© 2015 The Texas Lawbook.

By Mark Curriden

HOUSTON – (April 24) – Business lawyers in Texas worked more hours, charged higher rates and made more money in 2014 than any year in history.

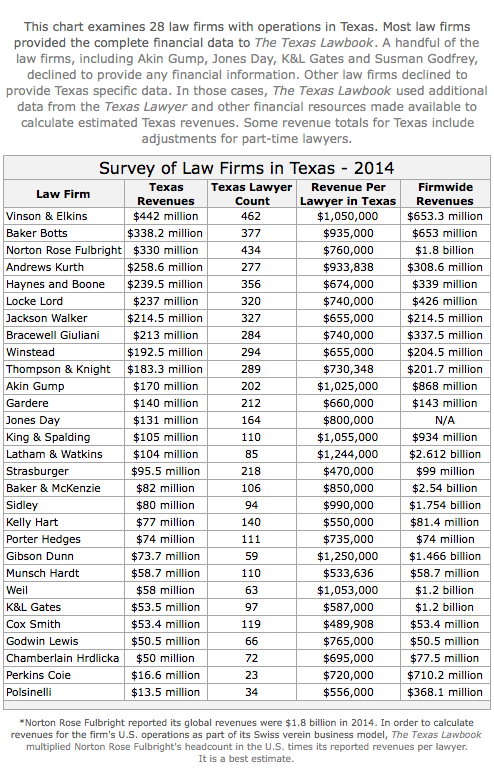

Texas-based lawyers for 28 corporate law firms with significant operations in the state generated revenues of $4.03 billion in 2014 – a seven percent increase over 2013, according to data obtained by The Texas Lawbook.

Leaders from most of the 28 law firms predict that 2014 was not an anomaly and that the good times will continue through this year, especially for the wealthier, elite law shops in the state.

“Texas is a red-hot market for many lawyers and it goes well beyond the energy sector,” said Kent Zimmerman, a legal consultant with Zeughauser Group, who monitors the Texas market closely. “Texas is extremely business-friendly and home to as many Fortune 500 companies as any other state. Those businesses need lawyers.”

Nineteen of the 28 in the survey experienced revenue jumps, which ranged from two percent to 74 percent. In addition, 18 of those law firms, which are headquartered in Texas, report that their out-of-state lawyers earned an additional $1.6 billion in revenues last year.

Nearly 80 percent of Texas law firm leaders surveyed by The Texas Lawbook said they believe 2015 financials will be as good, or even better than 2014, despite obvious challenges in the oil patch.

The increase in revenues, according to legal industry insiders, is the result of an increase in demand for legal services by businesses and a sizeable jump in fees charged by lawyers.

The survey has bad news for law students and lawyers considering switching their practice to business law: while the number of law firms focused on corporate law has increased significantly, the total attorney headcount has been stagnant or even declined during the past few years.

“2014 was a record year – even better than 2013, which was also a record year,” said Mark Kelly, chairman at Vinson & Elkins. “Revenue is up for 2015 and we think we are going to have another good year of revenues and profits.”

“Demand for legal services was essentially flat from 2009 to 2013 in Texas, but it jumped 3.6 percent last year, which was the biggest growth in the U.S.,” said John Wilmouth, a senior client advisor with Citi Private Bank’s Law Firm Group.

The busiest lawyers, according to legal analysts, have been those who specialized in corporate M&A, securities offerings, capital markets, internal corporate investigations, energy litigation, tax disputes and real estate law. The healthcare transactional and litigation practices also have been busy.

Intellectual property litigation, which was smoking hot only a few years ago, slowed considerably during the past several months. General litigation at large law firms has declined for many years because corporations either decided to resolve disputes long before trial or turned to a growing number of litigation boutiques, which often charge lower rates and have fewer client conflicts.

“Clients are clearly concerned by big firm billing rates when deciding whether to bring a lawsuit,” said Hilda Galvan, managing partner of Jones Day’s office in Dallas. “Despite that, our Texas offices, including our litigators, had a fantastic year because we focus on the specialty practices, such as antitrust, securities and internal investigations.”

The Texas Lawbook data shows that the 18 largest Texas-based law firms reported an estimated $5.36 billion in revenues for all of its offices in 2014, which is $500 million more than in 2009 or a 10 percent increase. The Texas Lawyer reported in 2000 that revenues for those same firms was about $2.5 billion that year.

Meanwhile, national law firms in Texas keep stealing more and more of the legal work. Last year, 10 of the 28 top revenue producing legal shops in Texas are firms based outside of the state – up from four such firms in 2009. The national law firms are also experiencing the largest revenue spikes.

During the past five years, more than two-dozen national law firms have opened offices in Austin, Dallas or Houston.

The Texas Lawbook survey shows that these new entrants to the Texas market came to the state with an aggressive business development plan that has so far proven amazingly successful.

The out-of-state law firms generated $698.6 million in revenue in 2014. Latham & Watkins’ outpost in Houston had $104 million in revenues last year, according to research by The Texas Lawbook. Chicago-based Sidley Austin reported its Texas lawyers made $80 million in revenues in 2014 – up from $45 million a year earlier. The Texas office of King & Spalding, an Atlanta-based firm, saw its revenues soar to $105 million. Gibson, Dunn & Crutcher’s Dallas operation had $73.7 million in revenues last year.

Just five years ago, these firms were either non-existent in Texas or had very small practices in the state.

“If you want to be a global law firm, you must have a Texas footprint,” said Locke Lord Chairwoman Jerry Clements. “We used to be the place where lawyers flew over.”

The new data, however, reveals an increasing amount of fragmentation in the Texas legal marketplace.

Rich law firms are getting richer. Many upper mid-market and mid-sized law firms are struggling to compete for talent and are losing higher paying legal work.

“We are witnessing an uber segmentation of the Texas legal marketplace,’ said Jeff Grossman, senior director of Wells Fargo Bank’s Wealth Management Legal Specialty Group. “The strongest and most profitable law firms are significantly outpacing the rest of the law firms.”

Grossman said that revenues at the elite law firms are up 12 percent, while revenues at the second-tier firms have either been stagnant or declined.

“Upper middle market firms in Texas are getting squeezed,” he said. “They are getting pressure from both ends.”

Grossman and others say elite national and specialized law firms that have moved into Texas during the past five years are spending significant amounts of money to lure the best lawyers from legacy Texas firms.

The best clients follow the best lawyers, who are able to charge higher rates and generate the most revenue, said Michael Dillard, Latham & Watkins’ managing partner in Houston.

Robert Walters, managing partner of Gibson Dunn’s Dallas office, agreed.

“The gap between the ‘haves’ and the ‘have nots’ has widened quickly in Texas,” Walters said. “We’ve been in a steady ascent toward the barrister system, where expertise and the ability to specialize is given a much higher value.”

Each lawyer in the Texas offices of Gibson Dunn and Latham generated $200,000 more in revenues in 2014 than their counterparts at Akin Gump and V&E, which are the highest performing Texas-based law firms.

The revenue gap widens to $500,000 per lawyer per year or more when Gibson Dunn and Latham are compared to lawyers at upper mid-market firms such as Haynes and Boone, Locke Lord and Thompson & Knight.

“Texas has been the fastest growing legal market in the U.S.,” said Brad Hildebrandt, a nationally recognized expert in law firm consulting. “The Texas legal market is experiencing some growing pains. That is to be expected.”

COMING NEXT WEEK…

A dozen managing partners discuss business trends in the Texas legal marketplace. They expect more out-of-state law firms to invade, more Texas law firms to merge and more talent poaching from each other.

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.