© 2013 The Texas Lawbook.

By Mark Curriden

Senior Writer for The Texas Lawbook

(July 17) – Texas corporations are doing fewer and smaller mergers and acquisitions and those businesses doing deals are increasingly turning to non-Texas-based law firms to represent them.

New data released Wednesday shows that M&A activity involving Texas businesses fell to near recessionary lows during the first six months of 2013, but corporate lawyers and investment bankers say they are seeing signs indicating a mild rebound during the second half of the year.

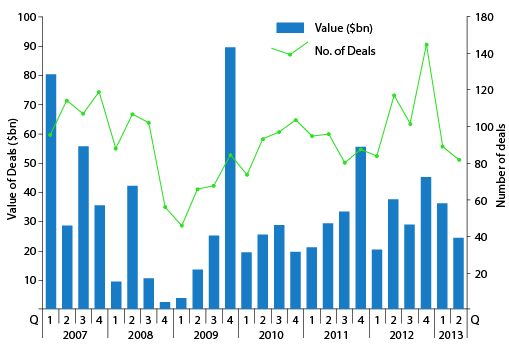

Texas businesses were involved in 171 mergers, joint ventures, acquisitions and divestitures valued at $60.5 billion for the first half of this year – down from 224 such transactions with a combined value of $174.3 billion during the final six months of 2012, according to mergermarket media, an independent global M&A research firm affiliated with the Financial Times.

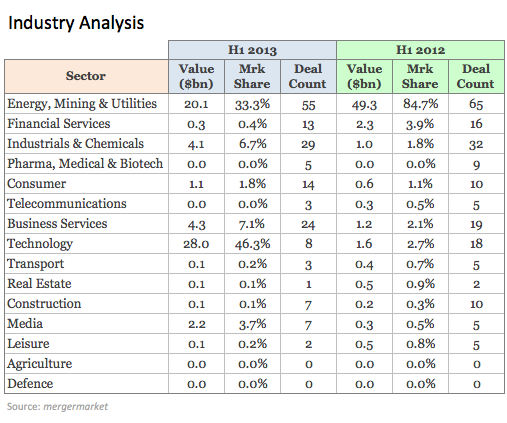

Nearly every business sector – from energy and mining to financial services and health care – witnessed a decline in M&A activity. The only statistical exception was technology, but even that was an anomaly caused by Michael Dell and Silver Lake Partner’s proposed $20 billion acquisition of Dell Inc., which accounted for one-third of the value of all deals.

“Texas followed the nation in taking a breather from M&A activity in the first half of the year,” said Chad Watt, a Dallas-based M&A research analyst and writer for mergermarket. “If not for the Dell takeout being renegotiated in the first half of the year, it would have been a dismal showing so far this year.”

Watt points out that without the Dell deal, the total value of all transactions during the first half of 2013 are less than one-fourth the value of the deals announced during the final six months of 2012.

Rick Lacher, the managing director of the investment bank Houlihan Lokey, said the appetite of many corporations, including private equity firms, is mostly satisfied following their substantial M&A investment, especially in oil and gas, from 2010 to 2012.

“We saw a ‘pull forward effect’ in 2012 by business leaders who wanted to quickly complete deals because of the tax changes that those people perceived were going to happen,” said Lacker, who is based in Dallas.

Troy Lewis, a M&A partner with Jones Day in Dallas, said the M&A market has suffered from a “hangover effect” after such an intense fourth quarter in 2012 and took a “breather” during the first quarter of 2013.

“The first three months of this year were the slowest we’ve seen in a while, but we have started to see deal activity pick up during the second quarter,” Lewis said.

A survey of more than a dozen M&A lawyers at different law firms found unanimous agreement that the frenzied pace of deal-making in Texas, especially in energy, has paused.

“We have seen a number of major deals put on hold during the past few months,” said Jeff Chapman, a partner at Gibson, Dunn & Crutcher who represented MetroPCS in its sale to T-Mobile, which closed May 1. “The economy still isn’t vibrant.”

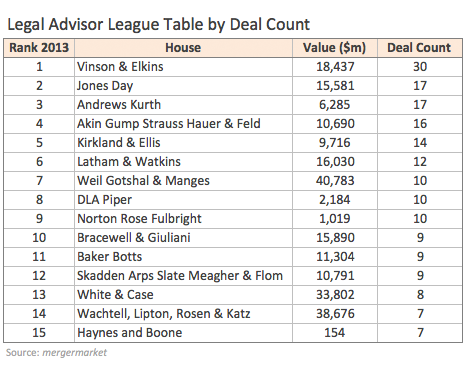

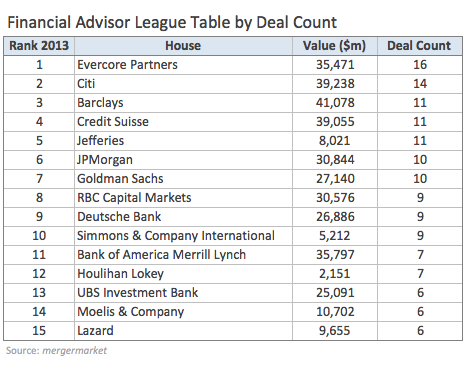

Mergermarket data shows that an increasing number of corporate general counsels are turning to non-Texas-based law firms to handle transactions.

In mergermarket’s listing of the 15 law firms doing the most deals for Texas-based businesses, a majority of firms are based outside of Texas for the first time since mergermarket started the rankings in 2001. Three of the 15 law firms – Kirkland & Ellis, White & Case and Wachtell, Lipton, Rozen & Katz – don’t even have offices in Texas.

Corporate leaders involved in three of the five largest transactions announced during the first half of 2013 – the Dell offer for $20.1 billion, Bain Capital’s acquisition of BMC Software for $6.7 billion and Belo Corp.’s decision to sell to Gannett Company for $2.2 billion – shunned the Texas-based law firms that have represented them for decades and relied on New York and Chicago firms instead.

But the Texas M&A market is still driven by energy and the Texas-based law firms have a strong grip on those clients.

Long-time energy M&A powerhouse Vinson & Elkins remains solidly at the top of the rankings, advising on 30 separate transactions valued at $18.4 billion. That is down from 39 deals during the first six months of 2012.

Houston-based Andrews Kurth and Washington, D.C.-based Jones Day, which has more than 200 lawyers in Dallas and Houston, both ranked second by mergermarket, each advising on 17 deals. Akin Gump, Norton Rose Fulbright, Bracewell & Giuliani, Baker Botts and Haynes and Boone are the other Texas-based firms listed in the top 15.

“The lack of middle market deal activity should be worrisome to Texas-based advisors, as those clients make up the bread and butter for Texas-centric law firms,” Watt said. “Strong Texas M&A advisors Vinson & Elkins, Baker Botts, Norton Rose Fulbright and Bracewell & Giuliani all saw significant declines in their deal counts in the first half of the year.”

“While the actual productivity of our M&A lawyers is up this year, we recognize that there are clearly fewer deals being done,” said V&E partner Keith Fullenweider, who heads the firm’s M&A and private equity practice.

“A lot of it has to do with pricing and valuation of the assets, and I have seen a widening of expectations between buyers and sellers over pricing,” he said. “As a result, the buyers are now willing to wait.”

Fullenweider predicts that there will be a few multi-billion-dollar strategic divestitures taking place during the next several months.

Mike O’Leary, who is co-head of the corporate and securities practice at Andrews Kurth, said that 2010 to 2012 was a seller’s market, especially in upstream energy, because private equity firms and energy companies didn’t want to be left out.

During the past few months, the energy upstream M&A market has flipped and is now a buyer’s market, he said.

“There is still capital out there interested in investing, but businesses are being much pickier and are willing to sit on the sidelines for a while to see what market conditions might be over the next several months,” said O’Leary.

O’Leary and Fullenweider said that midstream businesses, including pipelines, processing plants and gathering systems, have been immune from the downturn in M&A. That’s because midstream companies operate on contracts and are more cash-flow predictable and because those businesses are financially structured as master limited partnerships, which strongly encourage continued growth and expansion in order to generate an ever-increasing cash-flow.

Another factor in the M&A decline is that there are fewer industry consolidation opportunities available today than there were during the past three years, according to Ken Menges, a partner in the Dallas office of Akin Gump and co-head of the firm’s M&A practice.

“Investment banking firms I talk to say they are disappointed because they were expecting a gusher of M&A activity to continue into 2013, but it has only been a slow drip,” he said.

Menges said the market for initial public offers has stayed sluggish.

“We still have not seen the IPO as a reliable exit strategy for investors,” said Menges. “Instead, the decision to file to go public has become a way of showcasing a company and its finances for possible buyers.”

Lacher, the Dallas-based investment banker, said there are reasons for optimism for the months ahead.

“We have started seeing pitch activity and our pitch calendars filling up,” he said. “Our healthcare team started slow but now their hair is on fire. We will continue to see a fair amount of activity in oil and gas, especially if prices jump at all.

“Things are starting to heat up, but I don’t think we will see the volume of deals like we saw in 2007,” Lacher said. “That was crazy.”

© 2013 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.