to see any of those [deals] getting done until the global economy starts going back to work.”

Ericksen said the companies that were able to refinance debt last year and at the beginning of this year seem to be in a much better position than those that were gearing up to hit the market in the spring or summer of this year.

“A lot of planned capital markets activity was in part to finance capital expenditures. With companies dramatically scaling back their spending plans, the primary need to raise capital is to refinance debt,” he said. “Until commodity prices rebound some and stabilize, it will be very challenging for all but the very highest quality E&P companies to raise capital.”

With production now tapering off, Ericksen said it seems difficult for most midstream names to raise money, “although storage companies may do well in the near term as traders hold physical commodities for contango opportunities.” As for oilfield services, “I think investors are largely going to wait and see who the survivors are.”

V&E’s McWilliams said the capital markets are largely shut right now, with many energy companies facing pressure from lenders to reduce availability under their credit facilities or potential covenant compliance issues due to falling cash flows as commodity prices fall.

“[Those] who are facing nearer term maturities (particularly in 2021 and 2022) will be looking to access the capital markets as soon as they open or may need to seek alternative sources of financing,” he said.

Bracewell’s Anderson said the firm is actively working on a number of investment-grade bond offerings, as that market has been open. “But for many of our energy clients, it really is a day-to-day assessment on whether an offering window is open,” he said. “As a result, our clients want to be ready to launch if a window opens and we are participating in a lot of daily go/no-go calls.”

Anderson said the offerings are largely defensive for high quality issuers that want to build significant cash positions to weather the pandemic and commodity price volatility. He notes that the firm’s electric and gas clients have been pursuing debt offerings – including those of first mortgage bonds – to pre-fund maturities and fund capital projects.

“Companies have also been entering into term loans with banks in case the commercial paper markets become unattractive or unavailable,” he said. “The high-yield bond market remains completely closed.”

Latham’s Greer said he’s also seen limited capital markets activity in the energy space since the January window. But he agrees that there has been a recent uptick in investment-grade issuers seeking to tap the debt capital markets to take advantage of the low interest rate environment to term out existing debt or put cash on the balance sheet.

“There continues to be limited activity for non-investment grade issuers to access the debt markets and equity offerings across the space continue to be depressed,” he said. “We are seeing quite a bit of interest and activity in liability management as companies try to address near-term maturities and reallocate capital stacks.”

Going forward, Greer expects to continue to see companies engage in liability management transactions, including debt exchanges and repurchases to right-size capital structures.

“I think it will continue to be a challenge to issue public equity given the volatility in the market and the reality that most issuers are undervalued by present market conditions,” he said.

Baker Botts’ Ericksen thinks in the near term, the oil and gas industry is more likely to see exchanges where existing creditors aim to move up in the capital structure.

“But probably not very much new money in energy capital markets, even on very expensive terms,” he said. “Companies with funding needs are going to be looking at non-traditional sources.”

Sidley’s Howell said even the best capitalized issuers are looking to shore up their balance sheets while many poorly capitalized ones are facing potential Chapter 11 resets based primarily on commodity price issues.

“I personally am optimistic that the second half of the year could get back to some level of normalcy,” he said. “Hard assets require ongoing capital expenditures and refinancing of maturities, and buyers and sellers should be willing to place bets once we get more clarity on coronavirus impacts.”

And while Texas is likely to continue to see a slowdown for companies in the energy industry as investors remain wary of the sector, Howell is hopeful that when it becomes safe to return to work and gather in public, “issuers in other industries like healthcare, technology, manufacturing, financial services and consumer products will try to access the capital markets.”