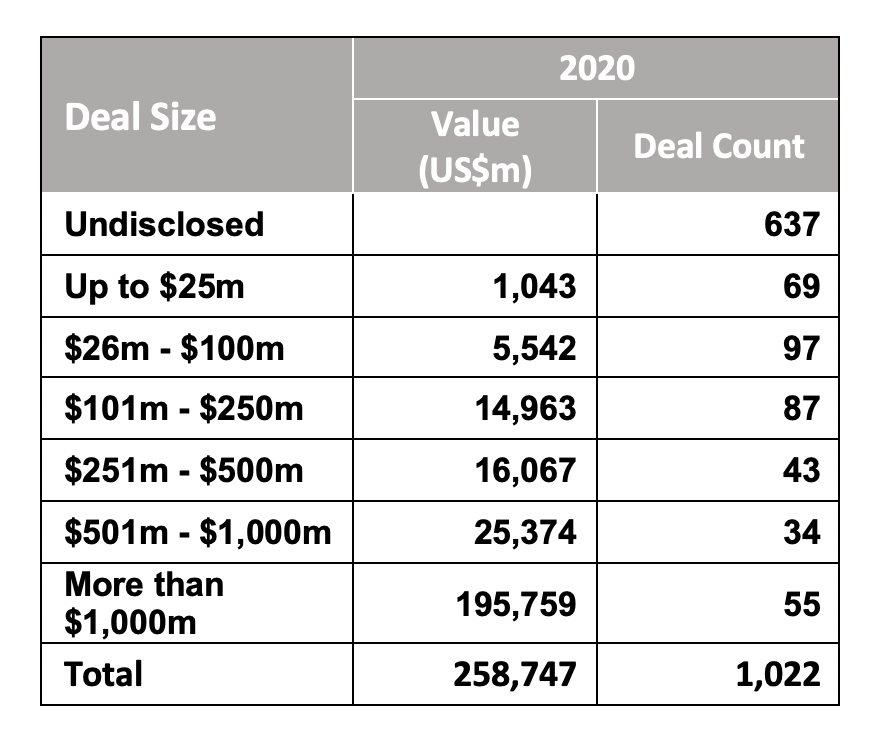

No matter how you look at it, the vast majority of mergers and acquisitions involving Texas businesses and Texas lawyers involved transactions of $500 million or less, according to two different bodies of data from Mergermarket and the Texas Lawbook’s Corporate Deal Tracker.

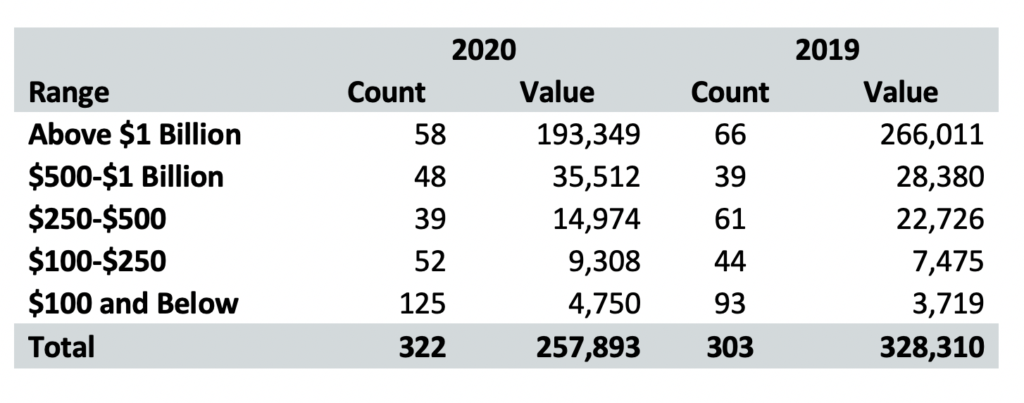

Mergermarket shows that 77% of M&A deals involving one or more Texas businesses in 2020 were at or below the $500 million mark while the Corporate Deal Tracker showed that two-thirds of the M&A deals handled by Texas lawyers were below the half-billion mark; this, despite there were actually more transactions worth $1 billion or more than deals between $500 million and $1 billion.

In addition, nearly half, or 48%, of all Texas M&A in 2020 had deal values between $25 million and $250 million, 43% were $100 million or less, and 18% were $25 million or less, according to the Mergermarket data.

The figures show that sellers were increasingly willing to make concessions to buyers amid a weak market made weaker by the Covid-19 pandemic, according to Locke Lord partner Joe Perillo.

“Finding a willing buyer is obviously a bit more difficult in this market,” Perillo, who is based in Houston, told The Texas Lawbook. “So what otherwise may have been considered upper middle market–$500 million to $1 billion — in some of those cases where they were on the lower end of the higher middle-market, they then basically are selling in the middle market-area.”

Dallas-based Hunton Andrews Kurth partner Gregg Schmitt also said he saw some more willingness on the part of sellers to meet buyers halfway. Some found creative ways of bridging the bid-ask spread, such as earnout payments.

“Rather than selling 100%, maybe they’re selling 80%, maybe they’re selling 60%, they’re rolling over a little bit more,” Schmitt told The Lawbook.

Schmitt also sees Texas in general, and Dallas in particular, as very fertile ground for middle-market deals to spring up from local private equity shops and entrepreneurial business owners.

“Dallas is very entrepreneurial, we’re very good at growing businesses into the $50 million, $100 million, $250 million range, and then they get sold,” he said.

According to the Corporate Deal Tracker, it was the deal volume in those ranges that helped Texas M&A recover from a very deadly summer to a year-ending 322 deals reported with non-confidential values, compared to 303 in 2019. Of those, 216 were $500 million or below:

- Almost all of the gains were made from deals below $250 million, with 177 in 2020 compared to 137 in 2019.

- Of the 177 deals below $250, 125 were below $100 million, well above the 93 sub-$100 million transactions reported in 2019.

- Deals between $250 million and $500 million were down from 61 in 2019 to 39 in 2020. Deals between $500 million and $1 billion were up from 39 in 2019 to 48 in 2020.

Overall, the middle market tracked the same pattern the overall deal market made over the course of 2020: It started out the year fairly evenly, ground to a halt in the second quarter, and recovered in the third and fourth quarters as the corporate world adjusted to work-from-home measures and lockdown restrictions were lifted.

For Haynes & Boone partner John McGowan, 2020 was perhaps the best year in the last few for his M&A team despite the Covid-19 pandemic, or in some ways, maybe because of it.

“I think when something happens, completely unpredictable, something you couldn’t plan for, it really shook and changed the way that the sellers were thinking about risk in the world in general,” McGowan, who is based in Dallas, told The Lawbook. “And I think that kind of thing sticks with you. So I think it shook a lot of sellers over to, you know, viewing the world differently, and hey, maybe it is time for me to sell, maybe it is time for me to diversify.”

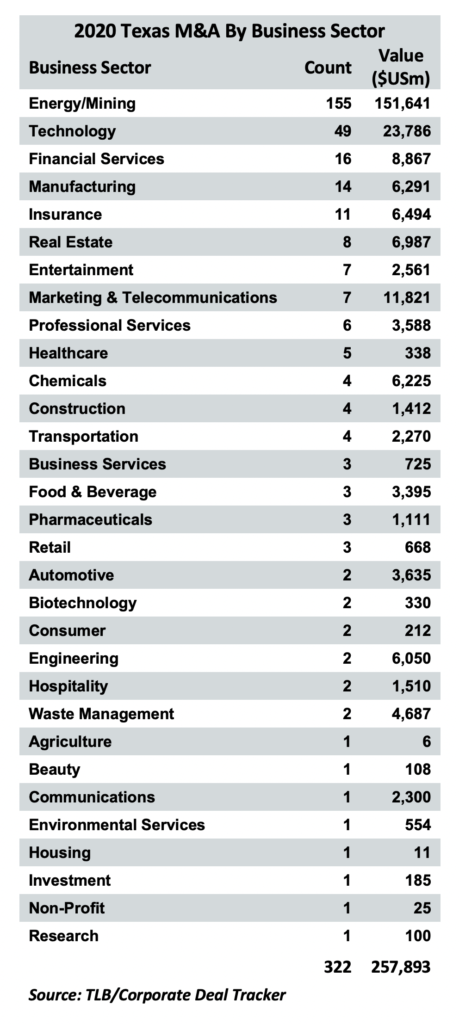

On a sector-by-sector basis, technology performed strongly in the middle-market M&A space, going hand-in-hand with growth in renewable energy and energy transition-focused fields. Traditional hydrocarbons deals, however, floundered amid low commodity prices.

Thompson & Knight partner Doug Lionberger told The Lawbook that part of the robustness of the middle market in 2020 was due to increased investment in smaller companies focused on energy technology.

“There are some really fast growing companies,” Lionberger, who is based in Houston, said.

“So I think over the next year, in five years, it’s going to be really interesting to see how these energy technology companies, in terms of the energy transition for lack of a better word, to see how that affects the Texas market as a whole.”

Looking ahead, the momentum that saw the deal market, including the middle market, recover is expected to carry forward into 2021.

“I think there’s a backlog of deal activity due to what happened in the middle of 2020,” Lionberger said. “So I think you’re just going to see a lot more deals. A lot more people are going to be able to come to an agreement on how to value these companies. A lot of people want to sell their property, there are a lot of distressed companies still need to find a buyer, but there are a lot of buyers out there.”

Sellers are also likely to feel more pressure to pull the trigger on a deal now that the Democratic party is set to be the ruling party in both the White House and Congress, and higher capital gains taxes are all but certain, Perillo said.

“If you’re a business owner, you’re focusing on after-tax proceeds… in addition to the sale price,” he said. “And so you’ll be looking to basically get an exit, I would think, in 2021. I would think they’ll be thinking more of an exit because they’ll have the lowest capital gains rates they’ll probably have over the next, at a minimum, a four year period.”