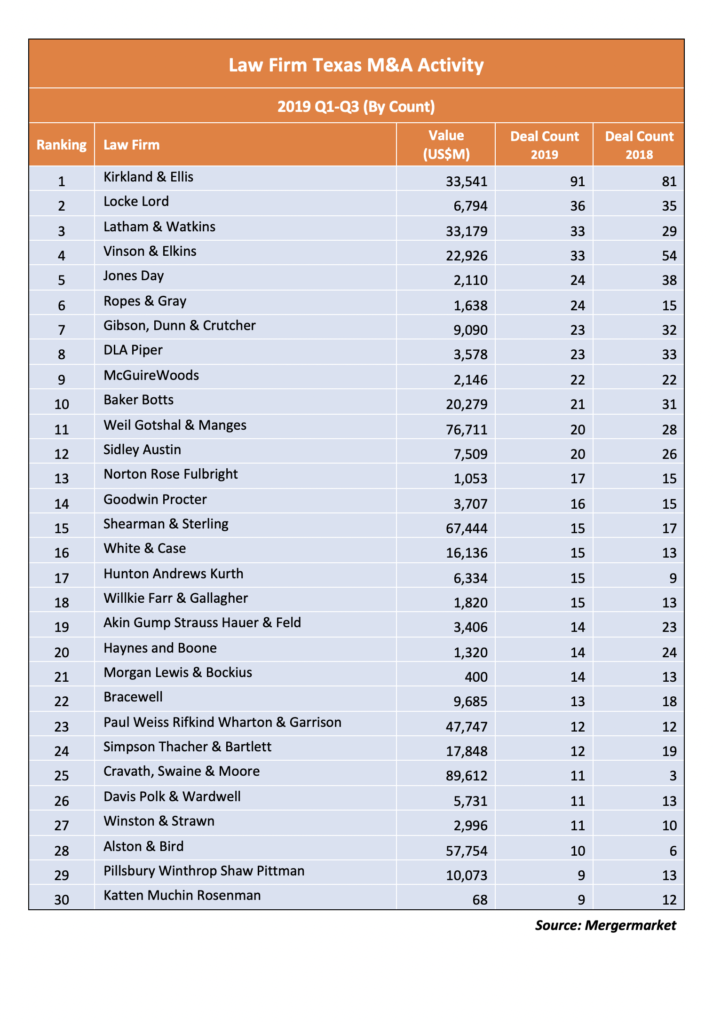

Note: This table has been corrected to reflect a change in information provided to The Lawbook by Mergermarket. An additional deal credited to Latham & Watkins is now reflected in both the story and the charts.

In a year when mergers, acquisitions and joint ventures in Texas are down significantly, lawyers at Kirkland & Ellis are actually expanding their position as the go-to M&A law firm for businesses in the state.

The number of M&A transactions involving Texas-based companies as the buyer or seller shrank 18.5% during the first nine months of 2019, but the number of deals handled by Kirkland jumped 12%, according to new data by the independent research firm Mergermarket provided exclusively to The Texas Lawbook.

By contrast, 17 of the top 30 corporate law firms saw the number of transactions they handled in Texas during the first nine months of this year declined or stayed the same, Mergermarket reports. Five firms are down double-digits in deal count from 2018. Kirkland is the only firm in the top 30 up double-digits.

Kirkland represented the buyer or seller in 91 Texas transactions with a total deal value of $33.5 billion. The firm’s lawyers were lead legal advisors in 13 of the 50 largest M&A deals between Jan. 1 and Sept. 30, including Hillcorp’s $4 billion acquisition of BP’s Alaska operations, SemGroup in its $3.6 billion sale to Energy Transfer Partners, Callon Petroleum’s $2.9 billion purchase of Carrizo Oil and Gas, BC Partner’s 50% acquisition of Advance Computer Software for $2.4 billion and ArcLight Capital’s $2.2 billion purchase of nearly three-fourth’s ownership of Third Coast Midstream.

“We’ve been very fortunate to have a nice spread of deals,” said Kirkland’s Andy Calder. “Our team in Texas has been extremely busy and a lot of our lawyers in other offices outside of Texas have worked on a lot of Texas deals, too.”

Mergermarket reports that lawyers at Kirkland did nearly as many transactions involving Texas companies as the next three highest ranked law firms combined.

Locke Lord ranks second with 36 deals under the belt of its lawyers so far in 2019, including advising Comstock Resources in its $2.1 billion acquisition of Covey Park Energy and NextEra Energy Partners in its $1.28 billion purchase of 39% of Central Penn Line.

Two energy powerhouses – Latham & Watkins and Vinson & Elkins – tied for third with 33 transactions each during the first nine months of this year.

Latham increased its M&A deal count in Texas from 29 during the first three quarters of 2018 with a combined price tag of $33.1 billion. The Los Angeles-founded firm which has 85 lawyers in Houston represented Sinclair Broadcast Group in its $9.6 billion acquisition of Fox Sports Net, Pembina Pipeline in its $1.5 billion purchase of the Cochin Pipeline from Kinder Morgan and UGI Energy Services in its $1.27 billion acquisition of Columbia Midstream group.

Houston-based V&E’s 33 transactions are actually down from 54 deals during the same period in 2018. V&E advised Buckeye Partners on tax matters in its $10.2 billion sale to IFM Investors and Targa Resources in its $1.6 billion sale of Targa Badlands to Blackstone Group.

The global law firm Jones Day worked on 24 Texas transactions so far this year – down from 38 in 2018 – a 36.8 decline.

The biggest surprise in this quarter’s Mergermarket data is fifth ranked Ropes & Gray, which ranked 21 last year with 15 deals in Texas during the first nine months. So far this year, the Boston-based law firm has worked on 24 Texas transactions.

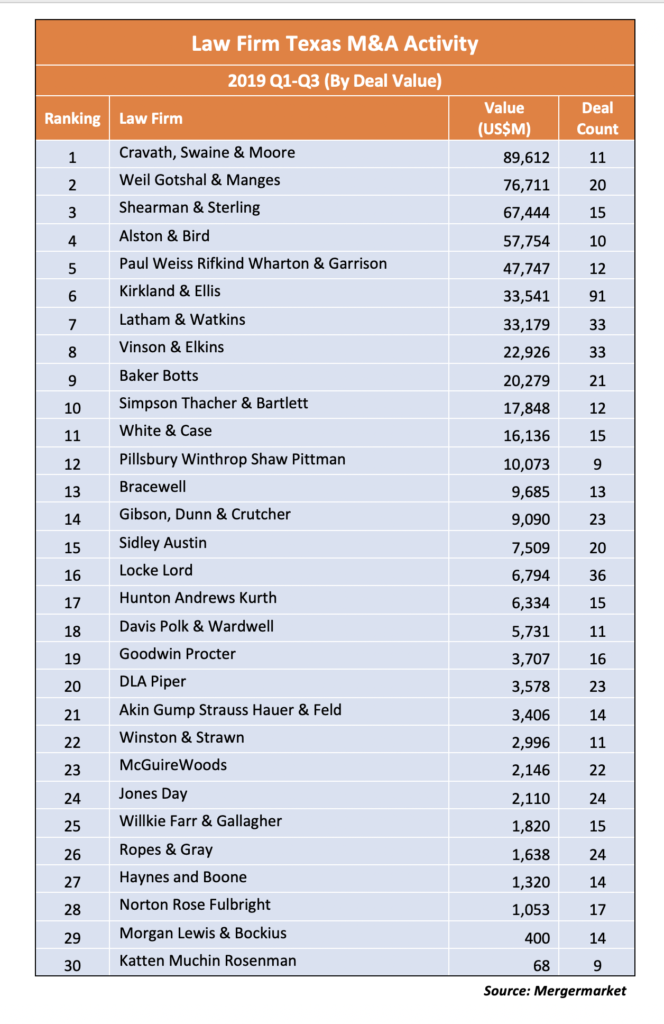

Most of the Ropes & Gray’s deals were small to mid-market with an average value of $68 million. By contrast, Weil Gotshal & Manges ranked 11th with 20 total deals valued at $76.7 billion or an average of $3.8 billion a transaction.

Six other law firms – Gibson, Dunn & Crutcher, DLA Piper, McGuireWoods, Baker Botts, Weil and Sidley Austin – were involved in 20 M&A deals or more involving Texas businesses.

Mergermarket legal advisory rankings take one factor into account: The companies or private equity firms either buying or selling must be headquartered in Texas.

The lawyers for the law firms working on the transactions do not have to be based in Texas.

In fact, 10 of the 30 top law firms ranked by deal value – including Cravath, Fried Frank, Wachtell Lipton, Freshfields and Davis Polk – have no Texas offices at all. Cravath did 11 transactions with a total price tag of $89.6 billion.

More than half of the deals handled by Kirkland involved no lawyers in either its Dallas or Houston offices.

One final note: Paul Weiss, which is headquartered on Sixth Avenue in Manhattan, was involved in a dozen transactions involving Texas companies with a combined value of $47.7 billion. Multiple sources tell The Texas Lawbook that Paul Weiss is planning to open a Texas office in the next few months.

Editor’s Note: This week, The Texas Lawbook will begin to publish results of our exclusive Corporate Deal Tracker data, which documents M&A activity handled by lawyers based in Texas. Stay tuned.