© 2013 The Texas Lawbook.

By Mark Curriden, JD

Senior Writer for The Texas Lawbook

(October 14) – The third quarter of 2013 witnessed a significant jump in the number of mergers and acquisitions announced by Texas-based businesses.

New data released by mergermarket media shows that July, August and September of 2013 comprised the best Q3 for M&A since 2007.

Texas M&A for the first nine months of the year is still 10 percent lower than deal-making for the first three quarters of 2012, but that is because Q2 of this year was so bad.

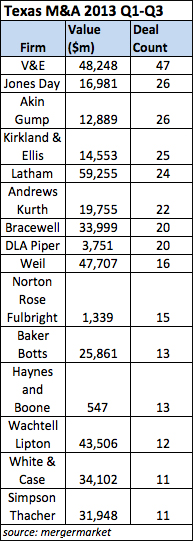

Vinson & Elkins has handled the most deals during the first three quarters of 2013 with 47, followed by Akin Gump and Jones Day with 26 transactions.

Latham & Watkins leads in the value of the deals with $59.3 billion. V&E is second with $48.2 billion and Weil Gotshal & Manges is third with $47.8 billion.

It should be noted that while mergermarket data is extraordinarily reliable and the best gauge for M&A activity, it does not include transactions where the parties are private companies and the deals are confidential.

© 2013 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.