M&A dealmaking by Texas lawyers rocketed to new highs during the first half of 2022, narrowly eclipsing deal counts for both the first and second half of 2021 — both were also records — according to statistics gathered by The Texas Lawbook’s Corporate Deal Tracker.

The size or dollar value of those transactions, however, declined significantly from the year before because there were no megadeals announced by the likes of AT&T, Chevron or Match.com.

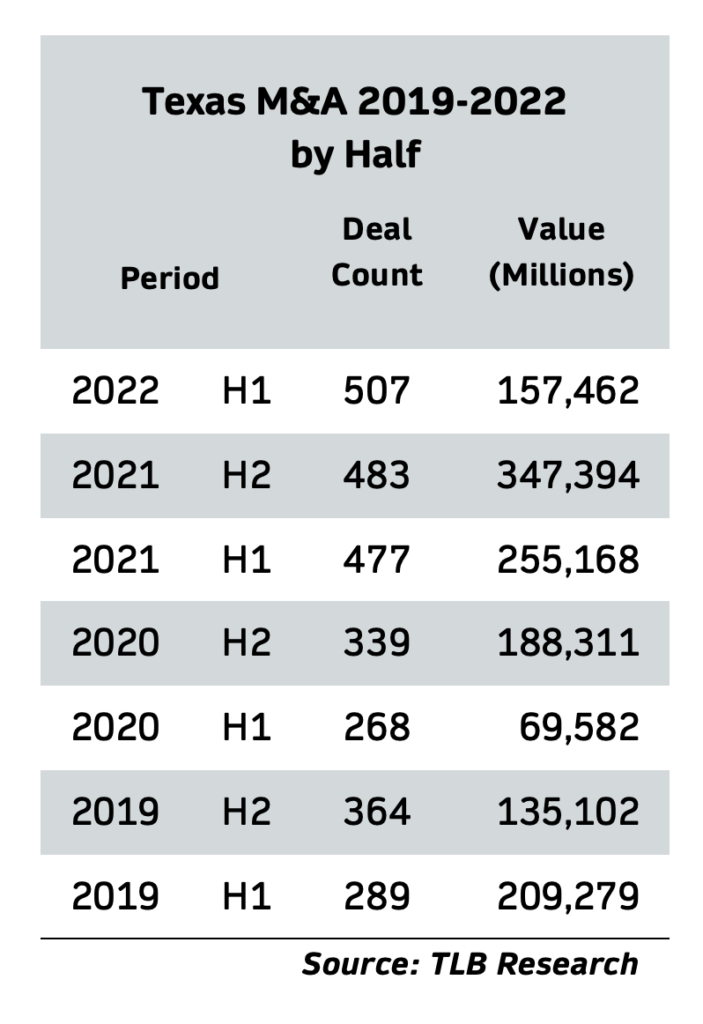

There were 507 transactions during the first six months of 2022 compared with 477 for the first half of last year, according to the Corporate Deal Tracker. Even more impressive, M&A activity during H1 2022 for Texas lawyers was up 75 percent compared to the first six months of pre-pandemic 2019, when there were 289 deals.

Corporate transactional lawyers attributed the heated M&A market in Texas to multiple factors. Interest rates, while increasing slightly during H1, remained historically low. The federal government has pumped trillions of dollars into the economy as the result of Covid pandemic relief, and that money is still filtering down.

The energy sector, boosted by rising commodity prices, bounced back, accounting for about one-third of the Texas transactions and nearly half of the total deal value during H1. And businesses in the middle and lower-middle market – sparked by interest in private equity funds – hit record highs in dealmaking.

Debbie Yee

Debbie Yee, a partner at Kirkland & Ellis in Houston, said that upstream consolidation is continuing at a moderate pace, with public companies continuing to look at accretive acquisitions of private companies to increase scale, free cash flow and shareholder returns.

“We are seeing significant financial investor interest in real assets, conventional energy and renewable and energy transition assets,” Yee said. “In addition, our clients have been very active in the broader infrastructure market — core plus — including investments in infrastructure-related software and digital infrastructure.”

Katten Muchin partner Peter Bogdanow said M&A activity from January through June occurred at “a very rapid pace” and “was pretty similar in terms of types of deals we saw” in 2021.

“While very busy, I would say not at the level of the record pace in 2021,” Bogdanow said. “A lot of existing and new investments continue to be made.”

In fact, the data shows that, despite the lofty deal numbers for the half, M&A trailed off during the second quarter of 2022. The first quarter saw 282 deals valued at $92.6 billion dollars. In the second quarter those numbers dropped to 225 at $65 billion.

Of the 507 reported to the Corporate Deal Tracker during the first six months of 2022, nearly half — 248 of them — had confidential values.

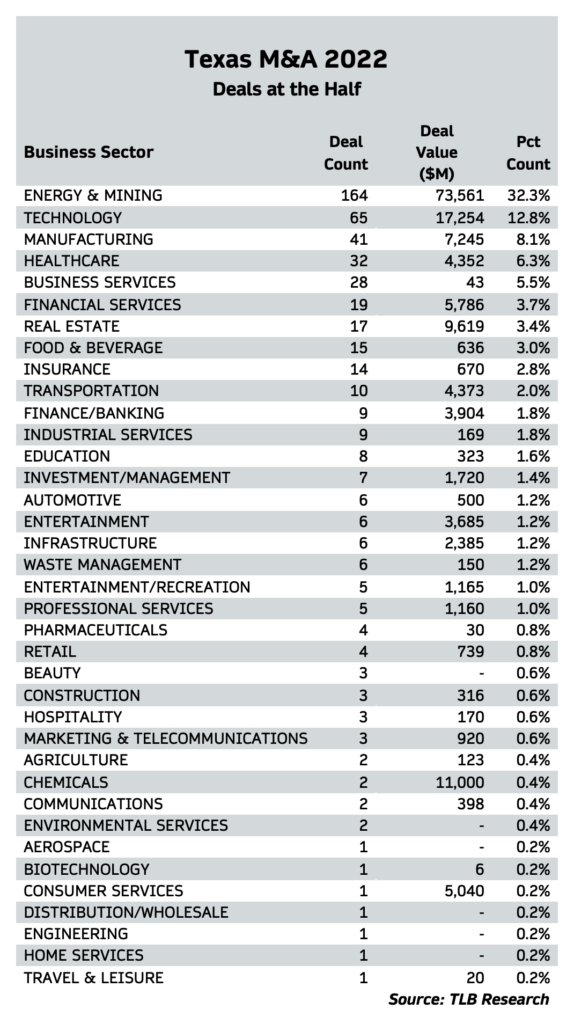

Energy transactions (energy and mining) took the lion’s share of deals at 32 percent followed by technology (12.8 percent), manufacturing (8.1 percent), healthcare (6.3 percent), business services (5.5 percent) and financial services (3.7 percent).

The price tag of the 259 transactions with deal values was $157.5 billion — well below the $255.1 billion for H1 2021 (down 62 percent) and even further below the $347.4 billion reported for H2 2022 (off 121 percent). Over the last four years, only the lowest points of the pandemic, H2 2019 ($135.1 billion) and H1 2020 ($69.6 billion), were lower.

The 164 energy deals, however, also led the gravy train with a reported value of nearly $74 billion — almost half (47 percent) of the reported deal values. Of those 164 energy deals, 46 involved renewable energy/storage deals and 29 were midstream.

As with all such statistics, Texas deals depend on reporting by law firms. At least some of the record number of deals for the year may reflect better and more aggressive reporting. And with fewer blockbuster transactions thus far, and only one Texas-related deal of more than $10 billion dollars (the $11 billion deal in February involving Irving-based Celanese and DuPont), depressed transaction values are in keeping with global trends.

The Dealmakers Weigh In

The Texas Lawbook checked in with dealmaking lawyers who have been particularly active to get their thoughts on the first half — and prognosticate what the second half will bring.

Bobby Cardone, a partner with Shearman & Sterling in Dallas, found the half started briskly but slowed down due to uncertainty related to Ukraine, elevated inflation and other macro headwinds.

“Nothing seemed to have stopped, but [dealmaking] definitely slowed, with valuations reducing and lending drying up,” he said. “I agree that the size has generally been smaller, perhaps stemming from rising financing costs and the market downturn, which has made it harder to value larger entities.”

Jon Finger, a partner at McGuireWoods in Dallas, noted that 2021 was a remarkable and unprecedented year, so — not surprisingly — the first half of 2022 was not as vigorous by comparison.

“That being said, H1 of 2022 continued to present a very strong M&A environment as sellers continued to look for opportunities to exit in such a robust environment, buyers similarly looked to deploy dry powder in PE funds and strategics found inorganic growth opportunities,” he said.

Eric Otness, a partner at Skadden in Houston, agrees that 2021 was an “incredible year” and the firm expected that 2022 could not quite keep up in terms of overall deal activity.

“But it has still been a solid first half of the year,” he notes. “And there seems to have been a rebound in activity in May and June, and we are seeing significant interest on the part of both corporates and sponsors in transactions.”

Eric Otness

Locke Lord partner Jennie Simmons in Houston said there is definitely a growing concern related to interest rates and how that will impact present and future value permeating the recent deal flow.

“In general, clients are being more cautious and wanting to ensure that they don’t overpay for an asset, particularly given the market volatility and unpredictability for the future,” she said. “For example, we have recently seen some adjustments to purchase price and valuation based on specific issues attributed to concerns identified during due diligence.”

Sidley partner Katy Lukaszewski in Houston did see some areas of softness in activity, such as in renewables M&A, which had a slow start to the year but has since largely rebounded.

“We have seen several multibillion-dollar deals by infrastructure funds investing in telecom and transportation assets, like the $2.5 billion investment by Stonepeak Infrastructure Partners in American Tower’s CoreSite data center that was announced earlier this month,” she said.

Benji Barron, a partner at Vinson & Elkins in Houston, has seen less activity toward the end of the second quarter and the beginning of the third quarter due to growing signs of inflation and the conflict between the Ukraine and Russia, “which we expect will continue into the second half of this year.”

As for the surge in energy deals, Larry Hall, a partner with Baker Botts in Dallas, agreed that increased oil prices/valuations impacted deal activity, although commodity price volatility kept the market mindful.

“Oil and gas prices generally stayed at values well above prior years, and that triggered deal activity,” he said.

To assure your firm’s deals are published in the CDT Roundup please email deal information to CDTRoundup@texaslawbook.net. For further information or for league table submissions, please contact Allen Pusey (allen.pusey@texaslawbook.net) or see our FAQ and online portals on the Corporate Deal Tracker page HERE.

Among trends in the energy sector, Hall said he noticed that reserve-based lending financing in the upstream seems to be limited, leading to alternative financing structures.

Shearman’s Cardone noted that the upstream saw the largest benefits from rising prices, followed by midstream, resulting in higher deal activity and valuations, “with some sellers taking the opportunity to exit and buyers with new optimism for growth (or at least healthy returns) in the segment.”

Locke Lord’s Simmons saw some clients consolidating their positions for efficiency and stability, particularly in the midstream.

“In particular, there is increased activity with respect to infrastructure and an emphasis on transportation,” she said. “Our midstream clients are expanding their existing assets and adding to their existing capabilities to position themselves strategically in a competitive market.”

Although upstream has seen an uptick in terms of activity, downstream, including, for example, oilfield services, remains more quiet than it was five or six years ago.

“We are seeing a lot of clients pivot strategically as they try to think creatively and outside of the box in terms of new growth opportunities and expansion capabilities,” Simmons said.

As for renewables and energy transition, everyone seems to be getting into renewables and energy transition in some shape, form or fashion to keep pace with market trends and public expectations and pressure, Simmons noted.

“We are actively and intimately involved in every aspect of the renewable and energy transition space, including several recent carbon capture, renewable diesel, battery storage and hydrogen deals,” she said.

Sidley’s Lukaszewski said the increase in oil and gas prices has had a significant impact on traditional energy deal activity, which experienced a rebound.

Katy Lukaszewski

“On the upstream side, buyers seem interested in buying not only PDP [proved developed producing] assets but also investing in upside potential and running drilling programs, though this has been tempered somewhat as of late due to inflation, which has a direct impact on drilling costs,” she said.

On the renewables side, Lukaszewski said oil prices, the war in Ukraine and other macro events had more of a direct impact on thermal power generation activity than it did renewables. “But from a market perception, it certainly has helped boost interest in renewables as well,” she noted.

As far as trends in the energy sector, the upstream deals are not without challenges given the current price environment, and Lukaszewski noted that sellers are contending with underwater hedge books that they are largely trying to assign to buyers, “which comes with valuation impacts,” she said.

On the renewables side, her colleagues continue to see a lot of solar activity. And while the market has been somewhat dampened by tariffs, import requirements related to forced Chinese labor and inflation, particularly in project construction, there is still a “very strong interest” in platform and portfolio deals, she said.

Kirkland’s Yee credited the negative impact of heightened SPAC scrutiny on the number of energy transition companies that are able to come to the public markets.

“During the SPAC wave, energy transition companies were common targets — along with fintech — and greatly benefited from the SPAC M&A process,” she said. “As many of these companies are pre-revenue, I think we will see fewer of them taken public, either through a de-SPAC process or traditional IPO.”

V&E’s Barron also said he continues to see a lot of consolidation in the upstream industry — consistent of what he’s seen since 2021. On the midstream side, he’s finally seeing a lot of the consolidation and larger deals and a continuing appetite for investment in renewables projects and businesses, “particularly on the private equity side.”

When we asked dealmaking lawyers how active was private equity during the first half of this year compared with 2021, Katten’s Bogdanow responded “very active” and Baker Botts’ Hall said “significantly” more active.

Benji Barron

“The fundraising successes of numerous local PE funds have been great to see in the headlines,” O’Melveny’s Chrissy Metcalf added.

Shearman’s Cardone said the firm’s private equity clients were all busy in 2021, whereas it has been somewhat of a “mixed bag” in 2022.

McGuireWoods’ Finger agreed — “It was slower in H1, but 2021 set a ridiculously high bar,” he said — and so did Skadden’s Otness — “Given 2021 was an all-time high and an exceptional year in every way, it is maybe unfair to compare, but there is still a lot of PE capital looking for opportunities,” he said.

Locke Lord’s Simmons said her firm saw a number of its private equity clients focus last year on ESG issues and rebranding to make themselves more attractive to traditional and nontraditional investors. “Now they are focusing on new opportunities, including add-on acquisitions and new platform investments,” she said.

Sidley’s Lukaszewski noted that her firm continues to see strong private equity activity in upstream and midstream transactions and activity for private equity in renewables was “flat to down” in 2021 when compared with 2022.

Sarah McLean, a Shearman partner based in Austin who specializes in energy, said the midstream was more active in the first half than in 2021, especially in private equity. “Private equity has been pretty quiet for a couple of years and has picked way up,” she said.

As far as non-energy sectors that were also brisk with activity, Shearman’s Cardone said healthcare also appears to have remained somewhat more strong and active than other sectors outside of energy, and Locke Lord’s Simmons agreed. O’Melveny’s Metcalf noticed strong growth in services-focused portfolio companies executing buy and build strategies.

For her part, Sidley’s Lukaszewsk has seen strong deal activity in infrastructure and transportation — like the recently announced acquisition by GIC, OMERS Infrastructure and Wren House of Direct ChassisLink — as well as the consumer products sector, such as the sale of the ILIA makeup brand to Famille C and the sale of the Briogeo hair care brand to Wella, both announced earlier this year. “This has been somewhat surprising given macro trends,” she said.

Coming This Week in The Texas Lawbook:

- M&A experts predict deal activity and trends for the year ahead

- Corporate Deal Tracker examines transactions data by deal size

- Corporate Deal Tracker ranks the law firms by deal count and deal value