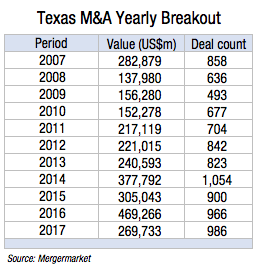

Texas businesses were on track last year to challenge 2014 as the best year ever for mergers and acquisitions, but then dealmaking slowed considerably in the fourth quarter.

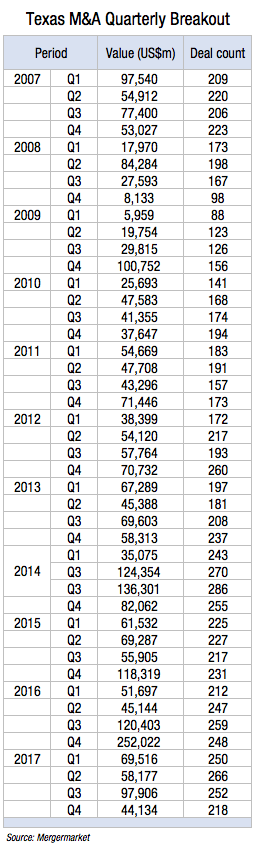

New data from Mergermarket shows that deal count during the final three months of 2017 dropped 13.3 percent from the third quarter. Even more alarming, the combined deal value of Q4 corporate transactions plummeted 55 percent.

Despite the fourth quarter slowdown, Mergermarket reports that total M&A involving Texas companies as the buyer or seller increased two percent in 2017 over the year before. Total deal value, however, declined 43 percent.

In comparison to the fourth quarter of 2016, Texas M&A deal count was down 12 percent and deal value declined a whopping 81 percent. But Q4 2016 deal value broke all records because two huge deals – AT&T’s purchase of Time Warner and Energy Transfer Partners merger with Sunoco Logistics – were announced during the final two months of the year.

The 986 Texas-based M&A in 2017 was the second highest number on record and only four percent less than the record 1,054 deals announced in 2014, according to Mergermarket.

The 218 M&A transactions during the fourth quarter marks the 18th straight quarter that Texas has experienced 200 or more corporate deals.

“Q4 was very slow, in large part because energy dealmaking slowed significantly,” says Chad Watt, who is an M&A analyst and writer for Mergermarket in Texas. “That was driven by weak commodity price outlook, and public equity investors’ distaste for oil and gas businesses. There were many potential deals in the marketplace, but most did not transact. I heard tale of bidders lowering their offer in second-round bidding. And the IPO markets had basically closed to energy companies, which left private equity as the only bidder out there.

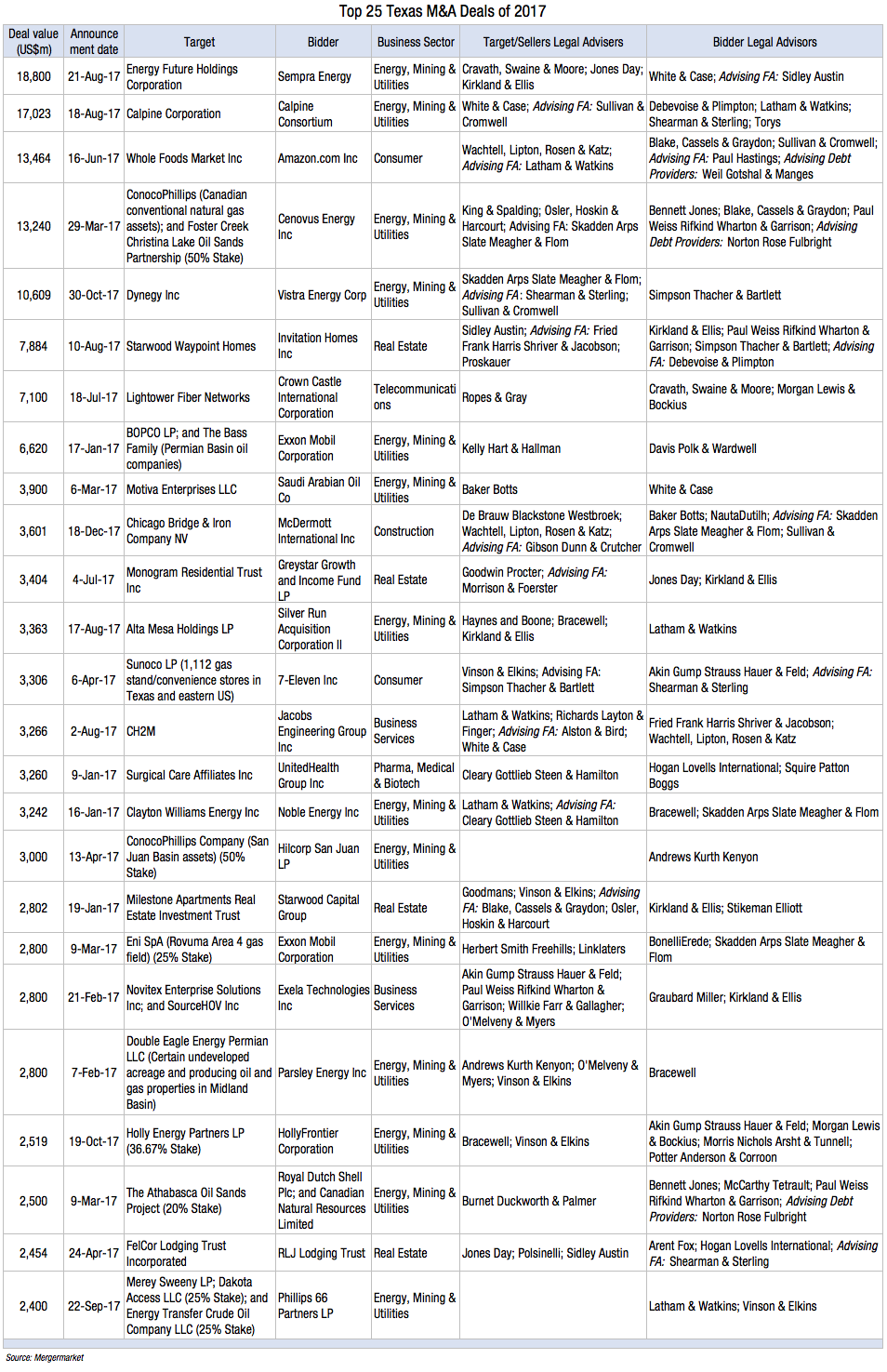

“The only two significant deals in Q4 were Dynegy getting bought by Vistra, and Chicago Bridge & Iron which was bought by Texas-based McDermott,” he added. “But that should not detract from a really robust year of dealmaking, which saw some storied Texas companies, including Whole Foods and ClubCorp find new owners. Overall, 2017 was a good year for deals in Texas, and anecdotally, 2018 activity has the potential to be strong, especially with oil prices eclipsing the $60 a barrel mark.”

Two-thirds of the 2017 Texas deals were in the energy sector, according to Mergermarket. Consumer-based companies came in a distant second with 12 percent of the transactions. Six percent of the Texas deals involved real estate companies.